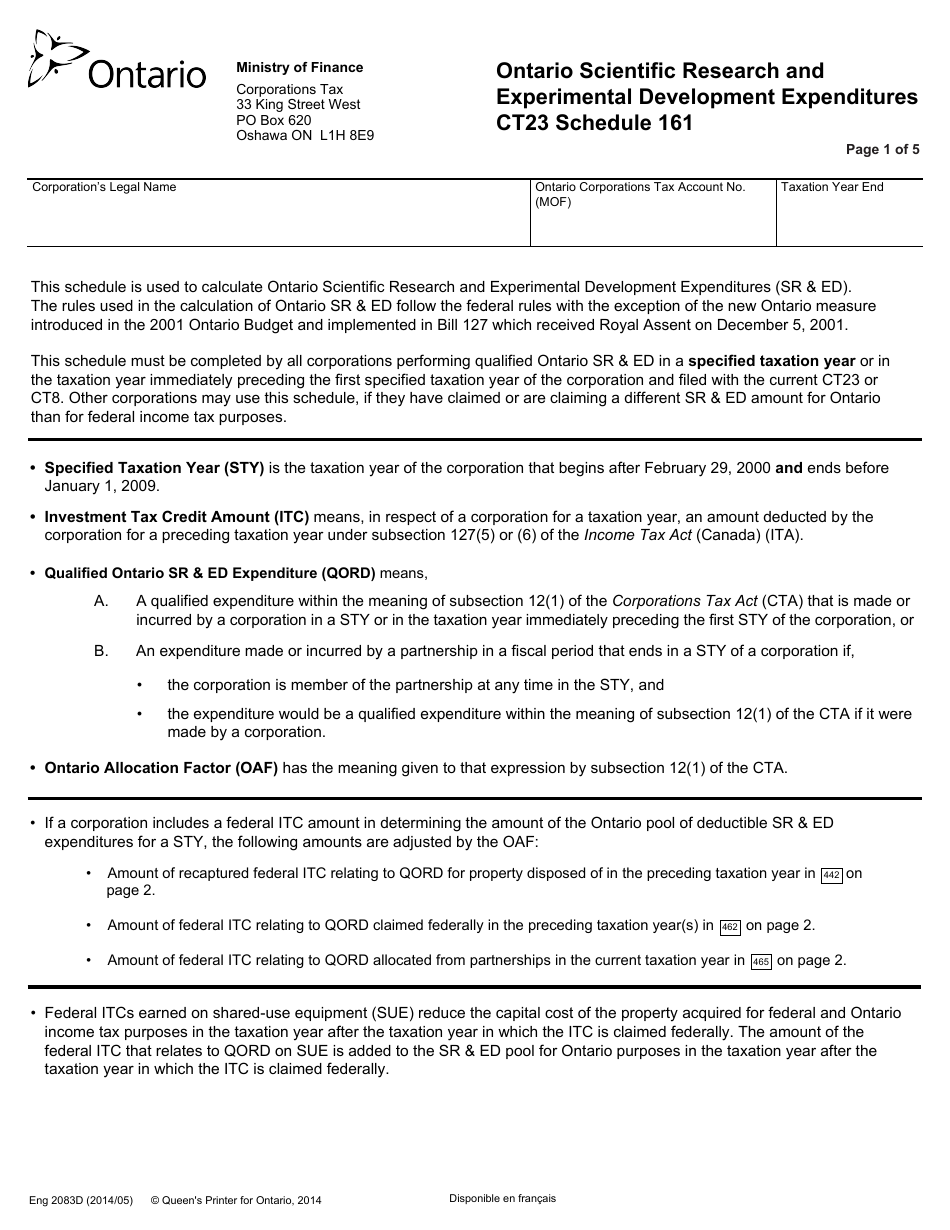

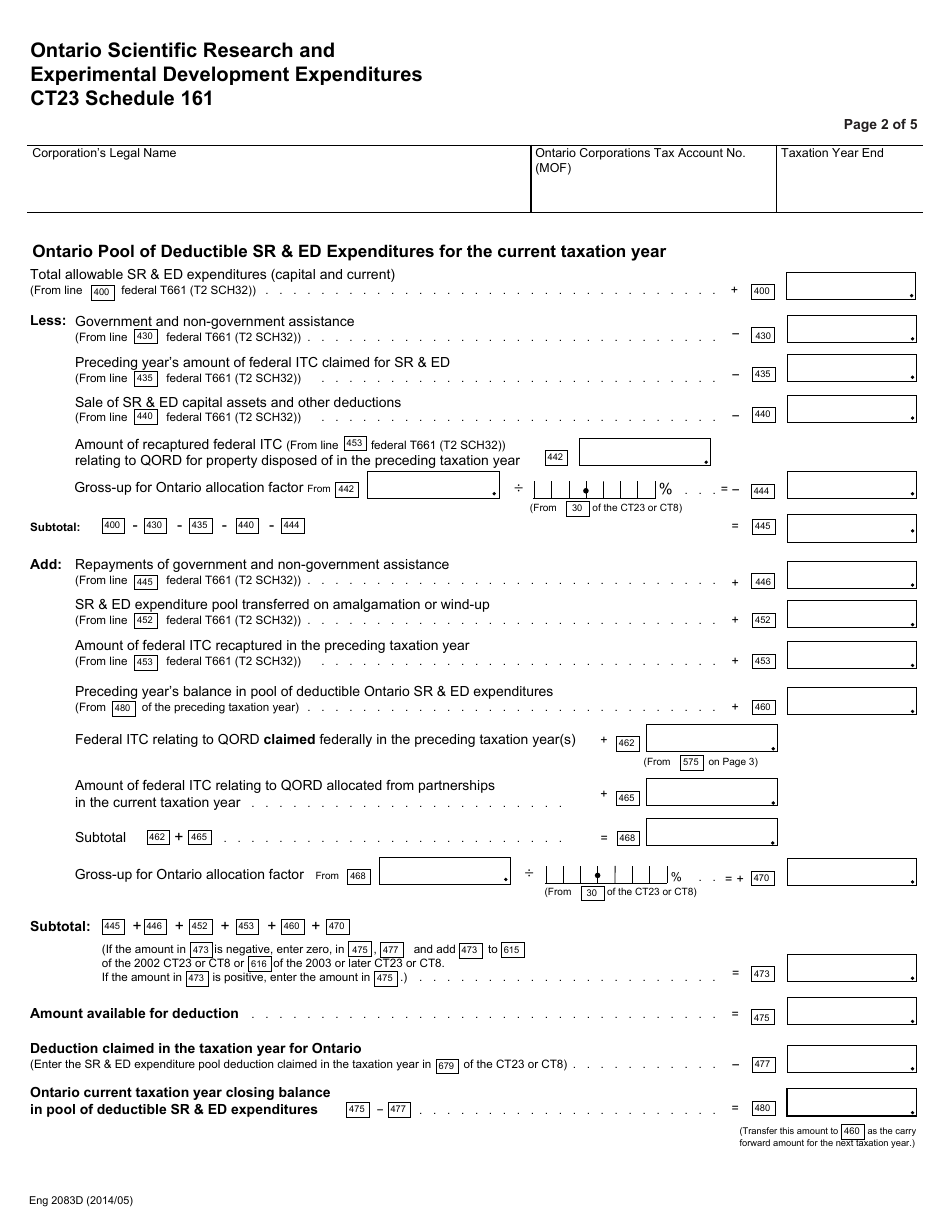

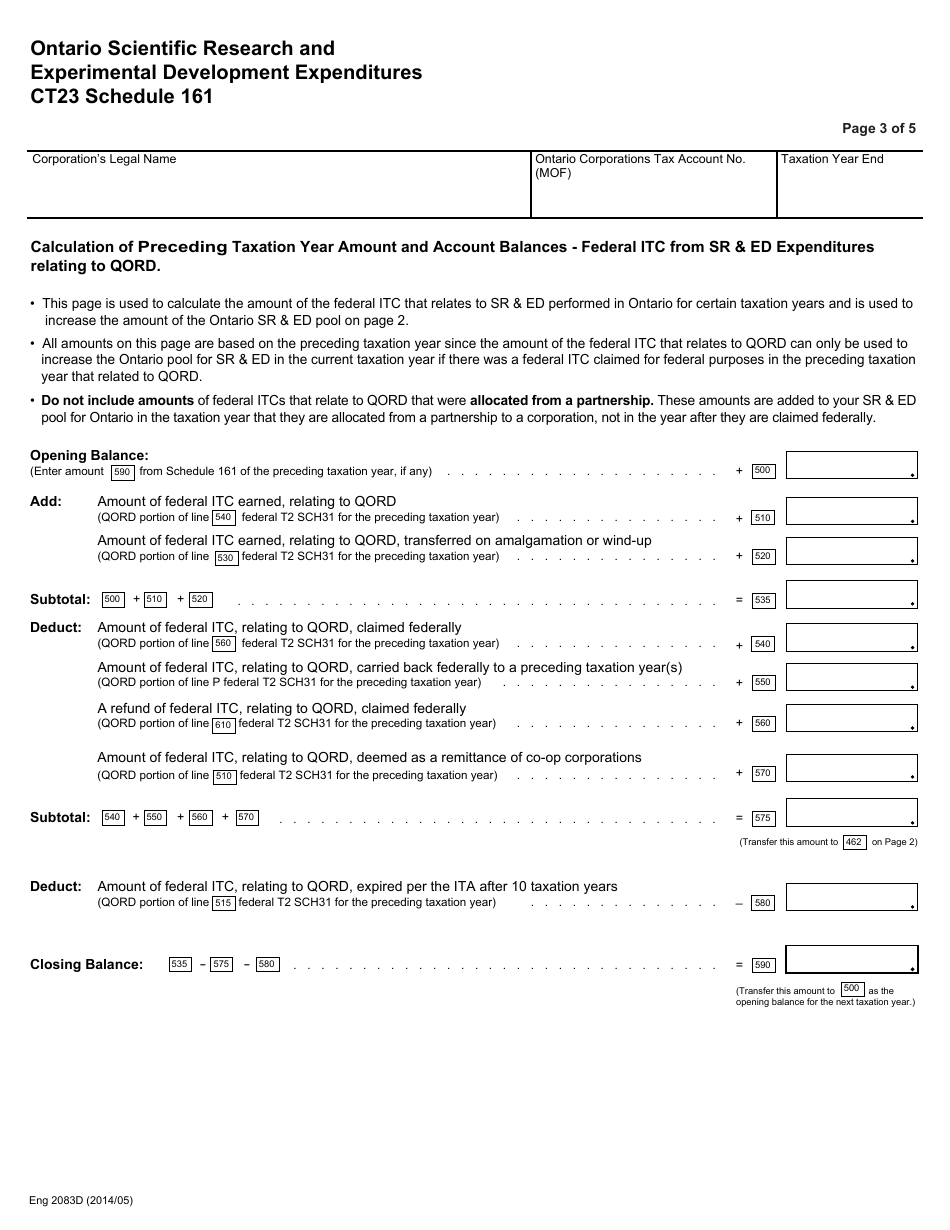

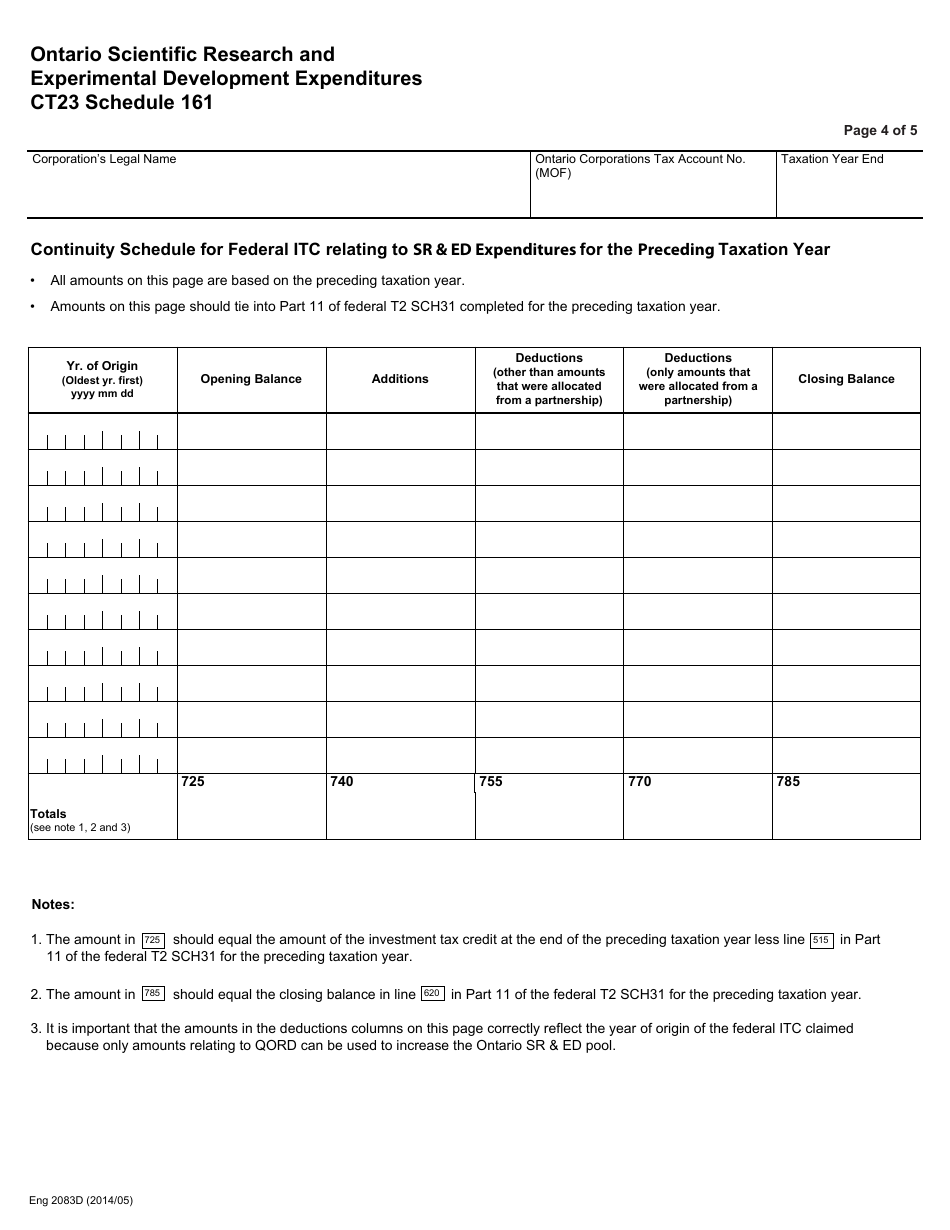

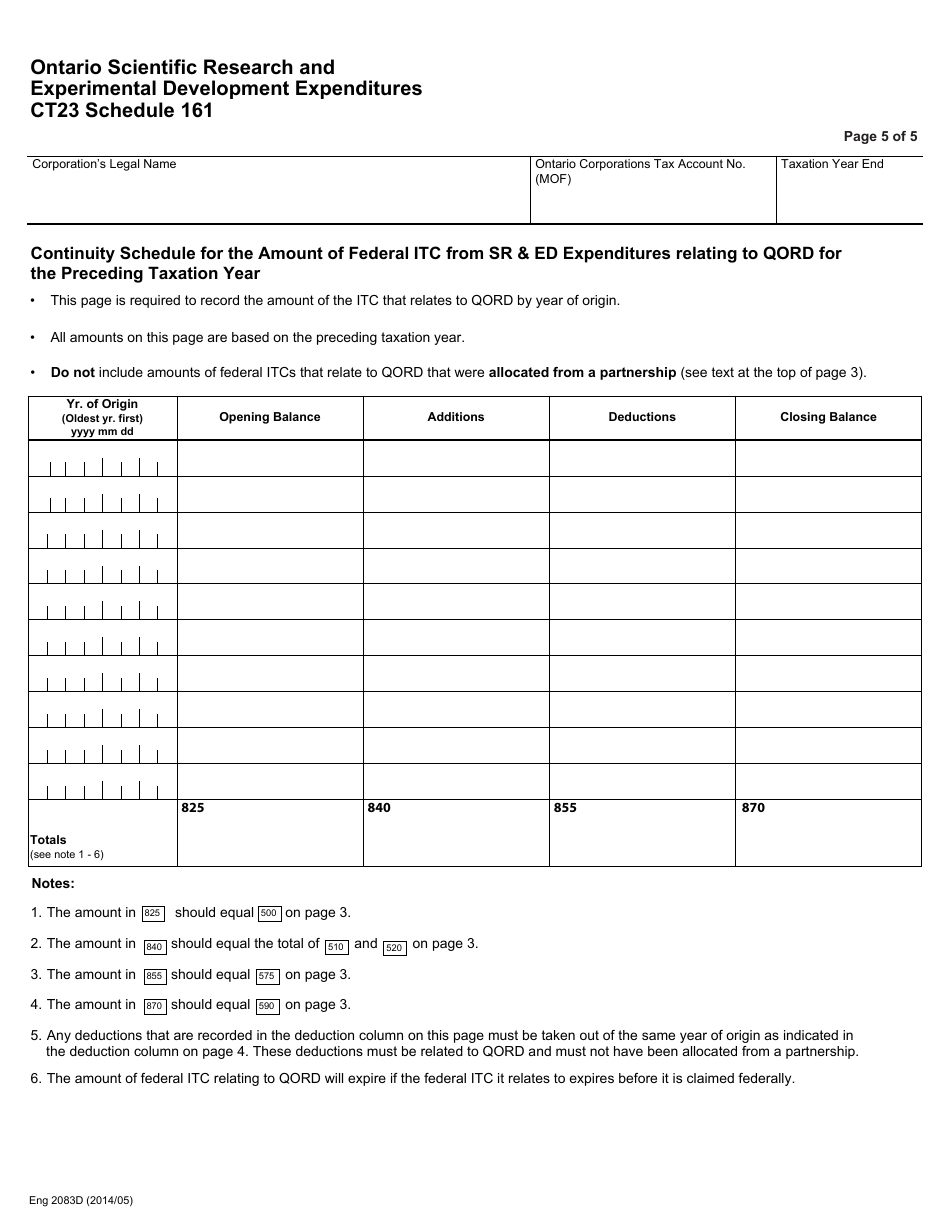

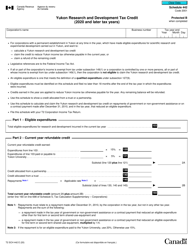

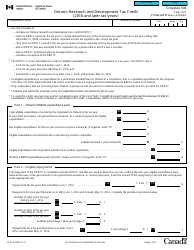

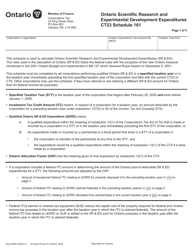

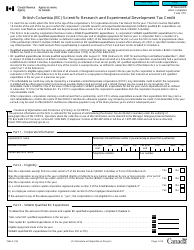

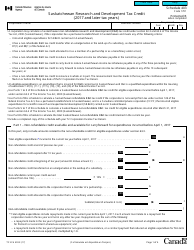

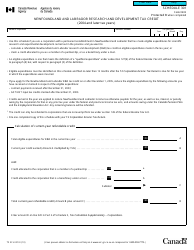

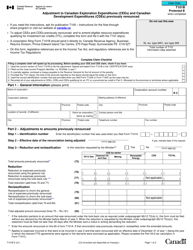

Form CT23 (2083D) Schedule 161 Ontario Scientific Research and Experimental Development Expenditures - Ontario, Canada

Form CT23 (2083D) Schedule 161 Ontario Scientific Research and Experimental Development Expenditures is used to report the expenses related to scientific research and development activities in the province of Ontario, Canada. It is part of the tax filing process for businesses operating in Ontario to claim tax credits for their eligible research and development expenditures.

The Form CT23 Schedule 161 Ontario Scientific Research and Experimental Development Expenditures is filed by corporations in Ontario, Canada who want to claim tax credits for their research and experimental development expenditures.

FAQ

Q: What is Form CT23 (2083D)?

A: Form CT23 (2083D) is a tax form in Ontario, Canada.

Q: What is Schedule 161?

A: Schedule 161 is a part of Form CT23 (2083D) in Ontario, Canada.

Q: What does Schedule 161 cover?

A: Schedule 161 covers Scientific Research and Experimental Development (SR&ED) expenditures in Ontario, Canada.