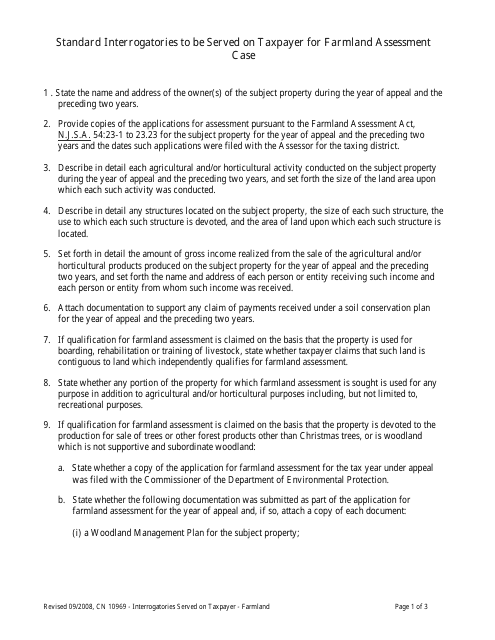

Form 10969 Standard Interrogatories to Be Served on Taxpayer for Farmland Assessment Case - New Jersey

What Is Form 10969?

This is a legal form that was released by the Tax Court of New Jersey - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10969?

A: Form 10969 is a set of standard interrogatories that are to be served on a taxpayer in a farmland assessment case in New Jersey.

Q: What are interrogatories?

A: Interrogatories are written questions that one party asks another party in a legal case.

Q: What is a farmland assessment case?

A: A farmland assessment case is a legal case that concerns the assessment of farmland for tax purposes.

Q: Who uses Form 10969?

A: Form 10969 is used by the party requesting information from the taxpayer in a farmland assessment case.

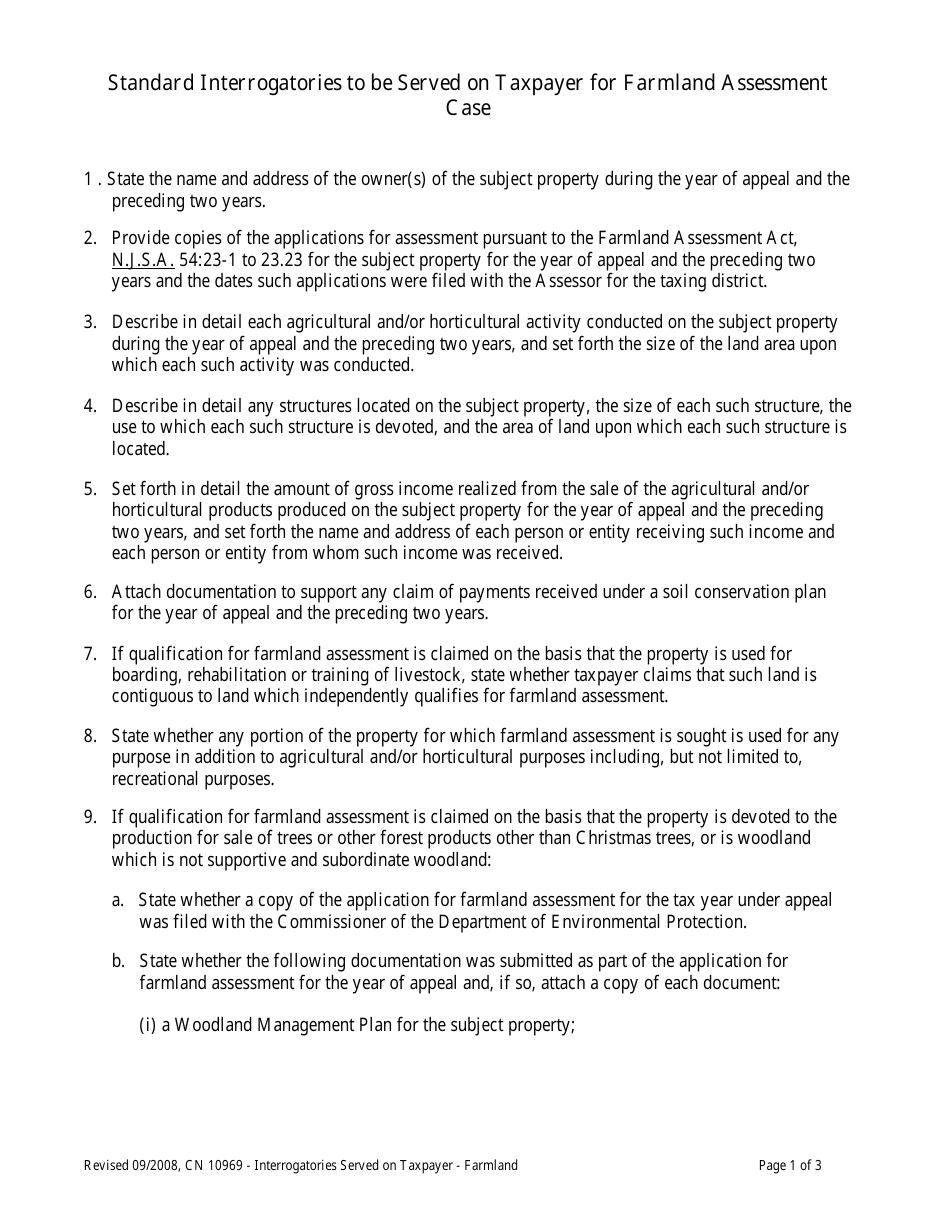

Q: What information does Form 10969 request?

A: Form 10969 requests various information related to the taxpayer's farmland, including ownership, use, and income.

Q: Is Form 10969 specific to New Jersey?

A: Yes, Form 10969 is specific to New Jersey and is designed to comply with the state's laws and regulations regarding farmland assessment cases.

Q: What is the purpose of serving Form 10969 on a taxpayer?

A: The purpose of serving Form 10969 is to collect information and evidence from the taxpayer relating to their farmland assessment, which will be used in the legal case.

Q: What should a taxpayer do if they receive Form 10969?

A: If a taxpayer receives Form 10969, they should carefully review the questions and provide accurate and complete answers within the specified time frame.

Q: Are the answers to Form 10969 considered confidential?

A: The answers to Form 10969 may be subject to confidentiality protections, but this may vary depending on the specific laws and regulations in New Jersey.

Q: Can a taxpayer refuse to answer the questions in Form 10969?

A: In most cases, a taxpayer is legally obligated to provide truthful answers to the questions in Form 10969. However, they may consult with an attorney to understand their specific rights and obligations.

Form Details:

- Released on September 1, 2008;

- The latest edition provided by the Tax Court of New Jersey;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 10969 by clicking the link below or browse more documents and templates provided by the Tax Court of New Jersey.