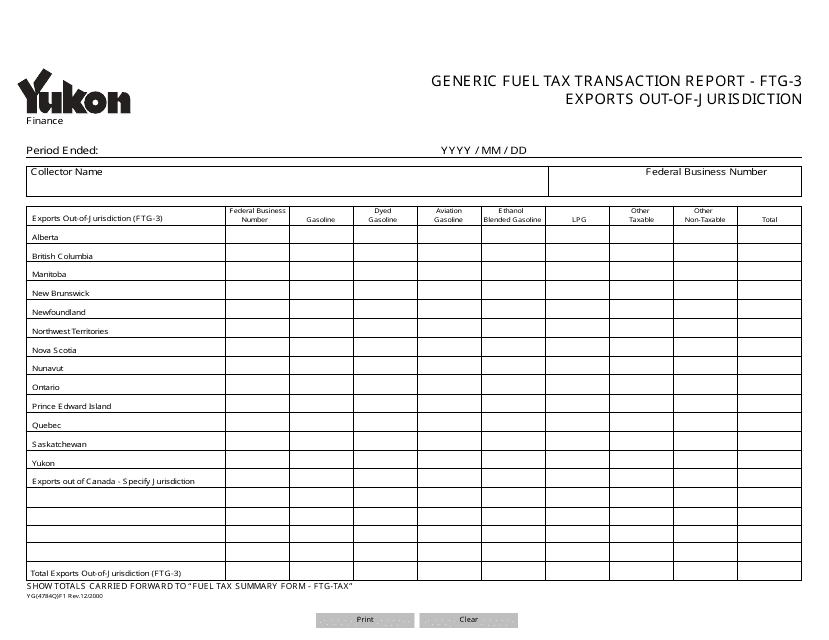

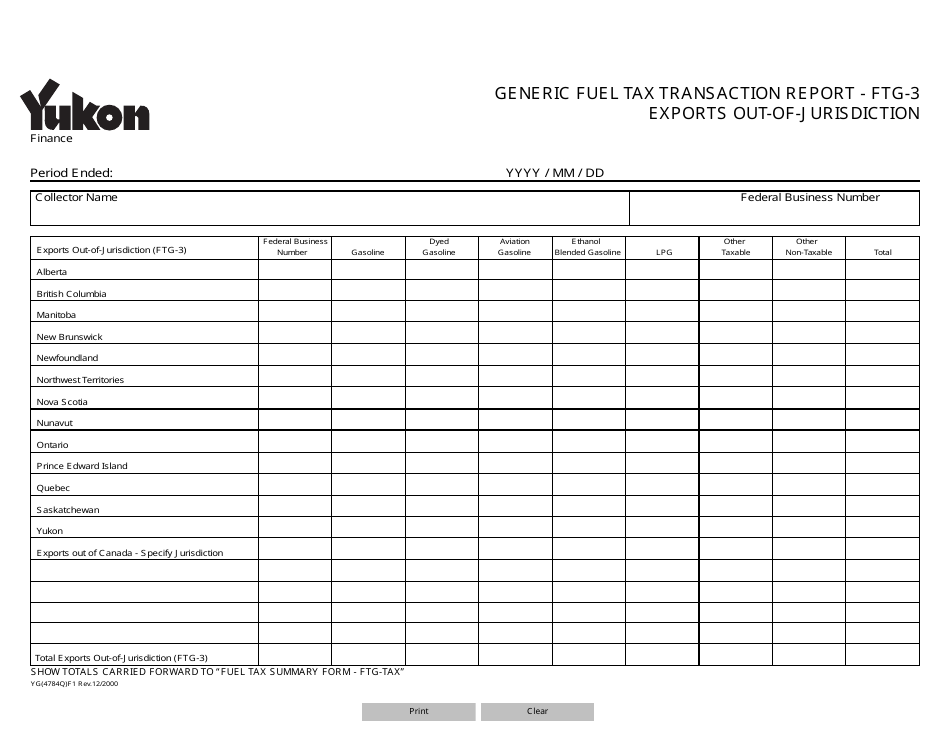

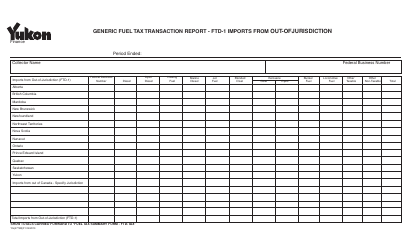

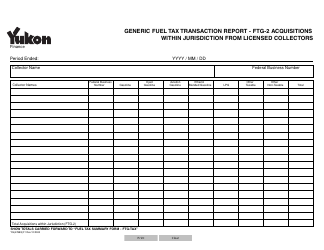

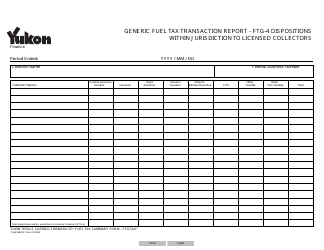

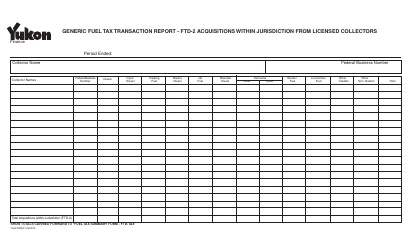

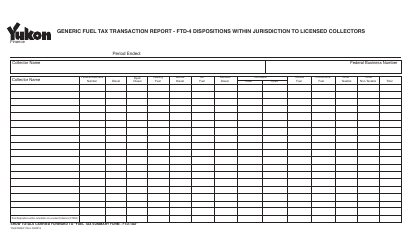

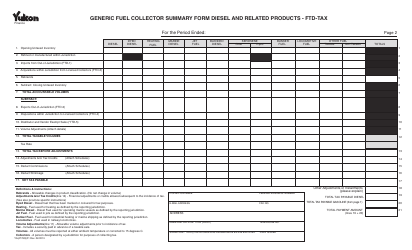

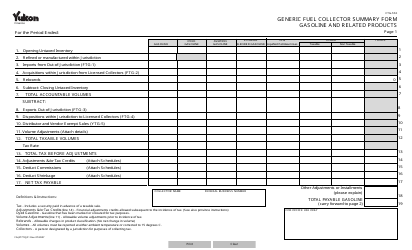

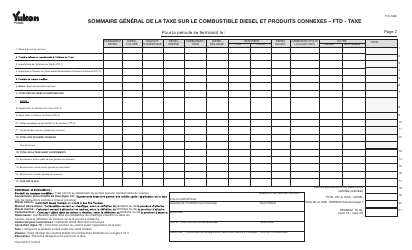

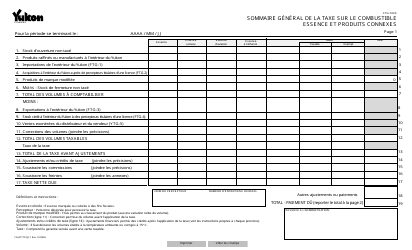

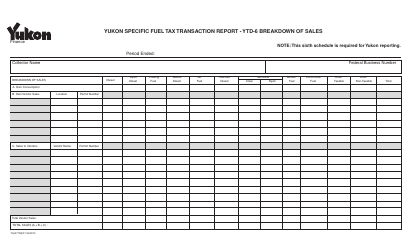

Form YG4784 Generic Fuel Tax Transaction Report - Ftg-3 Exports out-Of-Jurisdiction - Yukon, Canada

The Form YG4784 Generic Fuel Tax Transaction Report - FTG-3 Exports out-of-Jurisdiction is used in Yukon, Canada to report and record fuel transactions involving exports that occur outside of the jurisdiction. This form helps to track and monitor fuel sales and exports for taxation purposes.

The form YG4784 Generic Fuel Tax Transaction Report - FTG-3 Exports Out-of-Jurisdiction in Yukon, Canada is filed by fuel distributors or suppliers.

FAQ

Q: What is the Form YG4784?

A: Form YG4784 is a Generic Fuel Tax Transaction Report.

Q: What is the purpose of Form YG4784?

A: The purpose of Form YG4784 is to report fuel tax transactions.

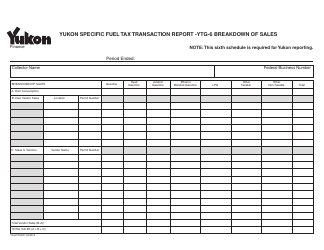

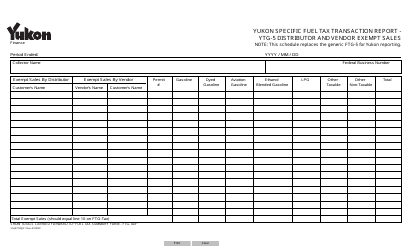

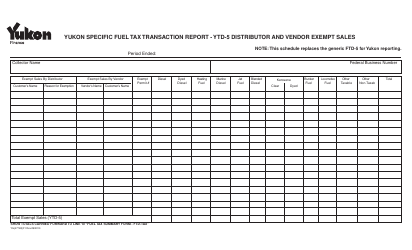

Q: What is FTG-3?

A: FTG-3 refers to the specific section of the form which deals with exports out-of-jurisdiction.

Q: What does 'exports out-of-jurisdiction' mean?

A: 'Exports out-of-jurisdiction' refers to fuel transactions where the fuel is being transported outside the jurisdiction of Yukon, Canada.

Q: Who needs to fill out Form YG4784?

A: Anyone involved in fuel tax transactions in Yukon, Canada needs to fill out Form YG4784 if applicable.

Q: What information is required on Form YG4784?

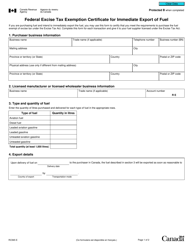

A: Form YG4784 requires information such as the type of fuel, quantity, recipient information, and details of the export transaction.

Q: Are there any deadlines for filing Form YG4784?

A: Yes, there are specific deadlines for filing Form YG4784. You should consult the official instructions or contact the relevant authorities for the most accurate information.

Q: Is there any fee associated with filing Form YG4784?

A: There may be fees associated with filing Form YG4784. It is best to check with the relevant authorities for the specific fee structure.

Q: What if I have further questions or need assistance with Form YG4784?

A: If you have further questions or need assistance with Form YG4784, you can contact the relevant authorities or consult an accountant or tax professional.