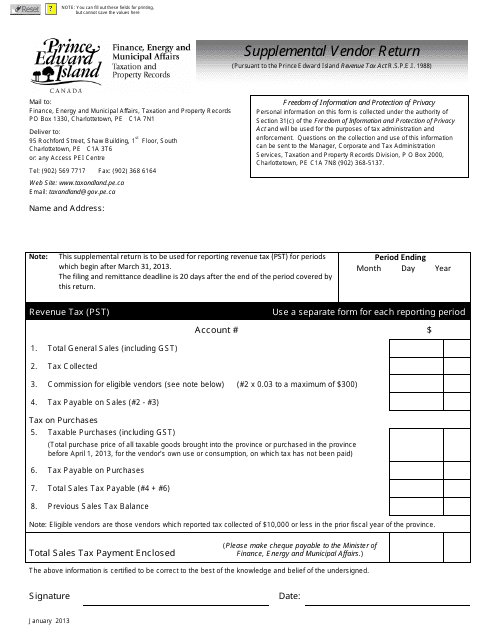

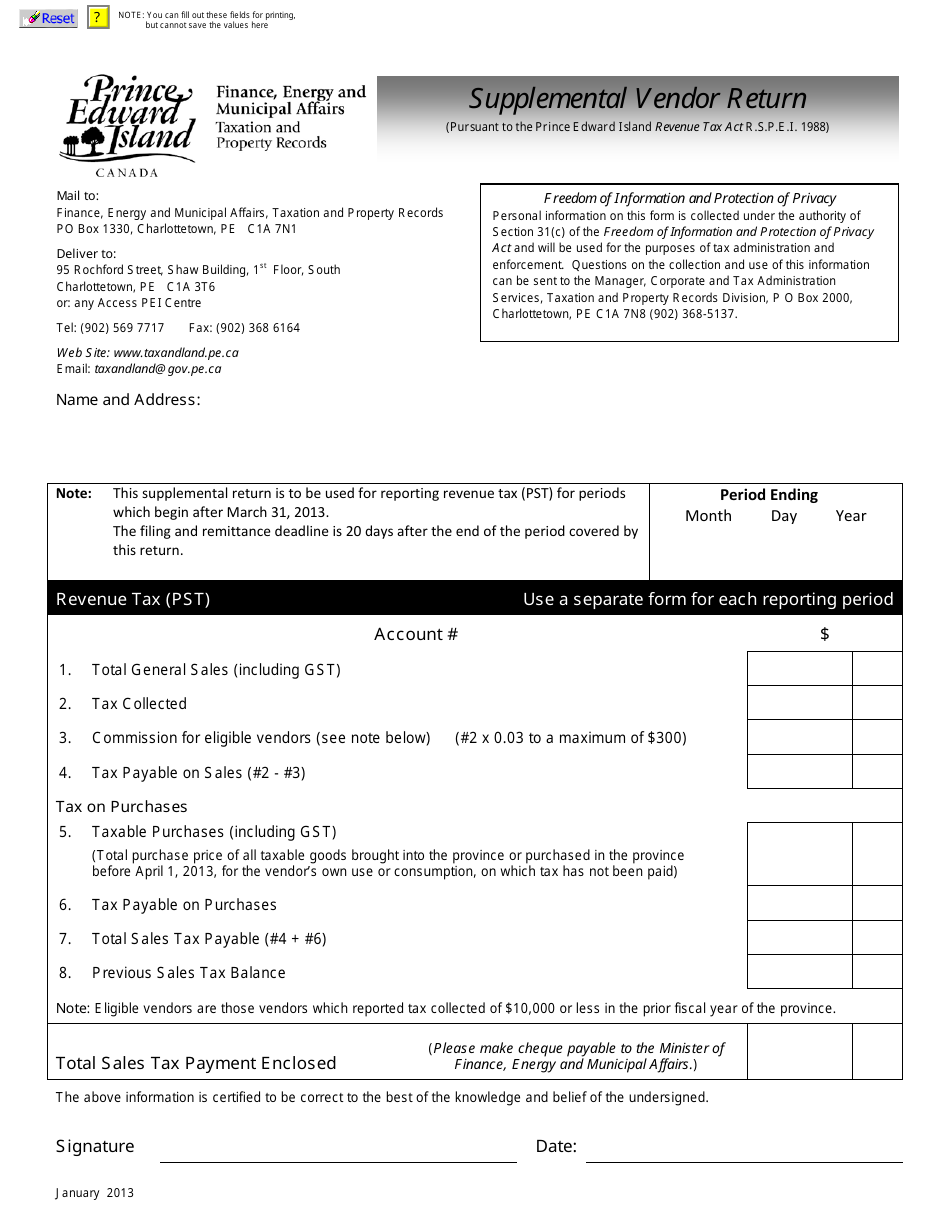

Supplemental Vendor Return - Prince Edward Island, Canada

The Supplemental Vendor Return in Prince Edward Island, Canada is a document used by vendors to report additional sales tax information to the tax authorities. It is filed to provide any additional information or corrections to the original sales tax return that was filed.

FAQ

Q: What is a Supplemental Vendor Return?

A: A Supplemental Vendor Return is a form that vendors in Prince Edward Island, Canada are required to fill out and submit to report their sales tax.

Q: Who needs to file a Supplemental Vendor Return in Prince Edward Island, Canada?

A: Vendors in Prince Edward Island, Canada who have made sales and are registered for sales tax are required to file a Supplemental Vendor Return.

Q: What is the purpose of filing a Supplemental Vendor Return in Prince Edward Island, Canada?

A: The purpose of filing a Supplemental Vendor Return is to report the sales tax collected from customers and remit the tax to the government.

Q: When is the deadline to file a Supplemental Vendor Return in Prince Edward Island, Canada?

A: The deadline to file a Supplemental Vendor Return in Prince Edward Island, Canada is usually on or before the 20th day of the month following the reporting period.

Q: Are there any penalties for not filing a Supplemental Vendor Return in Prince Edward Island, Canada?

A: Yes, there are penalties for not filing a Supplemental Vendor Return in Prince Edward Island, Canada. These penalties can include late filing penalties, interest charges, and other consequences as determined by the tax authorities.