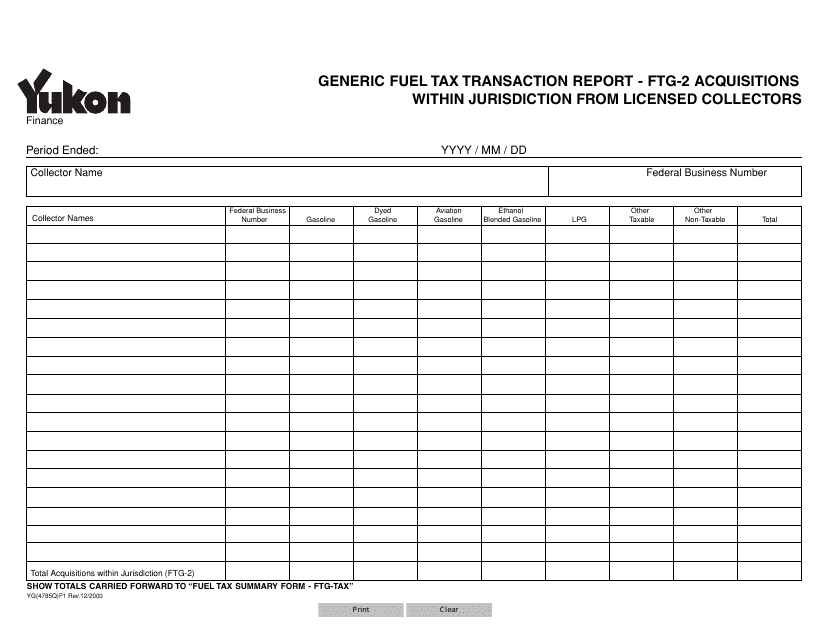

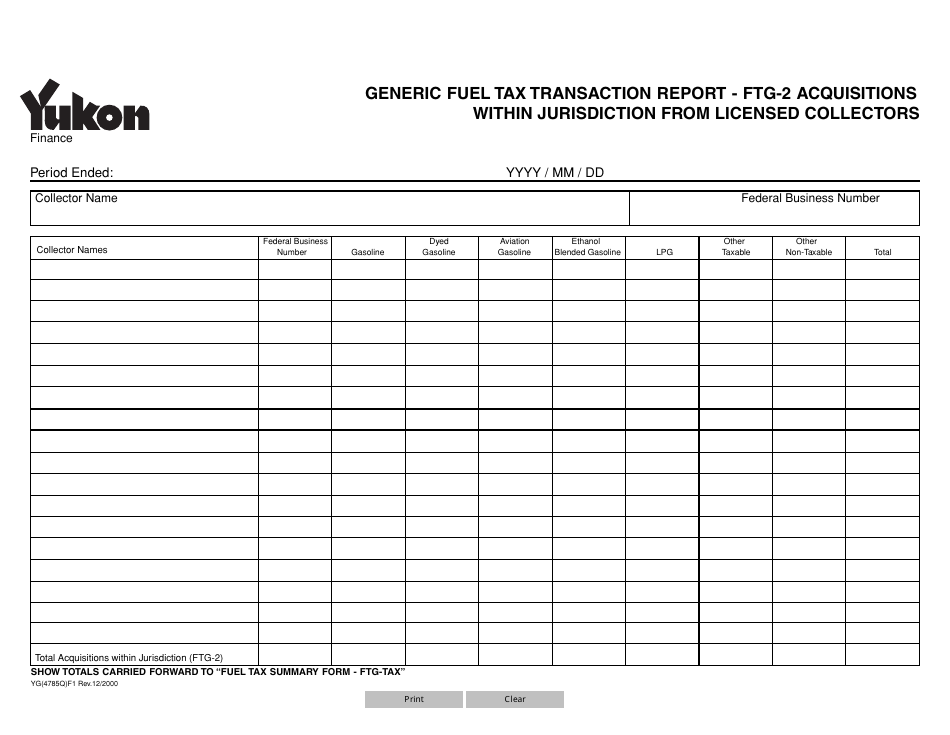

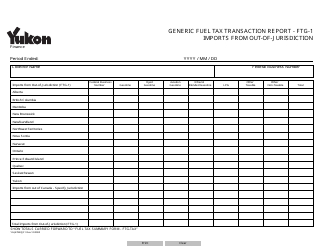

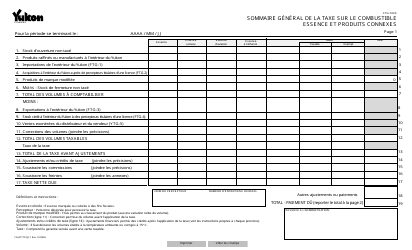

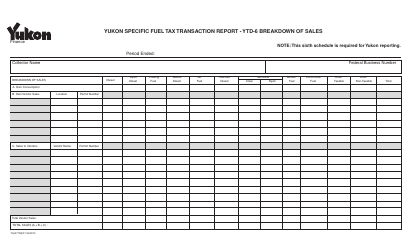

Form YG4785 Generic Fuel Tax Transaction Report - Ftg-2 Acquisitions Within Jurisdiction From Licensed Collectors - Yukon, Canada

Form YG4785 Generic Fuel Tax Transaction Report - FTG-2 Acquisitions Within Jurisdiction From Licensed Collectors - Yukon, Canada is a form used for reporting fuel tax transactions in the Yukon territory of Canada. It is used to track and document fuel acquisitions made within the jurisdiction from licensed collectors.

The Form YG4785 Generic Fuel Tax Transaction Report - FTG-2 Acquisitions within Jurisdiction from Licensed Collectors in Yukon, Canada is filed by the licensed collectors within the jurisdiction.

FAQ

Q: What is Form YG4785?

A: Form YG4785 is the Generic Fuel Tax Transaction Report - Ftg-2 for acquisitions within the jurisdiction from licensed collectors in Yukon, Canada.

Q: What is the purpose of Form YG4785?

A: The purpose of Form YG4785 is to report fuel tax transactions for acquisitions within the jurisdiction from licensed collectors in Yukon, Canada.

Q: Who needs to file Form YG4785?

A: Any person or business making fuel tax acquisitions within the jurisdiction from licensed collectors in Yukon, Canada needs to file Form YG4785.

Q: What is meant by 'acquisitions within the jurisdiction from licensed collectors'?

A: 'Acquisitions within the jurisdiction from licensed collectors' refer to the purchase or acquisition of fuel from licensed collectors within the geographic limits of Yukon, Canada.

Q: Is Form YG4785 specific to Yukon, Canada?

A: Yes, Form YG4785 is specific to Yukon, Canada and is used to report fuel tax transactions within the jurisdiction from licensed collectors in this region.