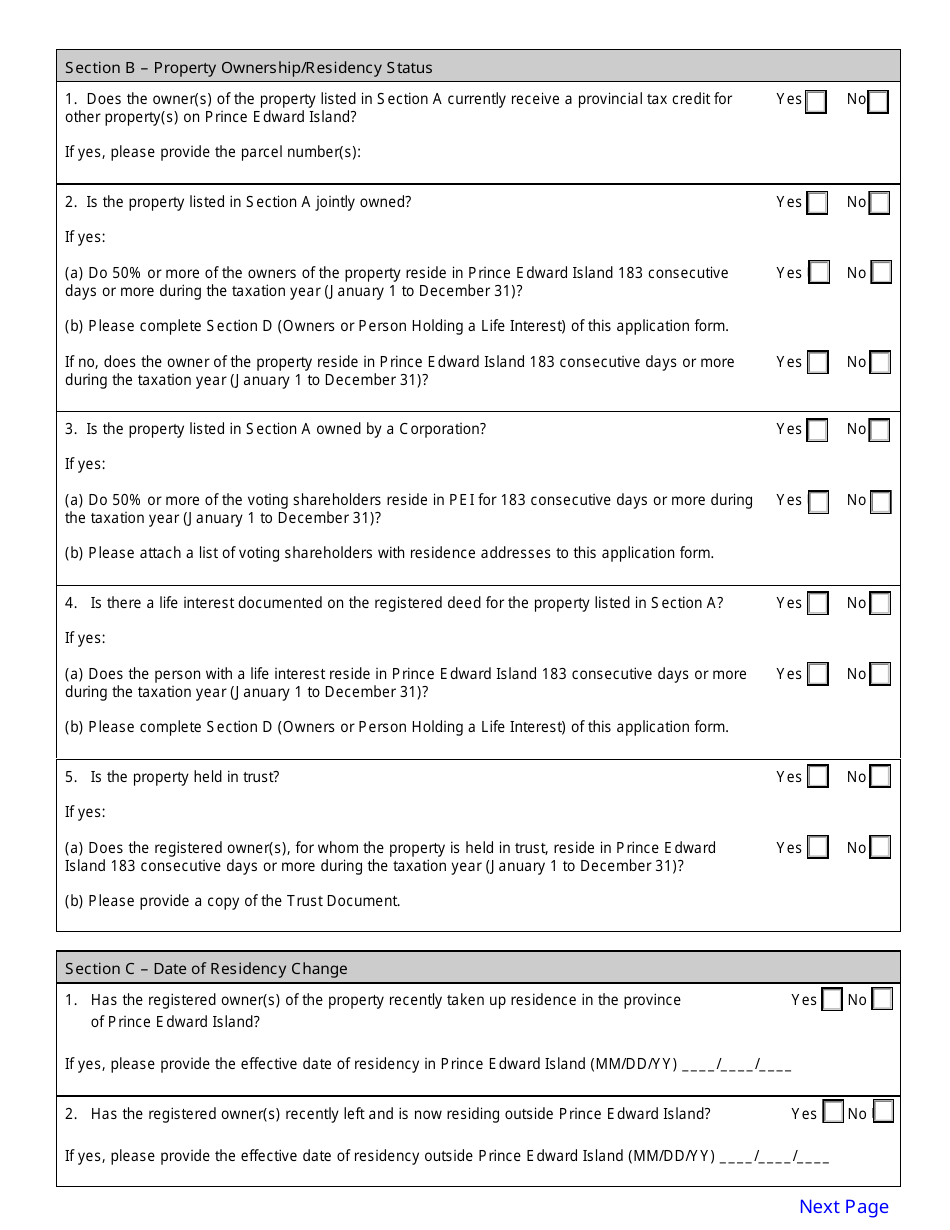

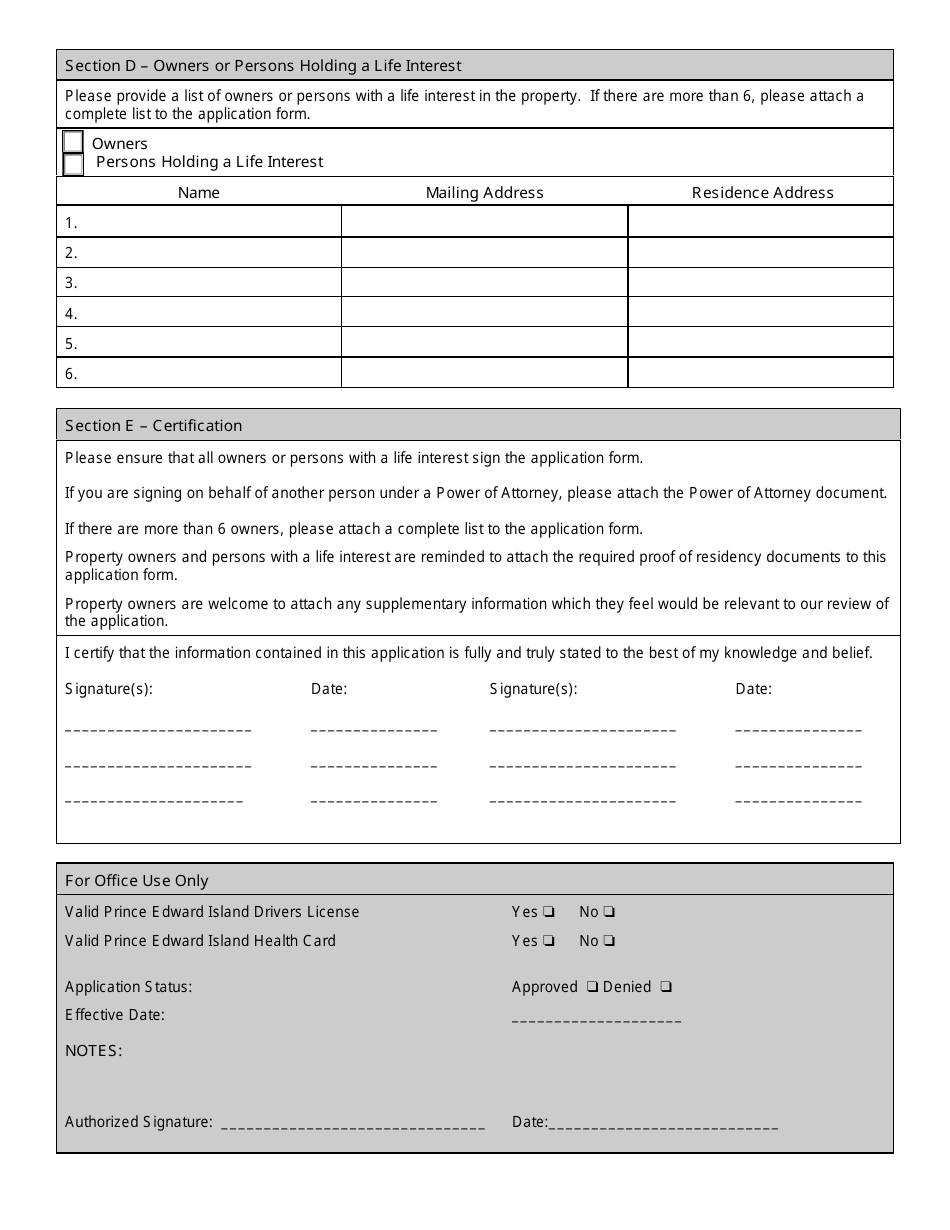

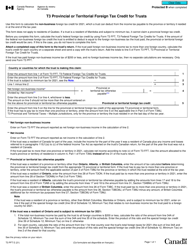

Provincial Tax Credit Application - Prince Edward Island, Canada

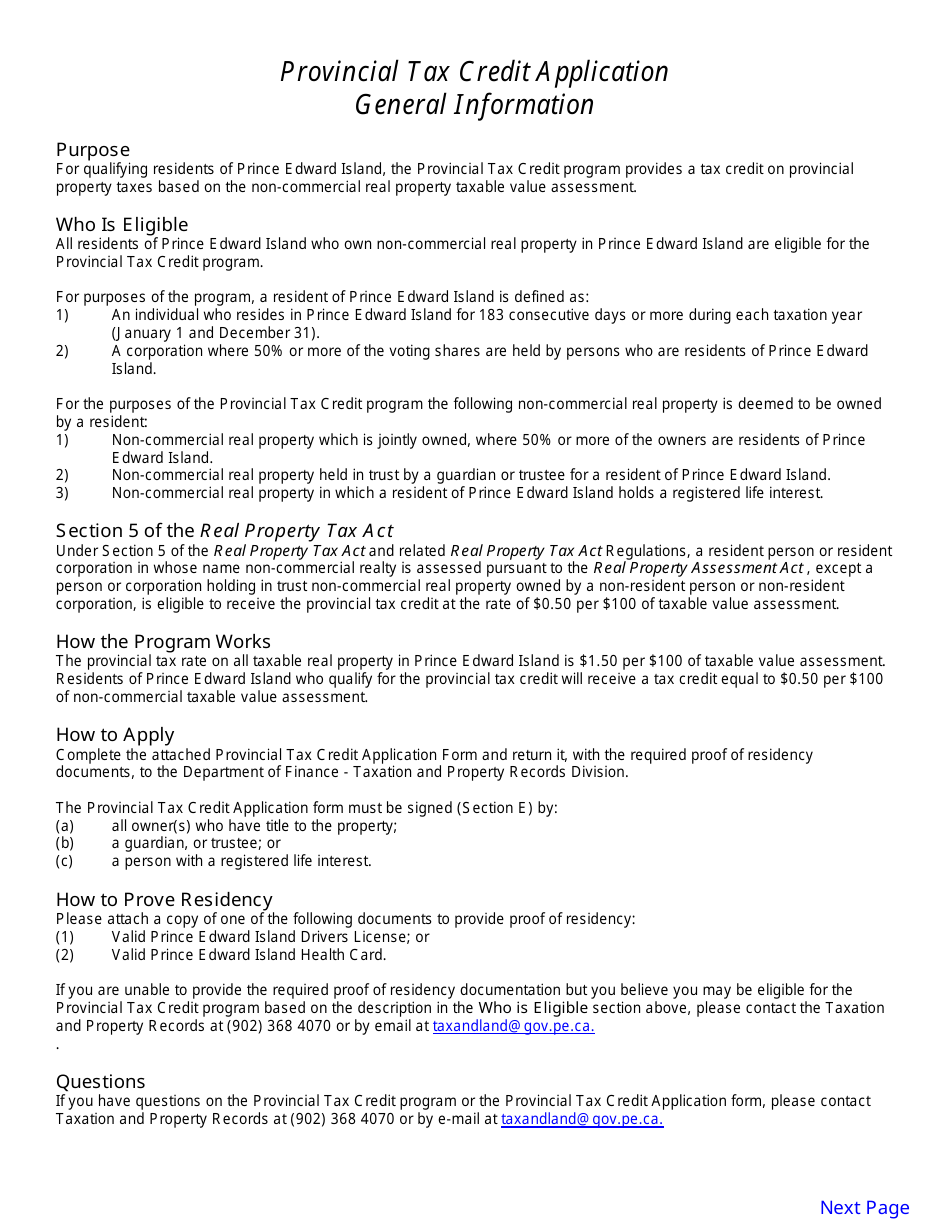

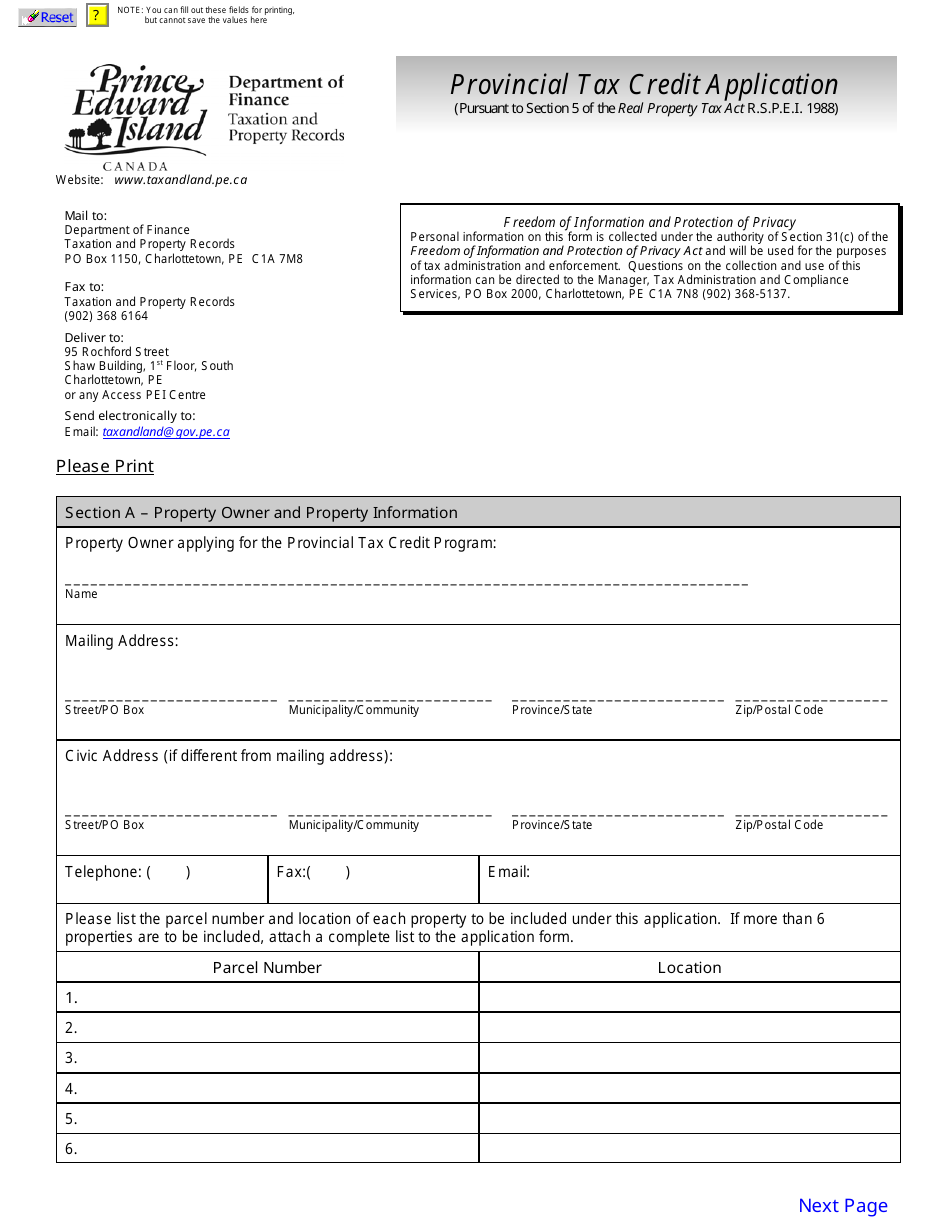

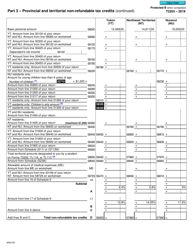

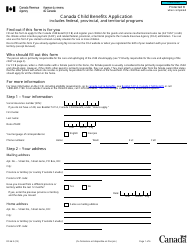

The Provincial Tax Credit Application in Prince Edward Island, Canada, is used to apply for tax credits and benefits offered by the provincial government to eligible residents. These credits can help reduce the amount of provincial taxes you owe.

In Prince Edward Island, Canada, individuals file their own provincial tax credit application.

FAQ

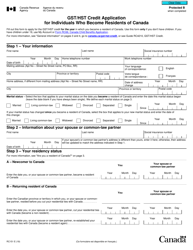

Q: Who is eligible to apply for the Provincial Tax Credit in Prince Edward Island?

A: Residents of Prince Edward Island who meet certain income requirements are eligible to apply for the Provincial Tax Credit.

Q: What is the Provincial Tax Credit in Prince Edward Island?

A: The Provincial Tax Credit is a tax relief program designed to assist low-income individuals and families in Prince Edward Island.

Q: What are the income requirements for the Provincial Tax Credit in Prince Edward Island?

A: The income requirements for the Provincial Tax Credit vary depending on the individual or family size. It is best to refer to the official guidelines or contact the relevant government department for specific details.

Q: How can I apply for the Provincial Tax Credit in Prince Edward Island?

A: To apply for the Provincial Tax Credit in Prince Edward Island, you need to complete the application form provided by the government and submit it to the relevant department. You may also need to provide supporting documents such as income statements or proof of residency.

Q: Are there any deadlines for applying for the Provincial Tax Credit in Prince Edward Island?

A: It is important to apply for the Provincial Tax Credit within the specified deadline. The exact deadline may vary each year, so it is recommended to check with the government department or review the official guidelines for up-to-date information.

Q: What benefits can I receive from the Provincial Tax Credit in Prince Edward Island?

A: The Provincial Tax Credit provides financial assistance to eligible individuals and families by reducing their provincial tax burden. The specific benefits may vary depending on the individual's income and family size.

Q: Can I apply for the Provincial Tax Credit if I am not a resident of Prince Edward Island?

A: No, the Provincial Tax Credit in Prince Edward Island is only available to residents of the province. Non-residents are not eligible to apply.

Q: What should I do if my application for the Provincial Tax Credit is denied?

A: If your application for the Provincial Tax Credit is denied, you may have the option to appeal the decision or seek assistance from a professional tax advisor. It is recommended to contact the relevant government department for guidance.

Q: How often do I need to reapply for the Provincial Tax Credit in Prince Edward Island?

A: In most cases, you need to reapply for the Provincial Tax Credit on an annual basis. This ensures that your eligibility and income information are up to date. You should check the official guidelines or contact the government department for specific details regarding reapplication.