This version of the form is not currently in use and is provided for reference only. Download this version of

the document

for the current year.

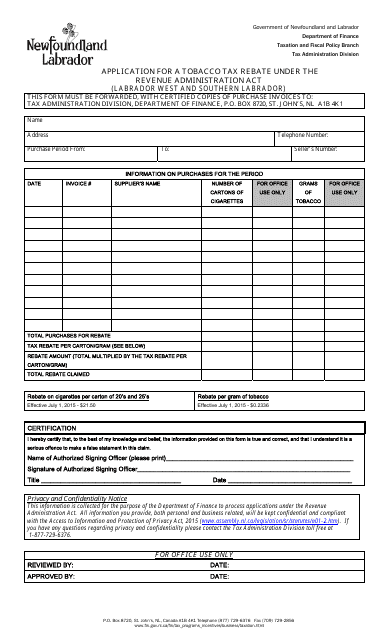

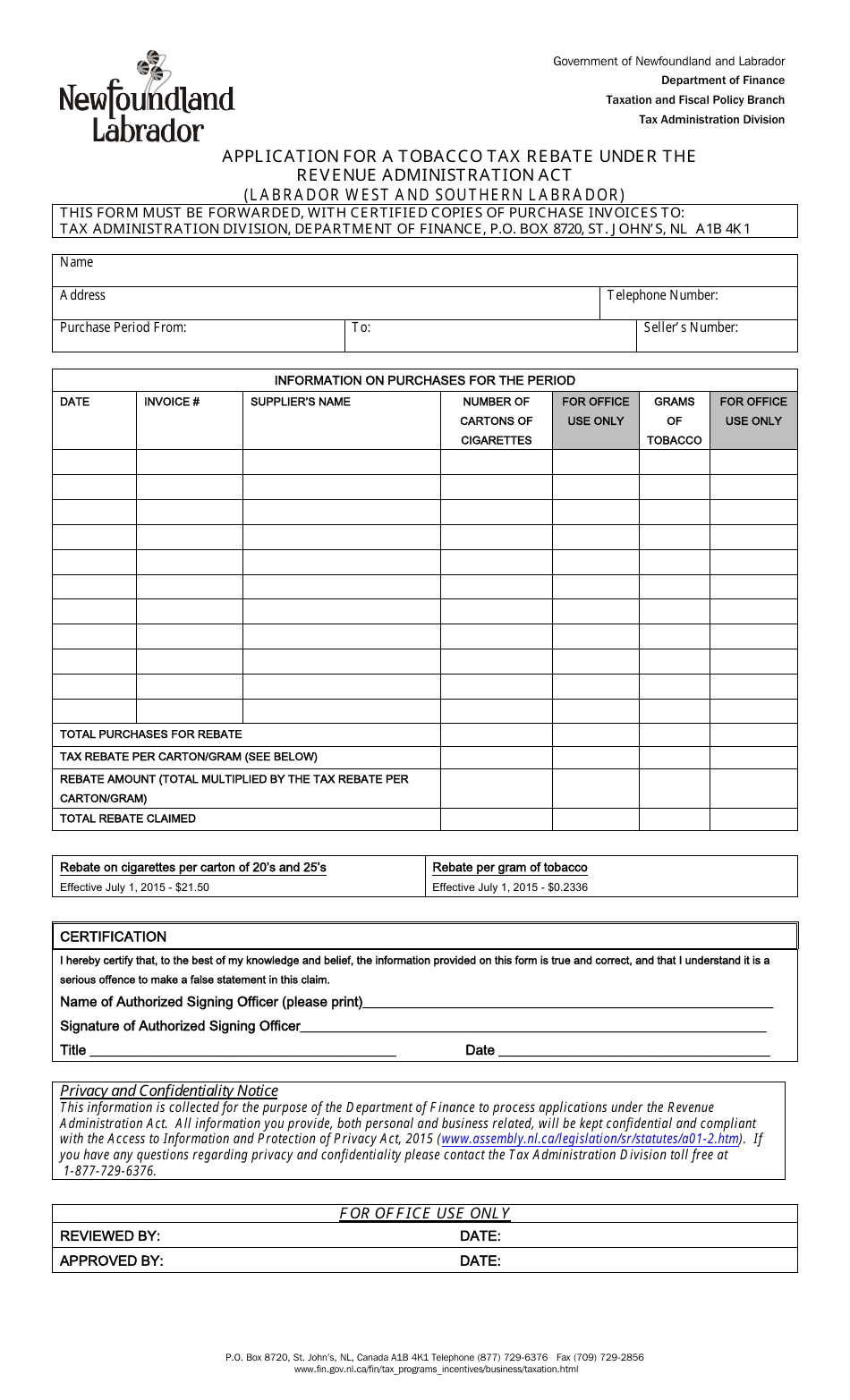

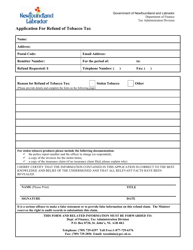

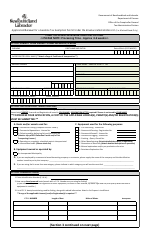

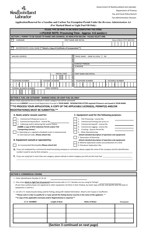

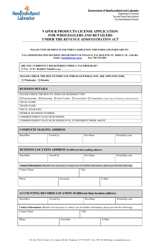

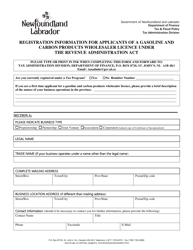

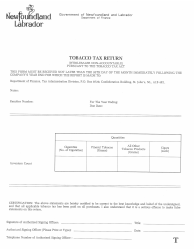

Application for a Tobacco Tax Rebate Under the Revenue Administration Act - Newfoundland and Labrador, Canada

This Newfoundland and Labrador-specific " Application For A Tobacco Tax Rebate Under The Revenue Administration Act " is a document released by the Newfoundland and Labrador Department of Finance .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is the Revenue Administration Act?

A: The Revenue Administration Act is a law in Newfoundland and Labrador, Canada.

Q: Who is eligible to apply for a tobacco tax rebate?

A: Individuals or businesses in Newfoundland and Labrador, Canada can apply for a tobacco tax rebate.

Q: What is a tobacco tax rebate?

A: A tobacco tax rebate is a refund of the tax paid on tobacco products.

Q: How can I apply for a tobacco tax rebate?

A: To apply for a tobacco tax rebate, you can fill out an application form provided by the Newfoundland and Labrador government.

Q: What documents do I need to submit along with my application?

A: You may need to submit documents such as purchase receipts or invoices to verify the amount of tax paid on tobacco products.

Q: Is there a deadline for applying for a tobacco tax rebate?

A: Yes, there is usually a deadline for applying for a tobacco tax rebate. Check with the Newfoundland and Labrador government for the specific deadline.

Q: How long does it take to process a tobacco tax rebate application?

A: Processing times may vary, but it typically takes several weeks to process a tobacco tax rebate application.

Q: Is there a fee to apply for a tobacco tax rebate?

A: There is usually no fee to apply for a tobacco tax rebate. However, additional fees may apply if you hire a third-party service to assist with the application process.

Q: Can I apply for a tobacco tax rebate if I purchased tobacco products outside of Newfoundland and Labrador?

A: No, you can only apply for a tobacco tax rebate if you purchased the tobacco products in Newfoundland and Labrador.

Q: What happens if my tobacco tax rebate application is approved?

A: If your tobacco tax rebate application is approved, you will receive a refund of the tax paid on tobacco products.

Q: What happens if my tobacco tax rebate application is denied?

A: If your tobacco tax rebate application is denied, you will not receive a refund of the tax paid on tobacco products.

Q: Can I appeal if my tobacco tax rebate application is denied?

A: Yes, you may have the option to appeal if your tobacco tax rebate application is denied. Consult with the Newfoundland and Labrador government for the appeals process.