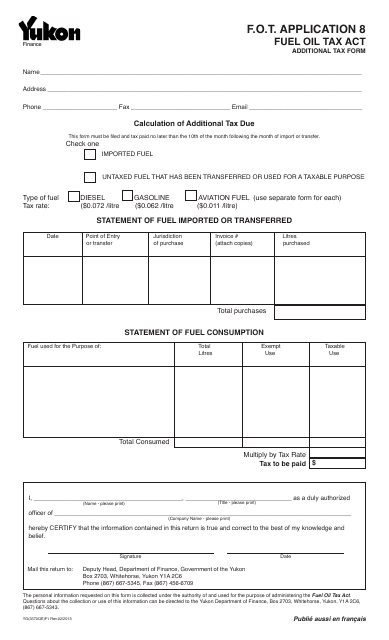

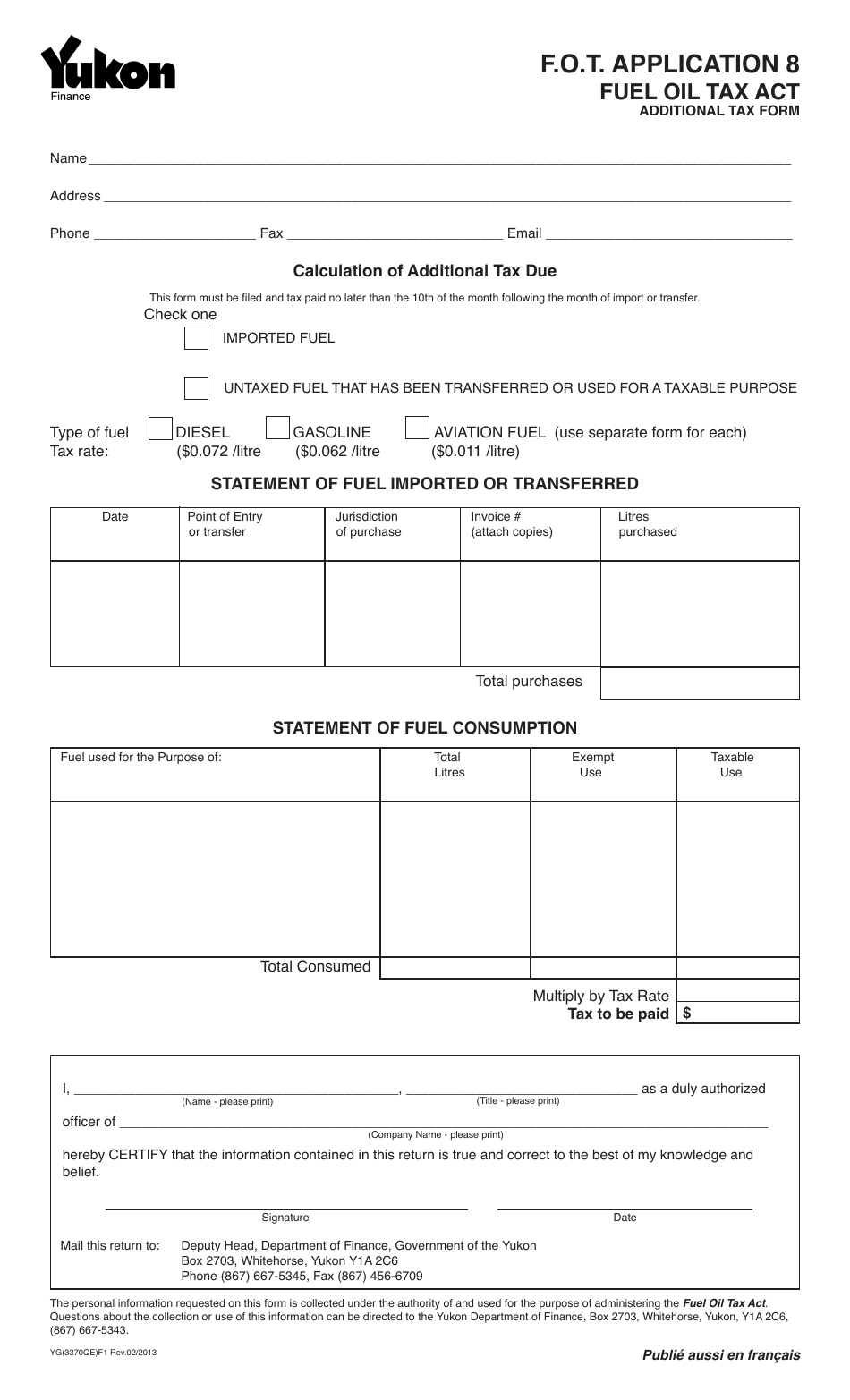

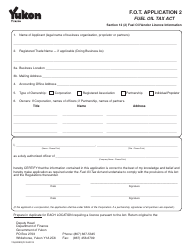

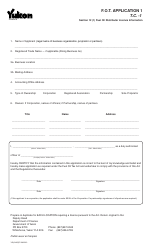

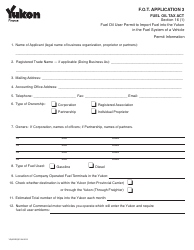

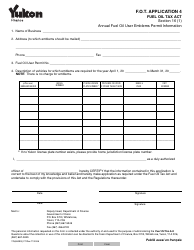

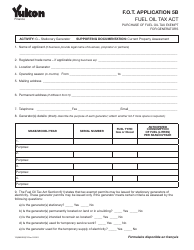

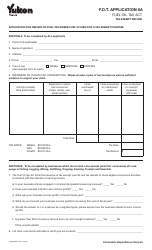

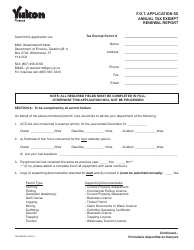

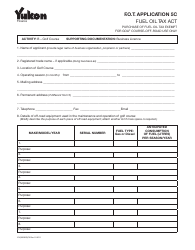

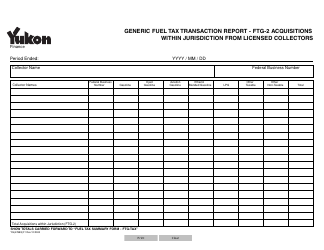

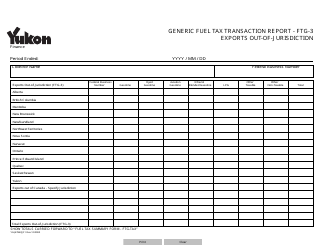

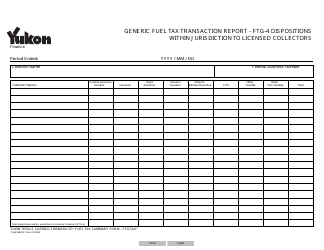

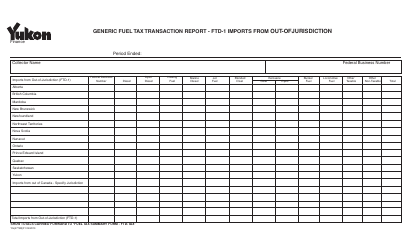

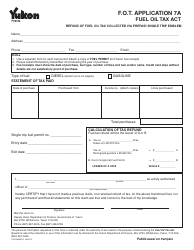

Form YG3370 Fuel Oil Tax - Application 8 - Yukon, Canada

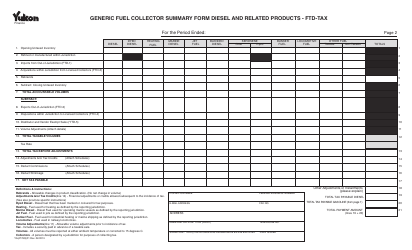

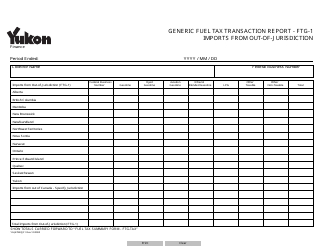

Form YG3370 Fuel Oil Tax - Application 8 is used in Yukon, Canada for applying for a fuel oil tax exemption or refund. This form is specifically used by businesses or organizations that are eligible for certain taxes to be refunded or exempted on the fuel oil they purchase.

The Form YG3370 Fuel Oil Tax - Application 8 in Yukon, Canada is filed by individuals, businesses, or organizations who are applying for fuel oil tax exemptions.

FAQ

Q: What is Form YG3370 Fuel Oil Tax?

A: Form YG3370 Fuel Oil Tax is an application form used in Yukon, Canada for reporting and paying fuel oil tax.

Q: Who needs to file Form YG3370 Fuel Oil Tax?

A: Any individual or business that purchases fuel oil in Yukon, Canada is required to file Form YG3370 Fuel Oil Tax.

Q: What information is required in Form YG3370 Fuel Oil Tax?

A: Form YG3370 Fuel Oil Tax requires information such as the amount of fuel oil purchased, the supplier's name and address, and the date of purchase.

Q: When is the deadline to file Form YG3370 Fuel Oil Tax?

A: Form YG3370 Fuel Oil Tax must be filed on or before the last day of the month following the end of the reporting period.

Q: Are there any penalties for late filing of Form YG3370 Fuel Oil Tax?

A: Yes, there are penalties for late filing of Form YG3370 Fuel Oil Tax, and interest may also be charged on any overdue amounts.

Q: Are there any exemptions or deductions available for fuel oil tax?

A: Yes, there are certain exemptions and deductions available for fuel oil tax in Yukon, Canada. You should refer to the instructions and guidelines provided with the form for more information.