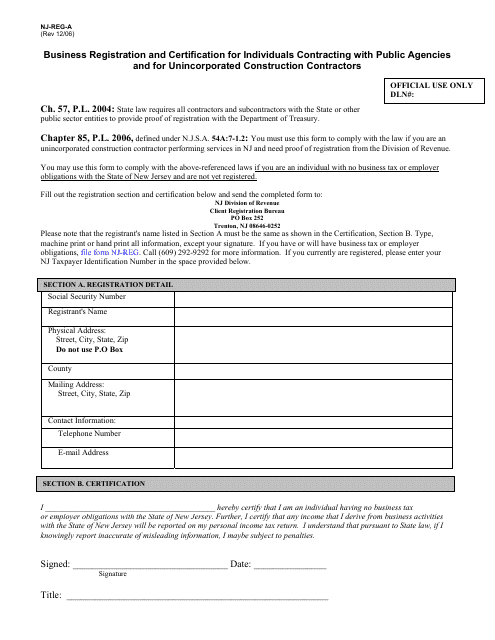

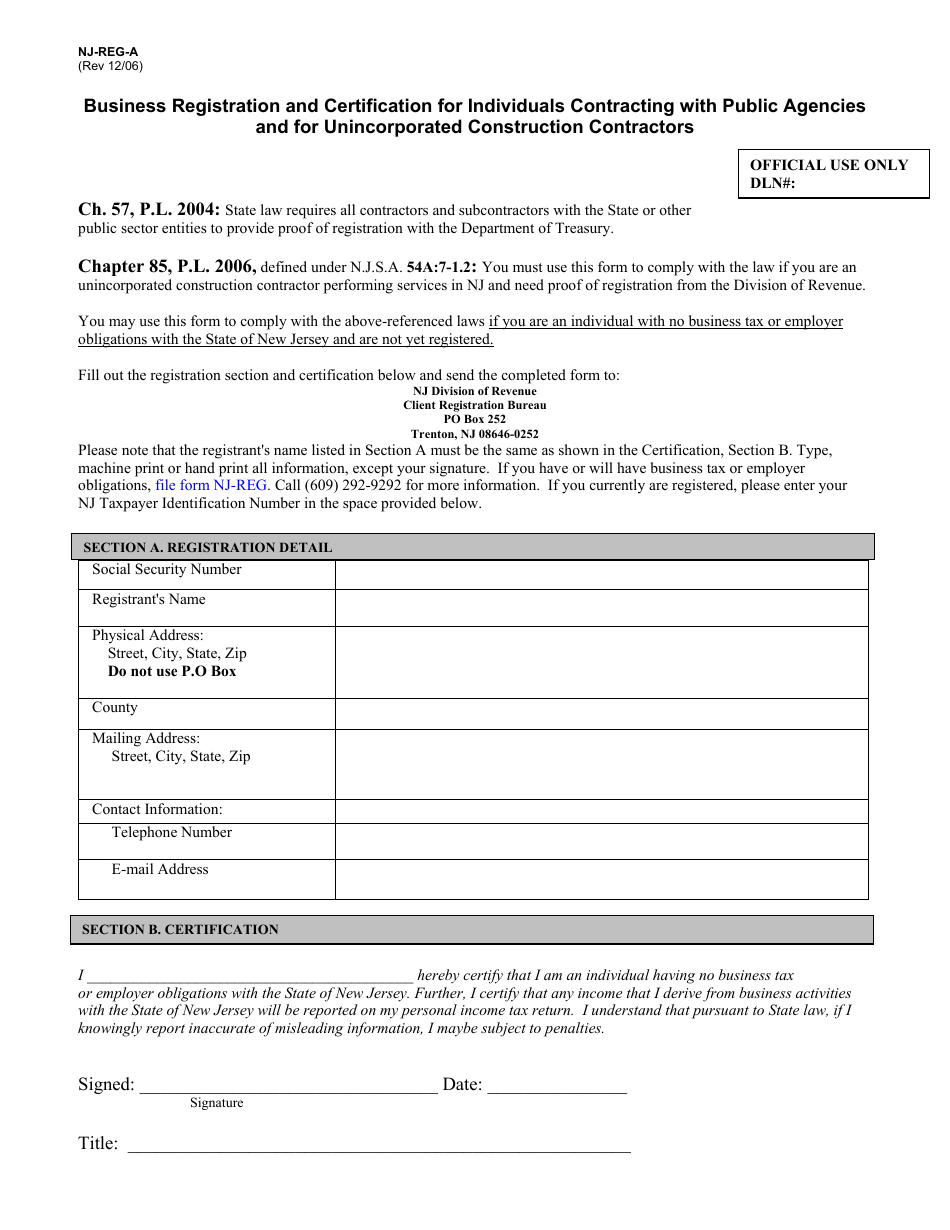

Form NJ-REG-A Business Registration and Certification for Individuals Contracting With Public Agencies and for Unincorporated Construction Contractors - New Jersey

What Is Form NJ-REG-A?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is the purpose of Form NJ-REG-A?

A: Form NJ-REG-A is used for business registration and certification for individuals contracting with public agencies and unincorporated construction contractors in New Jersey.

Q: Who needs to fill out Form NJ-REG-A?

A: Individuals contracting with public agencies and unincorporated construction contractors in New Jersey need to fill out Form NJ-REG-A.

Q: What information is required on Form NJ-REG-A?

A: Form NJ-REG-A requires information such as the individual's name, address, contact information, business type, and specific certifications.

Q: Is Form NJ-REG-A mandatory?

A: Yes, individuals contracting with public agencies and unincorporated construction contractors in New Jersey are required to fill out Form NJ-REG-A.

Q: Is there a deadline for submitting Form NJ-REG-A?

A: There is no specific deadline for submitting Form NJ-REG-A, but it should be completed and submitted before entering into a contract with a public agency or engaging in construction contracting in New Jersey.

Q: What should I do with my completed Form NJ-REG-A?

A: Once completed, Form NJ-REG-A should be submitted to the New Jersey Division of Revenue and Enterprise Services along with any required fees.

Q: What if my information changes after submitting Form NJ-REG-A?

A: If your information changes after submitting Form NJ-REG-A, you must notify the New Jersey Division of Revenue and Enterprise Services within 20 days of the change.

Form Details:

- Released on December 1, 2006;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-REG-A by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.