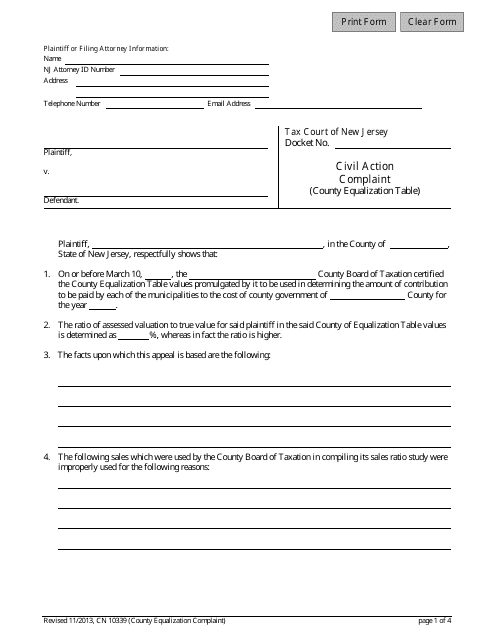

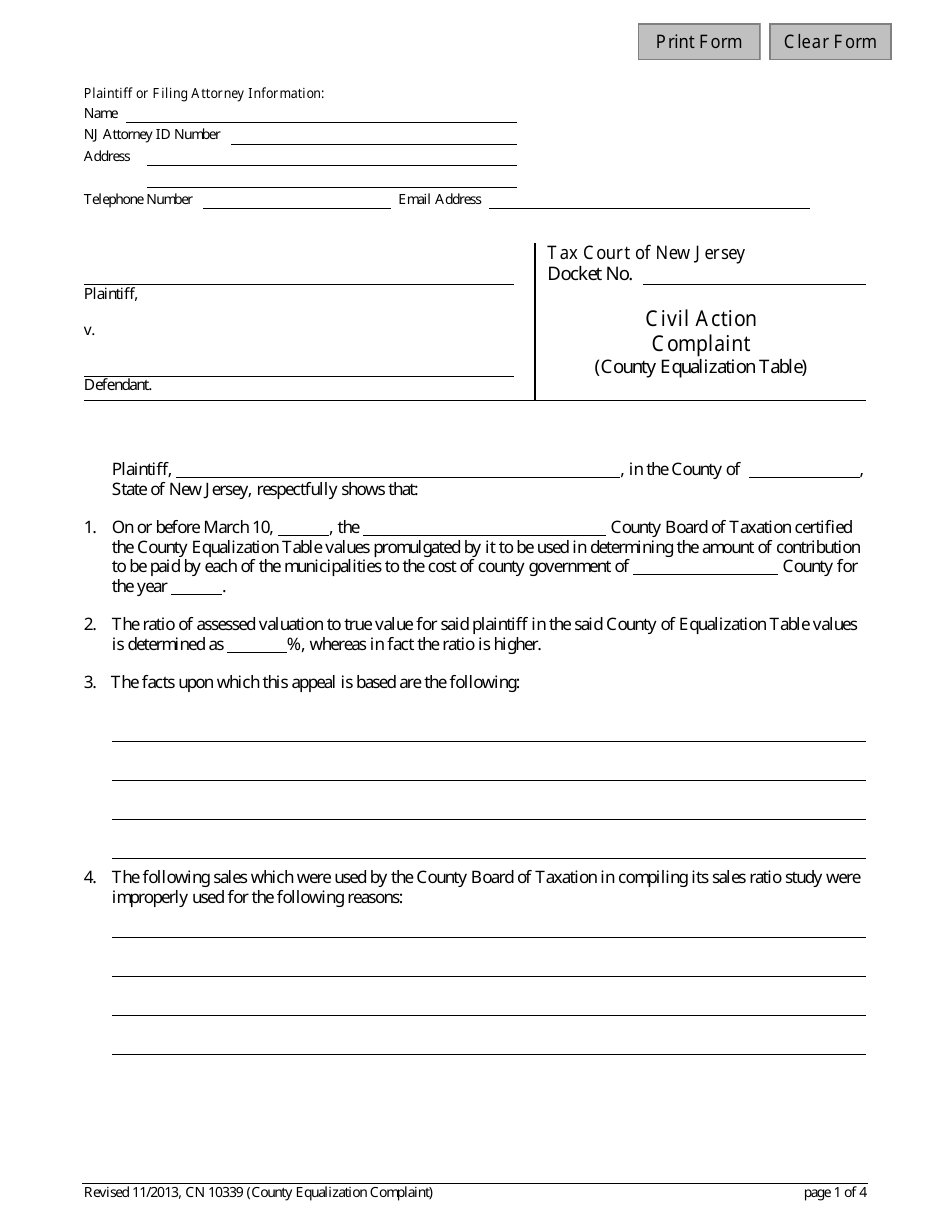

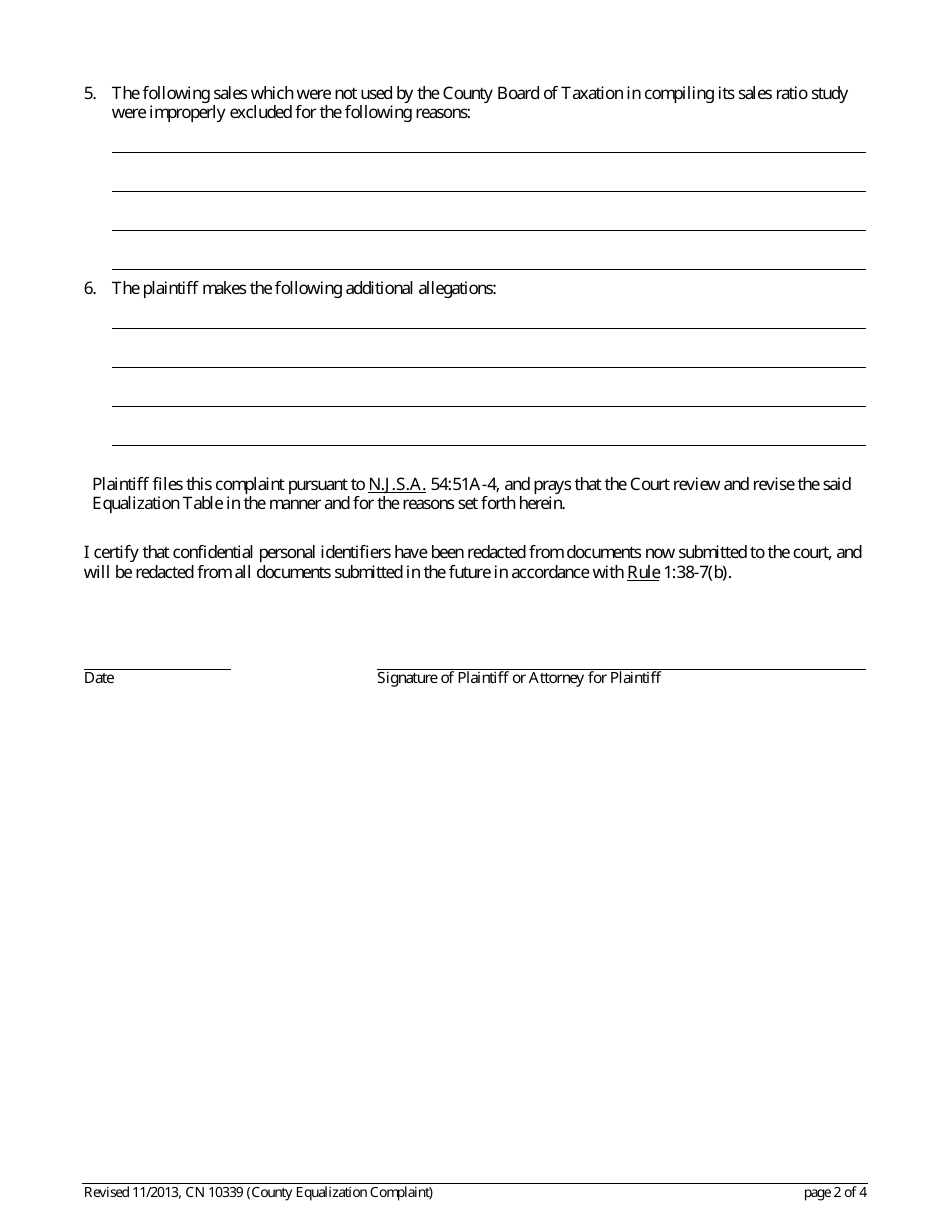

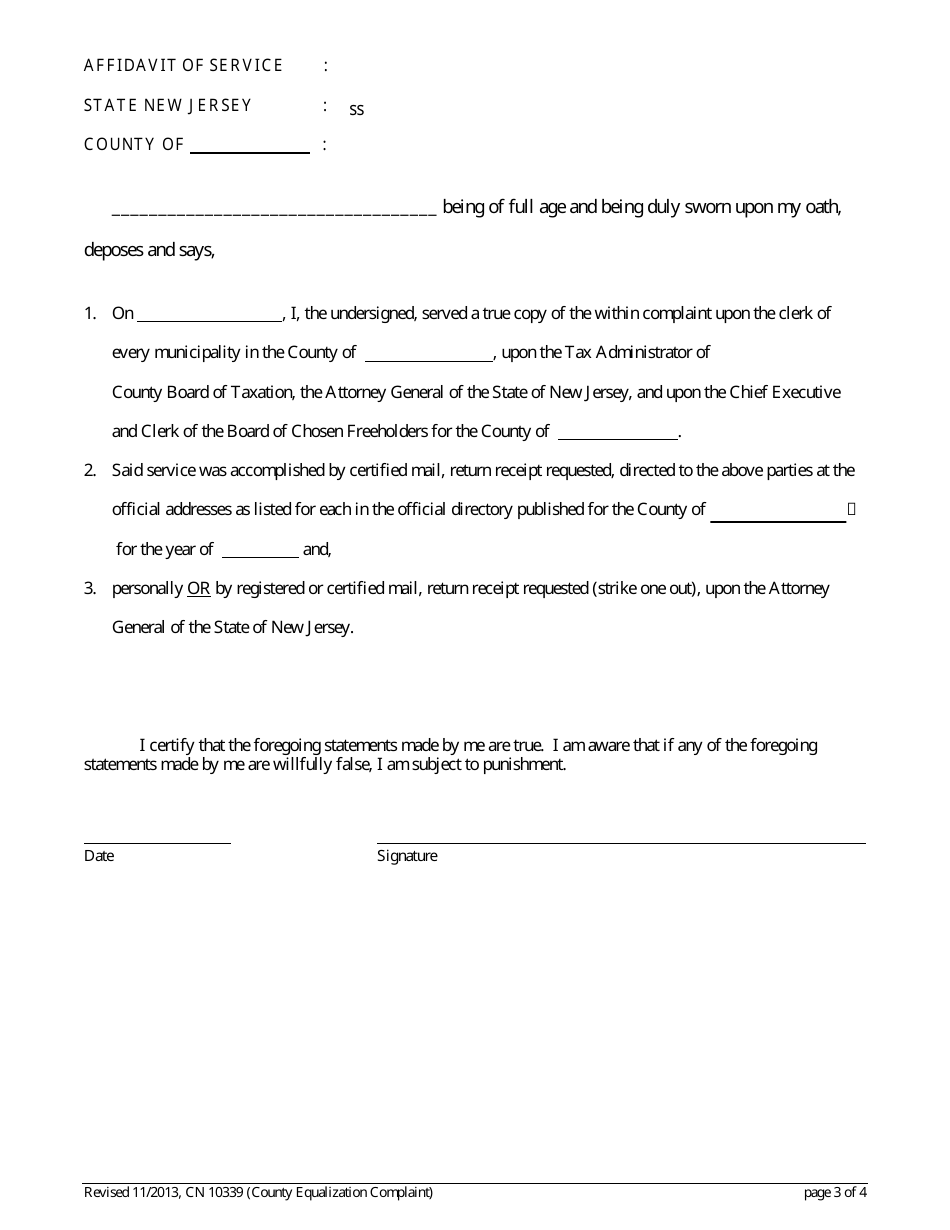

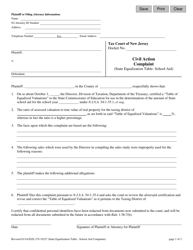

Form 10339 County Equalization Complaint - New Jersey

What Is Form 10339?

This is a legal form that was released by the Tax Court of New Jersey - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

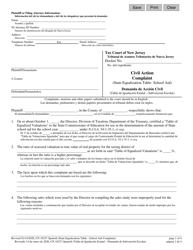

Q: What is Form 10339 County Equalization Complaint?

A: Form 10339 County Equalization Complaint is a document used in New Jersey for filing a complaint regarding property tax assessments.

Q: Who can file Form 10339 County Equalization Complaint?

A: Property owners or their designated agents can file Form 10339 County Equalization Complaint.

Q: What is the purpose of filing Form 10339 County Equalization Complaint?

A: The purpose of filing Form 10339 County Equalization Complaint is to dispute the property tax assessment and request a review of the assessed value.

Q: What information do I need to provide on Form 10339 County Equalization Complaint?

A: You need to provide details about the property, reasons for filing the complaint, and supporting evidence for your claim.

Q: Is there a deadline for filing Form 10339 County Equalization Complaint?

A: Yes, the deadline for filing Form 10339 County Equalization Complaint is usually April 1st of the tax year.

Q: What happens after I file Form 10339 County Equalization Complaint?

A: After filing Form 10339 County Equalization Complaint, your complaint will be reviewed by the County Board of Taxation, and you may be invited to a hearing to present your case.

Q: Can I appeal the decision made on my Form 10339 County Equalization Complaint?

A: Yes, if you disagree with the decision made on your Form 10339 County Equalization Complaint, you can appeal to the New Jersey Tax Court within 45 days of the decision.

Form Details:

- Released on November 1, 2013;

- The latest edition provided by the Tax Court of New Jersey;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10339 by clicking the link below or browse more documents and templates provided by the Tax Court of New Jersey.