This version of the form is not currently in use and is provided for reference only. Download this version of

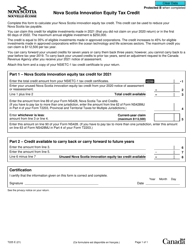

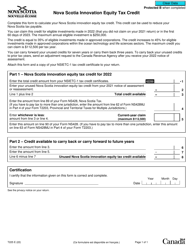

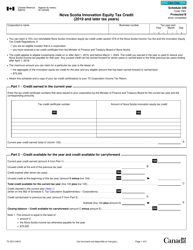

Form 0329F

for the current year.

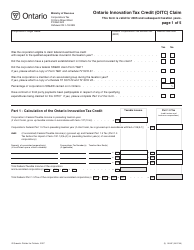

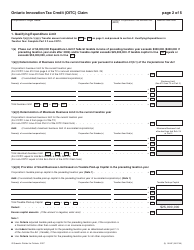

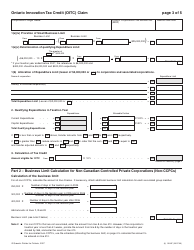

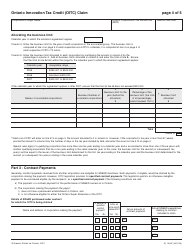

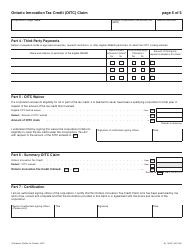

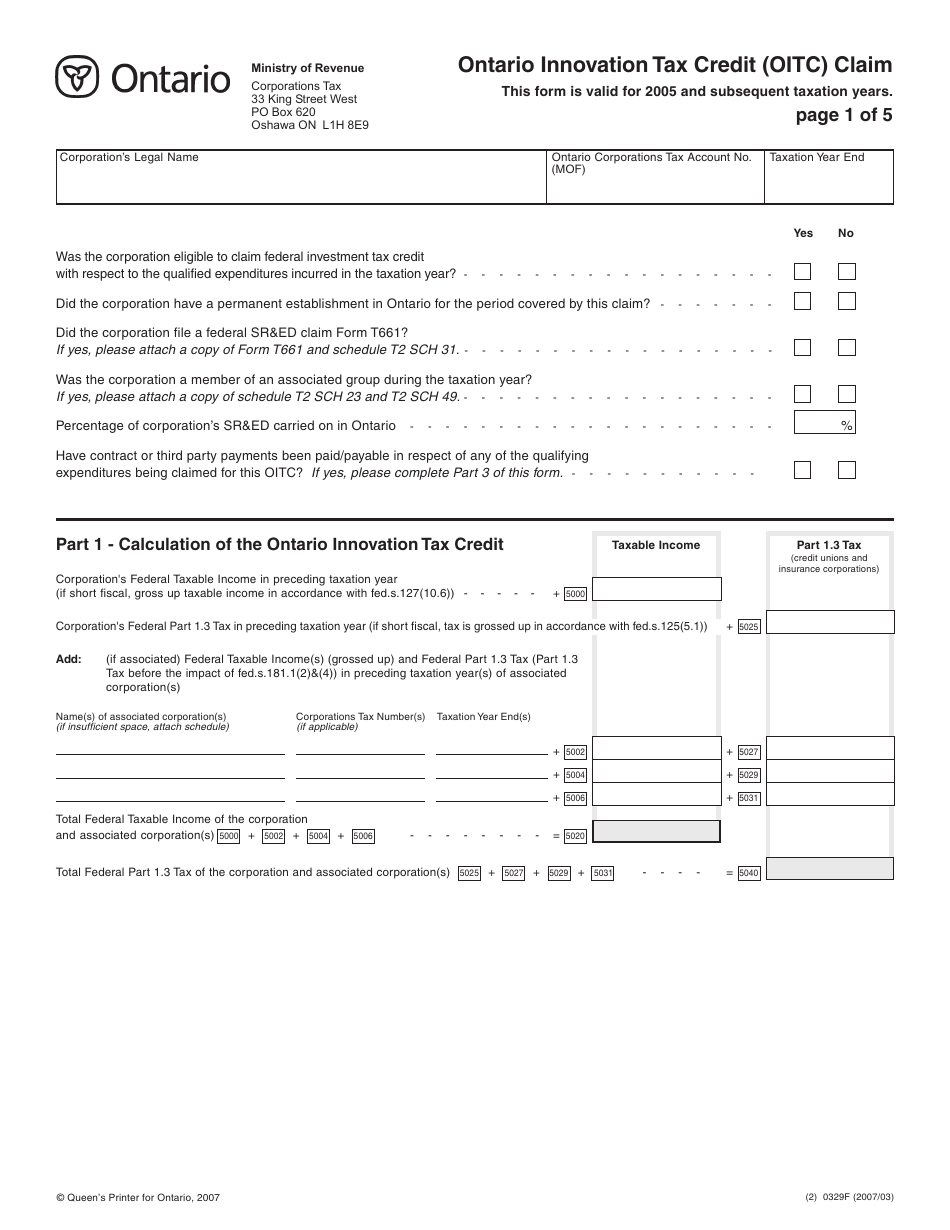

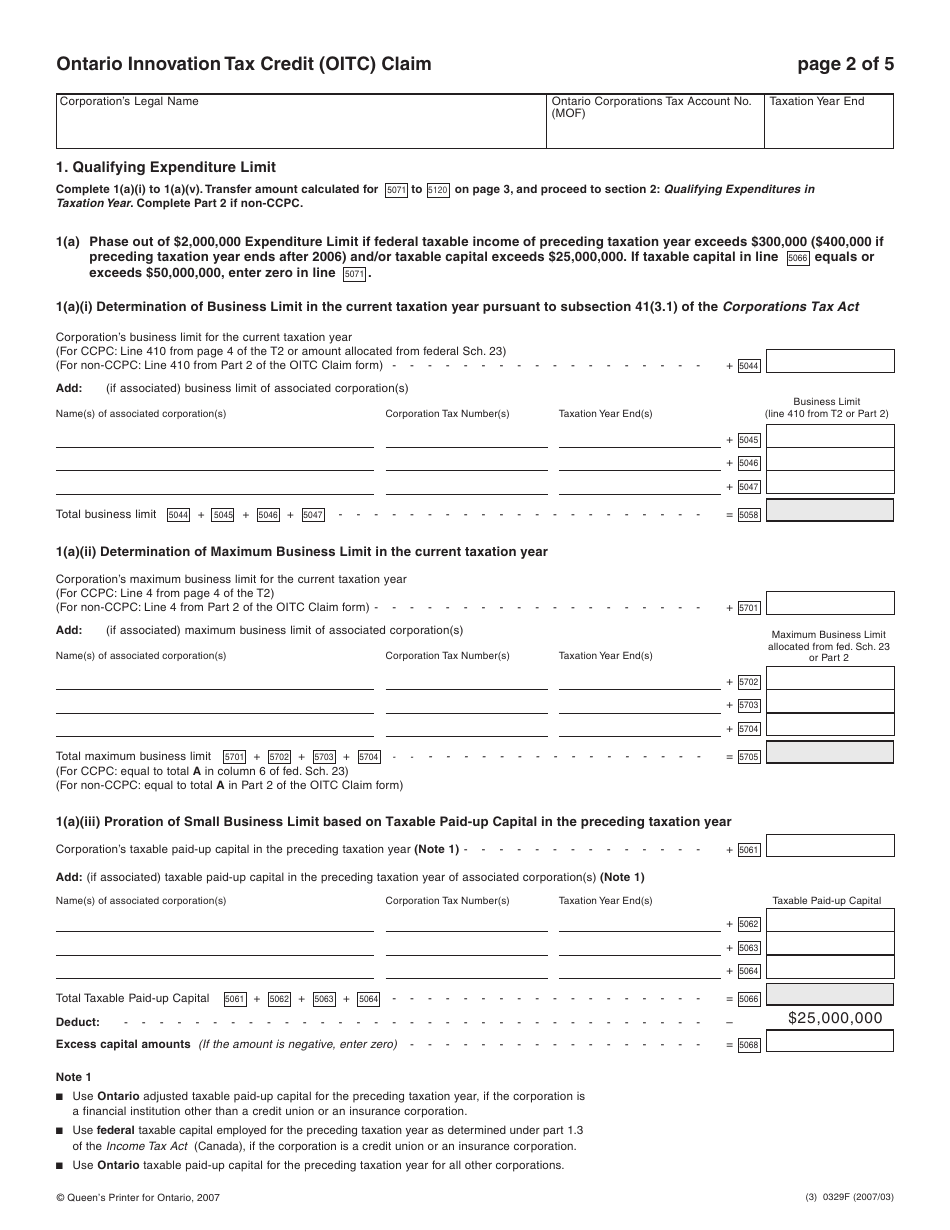

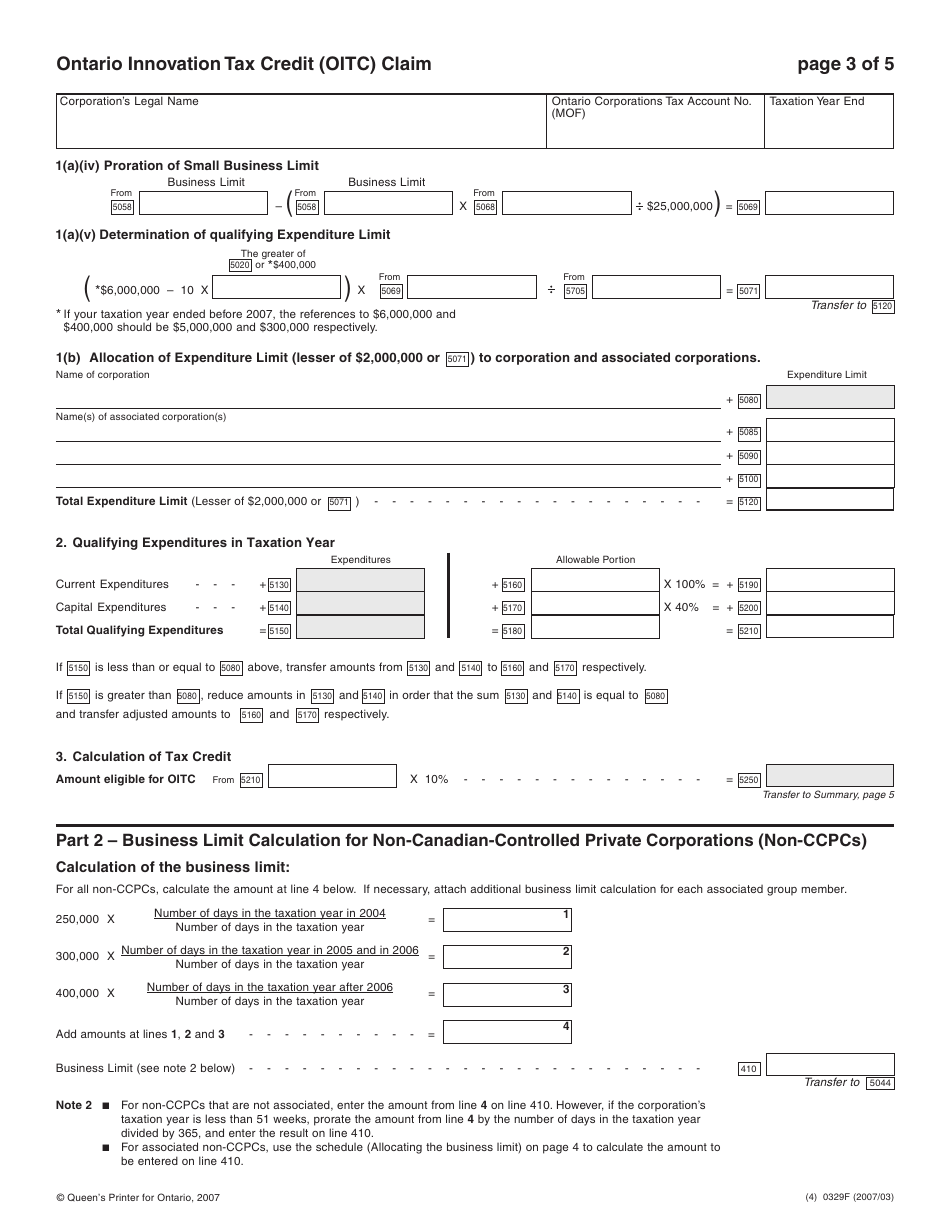

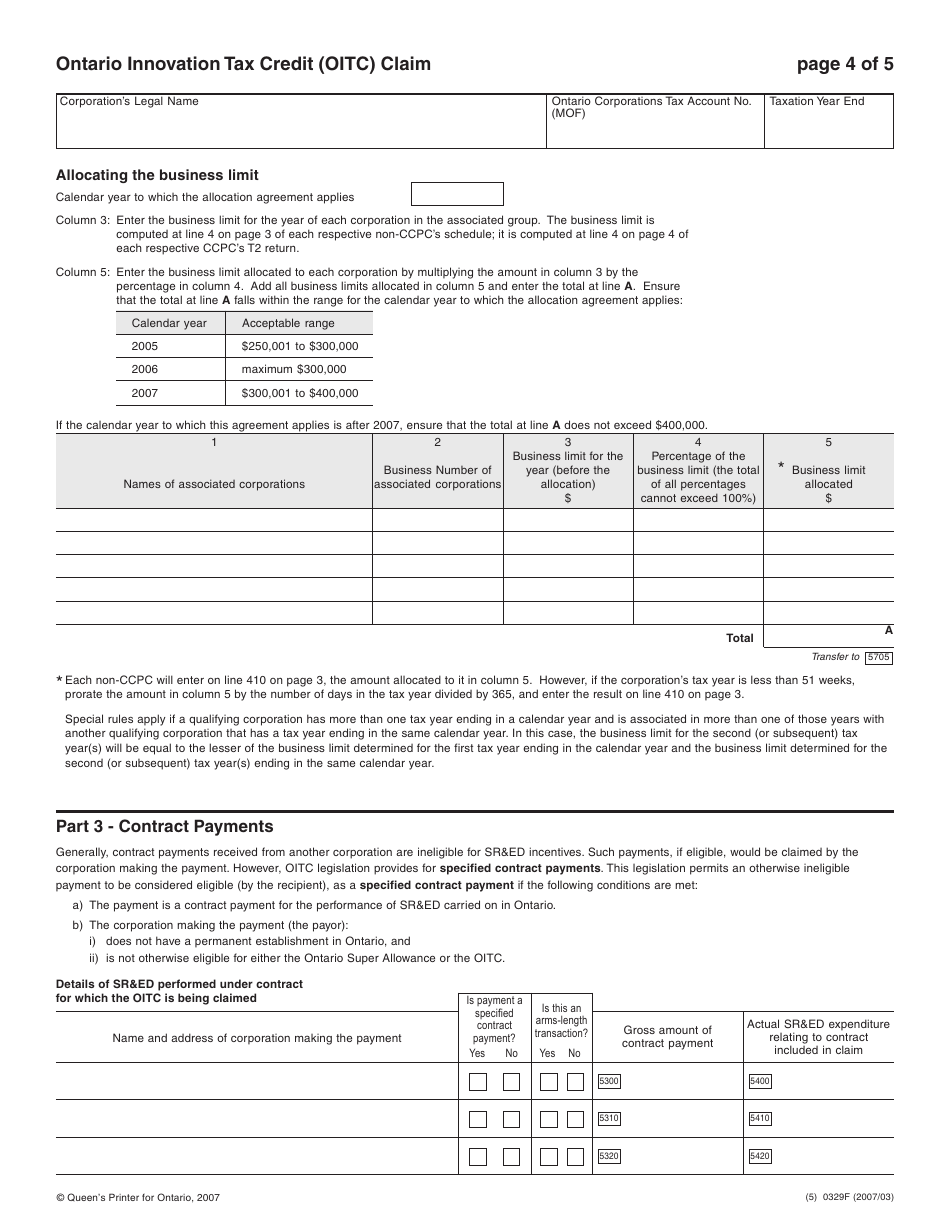

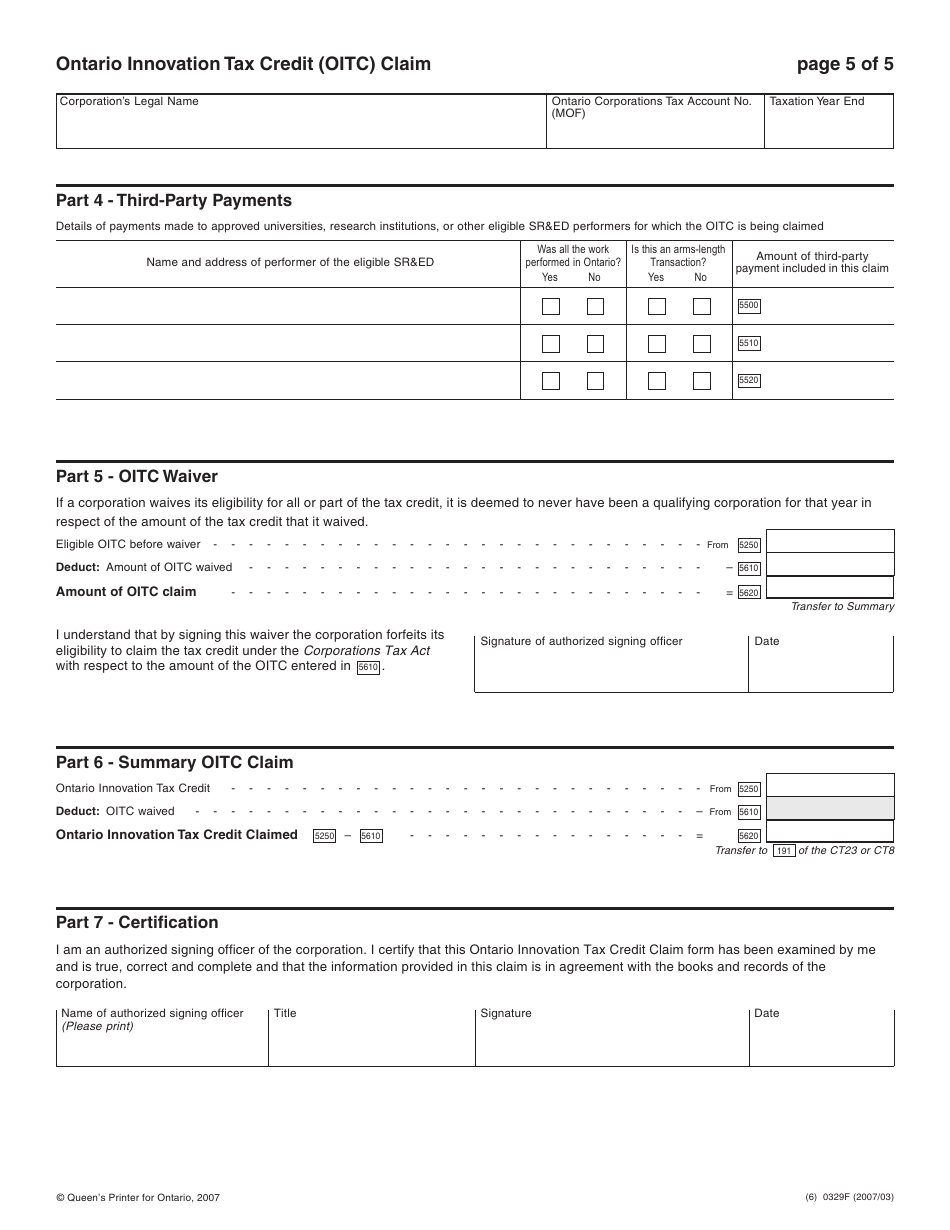

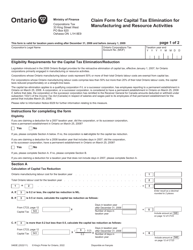

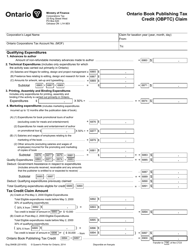

Form 0329F Ontario Innovation Tax Credit (Oitc) Claim - Ontario, Canada

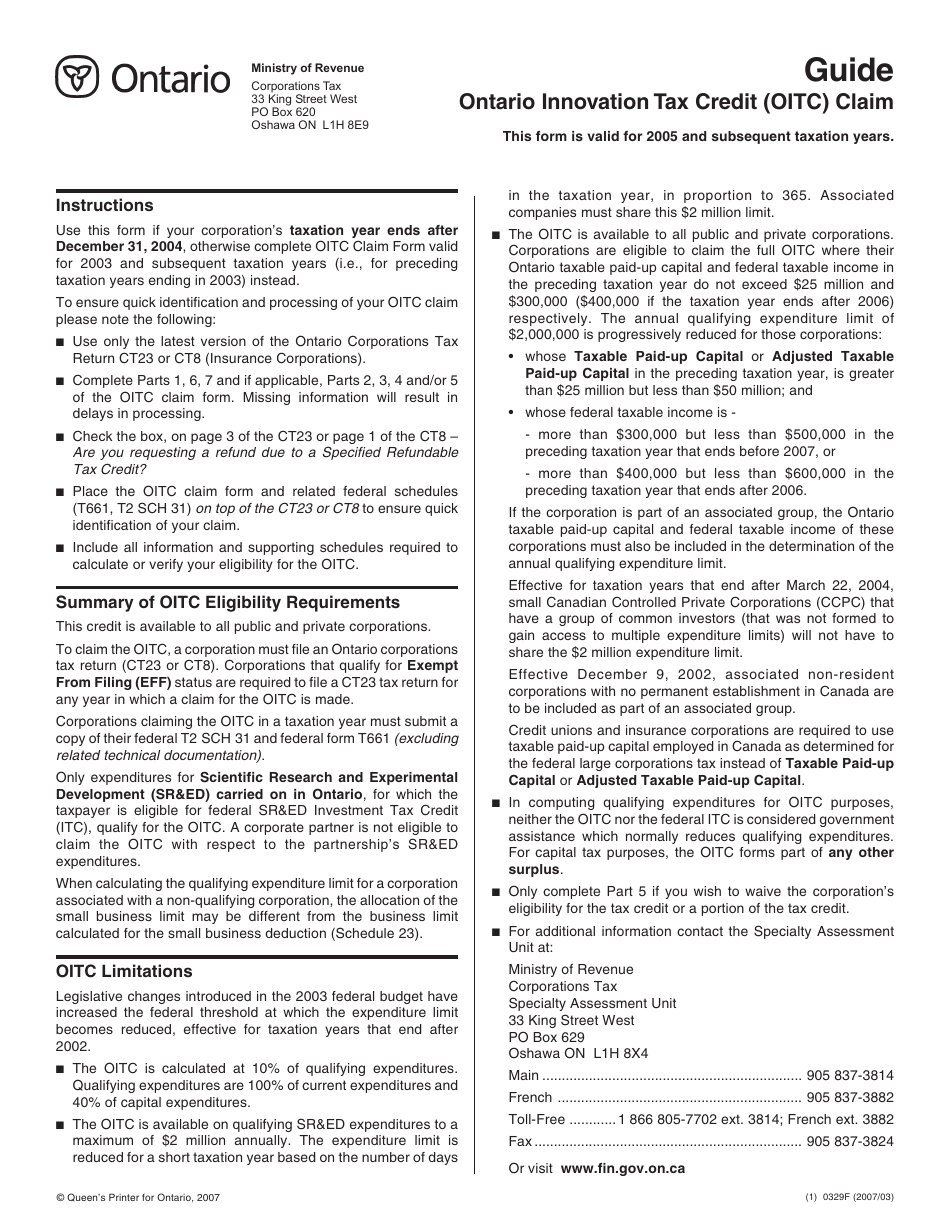

Form 0329F is used to claim the Ontario Innovation Tax Credit (OITC) in Ontario, Canada. OITC is a tax credit program designed to support businesses involved in scientific research and experimental development activities.

The Form 0329F for the Ontario Innovation Tax Credit (OITC) claim in Ontario, Canada is filed by eligible corporations who meet the necessary criteria.

FAQ

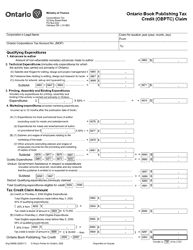

Q: What is Form 0329F?

A: Form 0329F is the Ontario Innovation Tax Credit (OITC) Claim form.

Q: What is the Ontario Innovation Tax Credit (OITC)?

A: The Ontario Innovation Tax Credit (OITC) is a tax credit available to corporations in Ontario, Canada.

Q: Who can claim the Ontario Innovation Tax Credit (OITC)?

A: Corporations that carry out scientific research and experimental development (SR&ED) in Ontario may be eligible to claim the OITC.

Q: What type of activities qualify for the Ontario Innovation Tax Credit (OITC)?

A: Activities such as scientific research, experimental development, and certain engineering work may qualify for the OITC.

Q: How do I claim the Ontario Innovation Tax Credit (OITC)?

A: To claim the OITC, you need to complete Form 0329F and submit it with your corporate tax return.

Q: Are there any deadlines for claiming the Ontario Innovation Tax Credit (OITC)?

A: Yes, the OITC must be claimed within 18 months from the end of the tax year in which the eligible expenditures were incurred.

Q: Can I claim the Ontario Innovation Tax Credit (OITC) if I am an individual taxpayer?

A: No, the OITC is available only to corporations.

Q: Is there a minimum expenditure requirement to claim the Ontario Innovation Tax Credit (OITC)?

A: Yes, you must have at least $20,000 in eligible expenditures to claim the OITC.

Q: What is the benefit of claiming the Ontario Innovation Tax Credit (OITC)?

A: By claiming the OITC, eligible corporations can reduce their Ontario corporate income tax.