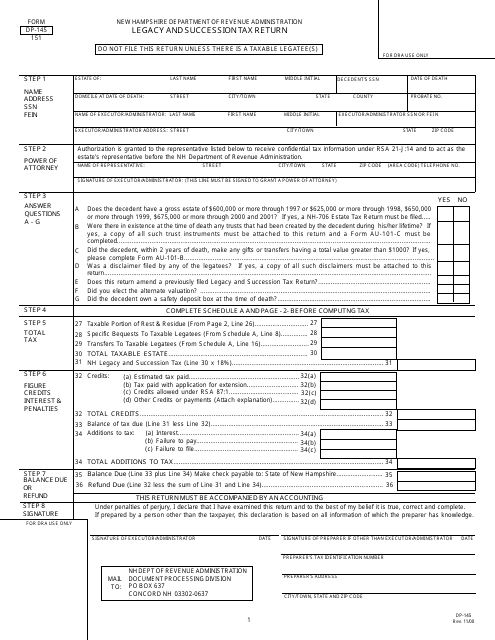

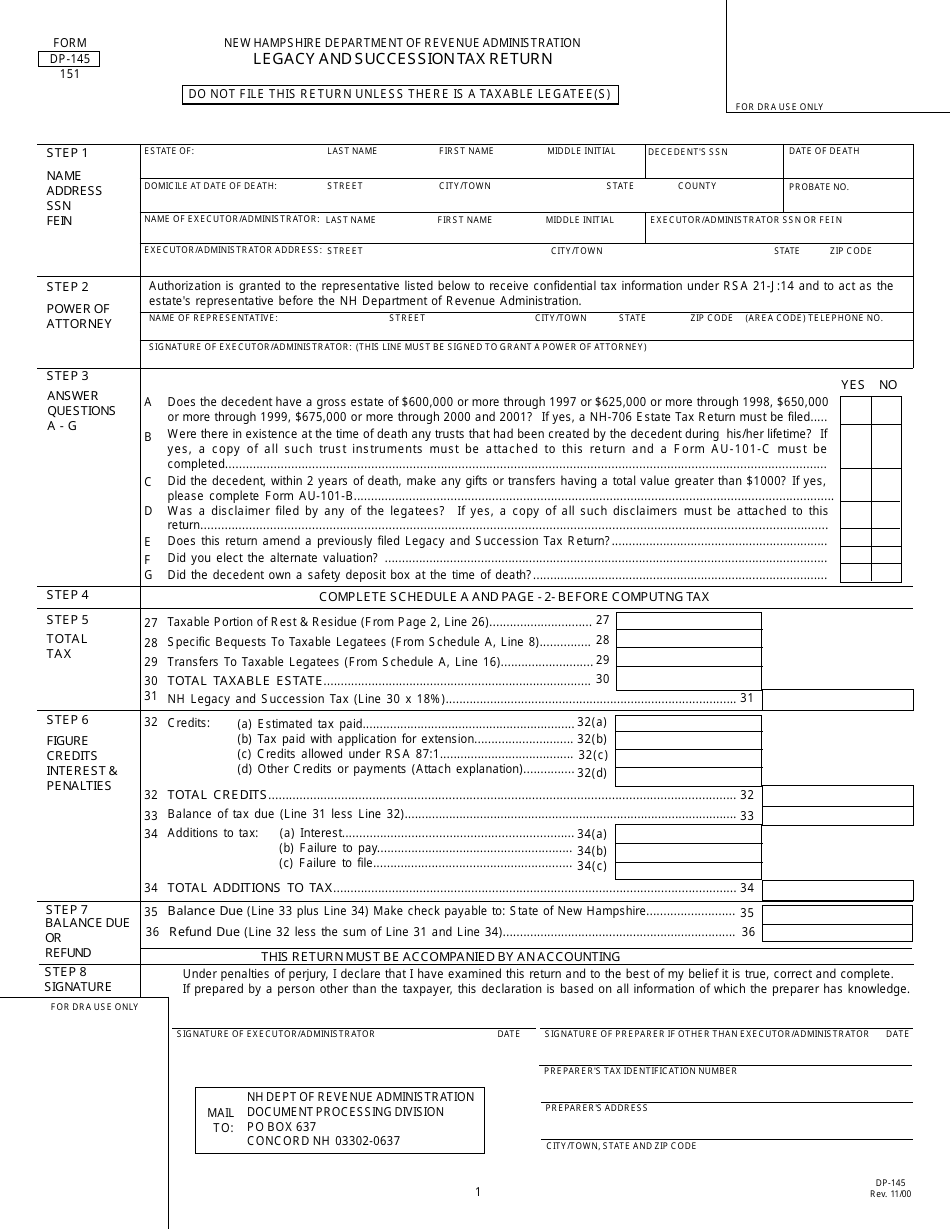

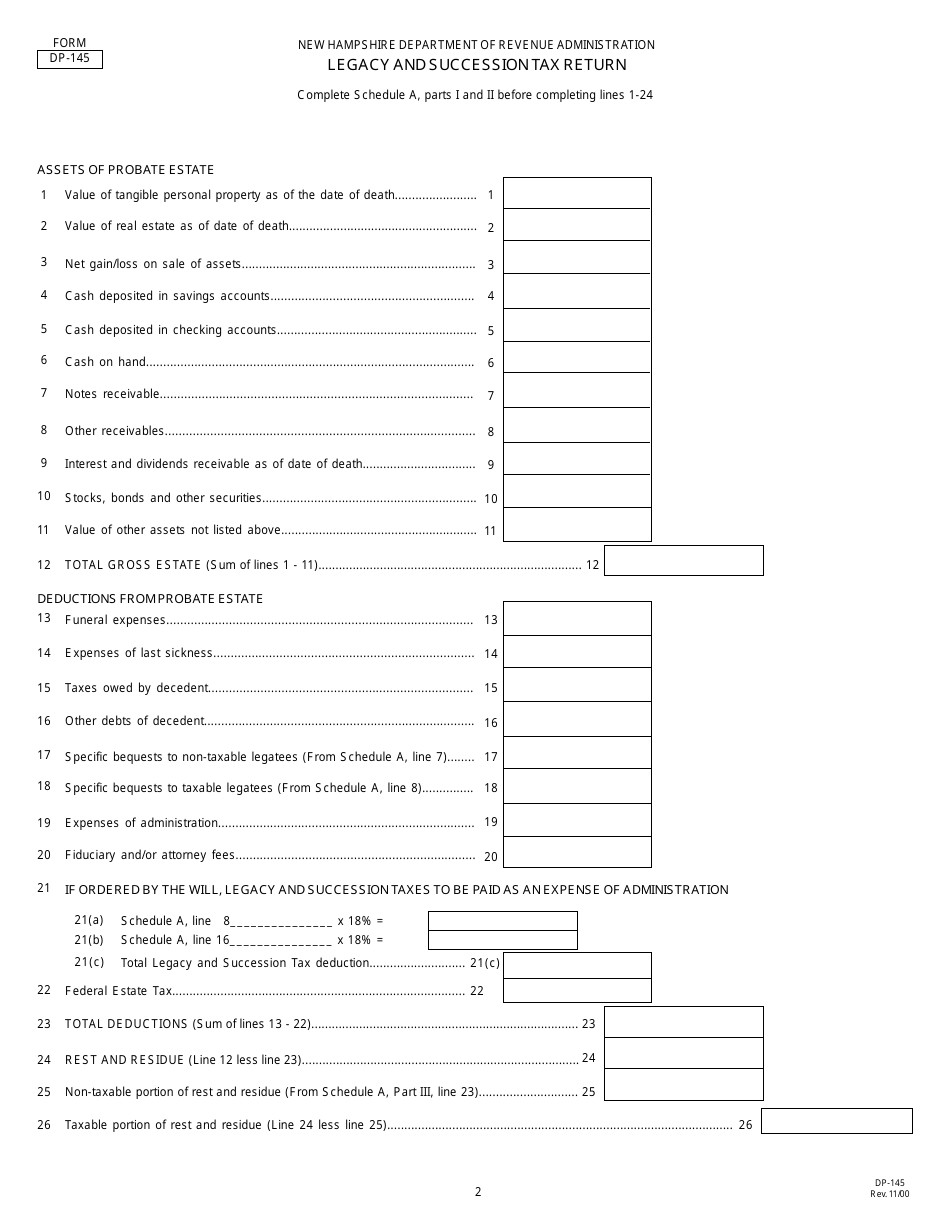

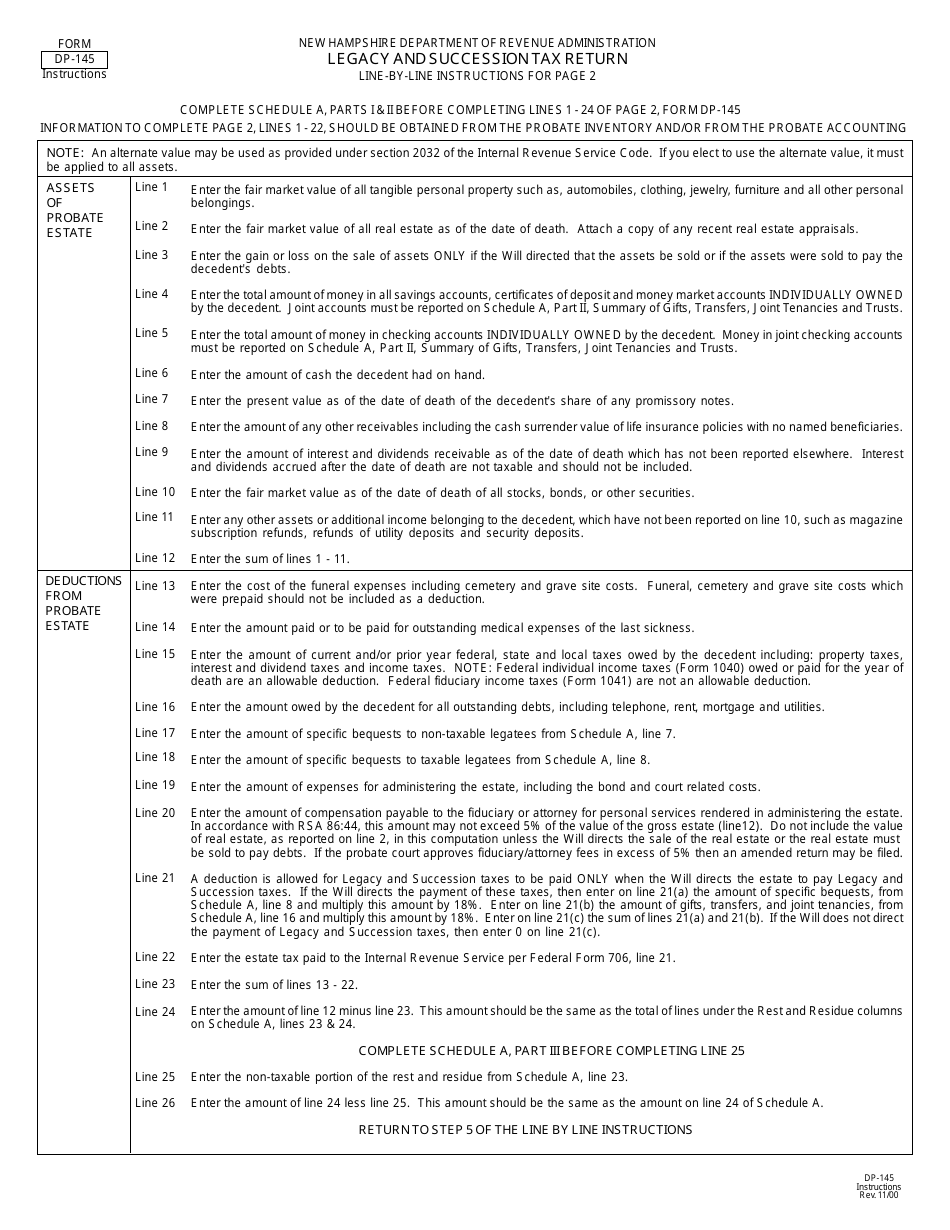

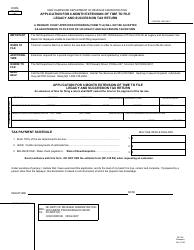

Form DP-145 Legacy and Succession Tax Return - New Hampshire

What Is Form DP-145?

This is a legal form that was released by the New Hampshire Department of Revenue Administration - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form DP-145?

A: Form DP-145 is the Legacy and Succession Tax Return for New Hampshire.

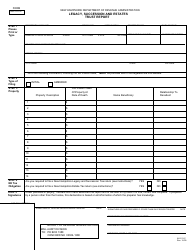

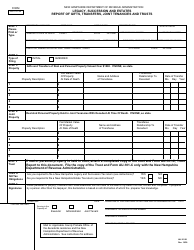

Q: What is the purpose of Form DP-145?

A: The purpose of Form DP-145 is to report and pay the legacy and succession tax in New Hampshire.

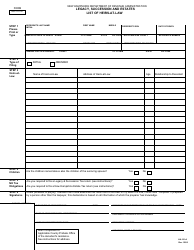

Q: Who needs to file Form DP-145?

A: Anyone who is subject to the legacy and succession tax in New Hampshire needs to file Form DP-145.

Q: When is Form DP-145 due?

A: Form DP-145 is generally due nine months after the date of death of the decedent.

Q: Are there any penalties for late filing of Form DP-145?

A: Yes, there are penalties for late filing of Form DP-145. It is important to file the form and pay the tax on time to avoid penalties.

Q: Is there a minimum threshold for the legacy and succession tax in New Hampshire?

A: Yes, there is a minimum taxable threshold for the legacy and succession tax in New Hampshire. It is important to consult the instructions for Form DP-145 to determine if you are required to file.

Q: What should I do if I have questions about Form DP-145?

A: If you have any questions about Form DP-145, you should contact the New Hampshire Department of Revenue Administration for assistance.

Q: Is Form DP-145 specific to New Hampshire?

A: Yes, Form DP-145 is specific to the legacy and succession tax in New Hampshire and is not used for any other state.

Form Details:

- Released on November 1, 2000;

- The latest edition provided by the New Hampshire Department of Revenue Administration;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form DP-145 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Revenue Administration.