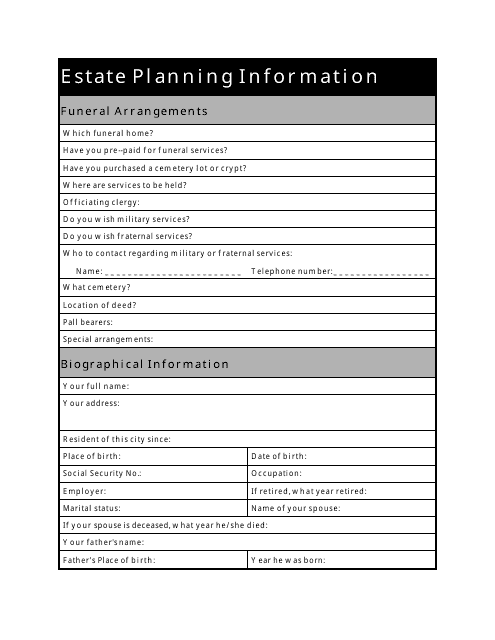

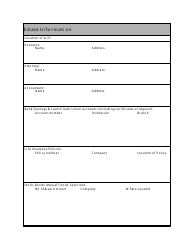

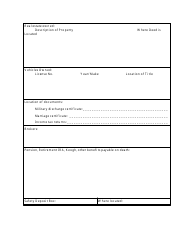

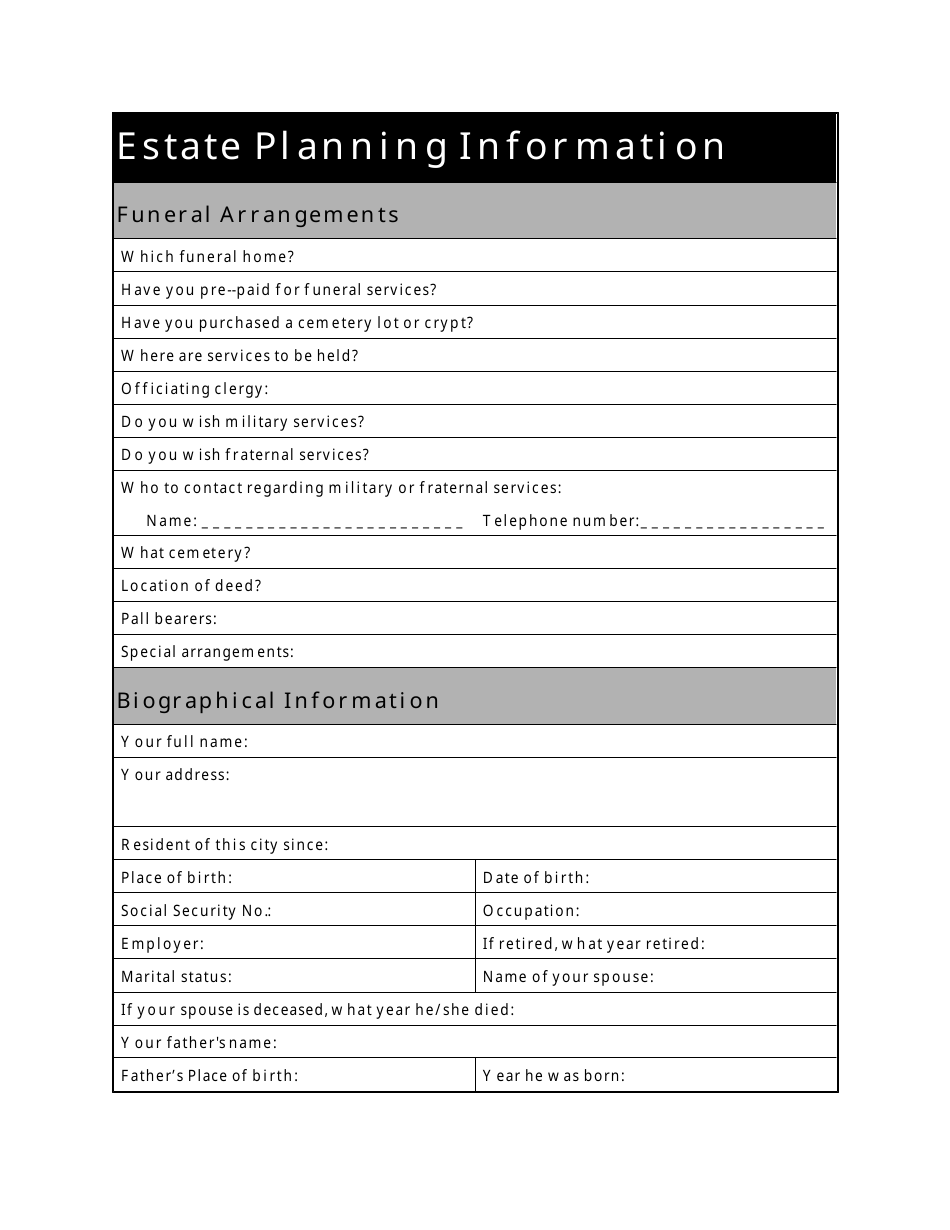

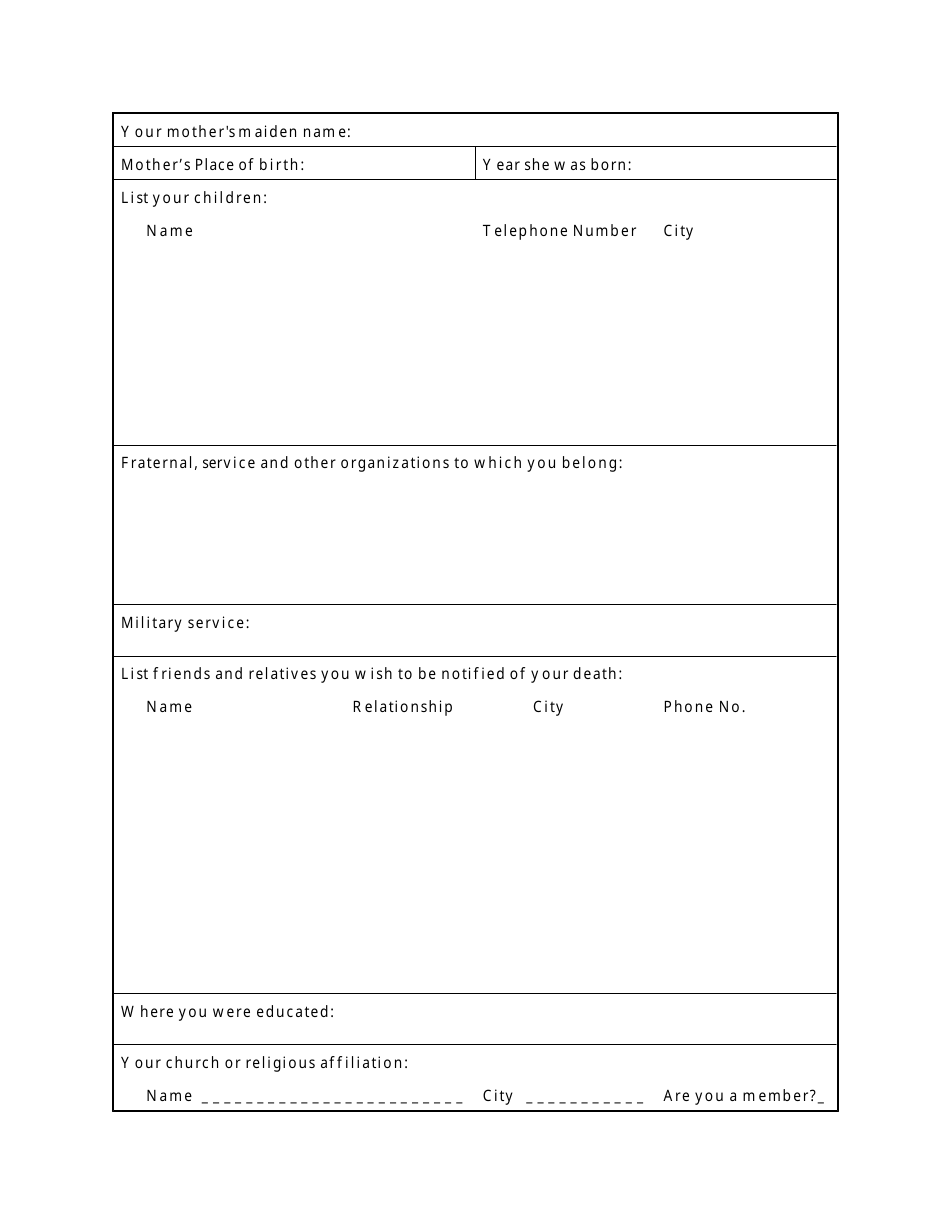

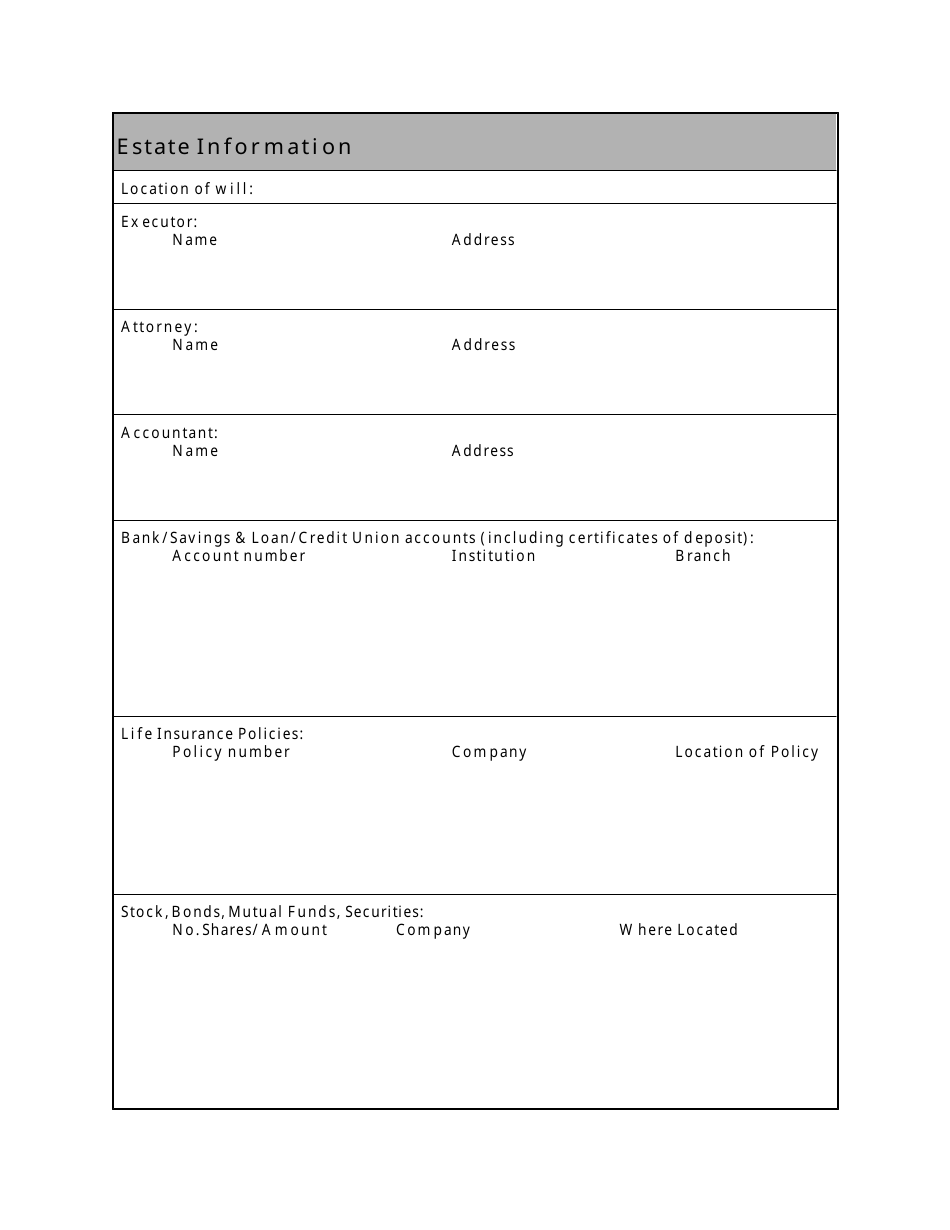

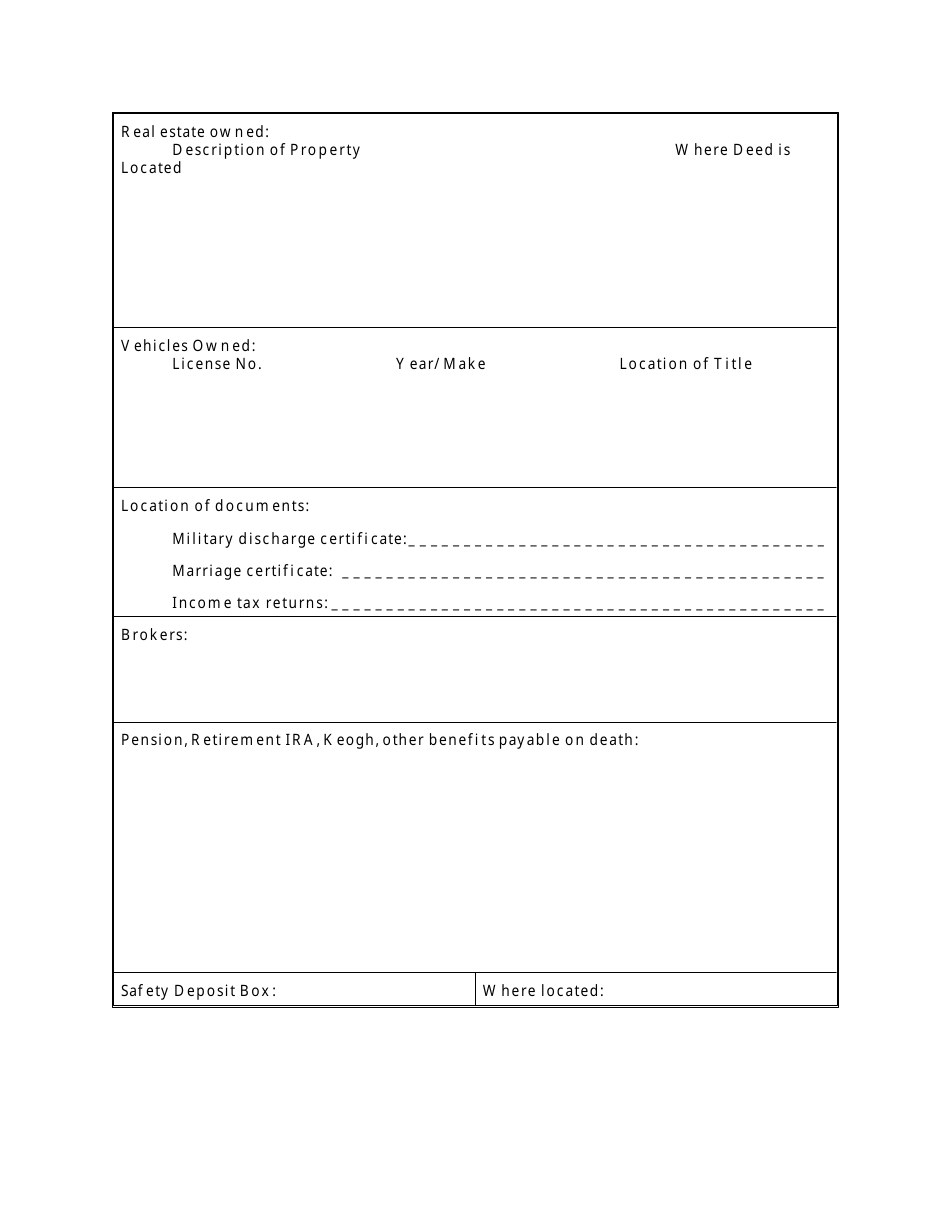

Estate Planning Information Form - Oregon

Estate Planning Information Form is a legal document that was released by the Oregon State Bar - a government authority operating within Oregon.

FAQ

Q: What is estate planning?

A: Estate planning involves making decisions about how your assets and affairs will be handled after your death.

Q: Why is estate planning important?

A: Estate planning allows you to protect your assets, provide for your loved ones, and ensure your wishes are carried out.

Q: What are some common estate planning documents?

A: Common estate planning documents include wills, trusts, powers of attorney, and advance healthcare directives.

Q: Do I need an attorney for estate planning?

A: While not required, it is often recommended to consult with an attorney experienced in estate planning to ensure your wishes are properly documented.

Q: What is a will?

A: A will is a legal document that specifies how your assets will be distributed after your death.

Q: What is a trust?

A: A trust is a legal entity that holds and manages assets for the benefit of designated beneficiaries.

Q: What is a power of attorney?

A: A power of attorney is a legal document that grants someone the authority to act on your behalf in managing your affairs.

Q: What is an advance healthcare directive?

A: An advance healthcare directive, also known as a living will, allows you to specify your healthcare preferences in case you become unable to communicate.

Q: What happens if I don't have an estate plan?

A: If you don't have an estate plan, your assets may be distributed according to state laws, and your wishes may not be honored.

Q: Can estate planning help minimize taxes?

A: Yes, estate planning can include strategies to minimize estate taxes and ensure more of your assets go to your intended beneficiaries.

Form Details:

- The latest edition currently provided by the Oregon State Bar;

- Ready to use and print;

- Easy to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of the form by clicking the link below or browse more documents and templates provided by the Oregon State Bar.