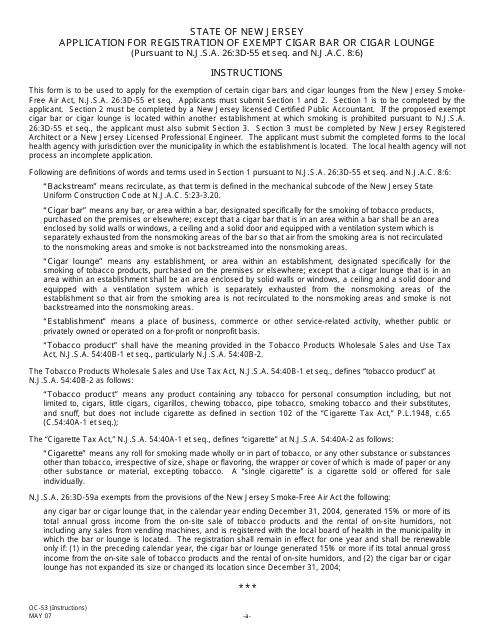

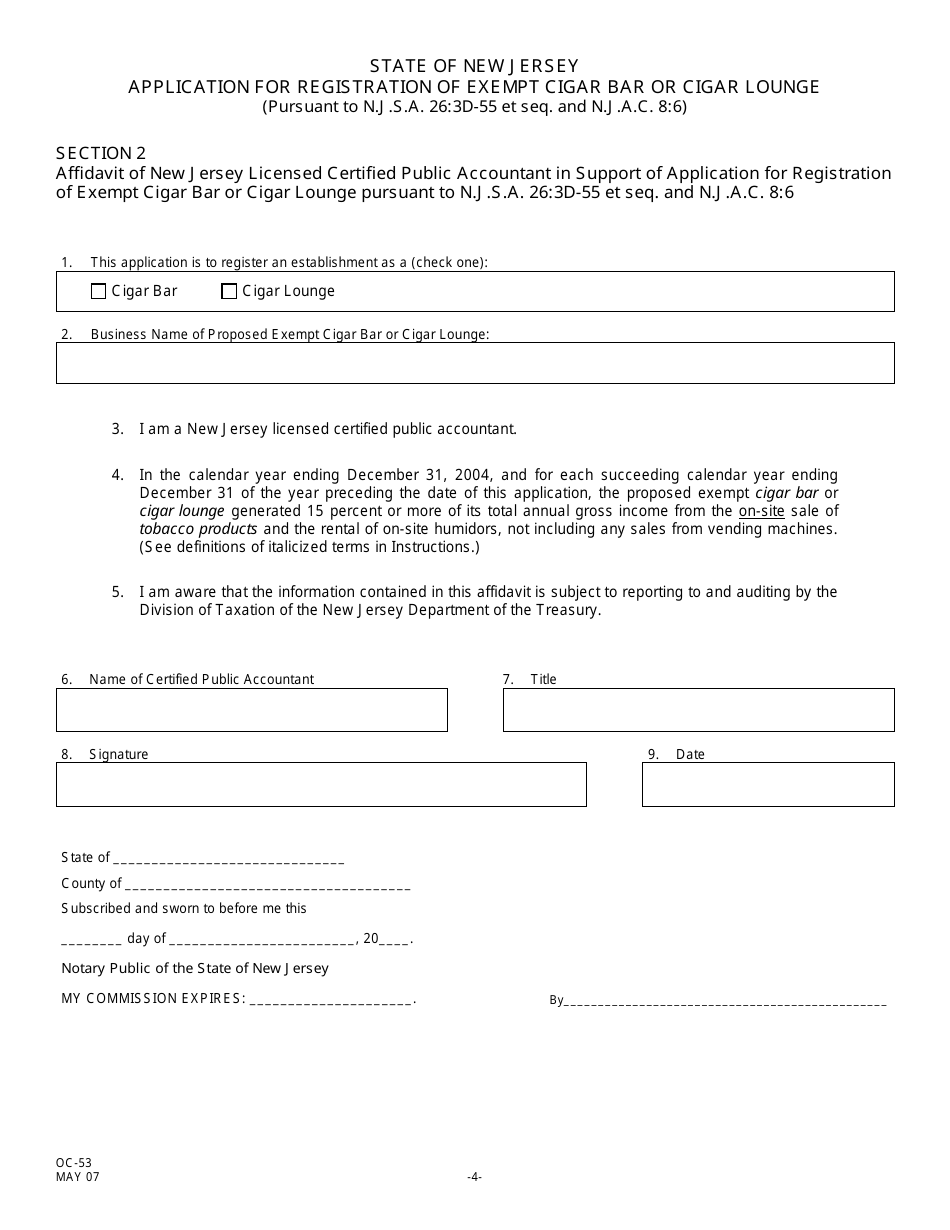

Form OC-53 Application for Registration of Exempt Cigar Bar or Cigar Lounge - New Jersey

What Is Form OC-53?

This is a legal form that was released by the New Jersey Department of Health - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form OC-53?

A: Form OC-53 is the application form for registering an exempt cigar bar or cigar lounge in New Jersey.

Q: What is an exempt cigar bar or cigar lounge?

A: An exempt cigar bar or cigar lounge is a place where smoking cigars is allowed, even in areas otherwise restricted by smoking bans.

Q: Who needs to fill out Form OC-53?

A: Owners or operators of cigar bars or lounges in New Jersey who want to register for an exemption from smoking bans need to fill out Form OC-53.

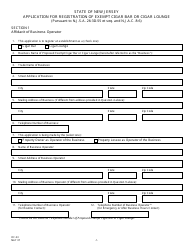

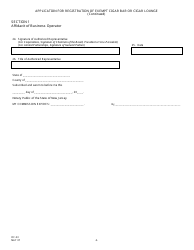

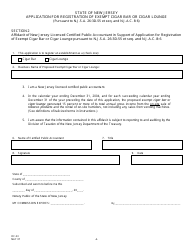

Q: What information is required in Form OC-53?

A: Form OC-53 requires information such as the name and address of the cigar bar or lounge, the owner's contact information, and details about the establishment's operations.

Q: Are there any fees associated with filing Form OC-53?

A: Yes, there is a non-refundable registration fee of $500 for filing Form OC-53.

Q: When should I submit Form OC-53?

A: Form OC-53 should be submitted at least 30 days before the cigar bar or lounge plans to open.

Q: What happens after submitting Form OC-53?

A: After submitting Form OC-53, the New Jersey Division of Taxation will review the application and notify the applicant of their decision.

Q: How long is the registration valid for?

A: The registration for an exempt cigar bar or cigar lounge is valid for a period of one year.

Q: Can I operate an exempt cigar bar or cigar lounge without registering?

A: No, it is illegal to operate an exempt cigar bar or cigar lounge without registering and obtaining the necessary exemption from smoking bans.

Form Details:

- Released on May 1, 2007;

- The latest edition provided by the New Jersey Department of Health;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OC-53 by clicking the link below or browse more documents and templates provided by the New Jersey Department of Health.