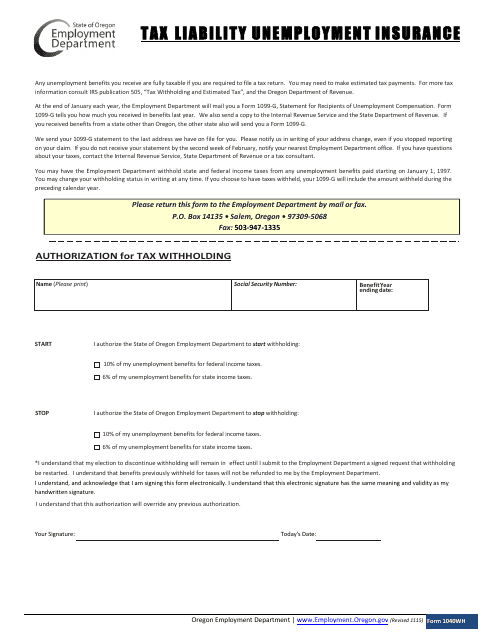

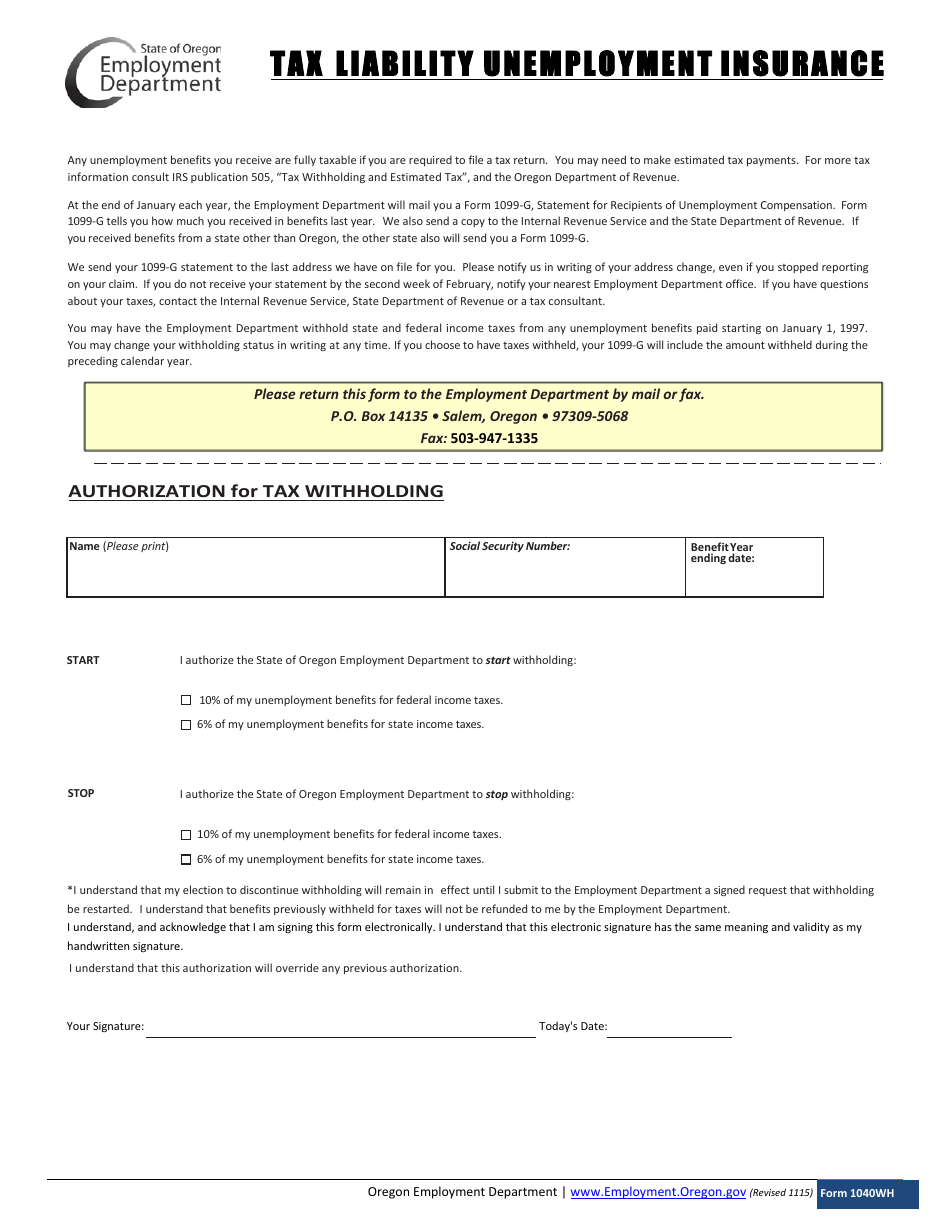

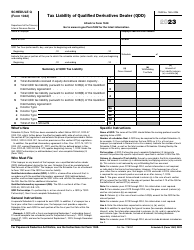

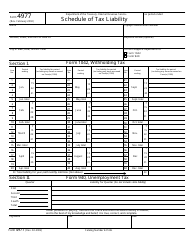

Form 1040WH Tax Liability Unemployment Insurance - Oregon

What Is Form 1040WH?

This is a legal form that was released by the Oregon Employment Department - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 1040WH?

A: Form 1040WH is an Oregon-specific tax form used to calculate and report tax liability on unemployment insurance.

Q: What is tax liability?

A: Tax liability refers to the amount of tax you owe to the government.

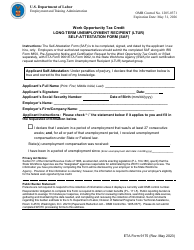

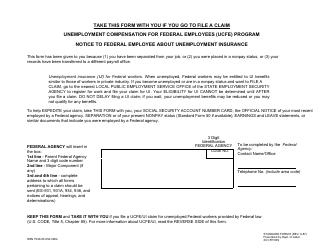

Q: What is unemployment insurance?

A: Unemployment insurance is a benefit provided to workers who have lost their jobs and meet certain eligibility criteria.

Q: Is Form 1040WH specific to Oregon?

A: Yes, Form 1040WH is specific to Oregon and is used to report tax liability on unemployment insurance in the state.

Q: Why do I need to report tax liability on unemployment insurance?

A: Reporting tax liability on unemployment insurance ensures that you meet your tax obligations and may impact your overall tax liability.

Q: When is the deadline to file Form 1040WH?

A: The deadline to file Form 1040WH is typically April 15th, unless it falls on a weekend or holiday, in which case the deadline is the next business day.

Q: Do I need to file Form 1040WH if I didn't receive unemployment insurance?

A: No, you only need to file Form 1040WH if you received unemployment insurance and have a tax liability to report.

Q: What happens if I don't file Form 1040WH?

A: If you are required to file Form 1040WH and fail to do so, you may face penalties and interest on any unpaid tax liability.

Form Details:

- Released on November 1, 2015;

- The latest edition provided by the Oregon Employment Department;

- Easy to use and ready to print;

- Available in Spanish;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 1040WH by clicking the link below or browse more documents and templates provided by the Oregon Employment Department.