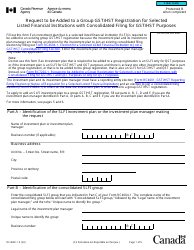

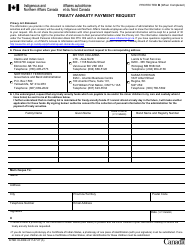

This version of the form is not currently in use and is provided for reference only. Download this version of

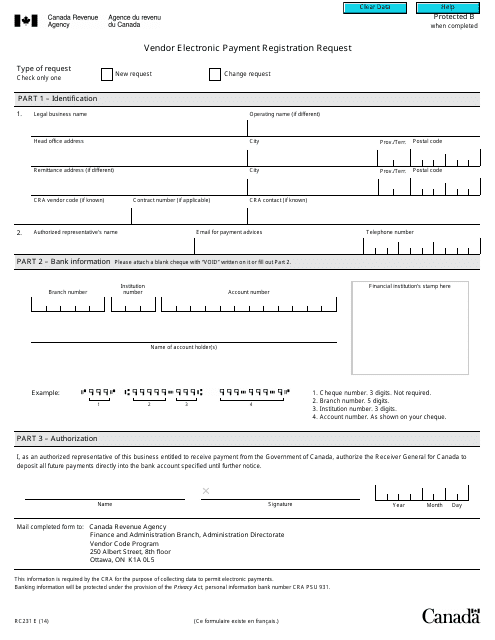

Form RC231

for the current year.

Form RC231 Vendor Electronic Payment Registration Request - Canada

Form RC231 is used by vendors in Canada to register for electronic payment options with the Canada Revenue Agency (CRA). It allows vendors to receive their payments electronically, such as through direct deposit, instead of through cheques.

The Form RC231 Vendor Electronic Payment Registration Request in Canada is usually filed by businesses/vendors who want to receive payments from the Government of Canada through electronic methods such as direct deposit.

FAQ

Q: What is Form RC231?

A: Form RC231 is the Vendor Electronic Payment Registration Request form in Canada.

Q: Who needs to complete Form RC231?

A: Vendors who want to receive electronic payments from the government of Canada need to complete and submit Form RC231.

Q: What is the purpose of Form RC231?

A: The purpose of Form RC231 is to register vendors for electronic payment by the government of Canada.

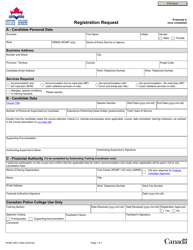

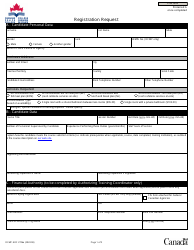

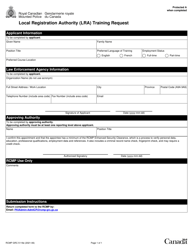

Q: What information is required on Form RC231?

A: Form RC231 requires information such as vendor contact details, banking information, and authorization for electronic payment.

Q: Is Form RC231 mandatory?

A: While not mandatory, completing and submitting Form RC231 is highly recommended for vendors who want to receive electronic payments from the government of Canada.

Q: Are there any fees associated with submitting Form RC231?

A: There are no fees associated with submitting Form RC231.

Q: What happens after submitting Form RC231?

A: Once Form RC231 is submitted, the vendor's information will be reviewed by the Canada Revenue Agency (CRA) and electronic payments can be initiated.

Q: How long does it take to process Form RC231?

A: The processing time for Form RC231 can vary, but it typically takes a few weeks for the Canada Revenue Agency (CRA) to review and approve the registration.