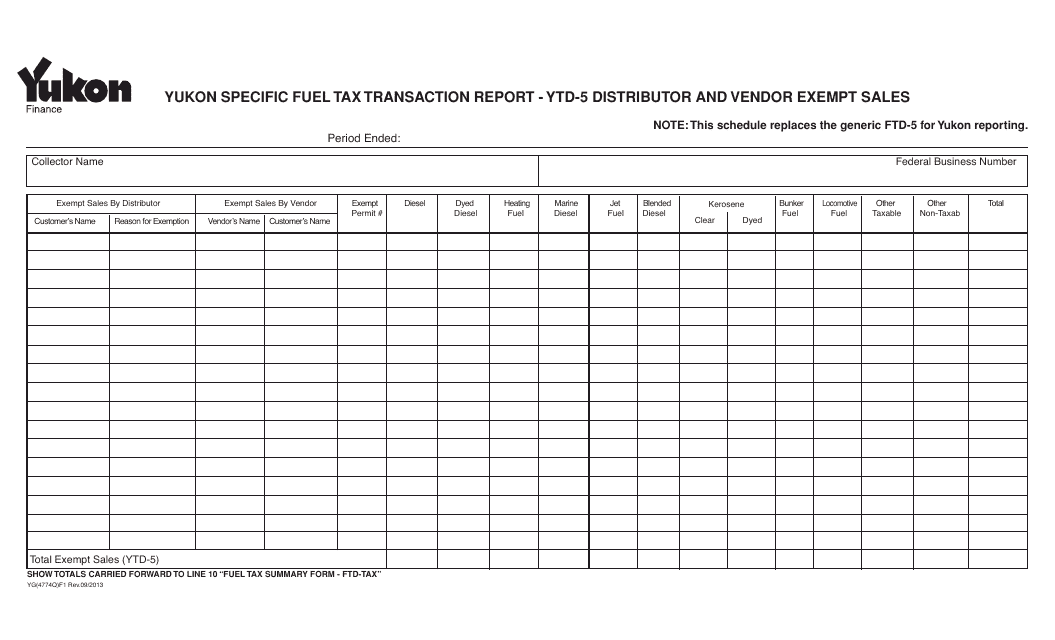

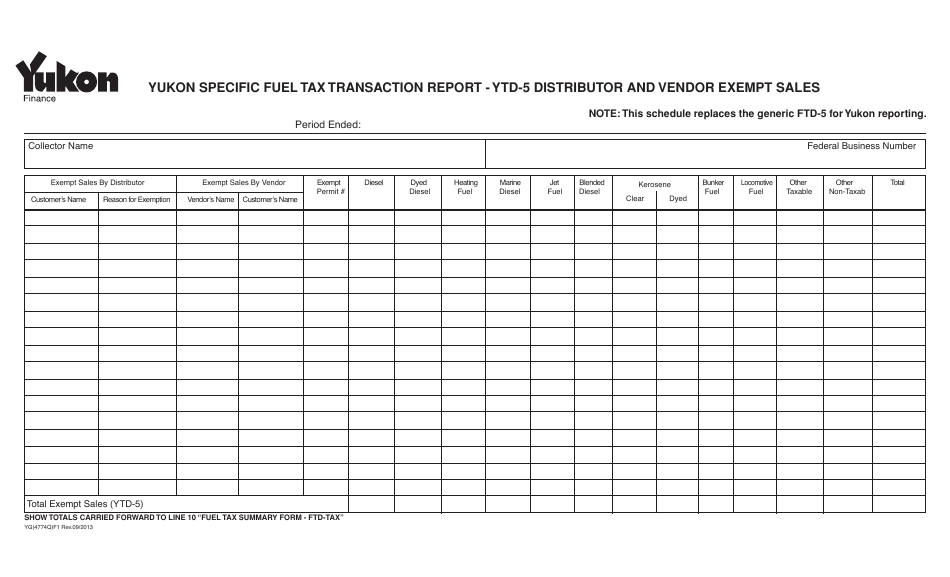

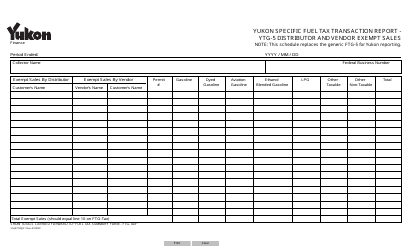

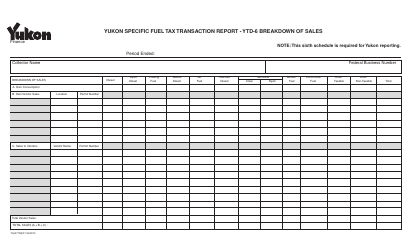

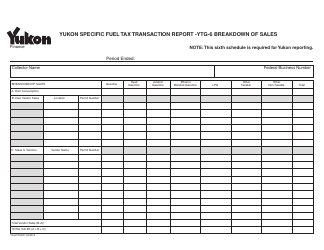

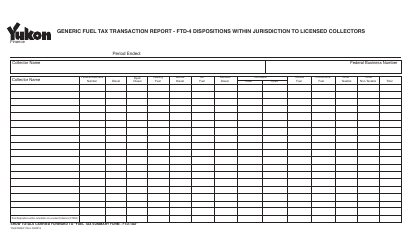

Form YG4774 Yukon Specific Fuel Tax Transaction Report - Ytd-5 Distributor and Vendor Exempt Sales - Yukon, Canada

Form YG4774 Yukon Specific Fuel Tax Transaction Report - Ytd-5 Distributor and Vendor Exempt Sales - Yukon, Canada is used for reporting exempt sales of fuel by distributors and vendors in Yukon, Canada.

The Form YG4774 Yukon Specific Fuel Tax Transaction Report - Ytd-5 Distributor and Vendor Exempt Sales - Yukon, Canada is typically filed by distributors and vendors in Yukon, Canada who have made exempt sales of fuel.

FAQ

Q: What is YG4774?

A: YG4774 is the form for the Yukon Specific Fuel Tax Transaction Report.

Q: What is the purpose of the YG4774 form?

A: The purpose of the YG4774 form is to report YTD-5 distributor and vendor exempt sales of fuel in Yukon, Canada.

Q: Who needs to file the YG4774 form?

A: Distributors and vendors who have exempt sales of fuel in Yukon, Canada need to file the YG4774 form.

Q: What is YTD-5?

A: YTD-5 refers to the year-to-date period being reported, specifically the fifth period of the year.

Q: What is the Yukon Specific Fuel Tax?

A: The Yukon Specific Fuel Tax is a tax imposed on the retail sale of fuel in Yukon, Canada.