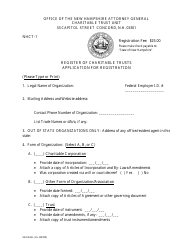

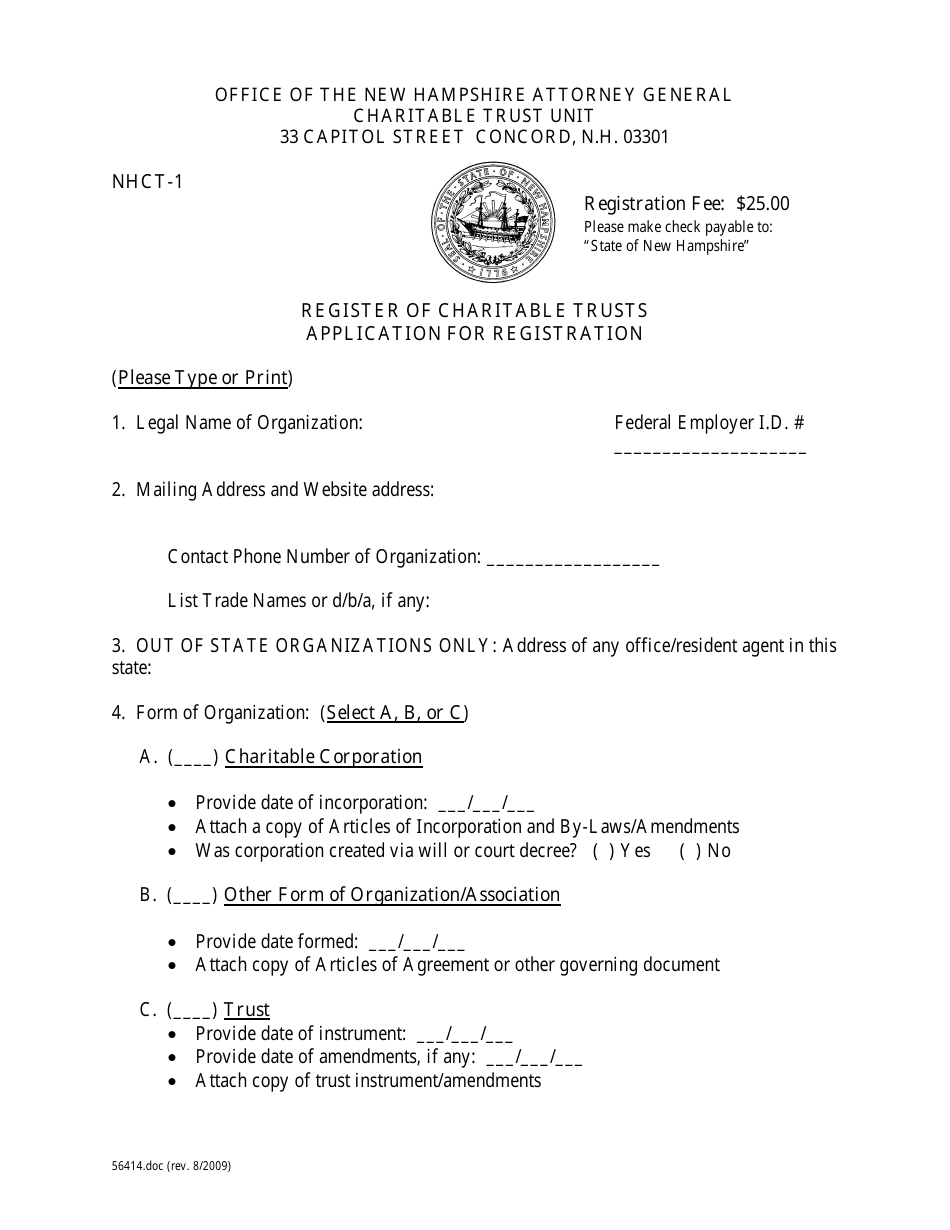

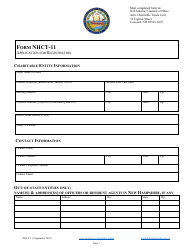

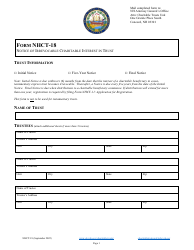

Form NHCT-1 Register of Charitable Trusts Application for Registration - New Hampshire

What Is Form NHCT-1?

This is a legal form that was released by the New Hampshire Department of Justice - a government authority operating within New Hampshire. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NHCT-1?

A: Form NHCT-1 is an application for registration of charitable trusts in New Hampshire.

Q: Who needs to file Form NHCT-1?

A: Anyone establishing a charitable trust in New Hampshire needs to file Form NHCT-1.

Q: What is the purpose of filing Form NHCT-1?

A: The purpose of filing Form NHCT-1 is to register a charitable trust with the state of New Hampshire.

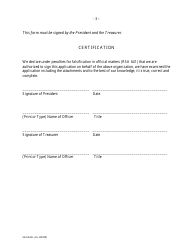

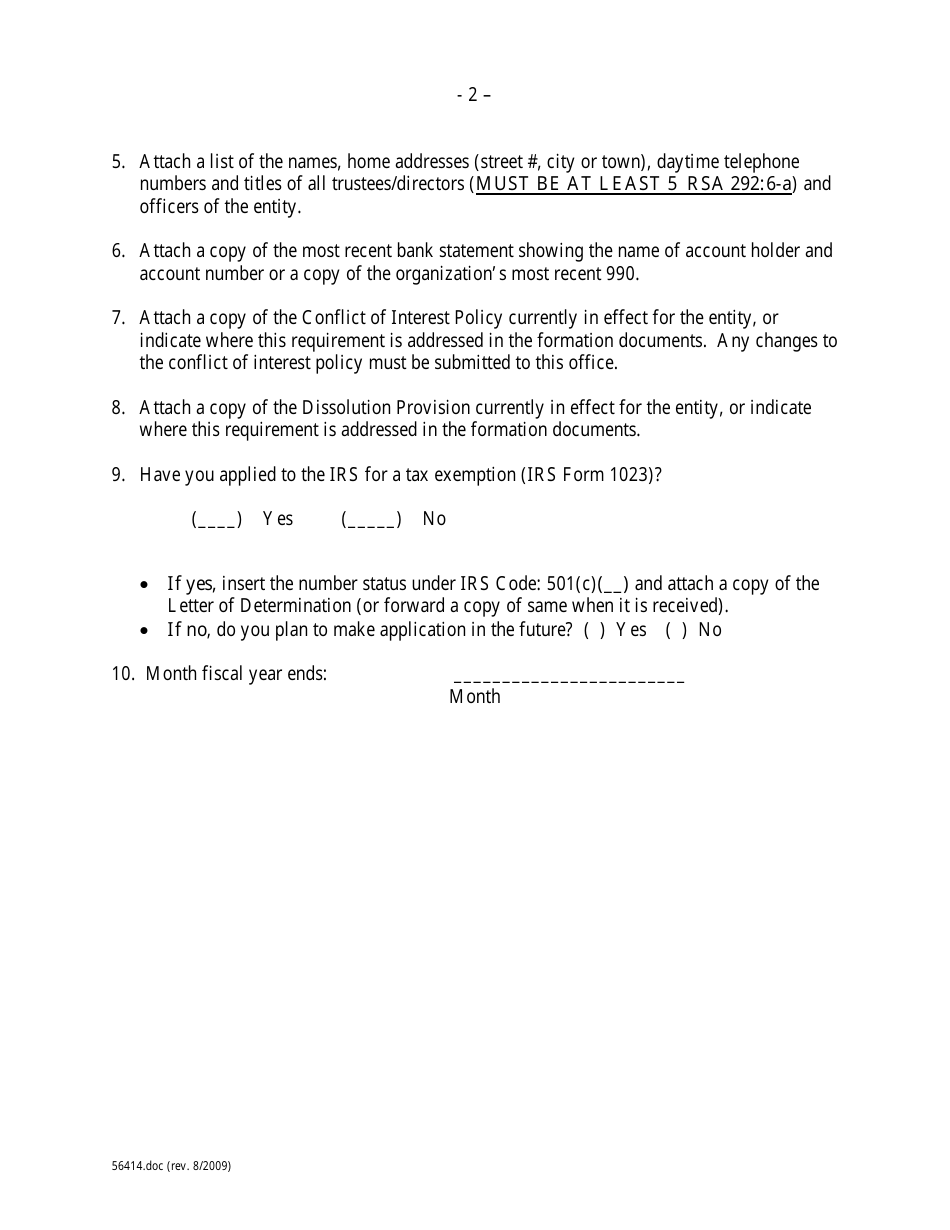

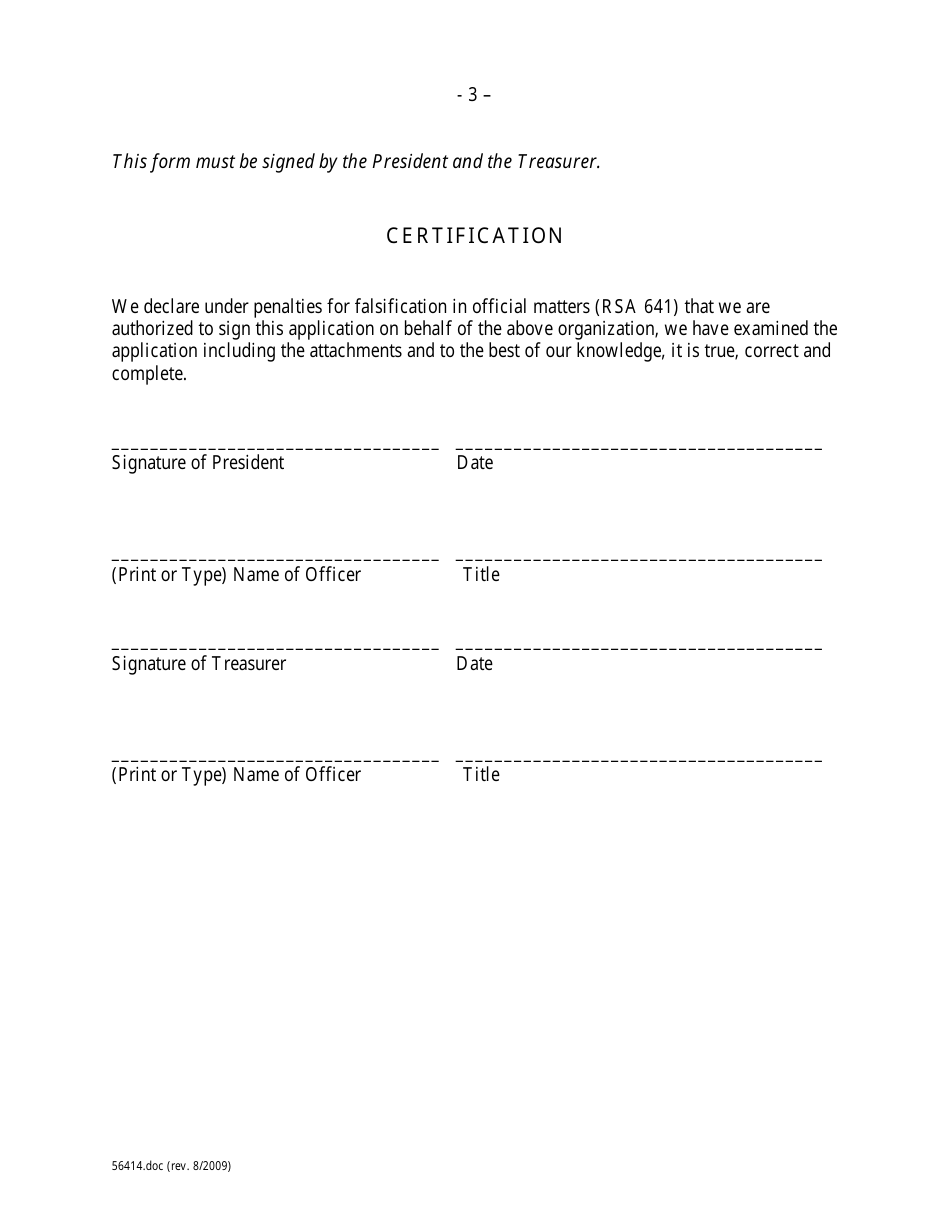

Q: What information is required on Form NHCT-1?

A: Form NHCT-1 requires information about the charitable trust, including its purpose, assets, and trustees.

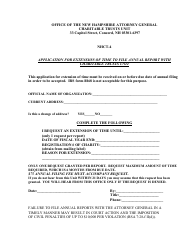

Q: Is there a deadline for filing Form NHCT-1?

A: There is no specific deadline for filing Form NHCT-1, but it is recommended to file as soon as the charitable trust is established.

Q: What happens after filing Form NHCT-1?

A: After filing Form NHCT-1, the charitable trust will be registered with the state of New Hampshire, and a registration number will be assigned.

Q: Are there any ongoing reporting requirements for registered charitable trusts in New Hampshire?

A: Yes, registered charitable trusts in New Hampshire are required to file annual reports with the Attorney General's Charitable Trusts Unit.

Form Details:

- Released on August 1, 2009;

- The latest edition provided by the New Hampshire Department of Justice;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form NHCT-1 by clicking the link below or browse more documents and templates provided by the New Hampshire Department of Justice.