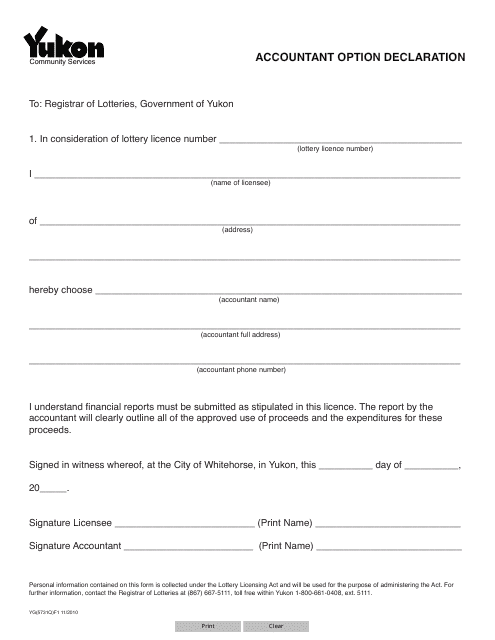

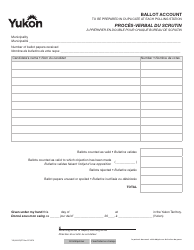

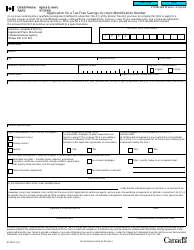

Form YG5731 Account Option Declaration - Yukon, Canada

FAQ

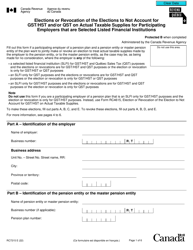

Q: What is Form YG5731?

A: Form YG5731 is an Account Option Declaration form used in Yukon, Canada.

Q: What is the purpose of Form YG5731?

A: The purpose of Form YG5731 is to declare the account options for taxation in Yukon.

Q: Who needs to fill out Form YG5731?

A: Individuals and businesses in Yukon who need to declare their account options for taxation.

Q: Is Form YG5731 mandatory?

A: Yes, if you are a resident of Yukon and have account options for taxation, you are required to fill out Form YG5731.

Q: When should I submit Form YG5731?

A: Form YG5731 should be submitted by the due date specified by the Yukon government, typically during tax filing season.

Q: Are there any penalties for not submitting Form YG5731?

A: Yes, failure to submit Form YG5731 on time may result in penalties imposed by the Yukon government.

Q: What information do I need to fill out Form YG5731?

A: You will need to provide information about your account options and any applicable taxation details.

Q: Can I make changes to my account options after submitting Form YG5731?

A: Yes, you can make changes to your account options by submitting an amended Form YG5731.

Q: Do I need to keep a copy of Form YG5731 for my records?

A: Yes, it is recommended to keep a copy of Form YG5731 for your records and future reference.