This version of the form is not currently in use and is provided for reference only. Download this version of

Form SH-2

for the current year.

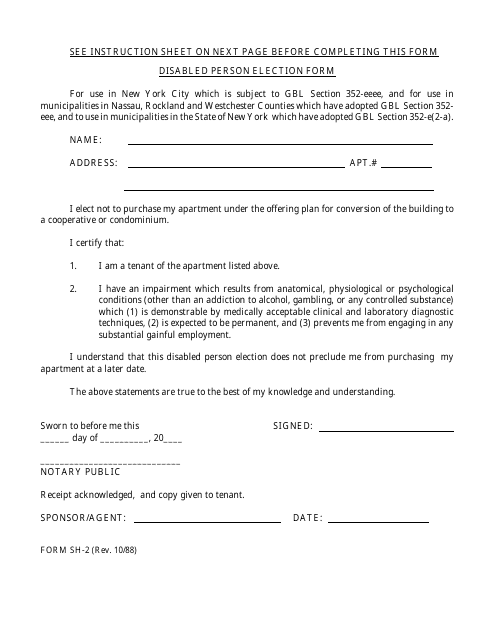

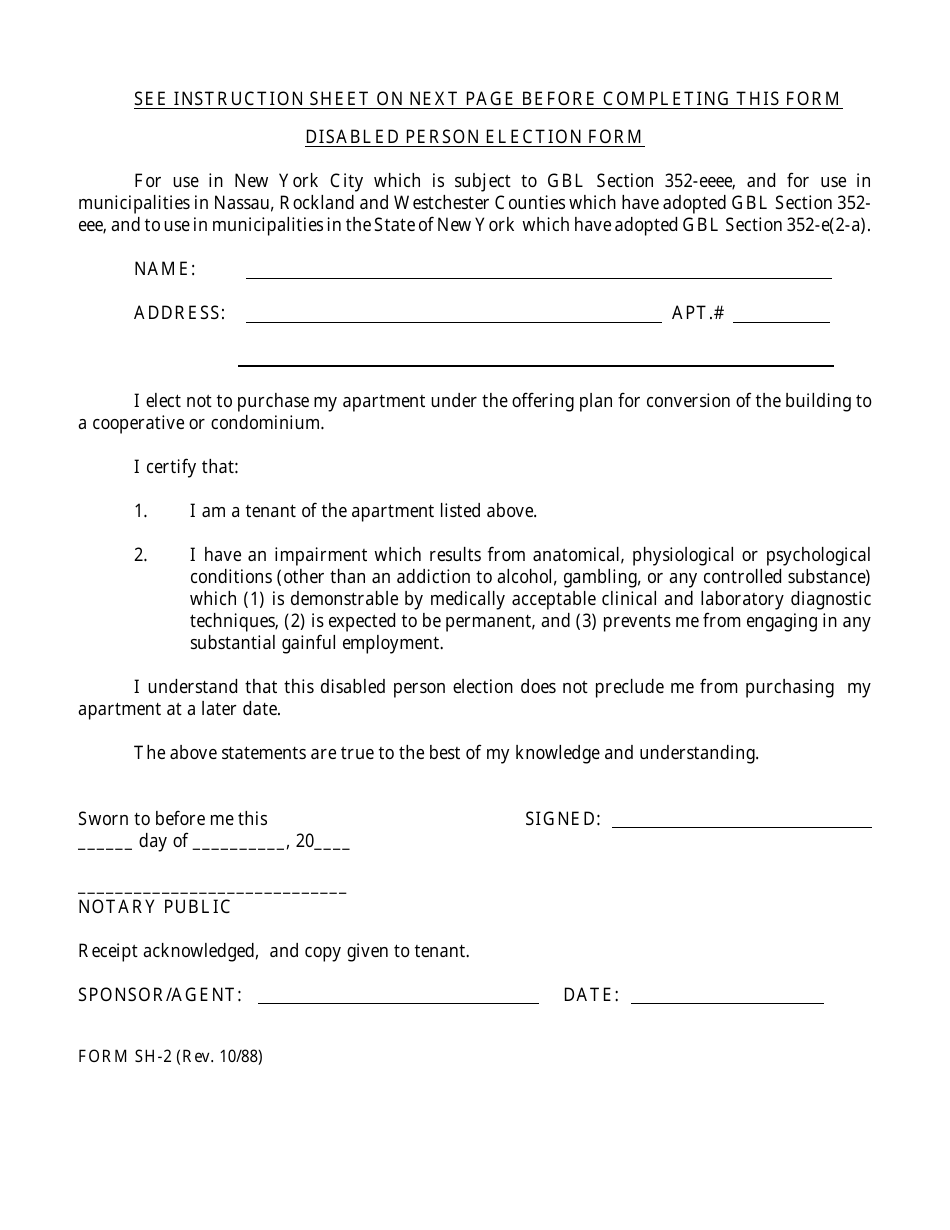

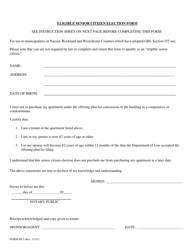

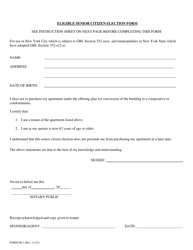

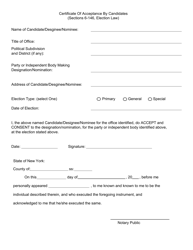

Form SH-2 Disabled Person Election Form - New York

What Is Form SH-2?

This is a legal form that was released by the New York State Attorney General - a government authority operating within New York. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form SH-2?

A: Form SH-2 is the Disabled Person Election Form.

Q: What is the purpose of Form SH-2?

A: The purpose of Form SH-2 is to elect to have certain real property exempt from taxation.

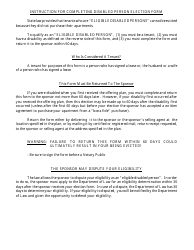

Q: Who can use Form SH-2?

A: Form SH-2 can be used by disabled persons who meet the eligibility criteria.

Q: What does the Form SH-2 allow eligible persons to do?

A: Form SH-2 allows eligible persons to claim an exemption from property taxation for their primary residence.

Q: Is there a deadline for submitting Form SH-2?

A: Yes, Form SH-2 must be filed with the Assessor's Office on or before the taxable status date of the local assessing unit.

Form Details:

- Released on October 1, 1988;

- The latest edition provided by the New York State Attorney General;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form SH-2 by clicking the link below or browse more documents and templates provided by the New York State Attorney General.