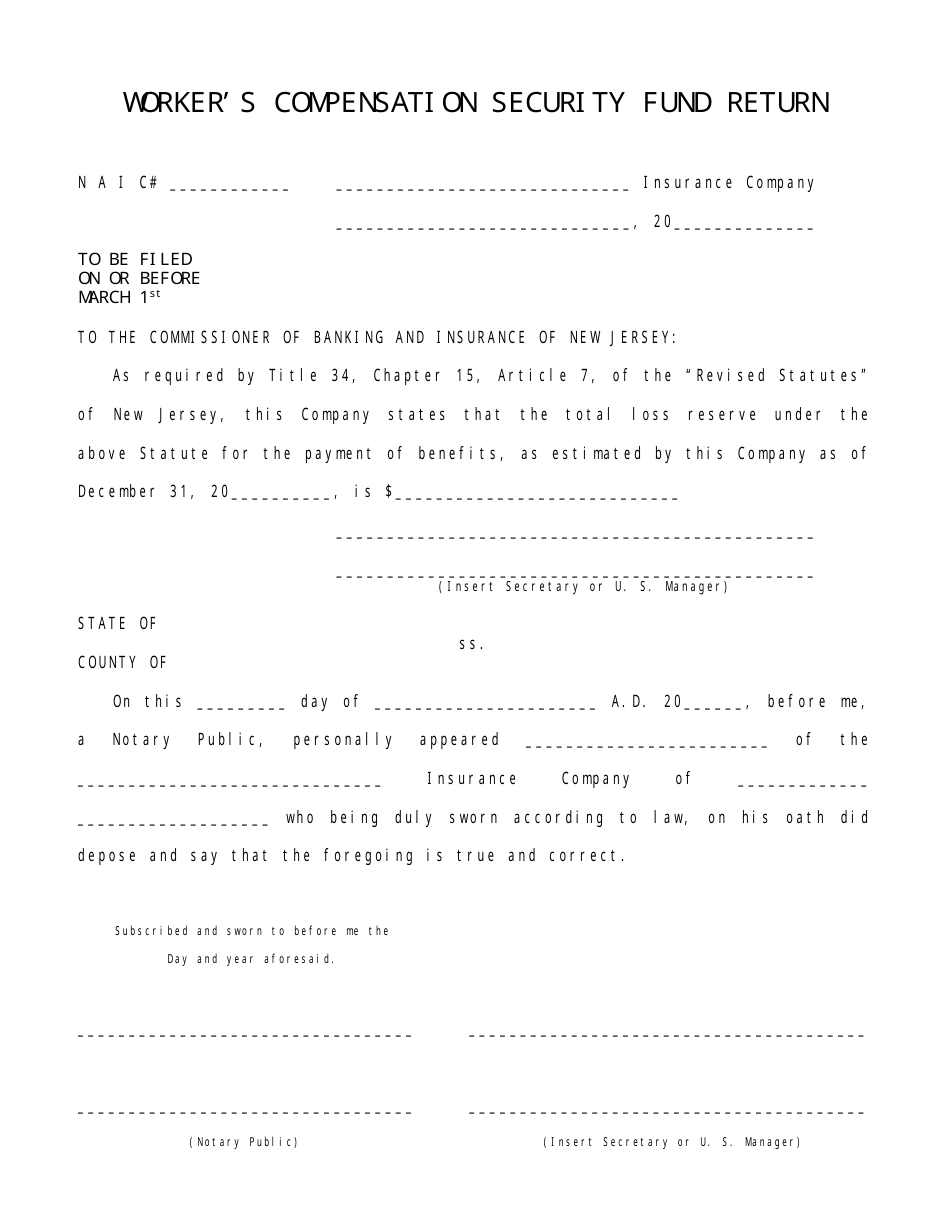

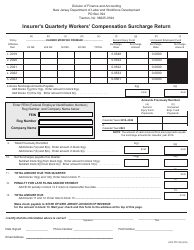

Worker's Compensation Security Fund Return - New Jersey

Worker's Compensation Security Fund Return is a legal document that was released by the New Jersey Department of Banking and Insurance - a government authority operating within New Jersey.

FAQ

Q: What is the Worker's Compensation Security Fund Return?

A: The Worker's Compensation Security Fund Return is a form that employers in New Jersey must file to report their workers' compensation insurance coverage.

Q: Who needs to file the Worker's Compensation Security Fund Return?

A: All employers in New Jersey are required to file the Worker's Compensation Security Fund Return.

Q: When is the deadline to file the Worker's Compensation Security Fund Return?

A: The deadline to file the Worker's Compensation Security Fund Return in New Jersey is typically on or before April 30th each year.

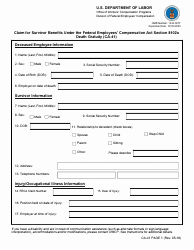

Q: What information is required to complete the Worker's Compensation Security Fund Return?

A: Employers need to provide details about their workers' compensation insurance policy, including the insurer's name and policy number.

Q: Are there any penalties for not filing the Worker's Compensation Security Fund Return?

A: Yes, there may be penalties for failing to file or filing the return late, such as fines or other legal consequences.

Q: What should I do if I have questions or need assistance with the Worker's Compensation Security Fund Return?

A: If you have questions or need assistance with the Worker's Compensation Security Fund Return, you can contact the New Jersey Department of Labor and Workforce Development for guidance.

Q: Is the Worker's Compensation Security Fund Return the same as workers' compensation insurance?

A: No, the Worker's Compensation Security Fund Return is a form used to report workers' compensation insurance coverage, while workers' compensation insurance is the actual insurance policy that provides coverage for workplace injuries.

Q: Are there any exemptions from filing the Worker's Compensation Security Fund Return?

A: There may be exemptions from filing the Worker's Compensation Security Fund Return for certain types of employers, such as those who are self-insured or covered by federal workers' compensation programs.

Form Details:

- The latest edition currently provided by the New Jersey Department of Banking and Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of Banking and Insurance.