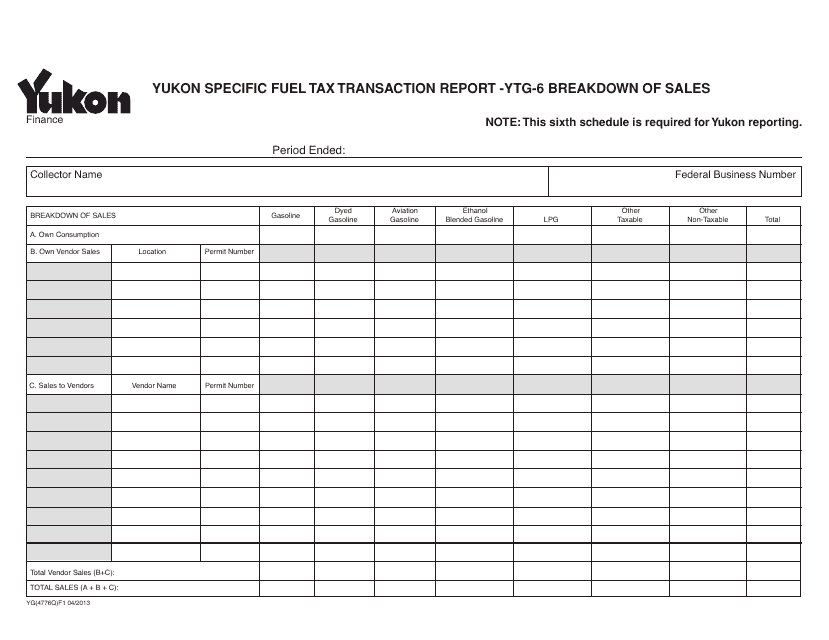

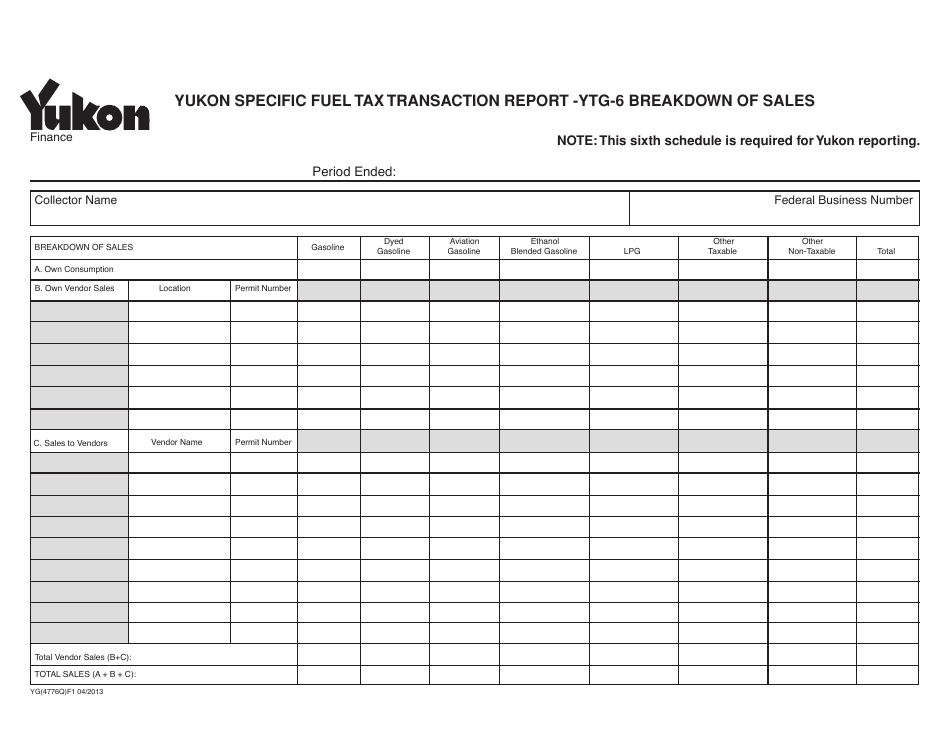

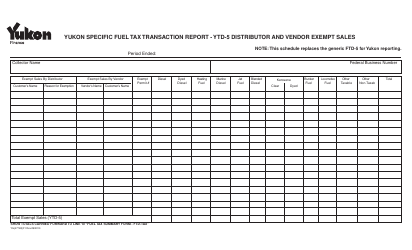

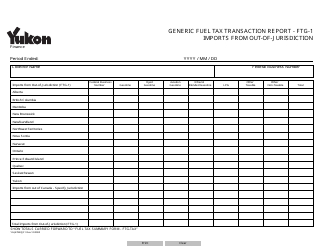

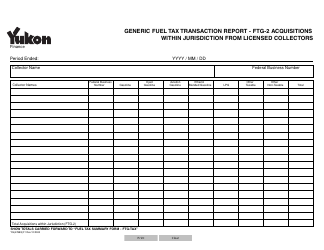

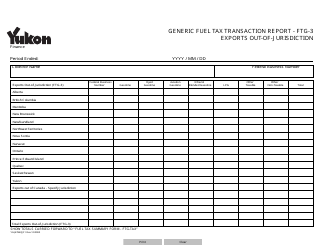

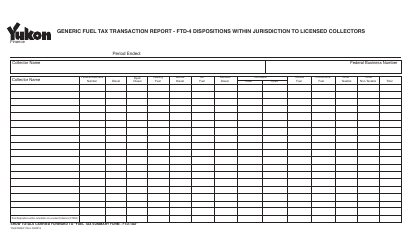

Form YG4776 Yukon Specific Fuel Tax Transaction Report - Ytg-6 Breakdown of Sales - Yukon, Canada

The Form YG4776 Yukon Specific Fuel Tax Transaction Report - YTG-6 Breakdown of Sales is used in Yukon, Canada to report detailed information about fuel sales for the purpose of calculating and collecting specific fuel taxes.

The Form YG4776 Yukon Specific Fuel Tax Transaction Report - YTG-6 Breakdown of Sales in Yukon, Canada is filed by fuel distributors or wholesalers in Yukon.

FAQ

Q: What is the YG4776 Yukon Specific Fuel Tax Transaction Report?

A: The YG4776 Yukon Specific Fuel Tax Transaction Report is a form used to report the breakdown of sales related to fuel tax in Yukon, Canada.

Q: What is YTG-6?

A: YTG-6 is a section in the YG4776 Yukon Specific Fuel Tax Transaction Report which provides a breakdown of sales.

Q: What is the purpose of the YG4776 form?

A: The purpose of the YG4776 form is to accurately report and document fuel tax transactions in Yukon, Canada.

Q: Who needs to fill out the YG4776 form?

A: Businesses and individuals involved in the sale of fuel in Yukon, Canada need to fill out the YG4776 form.

Q: What information is required in the YTG-6 section of the form?

A: The YTG-6 section of the YG4776 form requires detailed information about the breakdown of sales, such as the type of fuel sold, quantity, and total amount.

Q: How often do I need to submit the YG4776 form?

A: The frequency of submitting the YG4776 form varies and is determined by the Yukon government. It is important to follow the guidelines and deadlines set by the government.

Q: What are the consequences of not filing the YG4776 form?

A: Not filing the YG4776 form or providing false information can lead to penalties and legal consequences.

Q: Is the YG4776 form applicable only in Yukon, Canada?

A: Yes, the YG4776 form is specific to fuel tax transactions in Yukon, Canada, and may not be applicable in other provinces or territories.