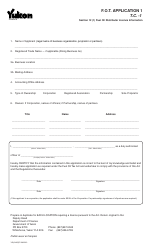

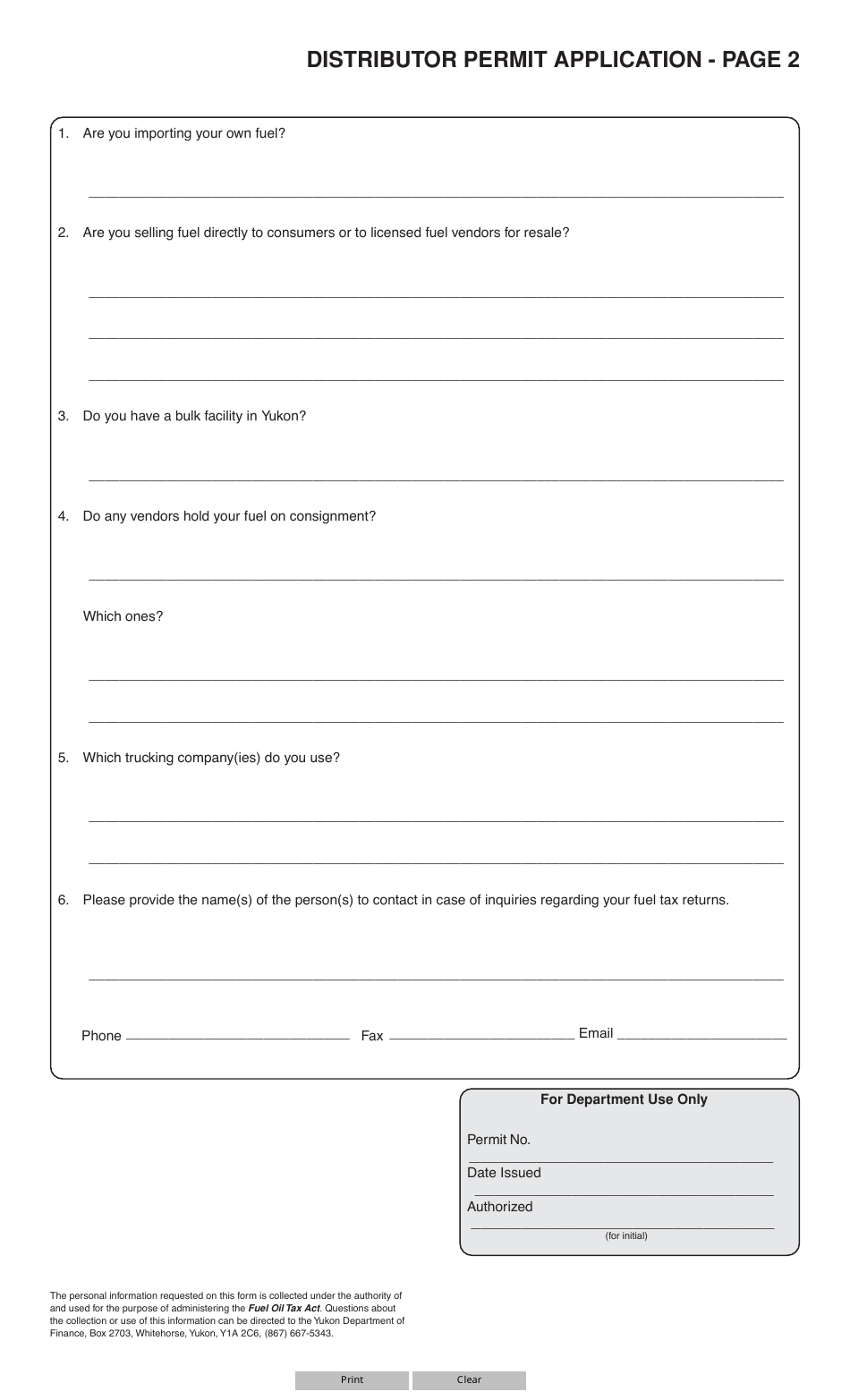

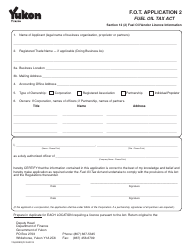

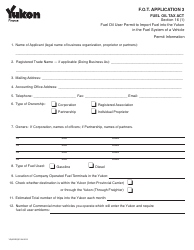

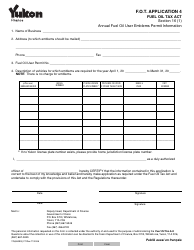

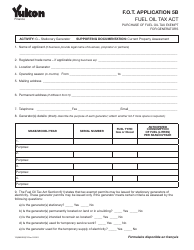

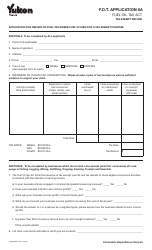

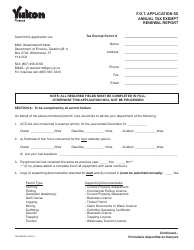

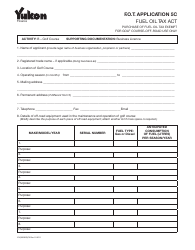

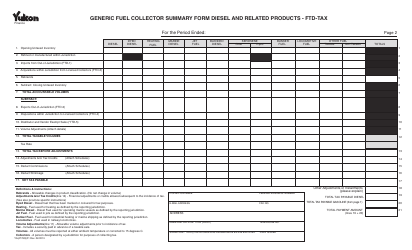

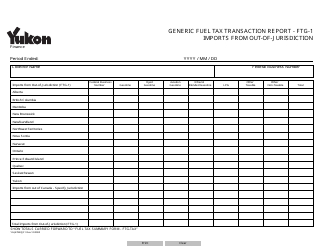

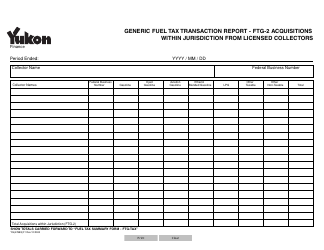

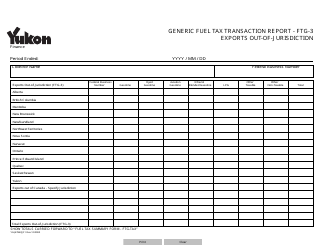

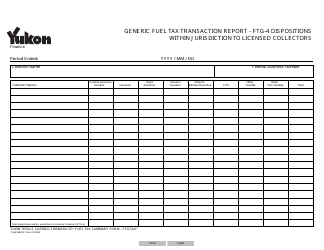

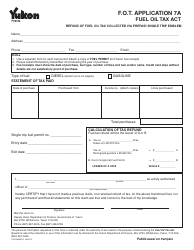

Form YG614 Fuel Oil Tax - Application 1 - Yukon, Canada

Form YG614 Fuel Oil Tax - Application 1 - Yukon, Canada is used to apply for fuel oil tax exemption or refund in the Yukon territory of Canada.

The Form YG614 Fuel Oil Tax - Application 1 in Yukon, Canada is typically filed by businesses or individuals who use fuel oil for commercial or non-commercial purposes.

FAQ

Q: What is Form YG614?

A: Form YG614 is the application for fuel oil tax in Yukon, Canada.

Q: Who needs to fill out Form YG614?

A: Anyone who wants to apply for fuel oil tax in Yukon, Canada needs to fill out Form YG614.

Q: What is the purpose of Form YG614?

A: The purpose of Form YG614 is to apply for fuel oil tax in Yukon, Canada.

Q: What information do I need to provide on Form YG614?

A: You will need to provide information such as your name, address, type of fuel oil, quantity of fuel oil, and other related details on Form YG614.

Q: Are there any fees associated with submitting Form YG614?

A: There may be fees associated with submitting Form YG614. Please refer to the instructions or contact the government office in Yukon, Canada for more information.

Q: How do I submit Form YG614?

A: Form YG614 can be submitted by mail or in person to the designated government office in Yukon, Canada.

Q: What is the deadline for submitting Form YG614?

A: The deadline for submitting Form YG614 may vary. Please refer to the instructions or contact the government office in Yukon, Canada for the specific deadline.

Q: Is Form YG614 specific to Yukon, Canada?

A: Yes, Form YG614 is specific to fuel oil tax application in Yukon, Canada.

Q: Can I use Form YG614 for other types of taxes?

A: No, Form YG614 is specifically for fuel oil tax application in Yukon, Canada and cannot be used for other types of taxes.