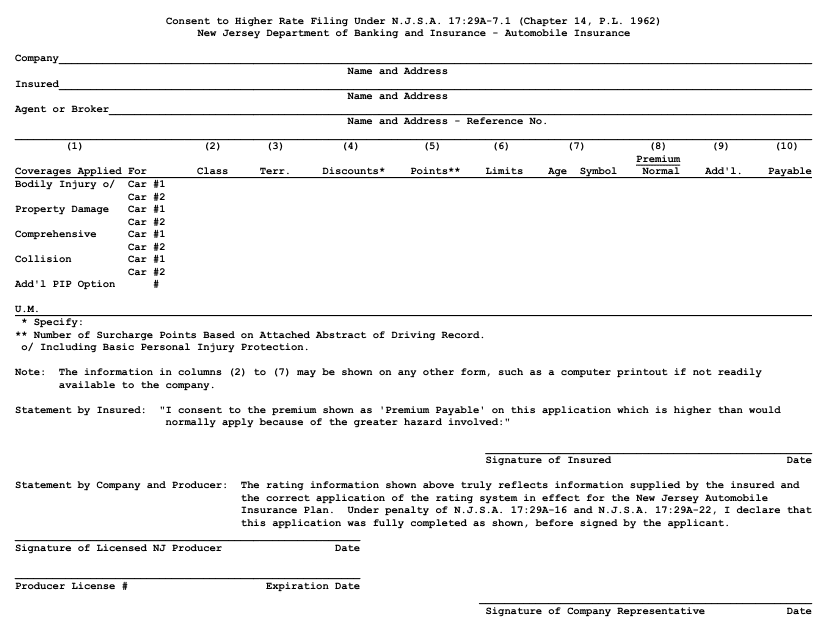

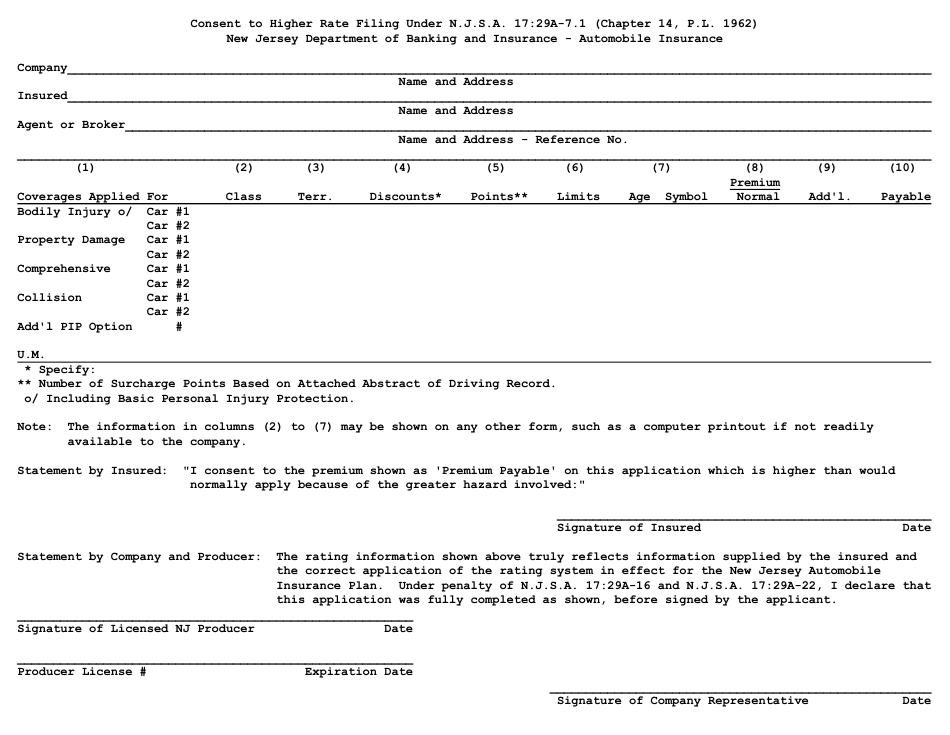

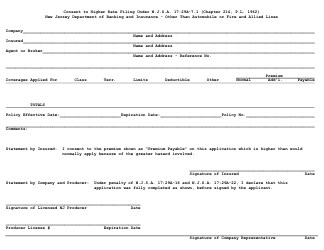

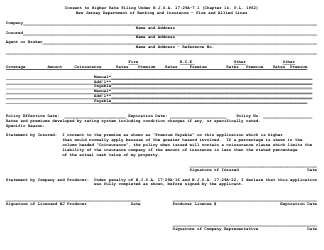

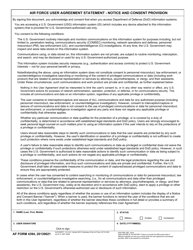

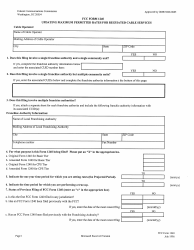

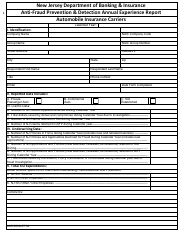

Consent to Higher Rate - Automobile Insurance - New Jersey

Consent to Higher Rate - Automobile Insurance is a legal document that was released by the New Jersey Department of Banking and Insurance - a government authority operating within New Jersey.

FAQ

Q: What is Consent to Higher Rate in automobile insurance?

A: Consent to Higher Rate is a form that allows insurance companies in New Jersey to charge higher premiums based on certain factors.

Q: Why would an insurance company charge a higher rate?

A: An insurance company may charge a higher rate if you have a history of accidents or violations, or if you are considered a high-risk driver.

Q: Do I have to consent to a higher rate?

A: Consenting to a higher rate is optional - it is up to you to decide if you want to pay the higher premiums or look for alternative coverage.

Q: Can the insurance company increase my rates without my consent?

A: No, the insurance company cannot increase your rates without your consent. They must provide you with the Consent to Higher Rate form and give you the option to accept or decline.

Q: Are there any regulations in place to protect consumers from excessive rate increases?

A: Yes, the New Jersey Department of Banking and Insurance regulates automobile insurance rates to ensure they are reasonable and not excessive.

Q: What should I do if I think my insurance rates are too high?

A: If you believe your insurance rates are too high, you can shop around for quotes from different insurance companies to compare prices and coverage options.

Q: Can I switch insurance companies if I am already paying a higher rate?

A: Yes, you are free to switch insurance companies at any time if you can find a better rate or coverage option elsewhere.

Q: Is it possible to negotiate the higher rate with my current insurance company?

A: It may be possible to negotiate a lower rate with your current insurance company, but they are not obligated to lower your premiums.

Q: What factors can affect my insurance rates?

A: Insurance companies consider factors such as your driving record, the type of vehicle you own, your age, and your location when determining your insurance rates.

Q: Is it legal for insurance companies to discriminate based on certain factors when setting rates?

A: No, it is illegal for insurance companies to discriminate based on factors such as race, gender, or marital status when setting rates.

Form Details:

- The latest edition currently provided by the New Jersey Department of Banking and Insurance;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the New Jersey Department of Banking and Insurance.