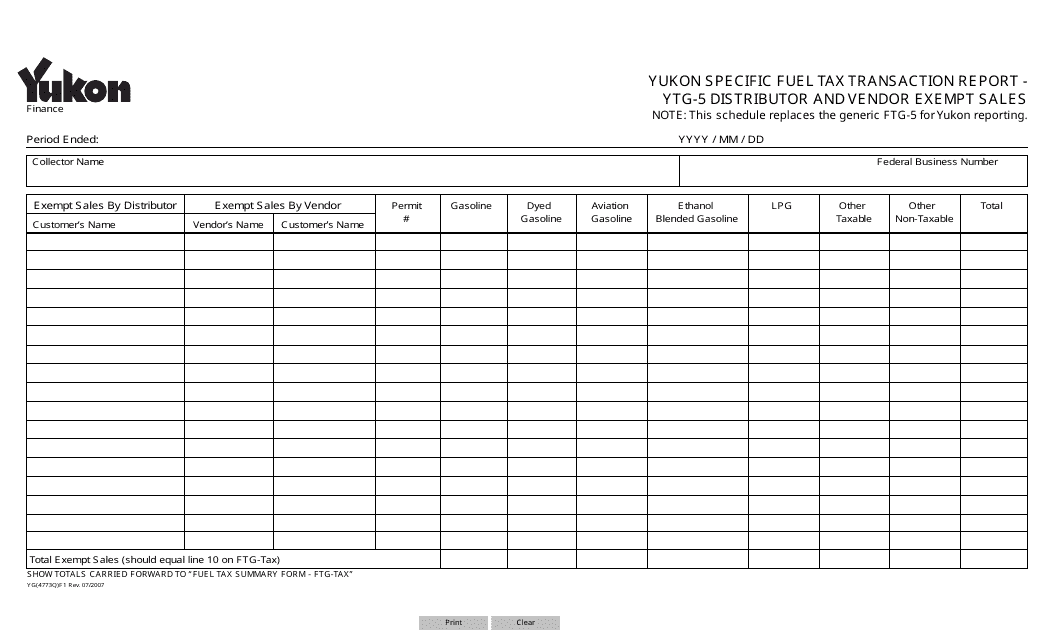

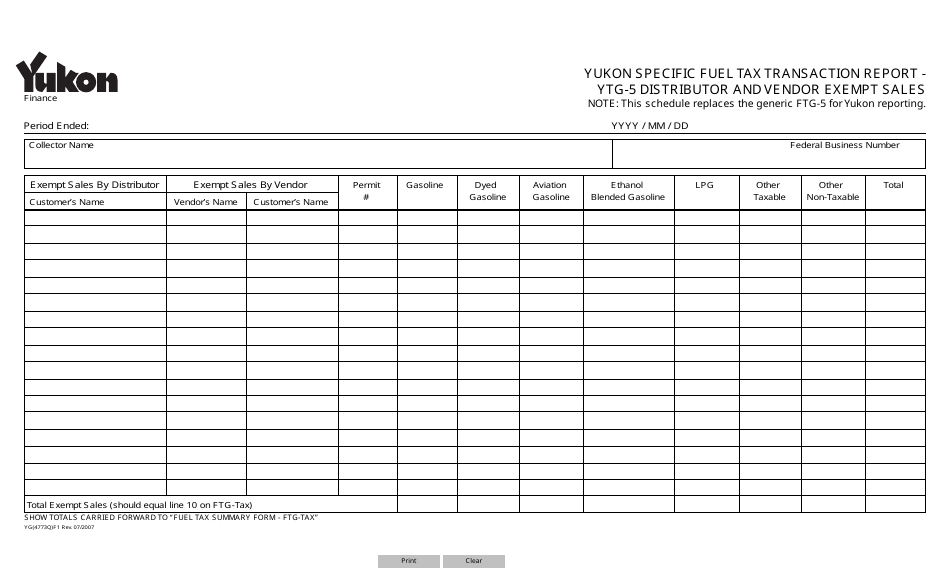

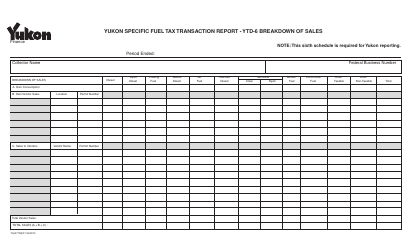

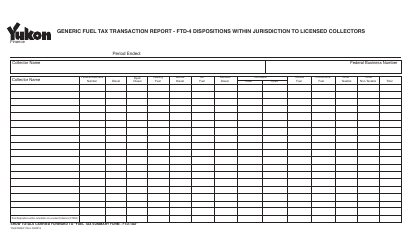

Form YG4773 Yukon Specific Fuel Tax Transaction Report - Ytg-5 Distributor and Vendor Exempt Sales - Yukon, Canada

Form YG4773 Yukon Specific Fuel Tax Transaction Report - Ytg-5 Distributor and Vendor Exempt Sales is used in Yukon, Canada to report fuel sales made by distributors and vendors that are exempt from specific fuel tax.

The Form YG4773 Yukon Specific Fuel Tax Transaction Report - YTG-5 Distributor and Vendor Exempt Sales in Yukon, Canada is filed by the distributor or vendor who is making exempt sales of fuel.

FAQ

Q: What is Form YG4773?

A: Form YG4773 is the Yukon Specific Fuel Tax Transaction Report.

Q: What is the purpose of Form YG4773?

A: Form YG4773 is used for reporting Yukon specific fuel tax transactions.

Q: What does YTG-5 stand for?

A: YTG-5 stands for Yukon Government 5.

Q: Who is required to file Form YG4773?

A: Distributors and vendors who make exempt sales are required to file Form YG4773.

Q: What type of sales are reported on Form YG4773?

A: Form YG4773 is used to report exempt sales.

Q: What is the Yukon specific fuel tax?

A: Yukon specific fuel tax is a tax imposed on specific fuels in Yukon.

Q: What other information is required on Form YG4773?

A: Form YG4773 requires information like the date of sale, type of fuel, quantity sold, etc.

Q: Is there a deadline for filing Form YG4773?

A: Yes, Form YG4773 must be filed by a specific deadline, as determined by the Yukon government.