This version of the form is not currently in use and is provided for reference only. Download this version of

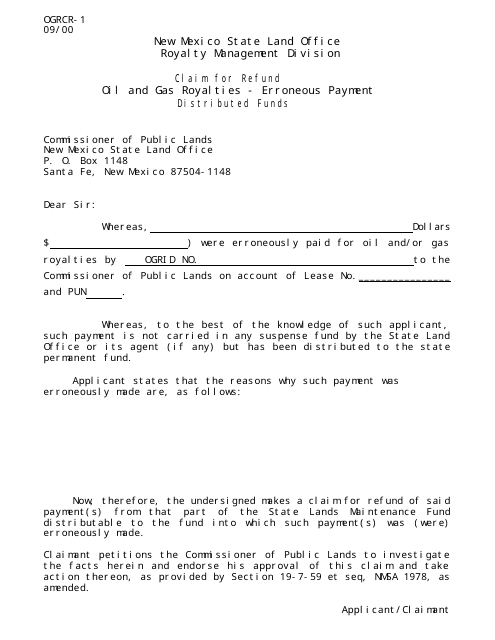

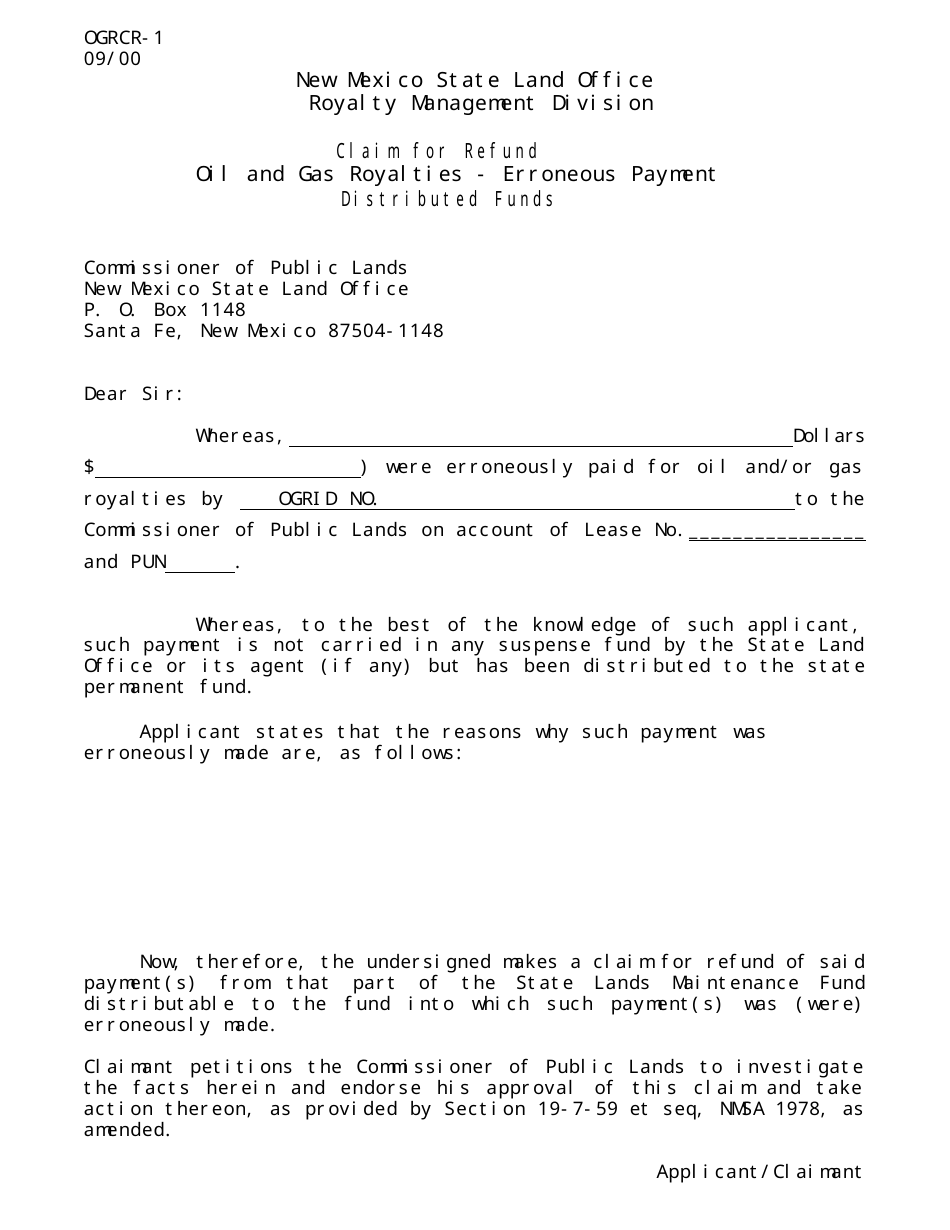

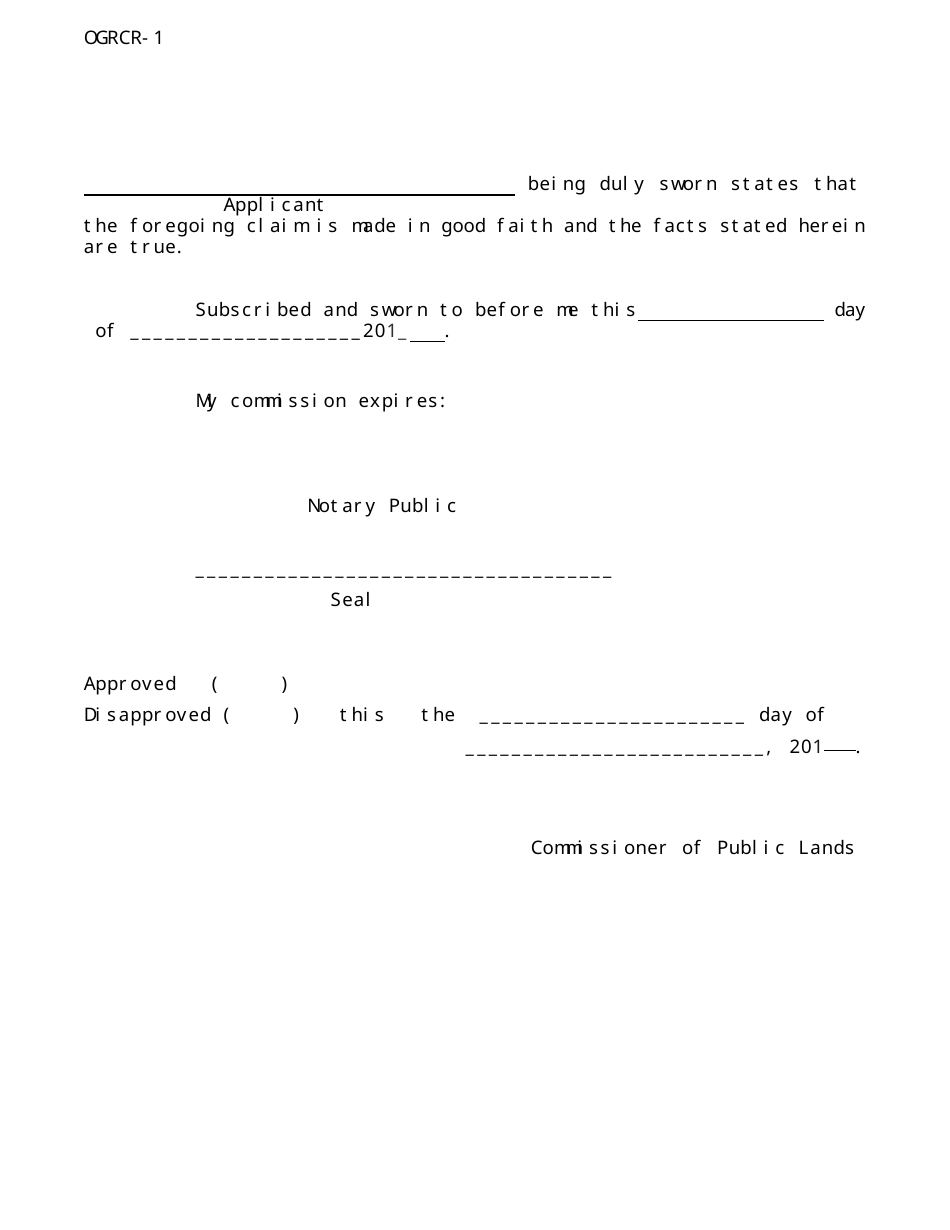

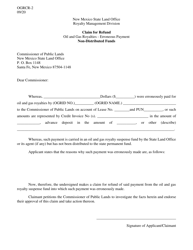

Form OGRCR-1

for the current year.

Form OGRCR-1 Claim for Refund Distributed Funds - New Mexico

What Is Form OGRCR-1?

This is a legal form that was released by the New Mexico State Land Office - a government authority operating within New Mexico. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is OGRCR-1?

A: OGRCR-1 is the form used to file a claim for a refund of distributed funds in New Mexico.

Q: Who can use OGRCR-1?

A: Any individual or business entity that has made distributed funds in New Mexico and wants to claim a refund can use OGRCR-1.

Q: What is a distributed fund?

A: A distributed fund refers to money or assets that have been disbursed or paid out.

Q: How do I file a claim for refund using OGRCR-1?

A: You can file a claim for refund using OGRCR-1 by completing the form and submitting it to the appropriate authority in New Mexico.

Q: Are there any requirements for claiming a refund using OGRCR-1?

A: Yes, you need to meet certain requirements specified on the form, such as providing proof of payment and complying with the refund policies of New Mexico.

Q: How long does it take to process a claim for refund using OGRCR-1?

A: The processing time for a claim for refund using OGRCR-1 can vary, but it typically takes several weeks to months.

Q: What should I do if my claim for refund using OGRCR-1 is denied?

A: If your claim for refund using OGRCR-1 is denied, you can follow the instructions provided by the tax authorities on how to appeal the decision.

Q: Can I get assistance in filling out OGRCR-1?

A: Yes, you can seek assistance from the New Mexico taxation department or consult a tax professional to help you fill out OGRCR-1 accurately.

Form Details:

- Released on September 1, 2000;

- The latest edition provided by the New Mexico State Land Office;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OGRCR-1 by clicking the link below or browse more documents and templates provided by the New Mexico State Land Office.