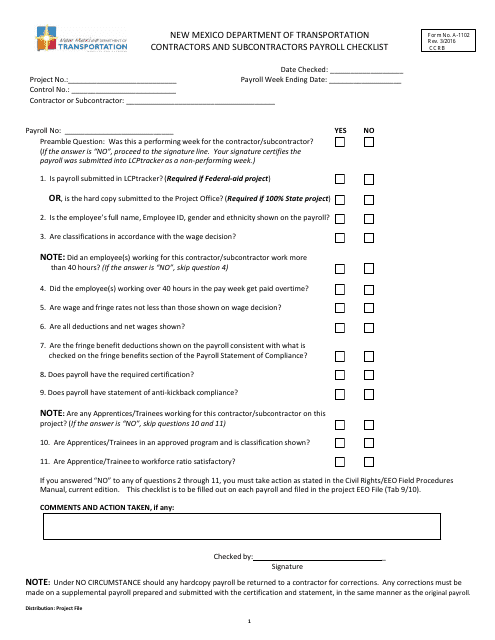

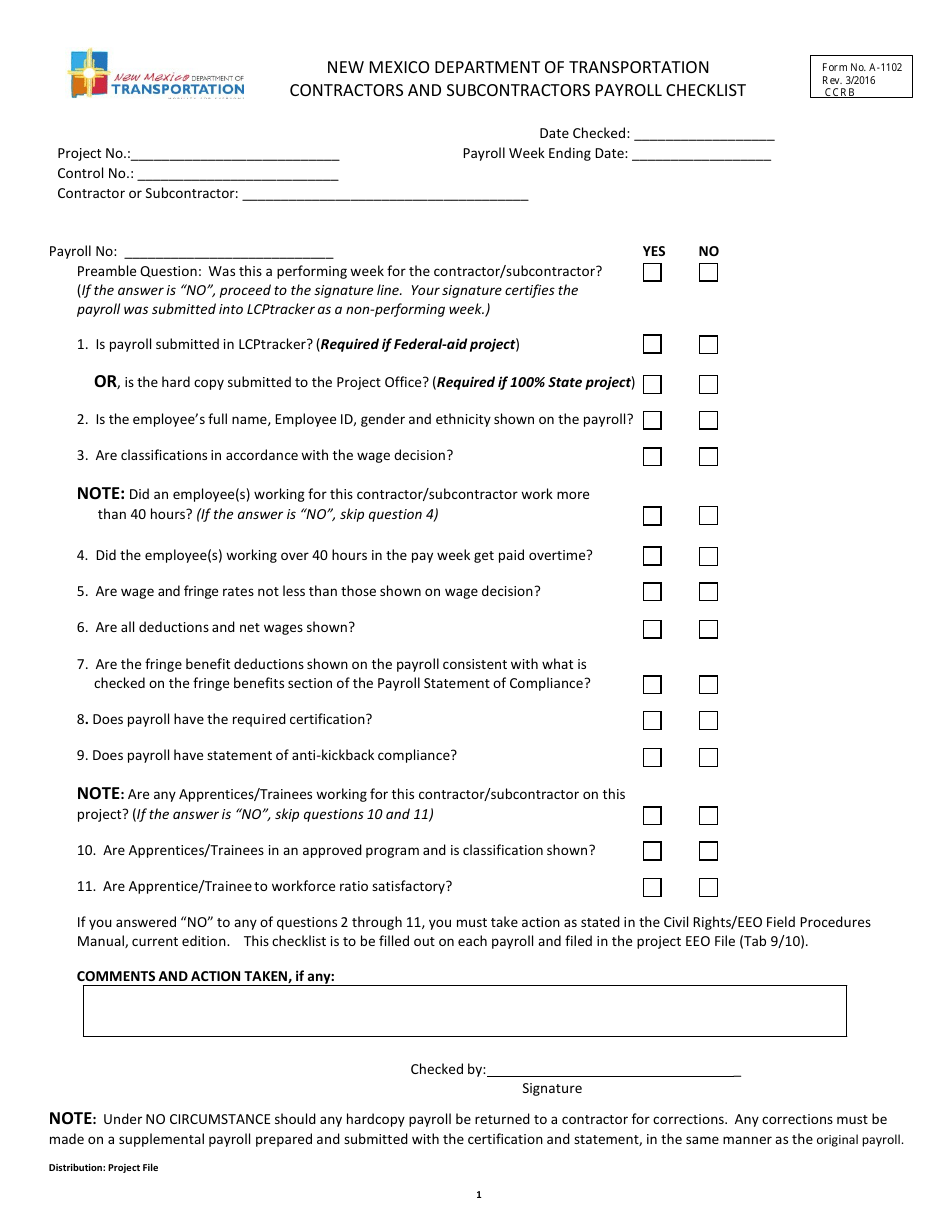

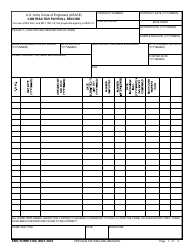

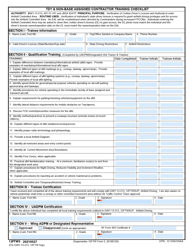

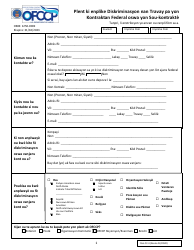

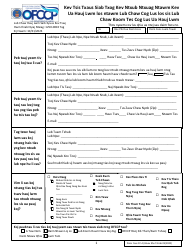

Form A-1102 Contractors and Subcontractors Payroll Checklist - New Mexico

What Is Form A-1102?

This is a legal form that was released by the New Mexico Department of Transportation - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

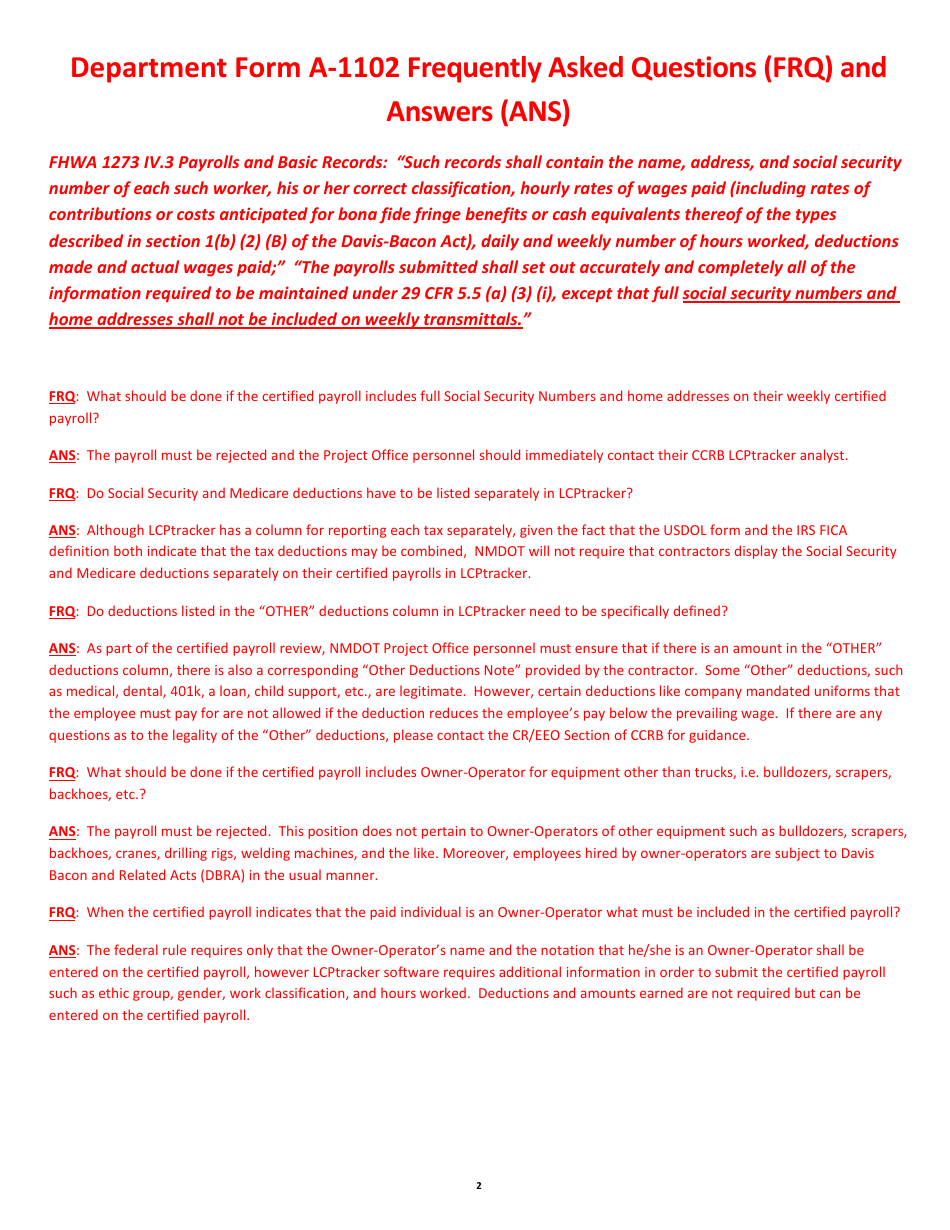

FAQ

Q: What is the Form A-1102?

A: The Form A-1102 is a checklist for contractors and subcontractors payroll in New Mexico.

Q: Who needs to use the Form A-1102?

A: Contractors and subcontractors in New Mexico need to use the Form A-1102.

Q: What is the purpose of the Form A-1102?

A: The Form A-1102 is used to ensure compliance with payroll requirements for contractors and subcontractors.

Q: What information is included in the Form A-1102?

A: The Form A-1102 includes information about employee wages, deductions, and taxes.

Q: Are there any penalties for non-compliance with the Form A-1102?

A: Yes, there can be penalties for non-compliance with the Form A-1102, including fines and potential legal action.

Q: Is the Form A-1102 specific to New Mexico?

A: Yes, the Form A-1102 is specific to contractors and subcontractors in New Mexico.

Q: Can I use the Form A-1102 for payroll in other states?

A: No, the Form A-1102 is only applicable for payroll in New Mexico.

Q: Do I need to submit the Form A-1102 to any government agency?

A: No, the Form A-1102 is a checklist for internal use and does not need to be submitted to any government agency.

Form Details:

- Released on March 1, 2016;

- The latest edition provided by the New Mexico Department of Transportation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form A-1102 by clicking the link below or browse more documents and templates provided by the New Mexico Department of Transportation.