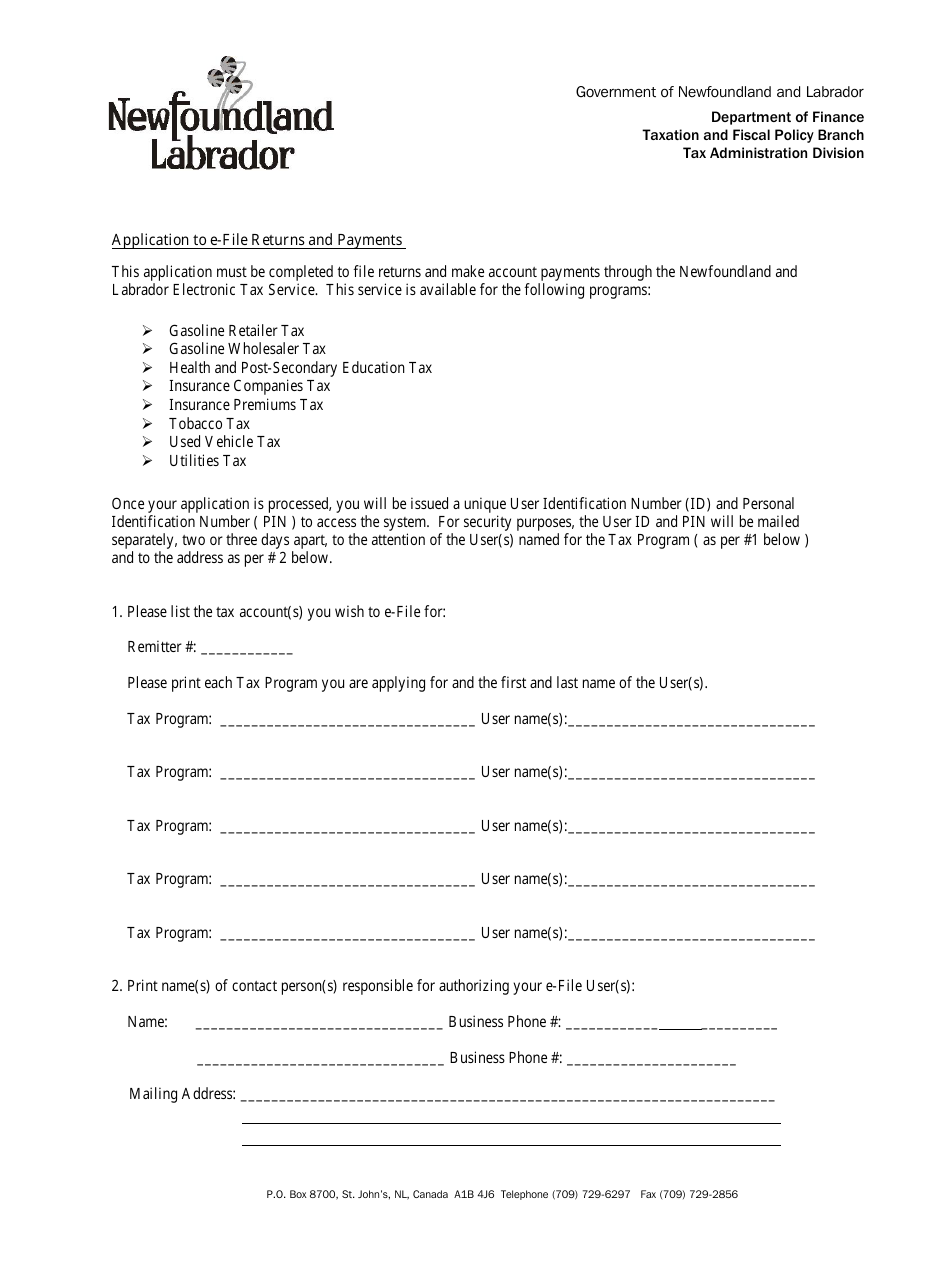

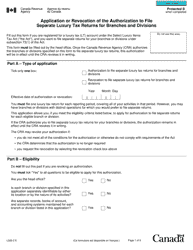

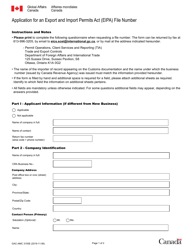

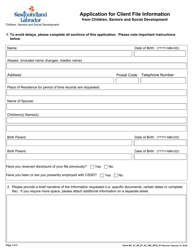

Application to E-File Returns and Payments - Newfoundland and Labrador, Canada

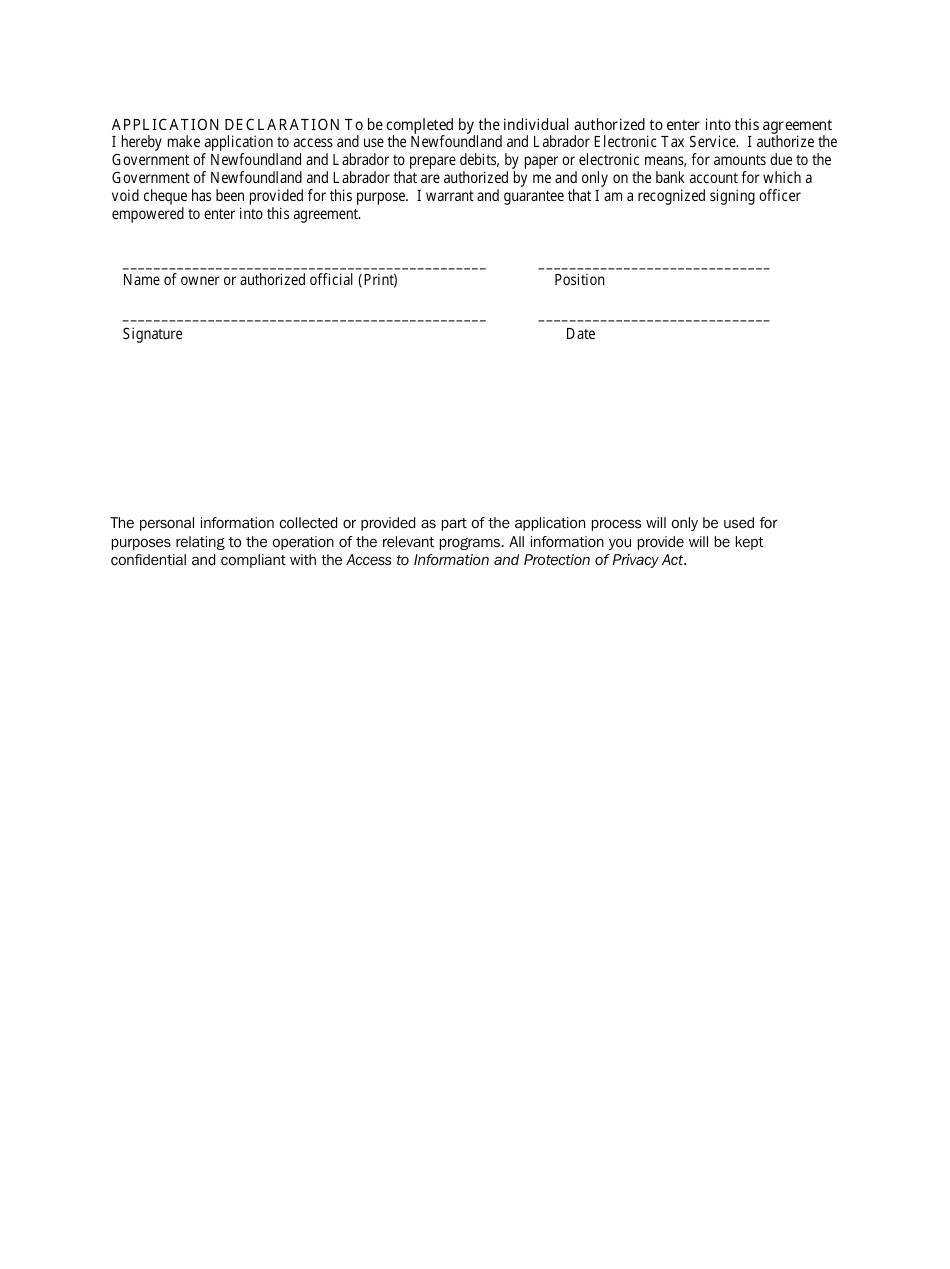

This Newfoundland and Labrador-specific " Application To E-file Returns And Payments " is a document released by the Newfoundland and Labrador Department of Finance .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is the application process for e-filing returns and payments?

A: To e-file returns and payments in Newfoundland and Labrador, you need to fill out an application form and submit it to the Department of Finance.

Q: Can individuals and businesses both e-file their returns and payments?

A: Yes, both individuals and businesses can e-file their returns and payments in Newfoundland and Labrador.

Q: Is e-filing returns and payments mandatory in Newfoundland and Labrador?

A: E-filing returns and payments is mandatory for businesses in Newfoundland and Labrador, but it is optional for individuals.

Q: What are the benefits of e-filing returns and payments?

A: E-filing returns and payments saves time, reduces errors, and allows for faster processing and refunds.

Q: Are there any penalties for not e-filing returns and payments in Newfoundland and Labrador?

A: Yes, businesses that do not e-file their returns and payments may be subject to penalties and interest charges.

Q: Can I e-file my returns and payments for previous years?

A: Yes, you can e-file your returns and payments for previous years in Newfoundland and Labrador.

Q: Are there any fees for e-filing returns and payments?

A: No, there are no fees for e-filing returns and payments in Newfoundland and Labrador.

Q: What types of returns and payments can be e-filed?

A: Various types of returns, including income tax, sales tax, and payroll tax, can be e-filed in Newfoundland and Labrador.