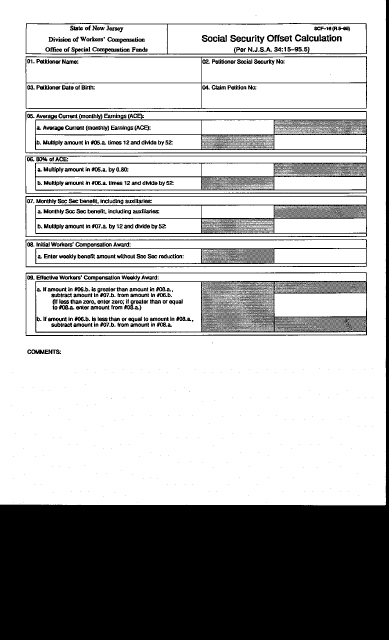

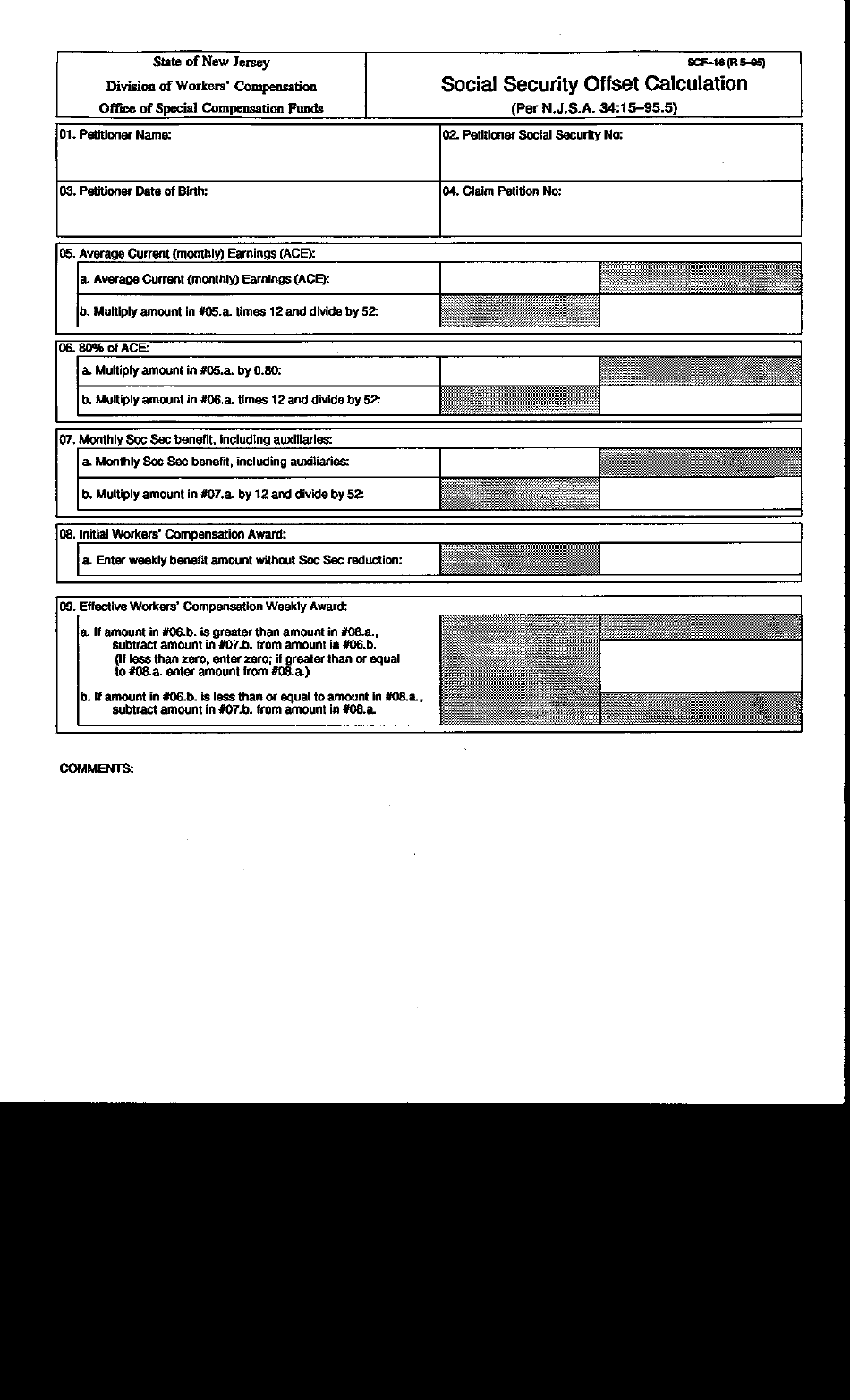

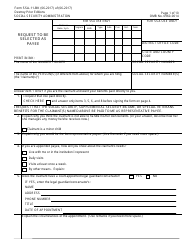

Form SCF-16 Social Security Offset Calculation - New Jersey

What Is Form SCF-16?

This is a legal form that was released by the New Jersey Department of Labor & Workforce Development - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

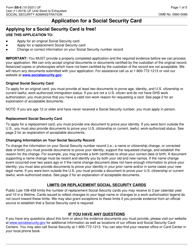

Q: What is Form SCF-16?

A: Form SCF-16 is a specific form used in New Jersey to calculate Social Security offsets.

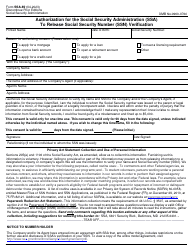

Q: What is a Social Security offset?

A: A Social Security offset refers to the reduction of Social Security benefits due to other sources of income.

Q: Who needs to file Form SCF-16?

A: Individuals in New Jersey who receive Social Security benefits and have other sources of income need to file Form SCF-16.

Q: What types of income are considered for the Social Security offset calculation?

A: Types of income considered for the calculation include pensions, retirement benefits, and other annuities.

Q: How does Form SCF-16 work?

A: Form SCF-16 helps determine the amount of the Social Security offset by calculating an individual's countable income.

Q: When should Form SCF-16 be filed?

A: Form SCF-16 should be filed with your annual New Jersey Income Tax Return.

Q: Are there any exemptions or deductions available?

A: Yes, there are certain exemptions and deductions available that can reduce the Social Security offset.

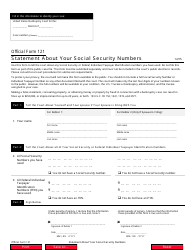

Q: What happens if I don't file Form SCF-16?

A: If you don't file Form SCF-16 when required, you may be subject to penalties or additional taxes.

Form Details:

- Released on May 1, 1995;

- The latest edition provided by the New Jersey Department of Labor & Workforce Development;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form SCF-16 by clicking the link below or browse more documents and templates provided by the New Jersey Department of Labor & Workforce Development.