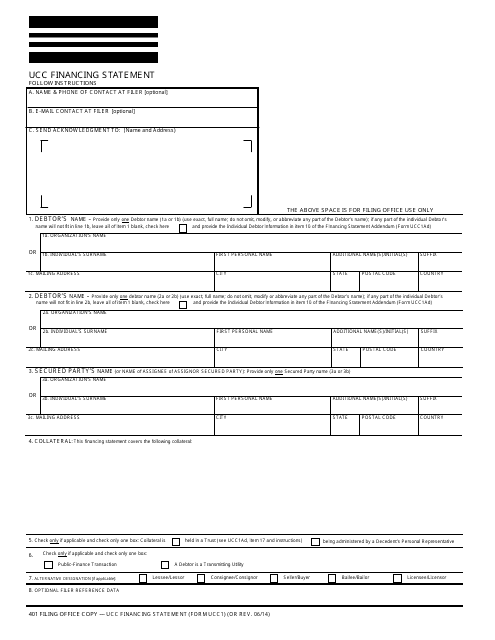

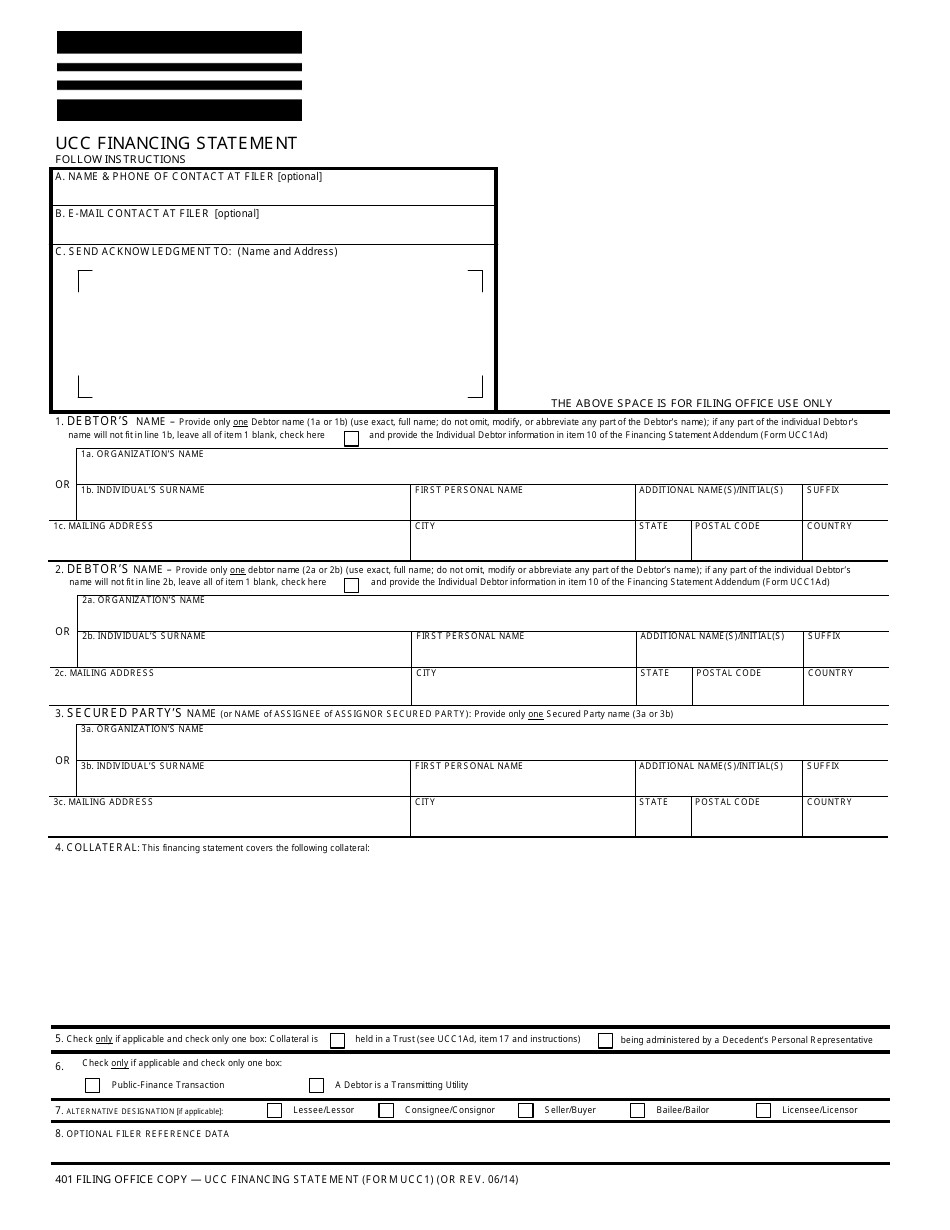

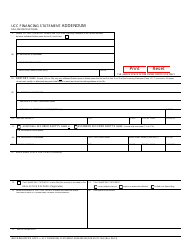

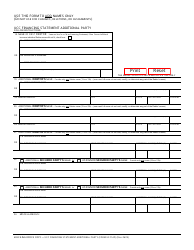

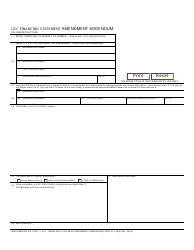

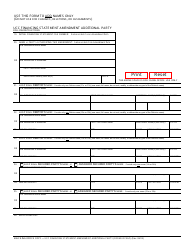

Form UCC1 Ucc Financing Statement - Oregon

What Is Form UCC1?

This is a legal form that was released by the Oregon Secretary of State - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a UCC1 Financing Statement?

A: A UCC1 Financing Statement is a legal document that serves as notice of a security interest in collateral.

Q: What does UCC stand for?

A: UCC stands for Uniform Commercial Code, which is a set of laws governing commercial transactions in the United States.

Q: Why would someone file a UCC1 Financing Statement?

A: A UCC1 Financing Statement is filed to establish a security interest in collateral and protect the creditor's rights in case of default.

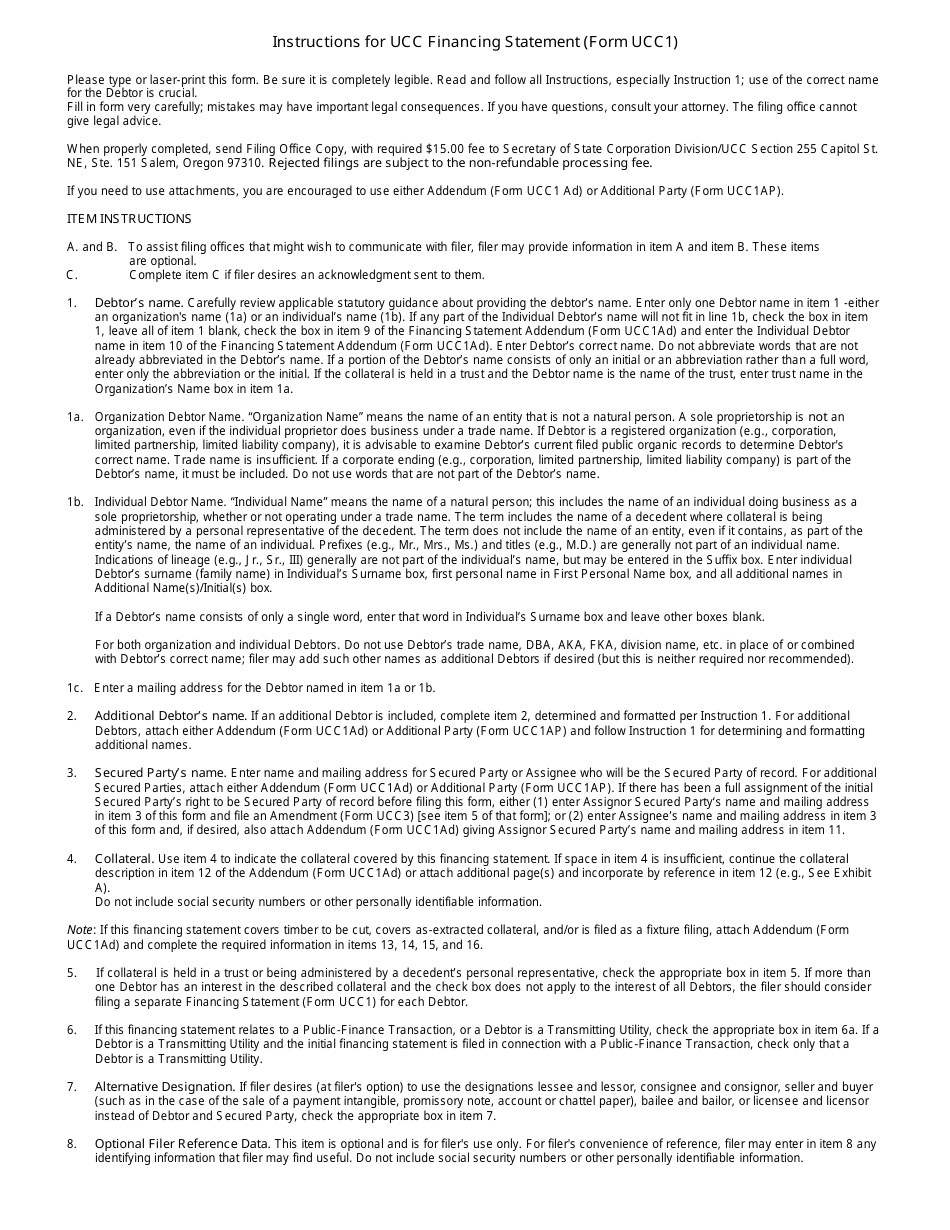

Q: What information is required in a UCC1 Financing Statement?

A: The UCC1 Financing Statement typically requires information about the debtor, secured party, collateral, and any relevant financial terms.

Q: Is there a fee for filing a UCC1 Financing Statement in Oregon?

A: Yes, there is a fee for filing a UCC1 Financing Statement in Oregon. The fee may vary depending on the type of filing and the number of pages.

Q: How long does a UCC1 Financing Statement remain valid in Oregon?

A: A UCC1 Financing Statement in Oregon typically remains valid for five years from the date of filing, but it can be extended for additional periods.

Q: What happens if a UCC1 Financing Statement is not renewed in Oregon?

A: If a UCC1 Financing Statement is not renewed before its expiration, it will no longer be effective to protect the creditor's rights in the collateral.

Q: Can a UCC1 Financing Statement be terminated in Oregon?

A: Yes, a UCC1 Financing Statement can be terminated in Oregon by filing a UCC3 Termination Statement.

Form Details:

- Released on June 1, 2014;

- The latest edition provided by the Oregon Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form UCC1 by clicking the link below or browse more documents and templates provided by the Oregon Secretary of State.