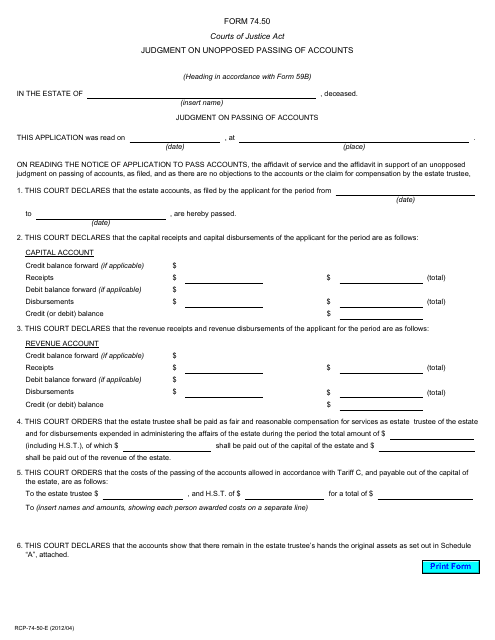

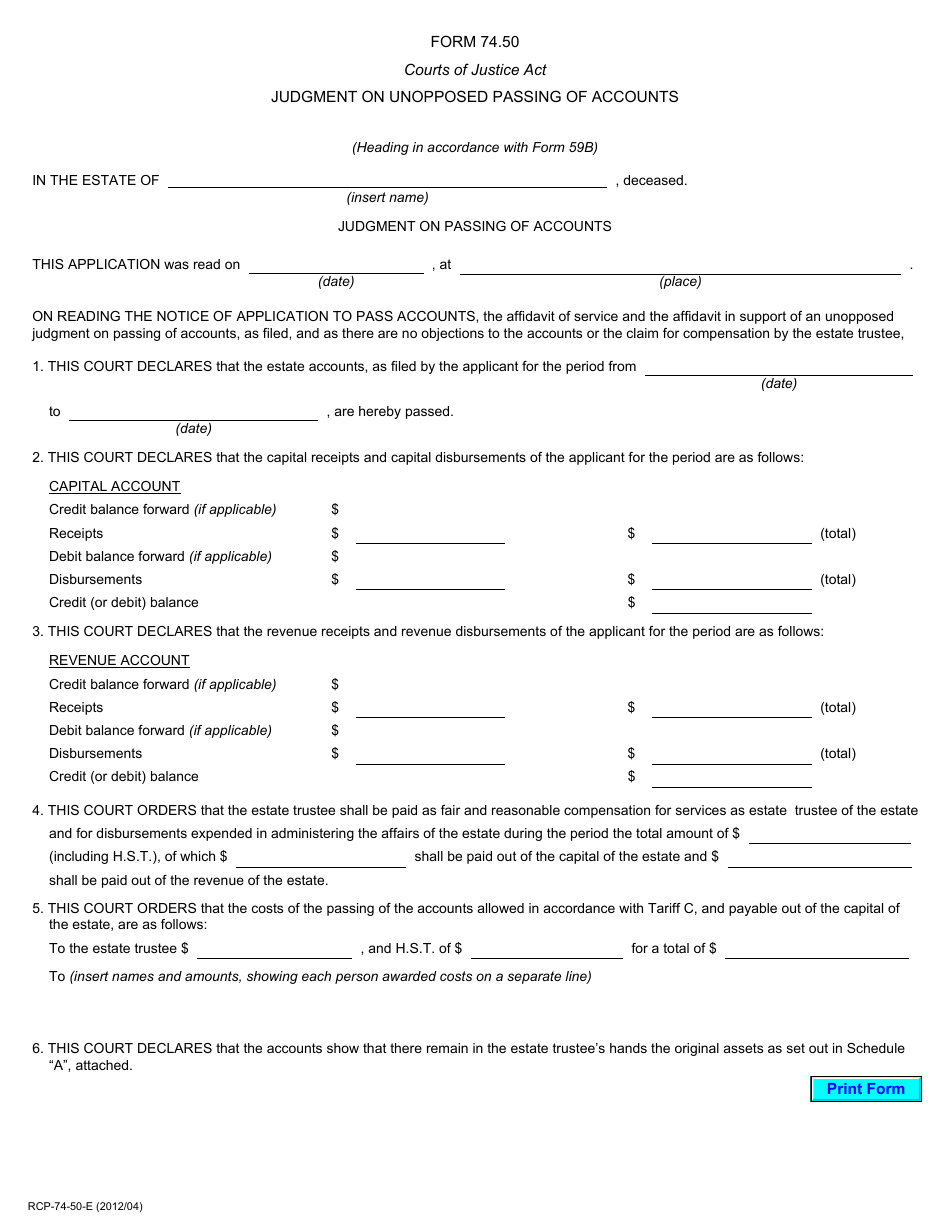

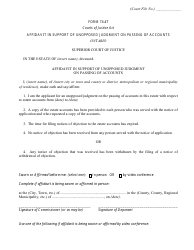

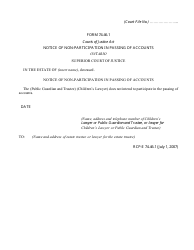

Form 74.50 Judgment on Unopposed Passing of Accounts - Ontario, Canada

Form 74.50 Judgment on Unopposed Passing of Accounts is used in Ontario, Canada for the purpose of allowing an individual or entity to submit their finalized accounts to the court for approval without any opposition from other parties involved in the matter. This form is typically utilized in situations where there are no objections or disputes regarding the accounts being presented. Once the form is completed and submitted, it seeks the court's endorsement, confirming that the accounts have been properly examined, reviewed, and approved.

In Ontario, Canada, the form 74.50 Judgment on Unopposed Passing of Accounts is typically filed by the estate trustee or executor of the deceased individual's estate. This form is used when there are no objections or oppositions to the accounts that have been prepared and filed with the court. The estate trustee is responsible for managing and administering the estate according to the deceased person's wishes and the applicable laws.

FAQ

Q: What is Form 74.50?

A: Form 74.50 is a legal document used in Ontario, Canada for the judgment on unopposed passing of accounts.

Q: What is the purpose of Form 74.50?

A: The purpose of Form 74.50 is to obtain a judgment from the court for the unopposed passing of accounts.

Q: What is an unopposed passing of accounts?

A: An unopposed passing of accounts is a process where the accounts of an estate, trust, or guardianship are reviewed by the court without any objections or disputes from interested parties.

Q: Who can use Form 74.50?

A: Form 74.50 can be used by executors, administrators, trustees, or guardians who are seeking approval for their accounts from the court.

Q: What information is required in Form 74.50?

A: Form 74.50 requires information about the applicant, the estate or trust, and the accounts being passed. It may also require supporting documents such as bank statements or receipts.

Q: Do I need to file Form 74.50 with the court?

A: Yes, Form 74.50 needs to be filed with the court along with the required supporting documents.

Q: Is a hearing required for an unopposed passing of accounts?

A: In some cases, a hearing may not be required if the court is satisfied with the accounts and supporting documents provided. However, it is up to the discretion of the court.

Q: What happens after Form 74.50 is filed?

A: After Form 74.50 is filed, the court will review the accounts and supporting documents. If everything is in order, the court may issue a judgment approving the accounts.

Q: Can the judgment on unopposed passing of accounts be appealed?

A: Yes, the judgment on unopposed passing of accounts can be appealed if there are valid grounds for appeal. It is recommended to seek legal advice in such cases.