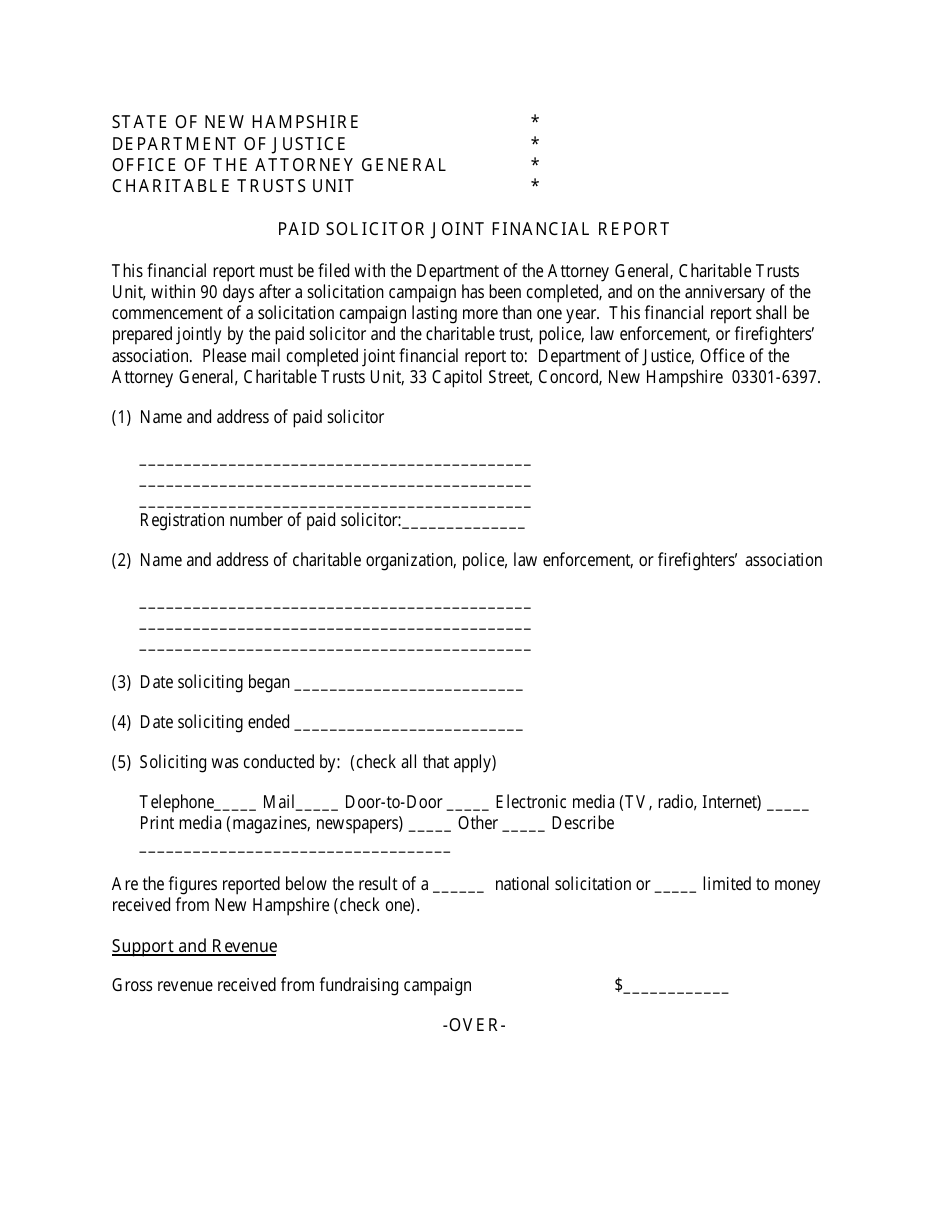

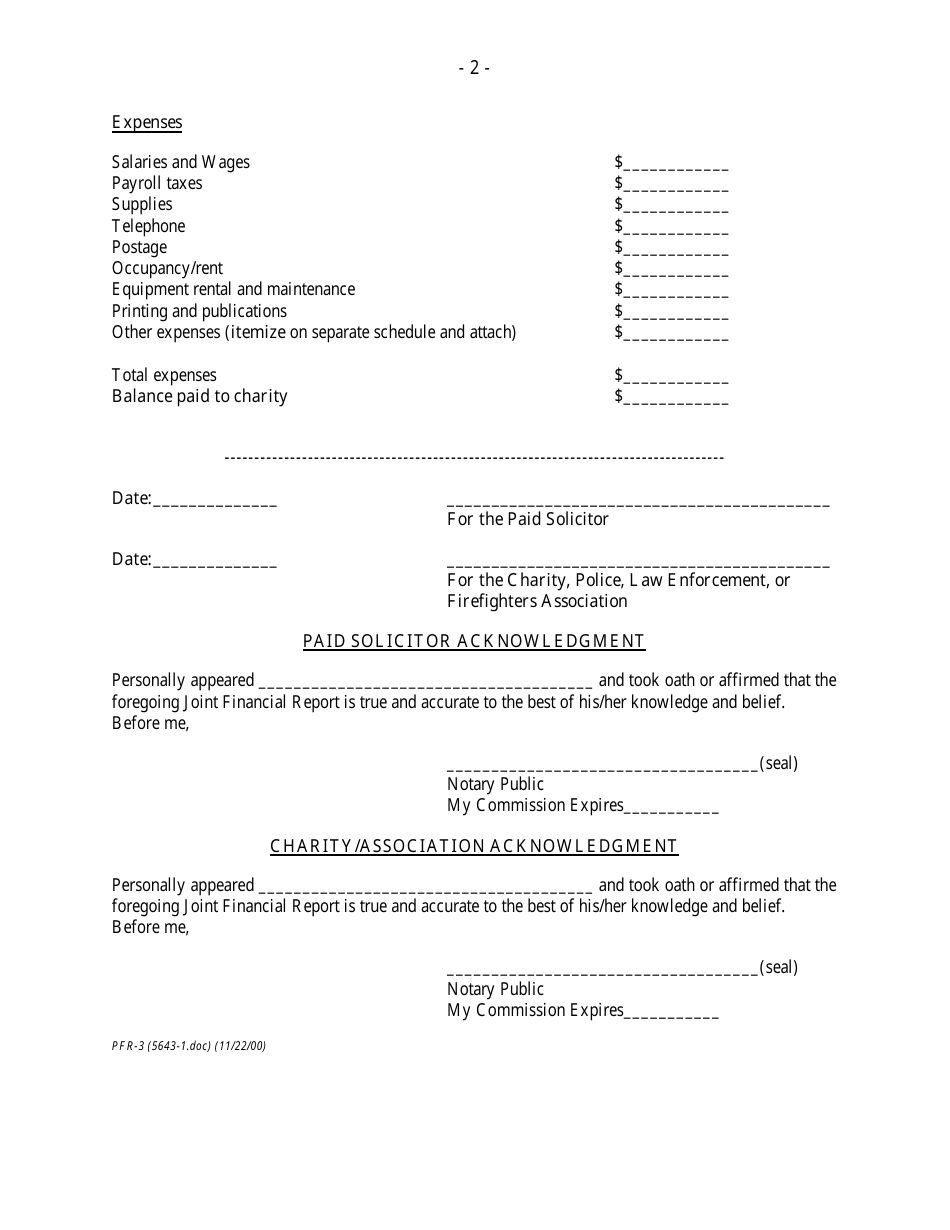

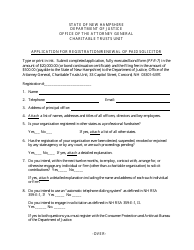

Form PFR-3 Paid Solicitor Joint Financial Report - New Hampshire

What Is Form PFR-3?

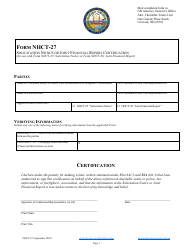

This is a legal form that was released by the New Hampshire Department of Justice - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PFR-3?

A: Form PFR-3 is the Paid Solicitor Joint Financial Report.

Q: Who needs to file Form PFR-3 in New Hampshire?

A: Paid solicitors in New Hampshire need to file Form PFR-3.

Q: What is the purpose of Form PFR-3?

A: The purpose of Form PFR-3 is to provide financial information about the activities of paid solicitors in New Hampshire.

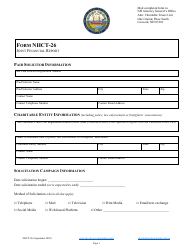

Q: What information is required on Form PFR-3?

A: Form PFR-3 requires information about the paid solicitor's activities, financial transactions, and fees.

Q: When is Form PFR-3 due?

A: Form PFR-3 is due no later than 90 days after the close of the solicitor's fiscal year.

Q: Are there any penalties for not filing Form PFR-3?

A: Failure to file Form PFR-3 may result in penalties and enforcement actions by the Attorney General's Office.

Form Details:

- Released on November 22, 2000;

- The latest edition provided by the New Hampshire Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form PFR-3 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Justice.