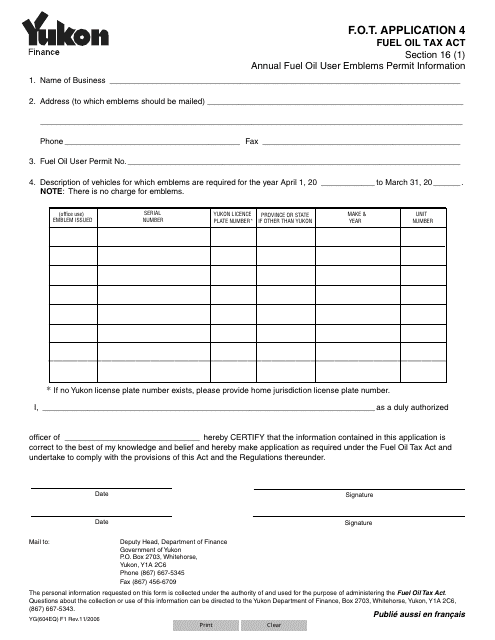

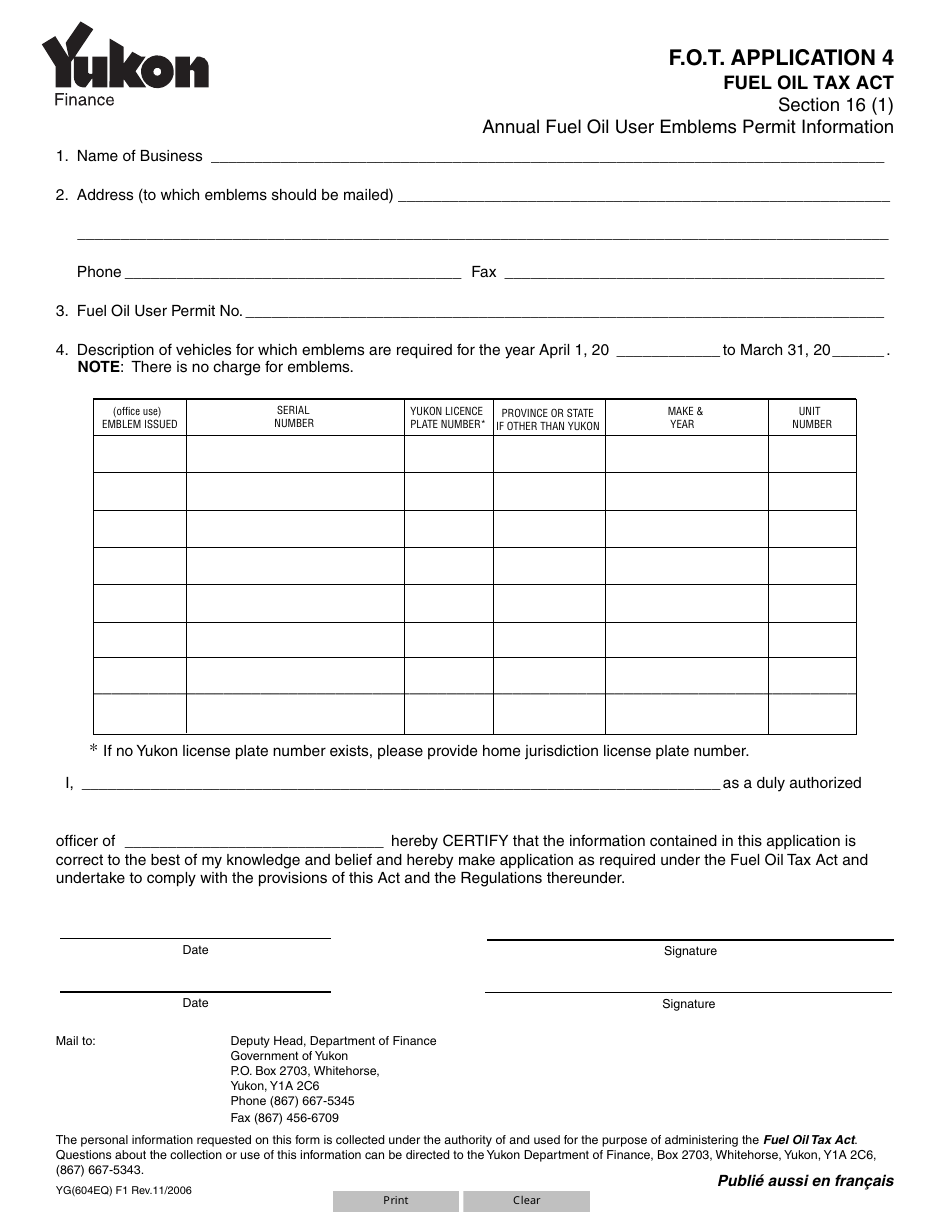

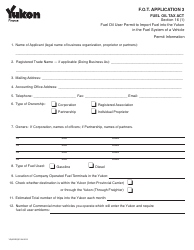

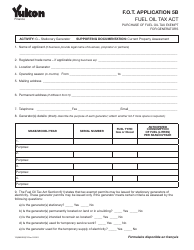

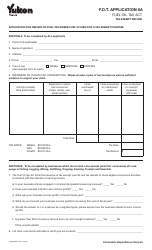

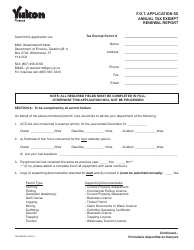

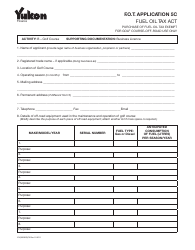

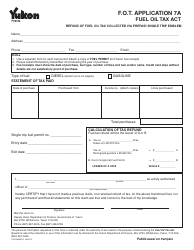

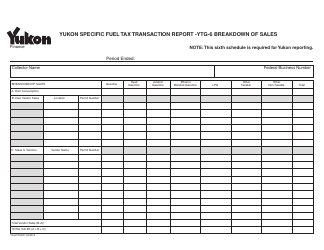

Form YG604 Fuel Oil Tax - Application 4 - Yukon, Canada

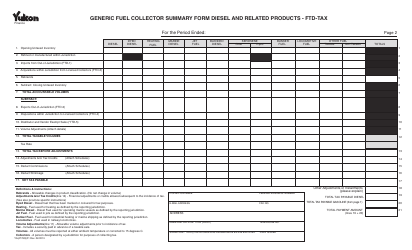

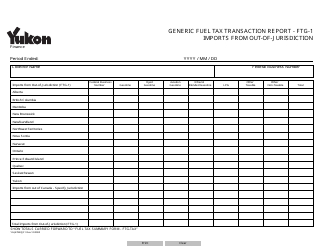

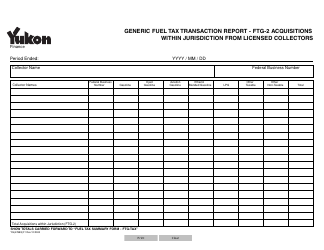

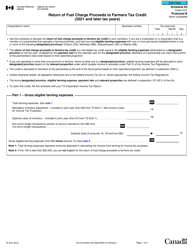

Form YG604 is an application form used in Yukon, Canada for reporting and paying fuel oil tax. It is used by individuals or businesses to apply for a fuel oil tax refund or exemption.

The Form YG604 Fuel Oil Tax - Application 4 in Yukon, Canada is filed by fuel oil suppliers or designated representatives.

FAQ

Q: What is Form YG604 Fuel Oil Tax?

A: Form YG604 Fuel Oil Tax is an application used in Yukon, Canada to apply for a fuel oil tax refund.

Q: Who can use Form YG604 Fuel Oil Tax?

A: Form YG604 Fuel Oil Tax can be used by individuals, businesses, and organizations in Yukon, Canada that use fuel oil for eligible purposes.

Q: What is the purpose of Form YG604 Fuel Oil Tax?

A: The purpose of Form YG604 Fuel Oil Tax is to apply for a refund of the fuel oil tax paid on eligible fuel oil purchases.

Q: How do I fill out Form YG604 Fuel Oil Tax?

A: To fill out Form YG604 Fuel Oil Tax, you need to provide information about your fuel oil purchases, such as the amount of fuel oil purchased, the purpose of use, and the amount of tax paid.

Q: What should I do if I have questions about Form YG604 Fuel Oil Tax?

A: If you have questions about Form YG604 Fuel Oil Tax, you can contact the Yukon government's tax department for assistance.

Q: Are there any eligibility requirements for claiming a fuel oil tax refund?

A: Yes, there are eligibility requirements for claiming a fuel oil tax refund. These requirements may include the purpose of use, the type of fuel oil, and documentation to support the claim. It is recommended to review the instructions and guidelines provided with Form YG604 Fuel Oil Tax.

Q: How long does it take to receive a fuel oil tax refund?

A: The processing time for a fuel oil tax refund can vary. It is advisable to contact the Yukon government's tax department for information about the expected processing time.