This version of the form is not currently in use and is provided for reference only. Download this version of

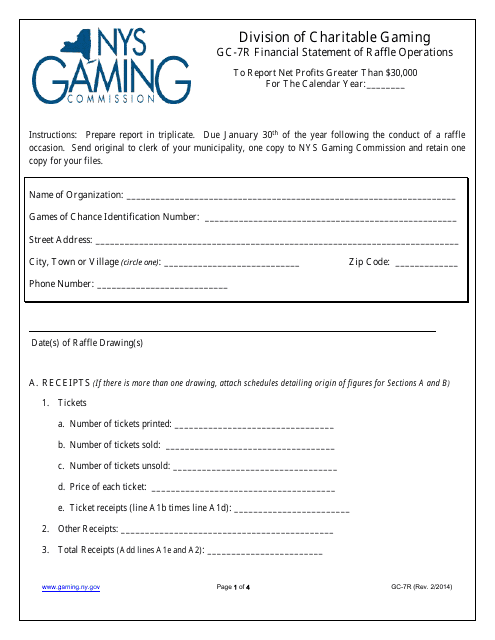

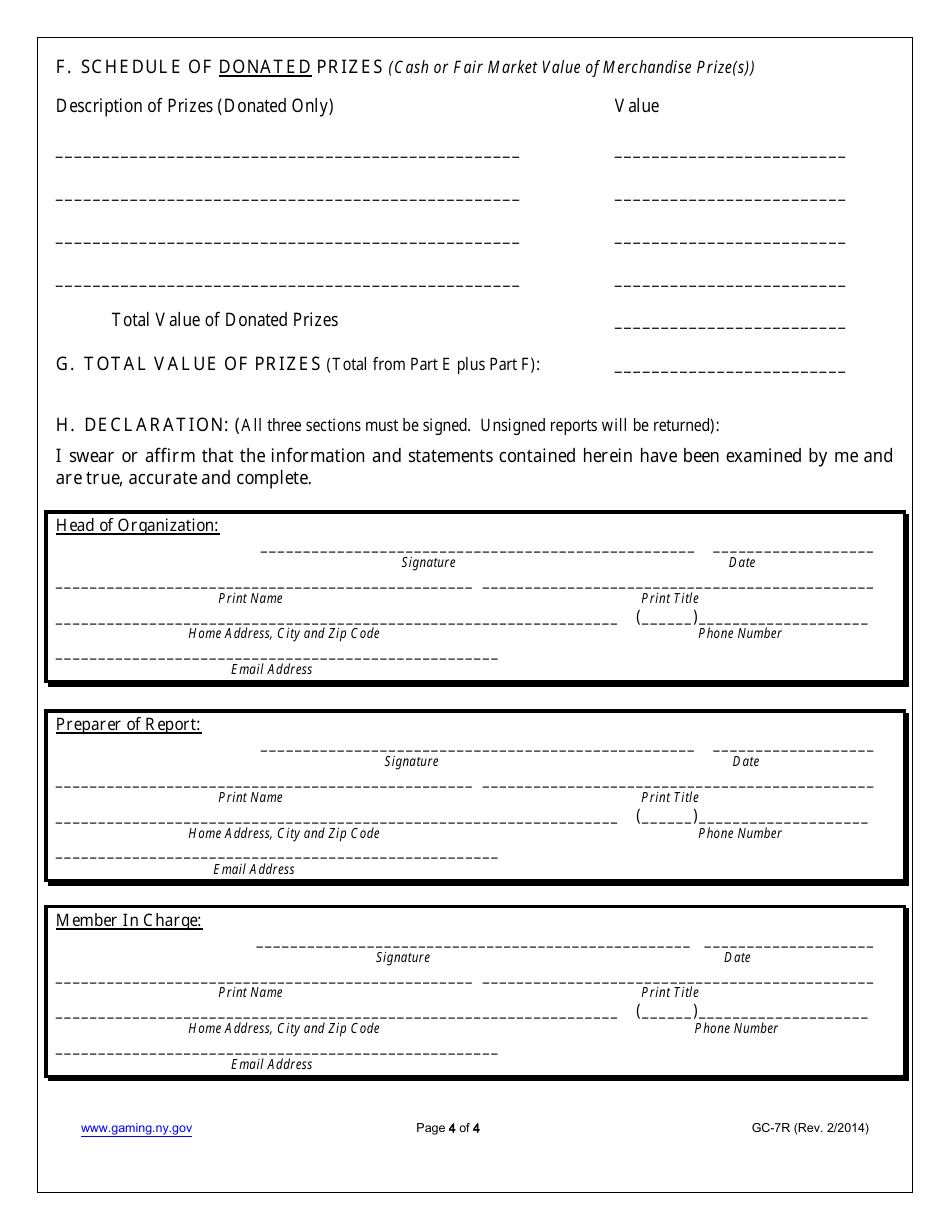

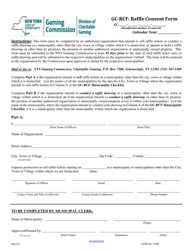

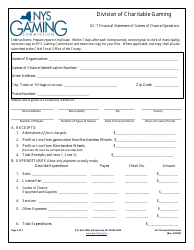

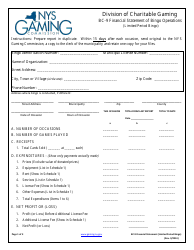

Form GC-7R

for the current year.

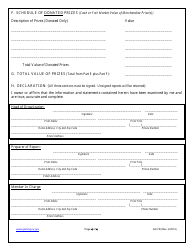

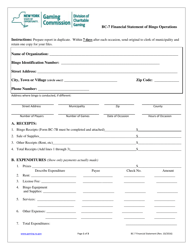

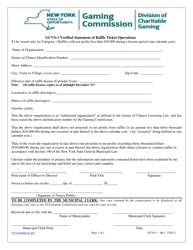

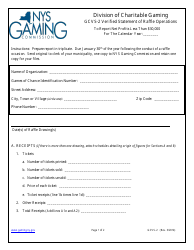

Form GC-7R Financial Statement of Raffle Operations - New York

What Is Form GC-7R?

This is a legal form that was released by the New York State Gaming Commission - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is GC-7R Financial Statement?

A: GC-7R Financial Statement is a form used to report the financial activities of raffle operations in the state of New York.

Q: Who needs to file GC-7R Financial Statement?

A: Any organization or entity that conducts raffle operations in the state of New York needs to file GC-7R Financial Statement.

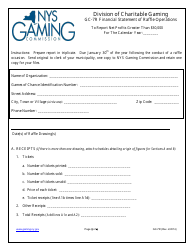

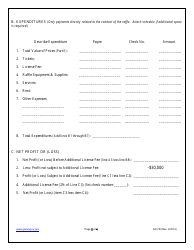

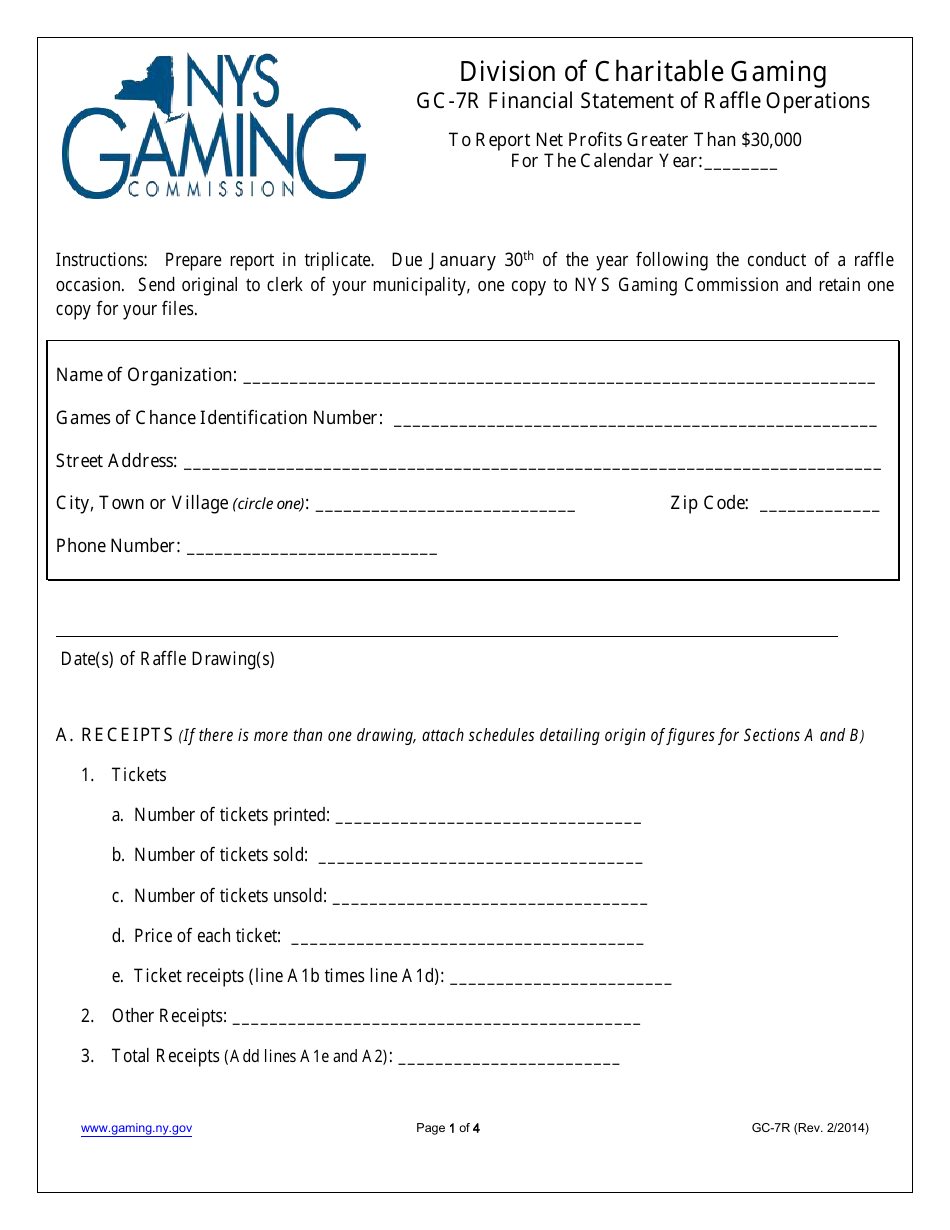

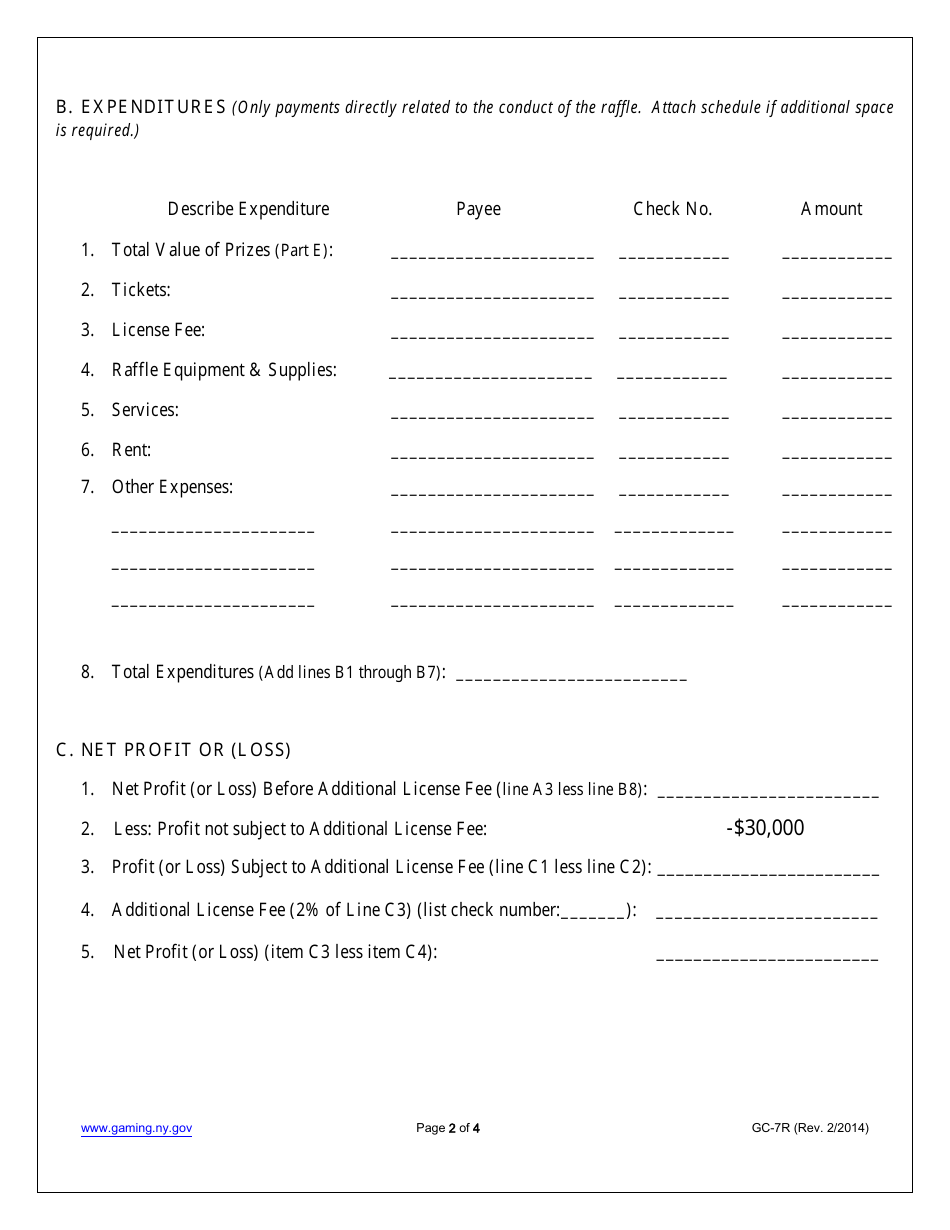

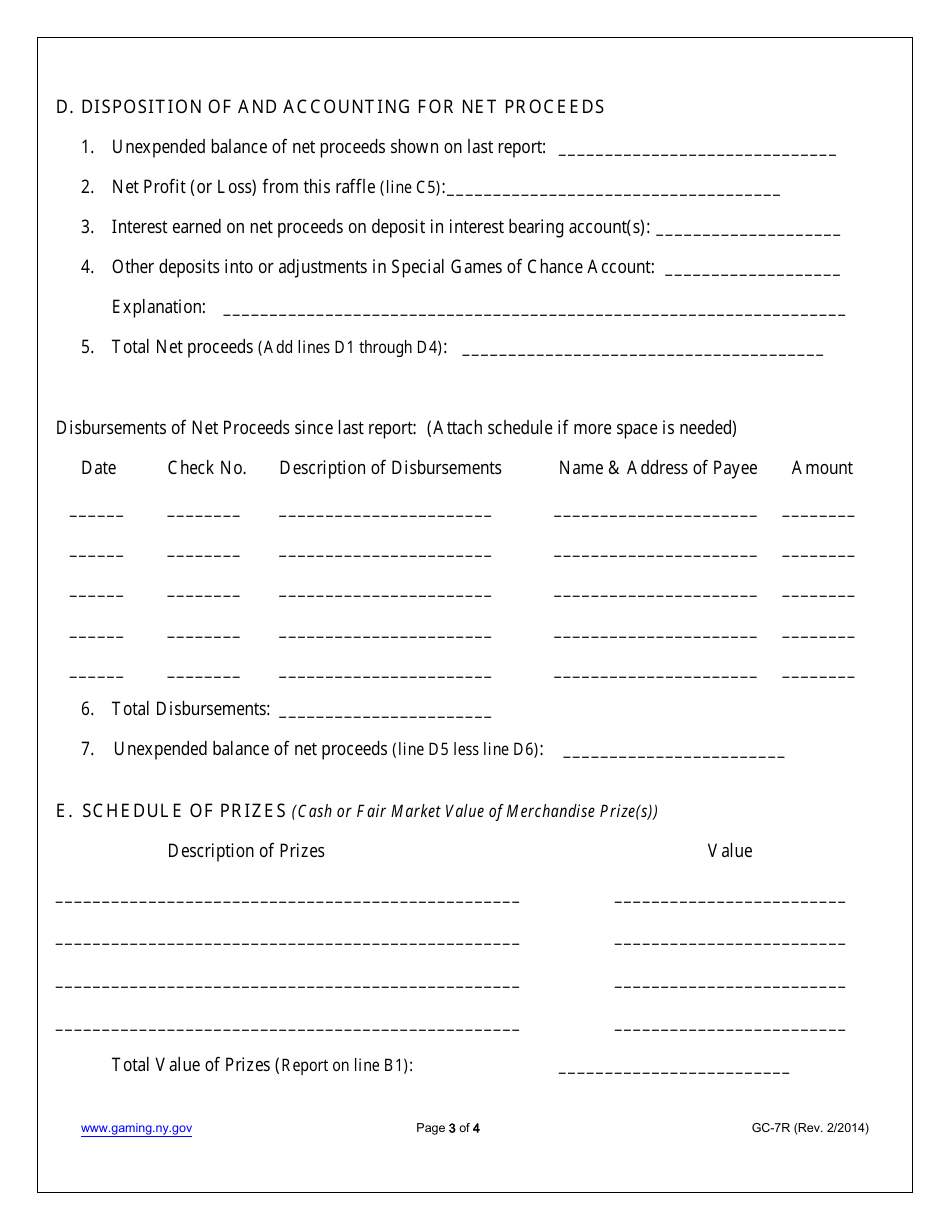

Q: What information is required in GC-7R Financial Statement?

A: GC-7R Financial Statement requires information about the organization conducting the raffle, details of the raffle operations, and financial transactions related to the raffle.

Q: Are there any filing fees for GC-7R Financial Statement?

A: No, there are no filing fees for GC-7R Financial Statement in New York.

Q: When is the deadline to file GC-7R Financial Statement?

A: GC-7R Financial Statement must be filed annually, within 90 days after the completion of the raffle operations for that fiscal year.

Form Details:

- Released on February 1, 2014;

- The latest edition provided by the New York State Gaming Commission;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form GC-7R by clicking the link below or browse more documents and templates provided by the New York State Gaming Commission.