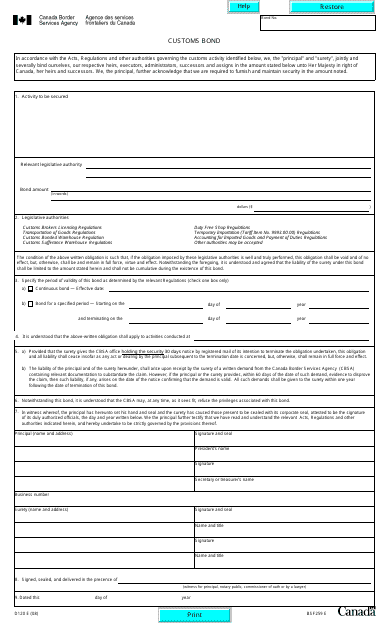

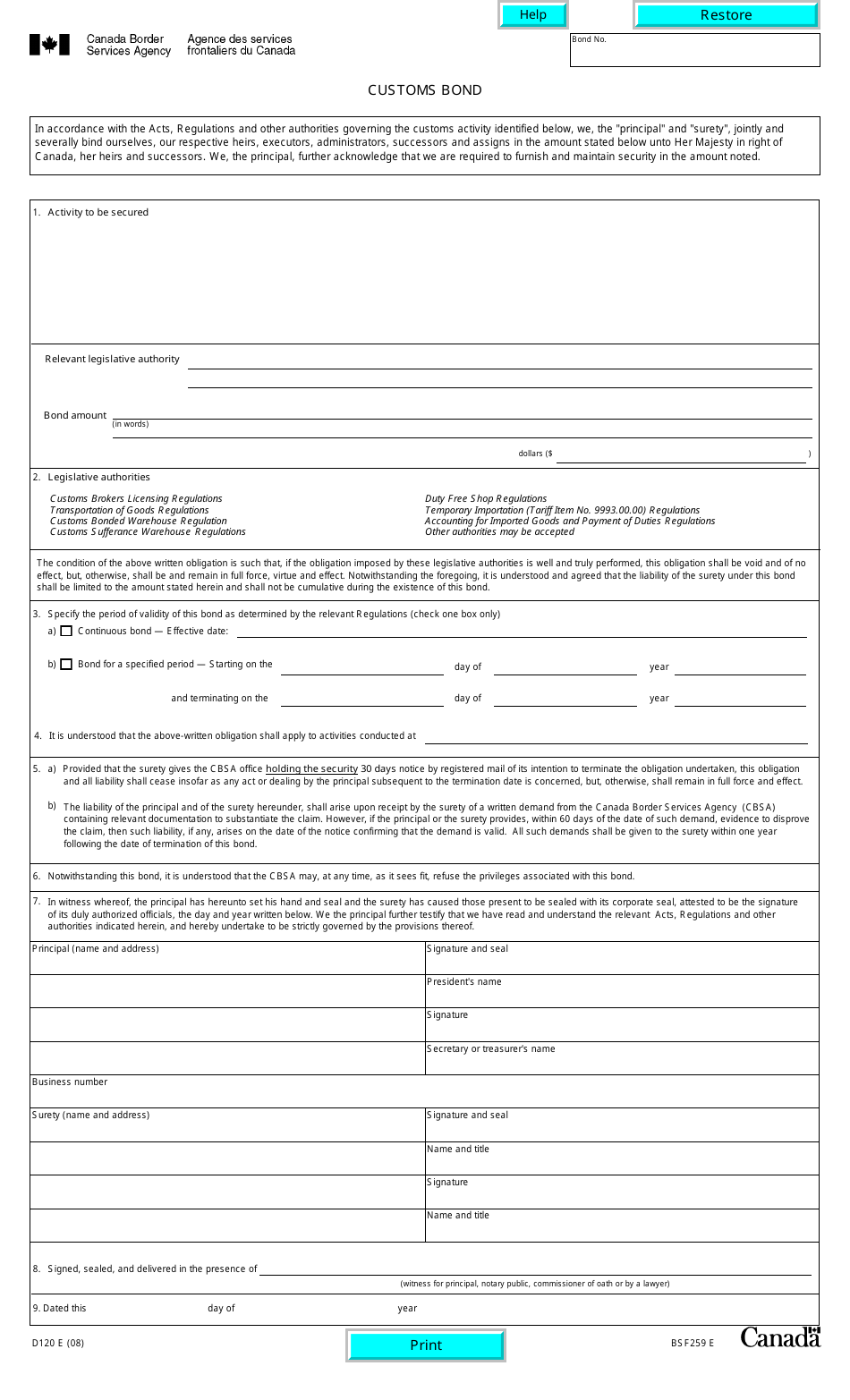

Form D120 Customs Bond - Canada

Form D120 Customs Bond is used in Canada for providing a guarantee to the Canadian Border Services Agency (CBSA) for paying import duties and taxes on goods being imported into Canada. It ensures that the importer will fulfill their financial obligations to CBSA.

The Form D120 Customs Bond in Canada is filed by the importer or their authorized representative.

FAQ

Q: What is Form D120?

A: Form D120 is a Customs Bond specific to Canada.

Q: What is a Customs Bond?

A: A Customs Bond is a financial guarantee that ensures compliance with customs regulations and payment of any potential duties or taxes.

Q: Why is Form D120 required?

A: Form D120 is required by the Canada Border Services Agency (CBSA) as a condition for importing certain goods into Canada.

Q: Who needs to complete Form D120?

A: Importers who are required to post a bond with the CBSA for their import activities need to complete Form D120.

Q: What information is needed on Form D120?

A: Form D120 requires information such as the importer's name, address, contact details, importer's CBSA business number, description of goods, and bond amount.

Q: Are there any fees associated with Form D120?

A: Yes, there may be fees associated with obtaining a customs bond, including the premium charged by the bond provider.

Q: How long is a Customs Bond valid?

A: A Customs Bond is typically valid for a specific period, depending on the nature of the import activities.

Q: What happens if I fail to comply with customs regulations?

A: Failure to comply with customs regulations can result in penalties, fines, and potential seizure of goods.

Q: Can I cancel or terminate a Customs Bond?

A: Yes, a Customs Bond can be cancelled or terminated by providing written notice to the CBSA and bond provider.