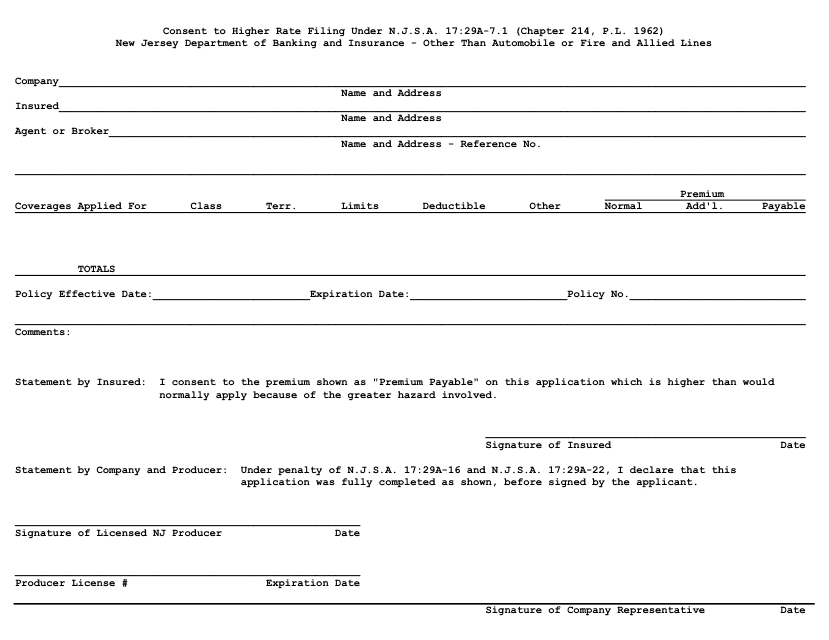

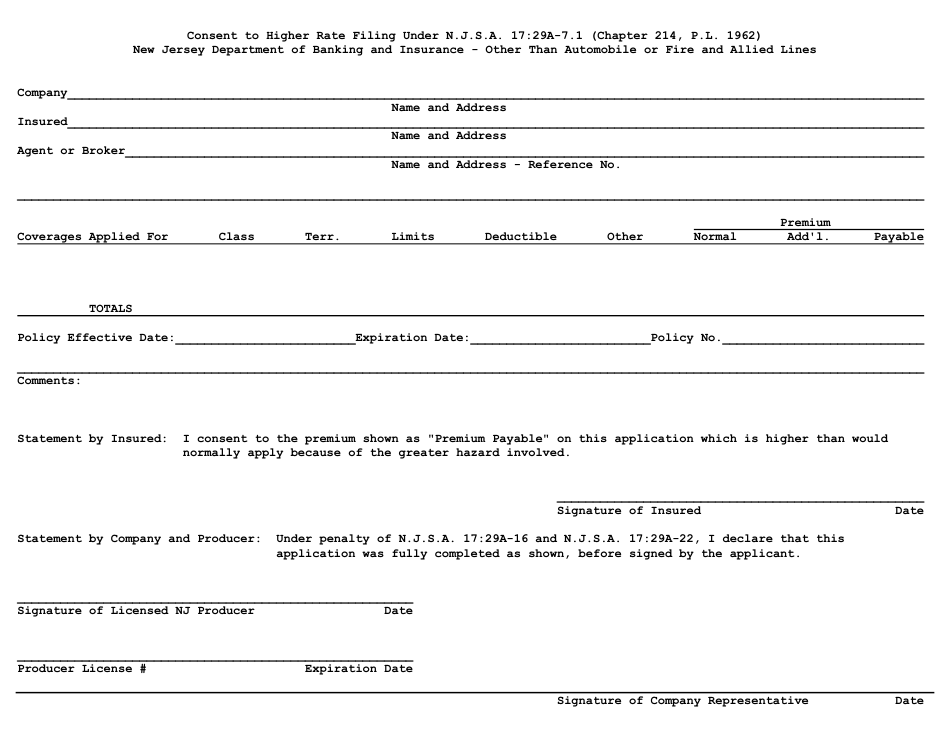

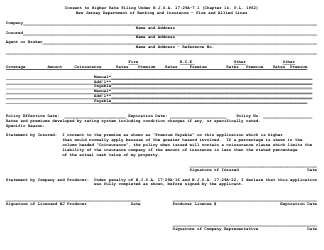

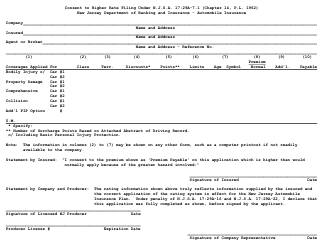

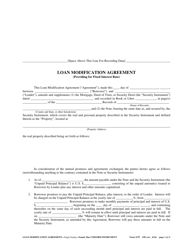

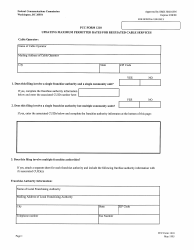

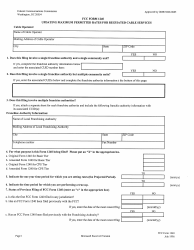

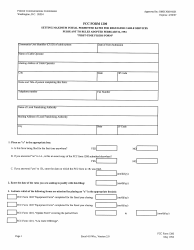

Consent to Higher Rate - Other Than Automobile or Fire and Allied Lines - New Jersey

Consent to Higher Rate - Other Than Automobile or Fire and Allied Lines is a legal document that was released by the New Jersey Department of Banking and Insurance - a government authority operating within New Jersey.

FAQ

Q: What is Consent to Higher Rate?

A: Consent to Higher Rate refers to an agreement where an insured individual voluntarily agrees to pay a higher rate for an insurance policy other than automobile or fire and allied lines in the state of New Jersey.

Q: Why would someone agree to Consent to Higher Rate?

A: There can be various reasons why someone would agree to Consent to Higher Rate, such as if they have specific coverage needs that are not typically covered by standard insurance policies.

Q: Does Consent to Higher Rate apply to automobile and fire insurance?

A: No, Consent to Higher Rate does not apply to automobile or fire and allied lines insurance policies in New Jersey. It is specifically for other types of insurance policies.

Q: Is Consent to Higher Rate mandatory?

A: No, Consent to Higher Rate is voluntary. The insured individual can choose whether or not to agree to pay a higher rate for their insurance policy.

Q: How can someone consent to a higher rate?

A: To consent to a higher rate, the insured individual would typically need to sign a specific agreement or endorsement with the insurance company, indicating their willingness to pay a higher premium.

Form Details:

- The latest edition currently provided by the New Jersey Department of Banking and Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of Banking and Insurance.