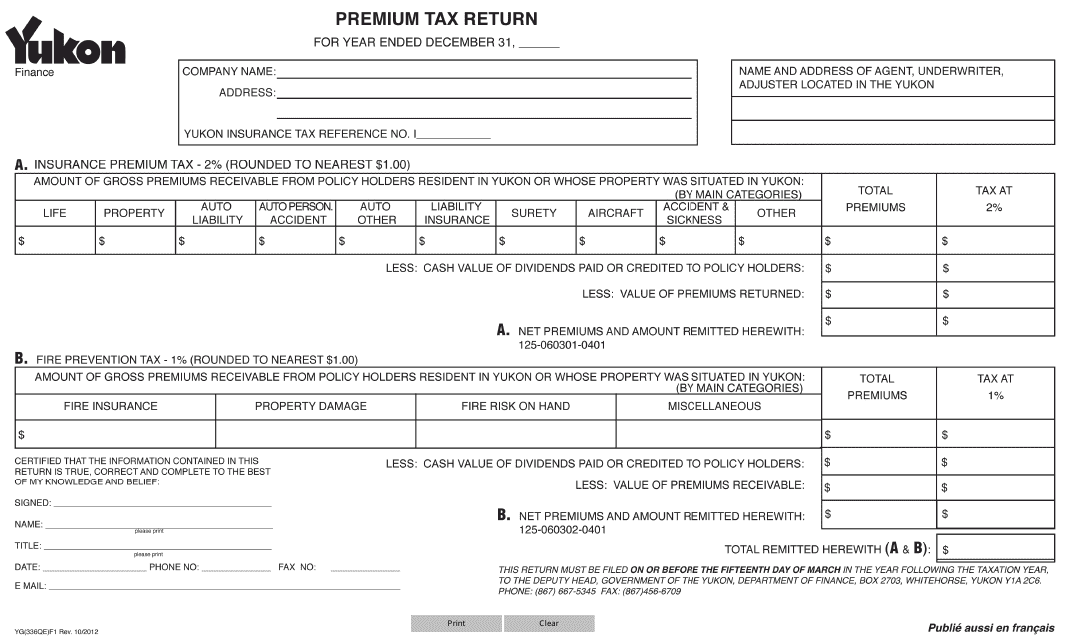

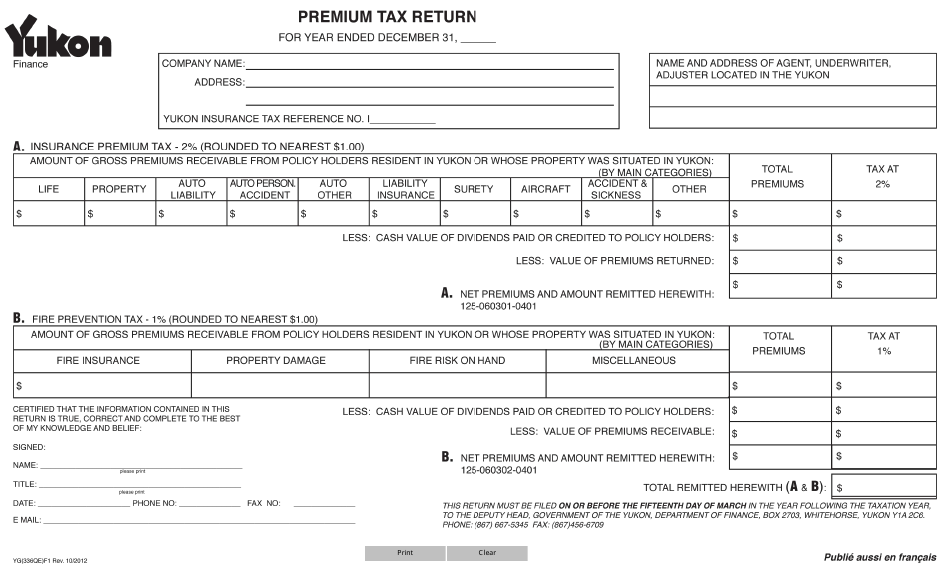

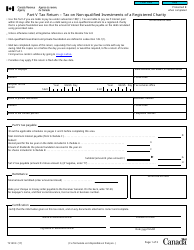

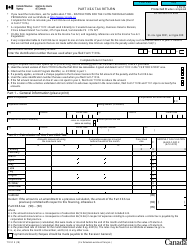

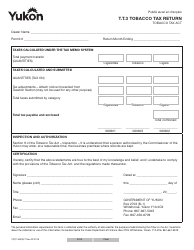

Form YG336 Premium Tax Return - Yukon, Canada

Form YG336 Premium Tax Return is used by individuals who reside in Yukon, Canada to report and pay their premium tax. Premium tax is a tax levied on certain insurance premiums, such as those paid for property and casualty insurance.

The Form YG336 Premium Tax Return in Yukon, Canada, is filed by individuals who have paid premiums for specific insurance coverage.

FAQ

Q: What is Form YG336?

A: Form YG336 is a premium tax return specific to the Yukon Territory in Canada.

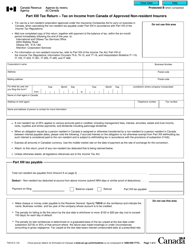

Q: Who needs to file Form YG336?

A: Individuals and businesses in the Yukon Territory who are liable for premium tax need to file Form YG336.

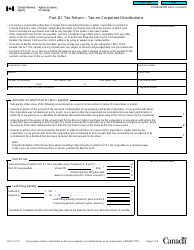

Q: What is premium tax?

A: Premium tax is a tax imposed on insurance premiums.

Q: What information is required on Form YG336?

A: Form YG336 requires information such as the total amount of insurance premiums received and tax payable for the reporting period.

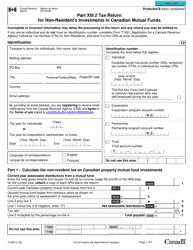

Q: Are there any penalties for late filing of Form YG336?

A: Penalties may apply for late filing of Form YG336. It is important to submit the form on time to avoid any potential penalties.

Q: Do I need to attach any supporting documents with Form YG336?

A: Depending on the circumstances, you may need to attach supporting documents such as insurance premium receipts or financial statements. It is important to carefully review the instructions provided with the form.

Q: Who can I contact for assistance with Form YG336?

A: For assistance with Form YG336, you can contact the tax department of the Government of Yukon or seek professional advice from a tax consultant or accountant.