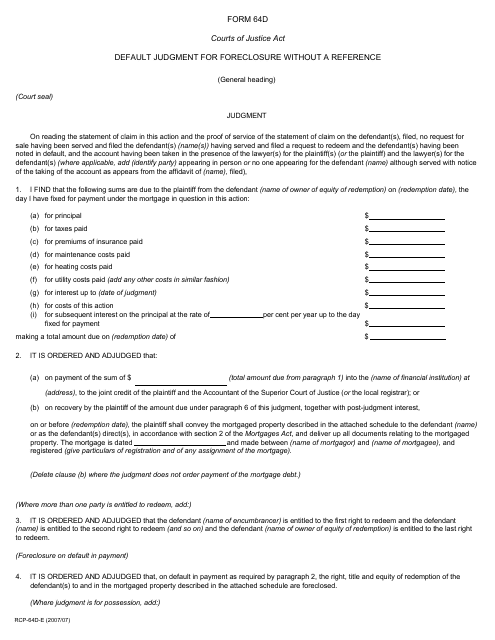

Form 64D Default Judgment for Foreclosure Without a Reference - Ontario, Canada

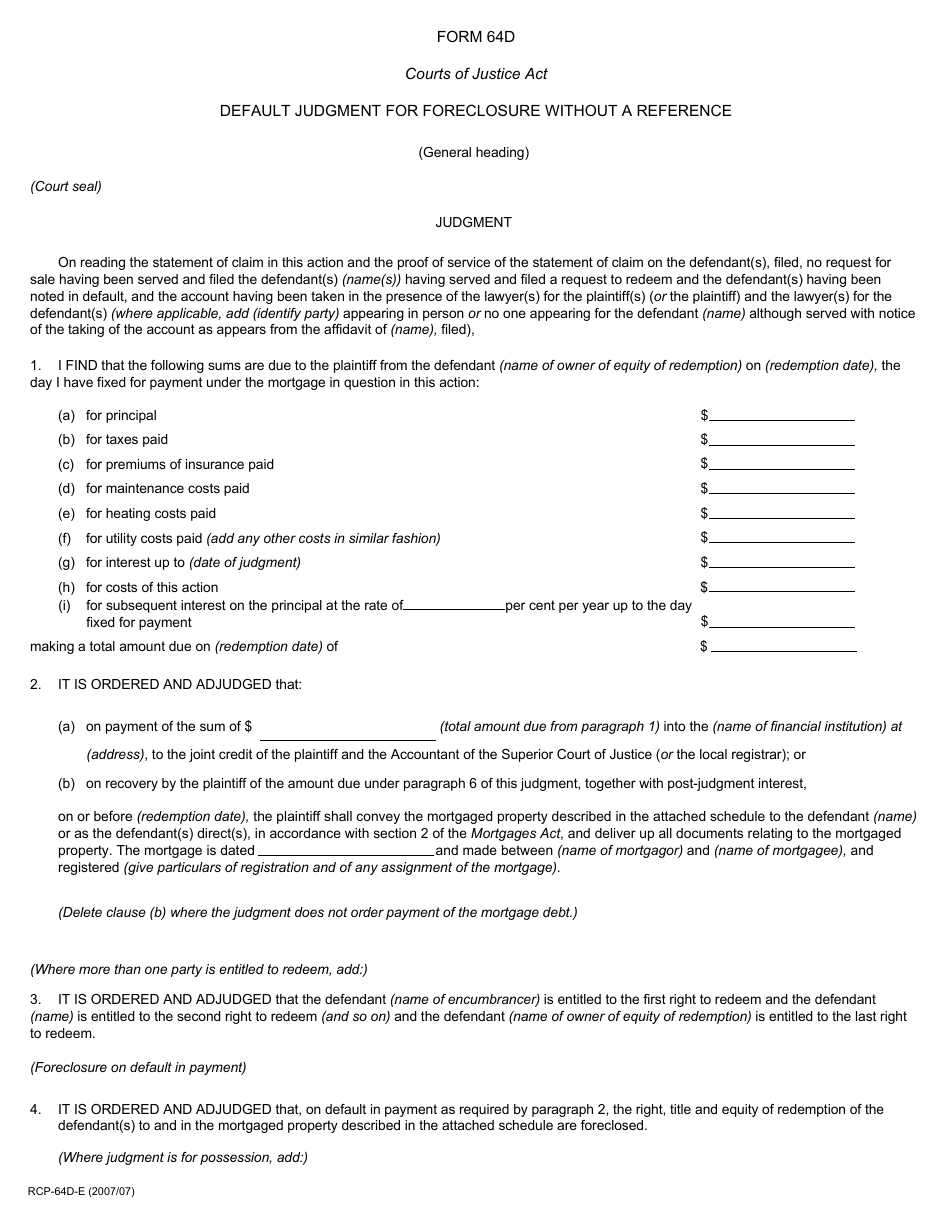

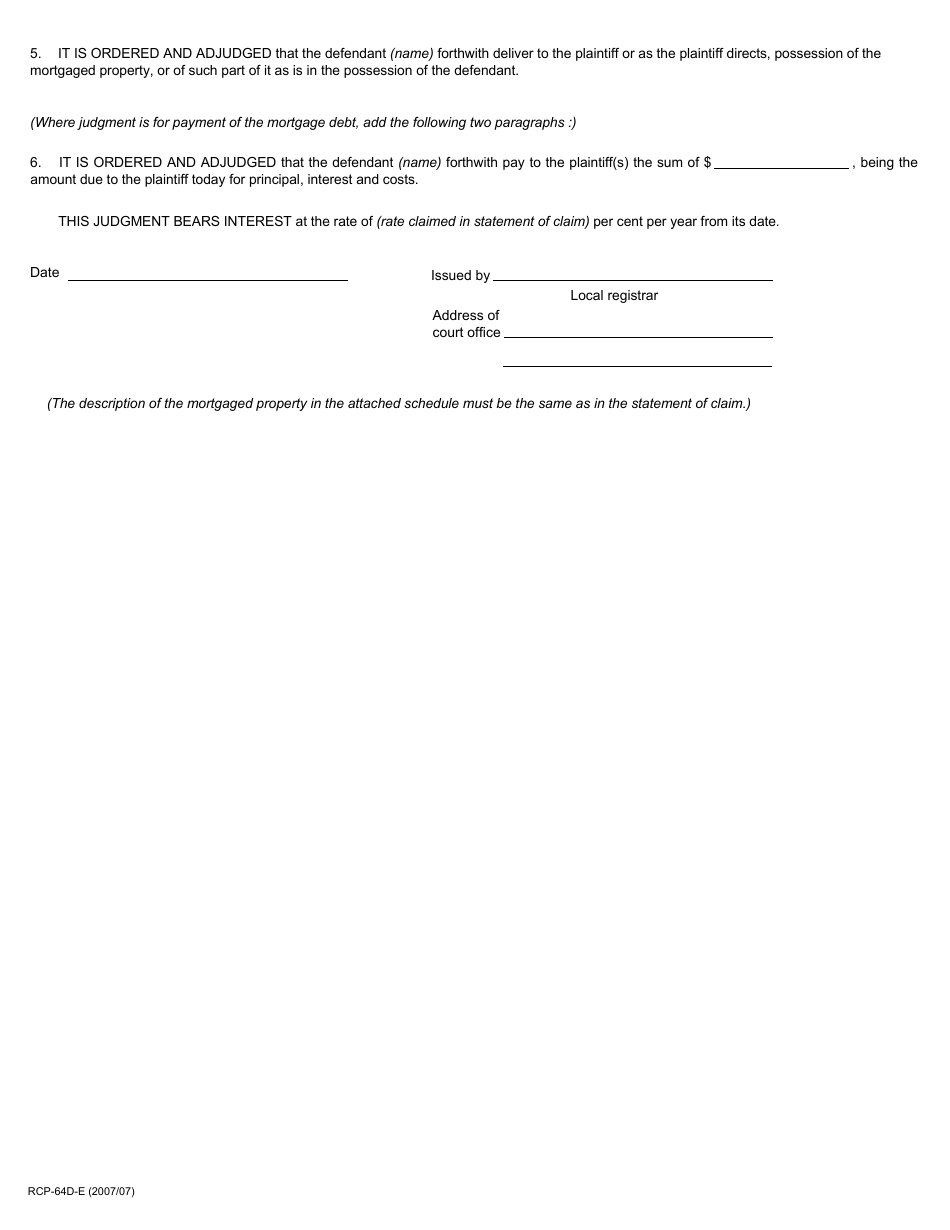

Form 64D Default Judgment for Foreclosure Without a Reference in Ontario, Canada is used in foreclosure proceedings when a homeowner has failed to respond to a foreclosure notice. It allows the court to enter a judgment in favor of the lender, enabling them to proceed with the foreclosure without the need for a hearing or reference to a master or judge.

In Ontario, Canada, the form 64D Default Judgment for Foreclosure Without a Reference is typically filed by the plaintiff, who is the party initiating the foreclosure.

FAQ

Q: What is Form 64D?

A: Form 64D is a legal document used in Ontario, Canada for obtaining a default judgment in a foreclosure case without a reference to a master or judge.

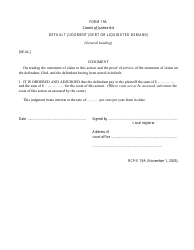

Q: What is a default judgment?

A: A default judgment is a judgment issued by the court in favor of one party when the other party fails to appear or respond within the required time.

Q: What is foreclosure?

A: Foreclosure is a legal process by which a lender seeks to recover the amount owed on a mortgage loan when the borrower fails to make the required payments.

Q: What is a foreclosure without a reference?

A: A foreclosure without a reference means that the court does not appoint a master or judge to oversee the case and instead relies on the documentation provided to issue a judgment.

Q: Why would someone use Form 64D?

A: Form 64D is used when a mortgage lender wants to obtain a default judgment in a foreclosure case without the need for a reference to a master or judge.

Q: What are the requirements for using Form 64D?

A: The requirements for using Form 64D include properly serving the defaulting party, providing all necessary documentation, and following the procedures outlined in the Ontario Rules of Civil Procedure.

Q: Can I use Form 64D in a different province in Canada?

A: No, Form 64D is specific to Ontario and may not be applicable in other provinces. It is important to consult the rules and forms specific to the province where the foreclosure is taking place.

Q: Do I need legal representation to use Form 64D?

A: While it is possible to complete and submit Form 64D without legal representation, it is advisable to seek the assistance of a legal professional familiar with foreclosure proceedings to ensure the process is followed correctly.

Q: What happens after Form 64D is filed?

A: After Form 64D is filed, the court will review the documentation and may issue a default judgment in favor of the mortgage lender. The defaulting party will then have limited time to take action to challenge the judgment.