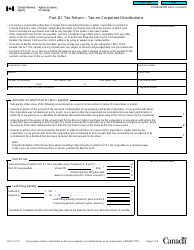

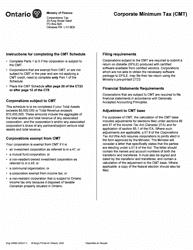

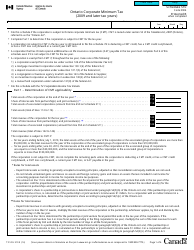

Form CT23 (2496) Schedule 101 Corporate Minimum Tax (Cmt) - Ontario, Canada

Form CT23 (2496) Schedule 101 Corporate Minimum Tax (CMT) in Ontario, Canada is used to calculate and report the corporate minimum tax liability for corporations operating in Ontario. It helps to ensure that corporations pay a minimum level of tax, regardless of their taxable income. The form is filed along with the corporation's income tax return.

The Form CT23 (2496) Schedule 101 Corporate Minimum Tax (CMT) in Ontario, Canada is filed by corporations that are subject to the corporate minimum tax.

FAQ

Q: What is Form CT23?

A: Form CT23 is a tax form used by corporations in Ontario, Canada.

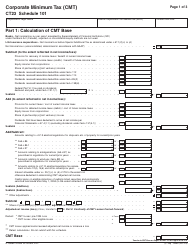

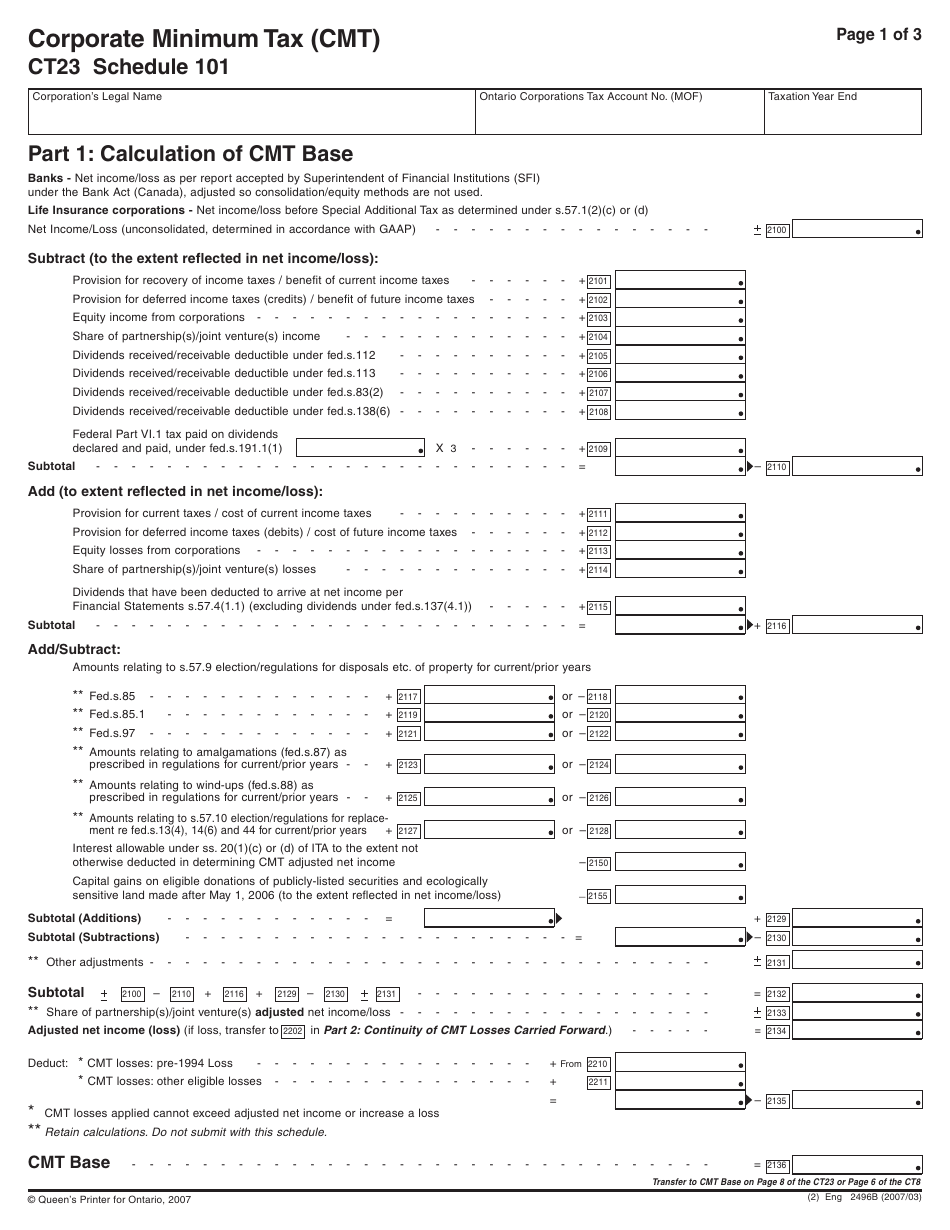

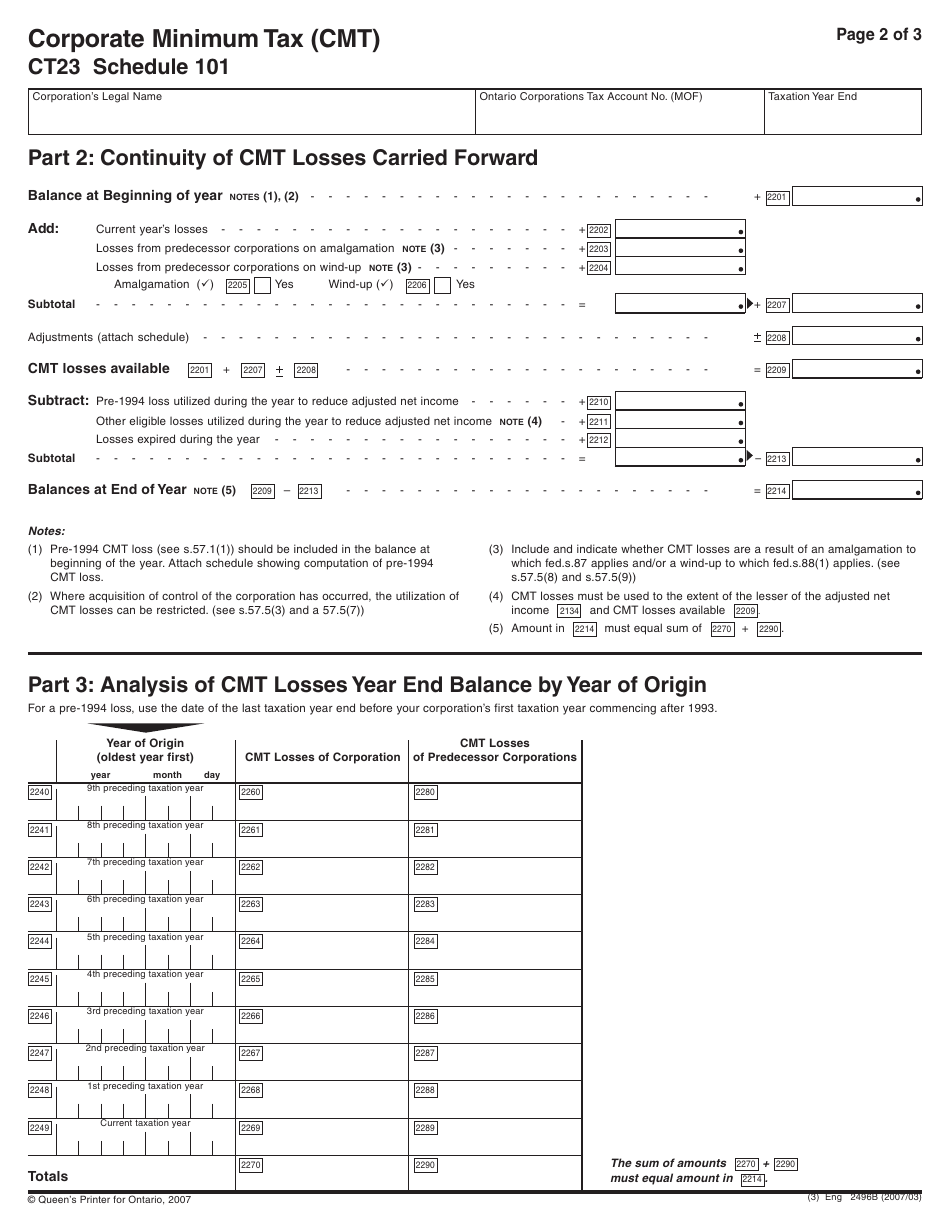

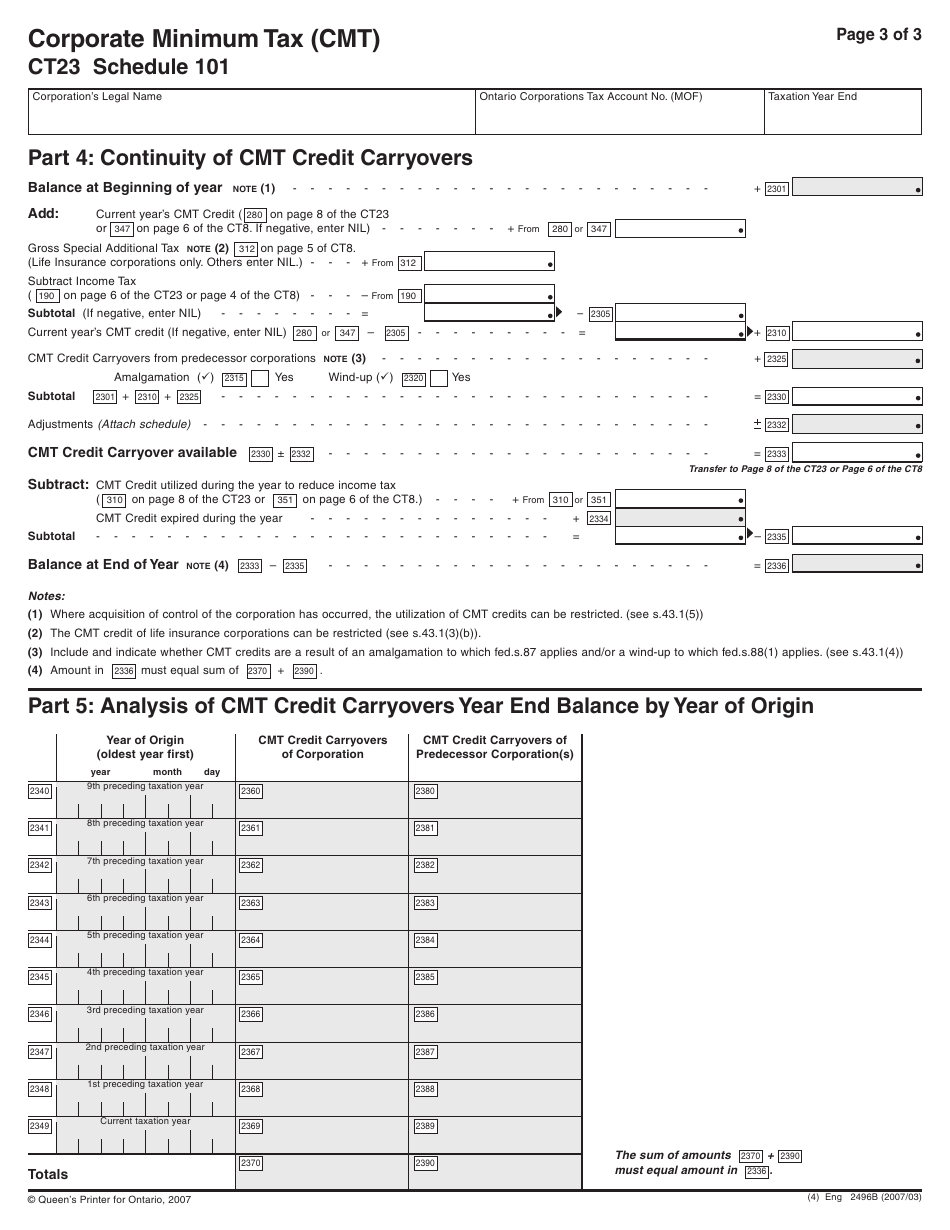

Q: What is Schedule 101?

A: Schedule 101 is a part of Form CT23 that calculates the Corporate Minimum Tax (CMT) in Ontario.

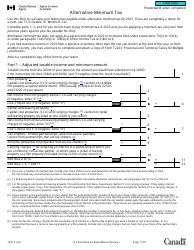

Q: What is Corporate Minimum Tax (CMT)?

A: Corporate Minimum Tax (CMT) is a tax imposed on corporations in Ontario, Canada.

Q: Who needs to file Form CT23 Schedule 101?

A: Corporations in Ontario, Canada are required to file Form CT23 Schedule 101 if they meet certain criteria.

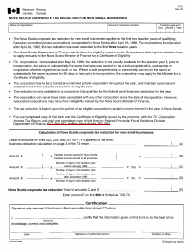

Q: How is Corporate Minimum Tax calculated?

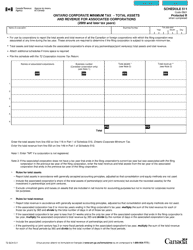

A: Corporate Minimum Tax is calculated using the formula provided in the Schedule 101.