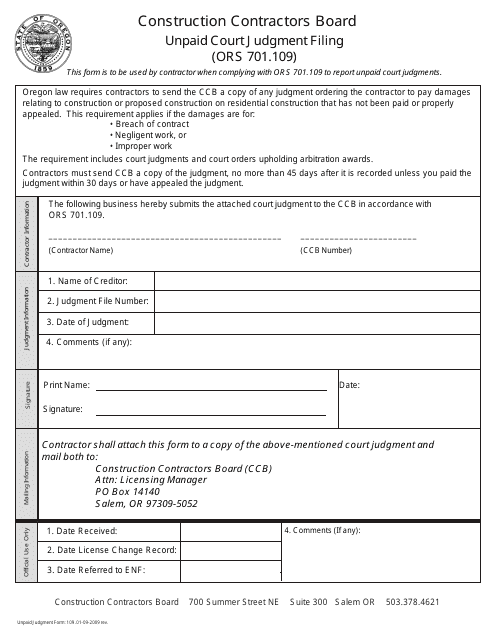

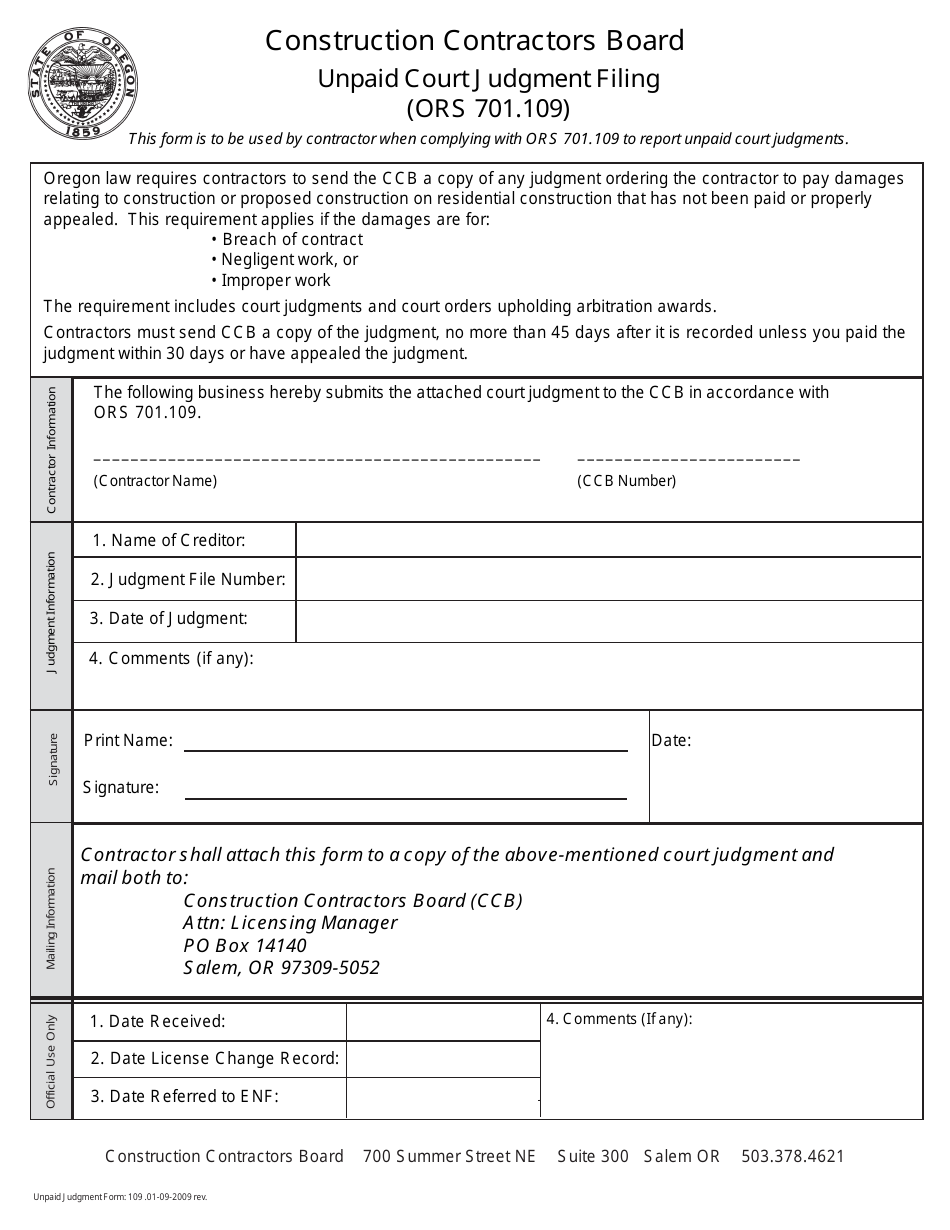

Form 109 Unpaid Court Judgment Filing - Oregon

What Is Form 109?

This is a legal form that was released by the Oregon Construction Contractors Board - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 109?

A: Form 109 is a document used for reporting unpaid court judgments to the Oregon Department of Revenue.

Q: What is an unpaid court judgment?

A: An unpaid court judgment is a legal decision where a court has ordered someone to pay a certain amount of money, and the payment has not been made.

Q: Who is required to file Form 109?

A: The person or business that obtained the court judgment is required to file Form 109.

Q: What information is needed to complete Form 109?

A: You will need the court case number, the name of the debtor, the amount owed, and other relevant details.

Q: Is there a deadline for filing Form 109?

A: Yes, the form must be filed within 30 days of obtaining the court judgment.

Q: What happens after filing Form 109?

A: The Oregon Department of Revenue will place a lien on the debtor's property and take necessary actions to collect the unpaid judgment.

Q: What if the debtor pays after Form 109 is filed?

A: If the debtor pays the judgment amount after Form 109 is filed, you must notify the Oregon Department of Revenue and request a release of the lien.

Form Details:

- Released on January 9, 2009;

- The latest edition provided by the Oregon Construction Contractors Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 109 by clicking the link below or browse more documents and templates provided by the Oregon Construction Contractors Board.