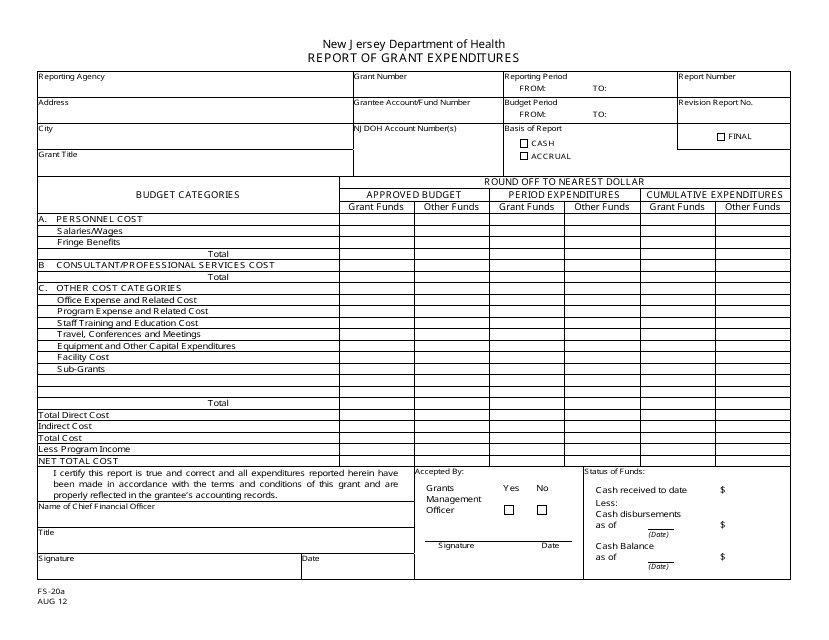

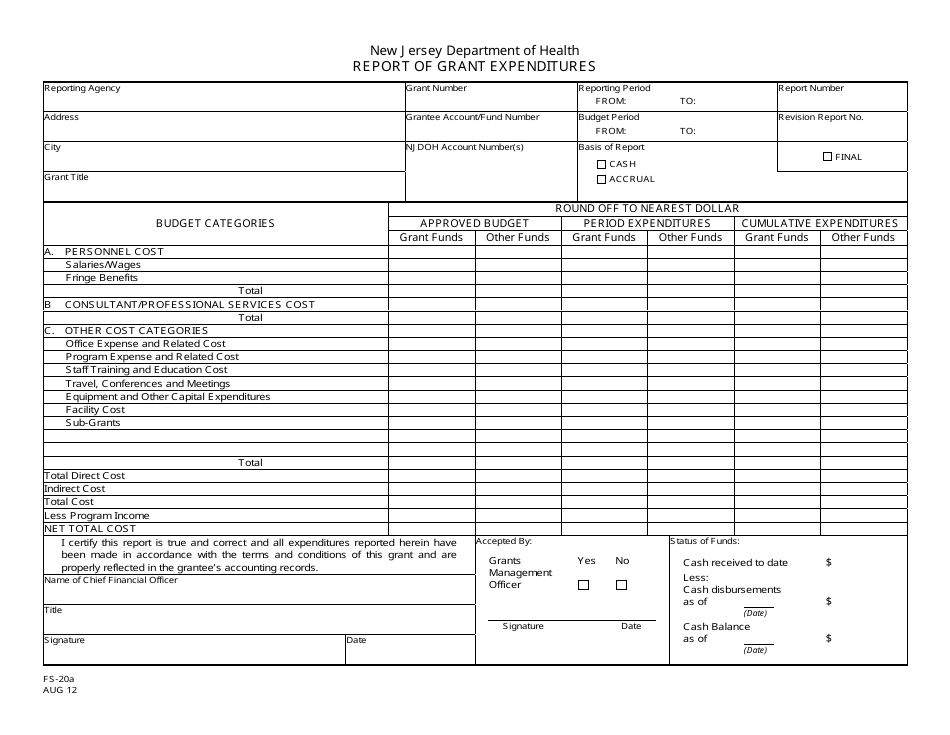

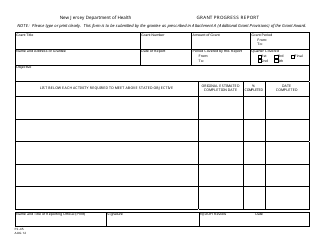

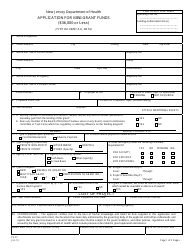

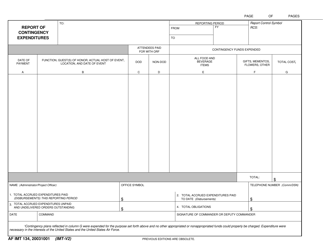

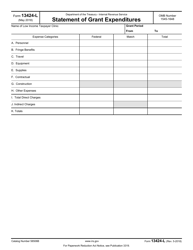

Form FS-20A Report of Grant Expenditures - New Jersey

What Is Form FS-20A?

This is a legal form that was released by the New Jersey Department of Health - a government authority operating within New Jersey. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form FS-20A?

A: Form FS-20A is the Report of Grant Expenditures.

Q: Who needs to file Form FS-20A?

A: Organizations that have received a grant from the state of New Jersey.

Q: What is the purpose of Form FS-20A?

A: The form is used to report the expenditures made using the grant funds.

Q: When is Form FS-20A due?

A: The due date for filing Form FS-20A is usually specified in the grant agreement.

Q: What information do I need to complete Form FS-20A?

A: You will need to provide details about the grant, including the grant number, grant amount, and a breakdown of expenditures.

Q: Are there any penalties for late or incorrect filing of Form FS-20A?

A: Penalties may apply for late or incorrect filing of Form FS-20A, so it's important to comply with the filing requirements.

Q: What should I do if I need assistance with Form FS-20A?

A: If you need assistance with Form FS-20A, you can contact the grant-awarding agency or consult a professional tax advisor.

Q: Is Form FS-20A specific to New Jersey?

A: Yes, Form FS-20A is specific to reporting grant expenditures in the state of New Jersey.

Form Details:

- Released on August 1, 2012;

- The latest edition provided by the New Jersey Department of Health;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form FS-20A by clicking the link below or browse more documents and templates provided by the New Jersey Department of Health.