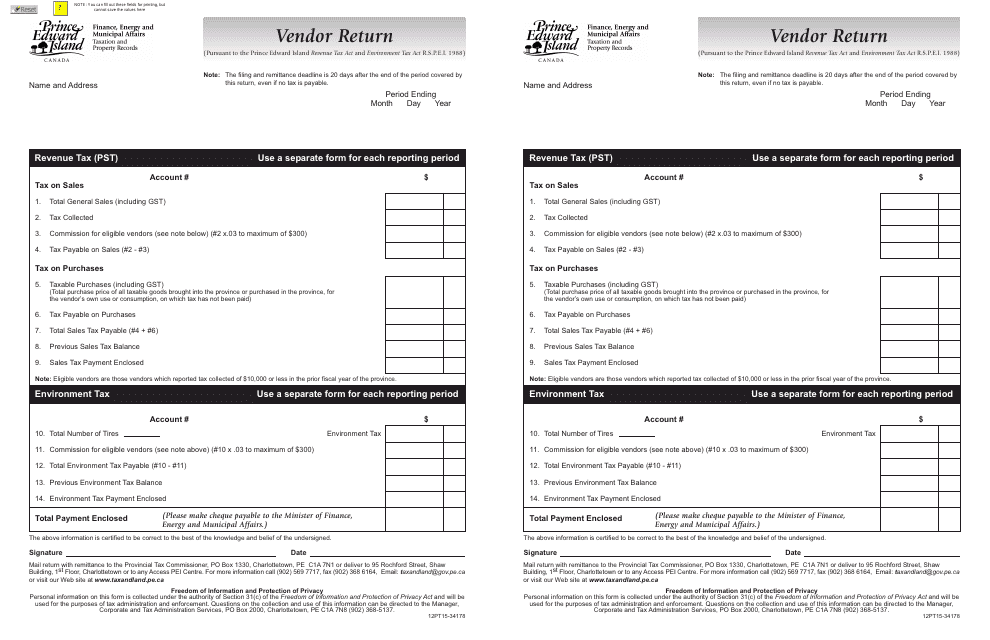

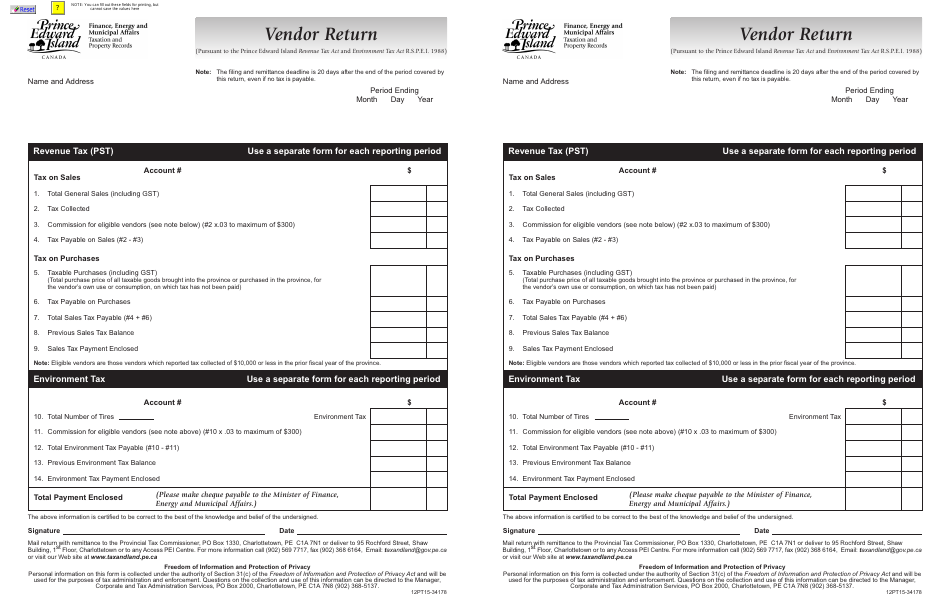

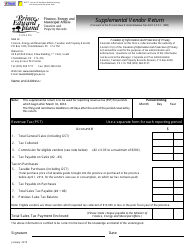

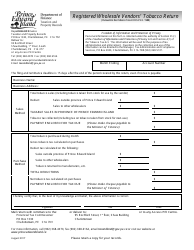

Form 12PT15-34178 Vendor Return - Prince Edward Island, Canada

Form 12PT15-34178 Vendor Return - Prince Edward Island, Canada is a document used for returning goods or products to a vendor in the province of Prince Edward Island, Canada.

FAQ

Q: What is Form 12PT15-34178?

A: Form 12PT15-34178 is a vendor return form in Prince Edward Island, Canada.

Q: Who should use Form 12PT15-34178?

A: This form should be used by vendors in Prince Edward Island, Canada to report their sales and remit the applicable taxes.

Q: What is a vendor return?

A: A vendor return is a form used by businesses to report their sales and remit the applicable taxes.

Q: What is Prince Edward Island?

A: Prince Edward Island is a province in Canada.

Q: What taxes are applicable in Prince Edward Island?

A: In Prince Edward Island, the HST (Harmonized Sales Tax) is applicable.

Q: How often should vendor returns be filed?

A: Vendor returns in Prince Edward Island should be filed monthly.

Q: Is Form 12PT15-34178 mandatory?

A: Yes, it is mandatory for vendors in Prince Edward Island to file Form 12PT15-34178.

Q: Are there any penalties for not filing a vendor return?

A: Yes, there may be penalties for not filing a vendor return in Prince Edward Island, including interest charges and potential legal consequences.