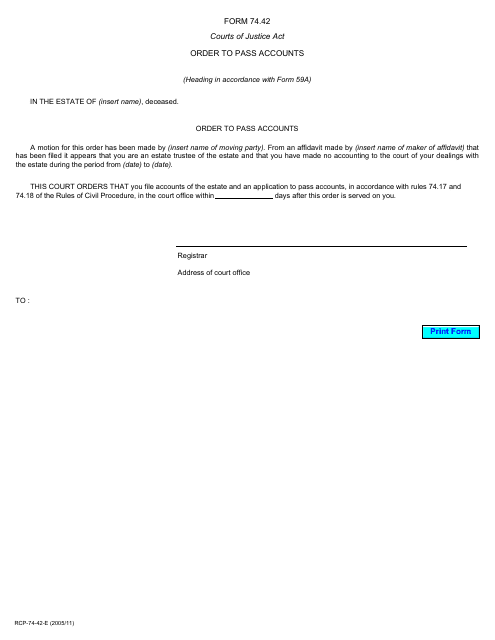

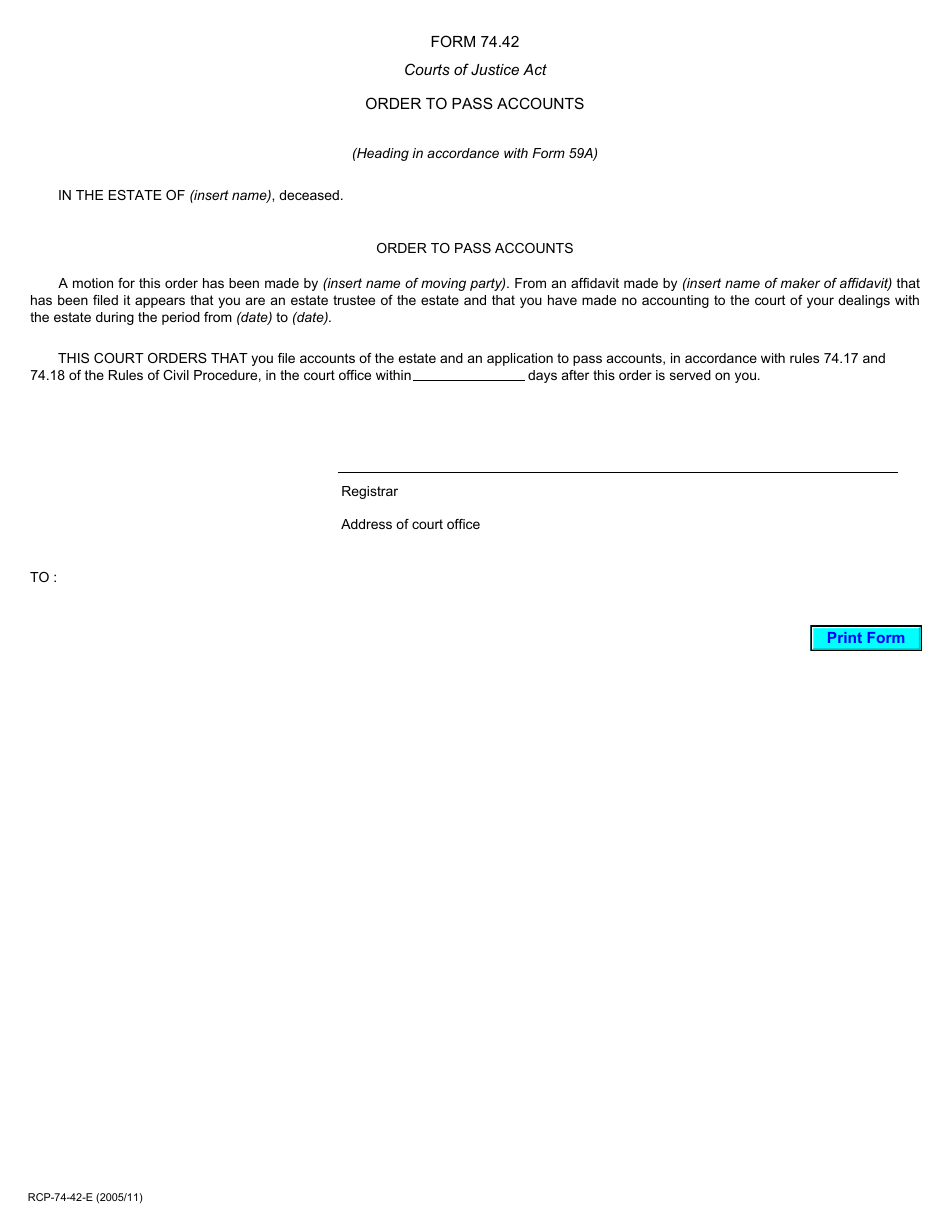

Form 74.42 Order to Pass Accounts - Ontario, Canada

Form 74.42 Order to Pass Accounts in Ontario, Canada is used in the legal process to request a detailed review and approval of an executor or trustee's accounting of the estate or trust. It ensures transparency and accountability in managing the assets.

The form 74.42 Order to Pass Accounts in Ontario, Canada is filed by an estate trustee or executor.

FAQ

Q: What is Form 74.42?

A: Form 74.42 is an Order to Pass Accounts.

Q: What is an Order to Pass Accounts?

A: An Order to Pass Accounts is a legal document in Ontario, Canada that requires the executor or trustee of an estate to submit their accounts for review and approval by the court.

Q: Who needs to file Form 74.42?

A: Executors or trustees of an estate in Ontario, Canada need to file Form 74.42 if they are required to pass their accounts.

Q: What is the purpose of filing Form 74.42?

A: The purpose of filing Form 74.42 is to provide transparency and accountability in the administration of an estate by allowing the court to review the executor or trustee's accounts.

Q: What information is required in Form 74.42?

A: Form 74.42 requires the executor or trustee to provide a detailed account of all financial transactions related to the estate, including income, expenses, and distributions.

Q: What happens after filing Form 74.42?

A: After filing Form 74.42, the court will review the accounts and may request additional information or hold a hearing to approve or disapprove the accounts.

Q: Is filing Form 74.42 mandatory?

A: Yes, filing Form 74.42 is mandatory if the executor or trustee is required to pass their accounts in Ontario, Canada.

Q: Are there any deadlines for filing Form 74.42?

A: Yes, there are specific deadlines for filing Form 74.42, which can vary depending on the circumstances and court orders.