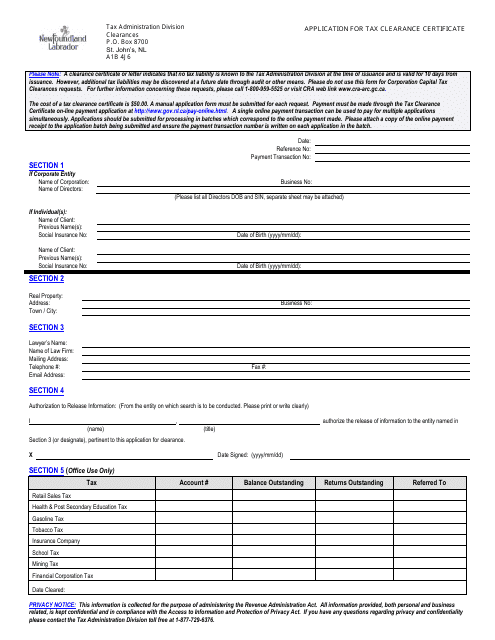

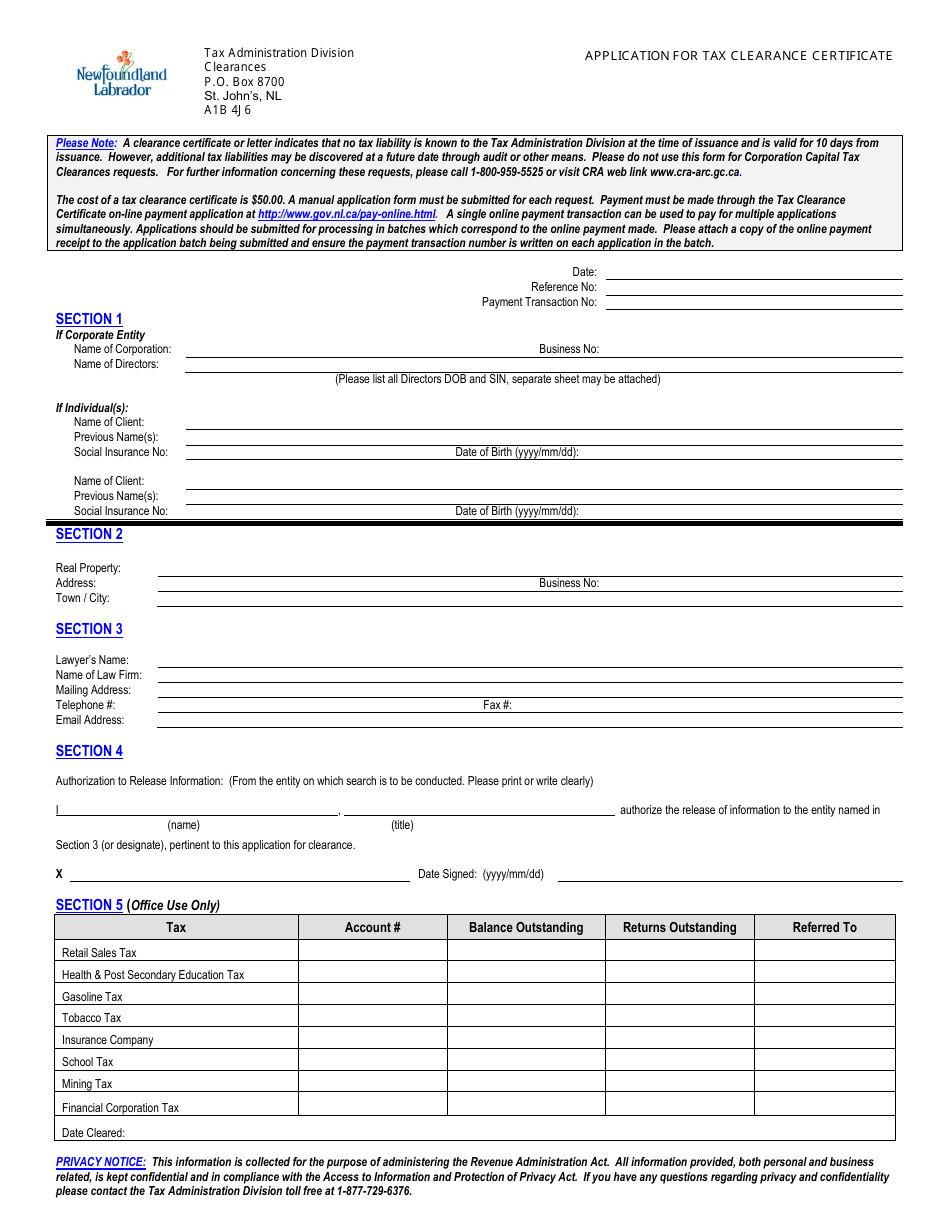

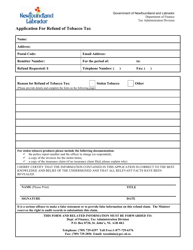

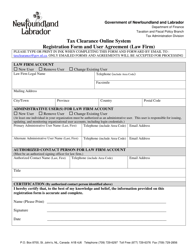

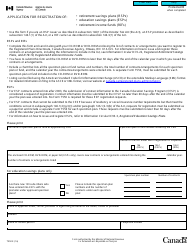

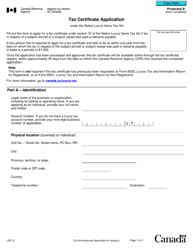

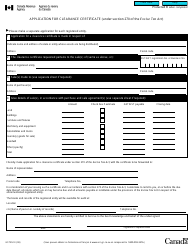

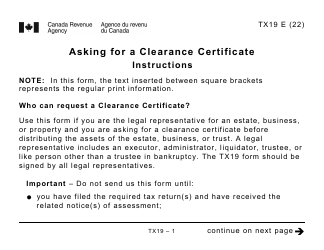

Application for Tax Clearance Certificate - Newfoundland and Labrador, Canada

This fillable " Application For Tax Clearance Certificate " is a document issued by the Newfoundland and Labrador Department of Finance specifically for Newfoundland and Labrador residents.

Download the PDF by clicking the link below and complete it directly in your browser or through the Adobe Desktop application.

FAQ

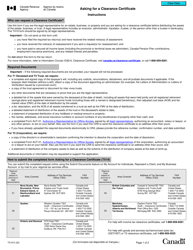

Q: What is a Tax Clearance Certificate in Newfoundland and Labrador, Canada?

A: A Tax Clearance Certificate is a document issued by the government of Newfoundland and Labrador, Canada, certifying that an individual or business has paid all their taxes and is in good standing with the tax authorities.

Q: Why would I need a Tax Clearance Certificate?

A: You may need a Tax Clearance Certificate for various reasons, such as applying for a government contract, selling a business, or during the process of bankruptcy or dissolution.

Q: How can I apply for a Tax Clearance Certificate in Newfoundland and Labrador?

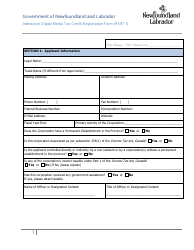

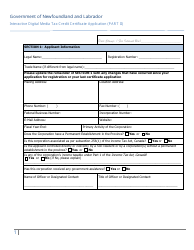

A: To apply for a Tax Clearance Certificate in Newfoundland and Labrador, you need to complete and submit the appropriate application form, along with any required supporting documentation, to the applicable tax authority.

Q: What information do I need to provide when applying for a Tax Clearance Certificate?

A: When applying for a Tax Clearance Certificate, you will typically need to provide information such as your name or the business name, contact information, tax account numbers, and details about the taxes you have paid.

Q: Is there a fee for obtaining a Tax Clearance Certificate?

A: Yes, there is usually a fee associated with obtaining a Tax Clearance Certificate. The specific fee amount may vary depending on the circumstances and the tax authority in Newfoundland and Labrador.

Q: How long does it take to process a Tax Clearance Certificate application?

A: The processing time for a Tax Clearance Certificate application in Newfoundland and Labrador can vary, but it is typically a few weeks. It is advisable to submit your application well in advance of any deadlines or transactions requiring the certificate.

Q: What happens if I owe taxes or have outstanding tax issues?

A: If you owe taxes or have outstanding tax issues, you may not be eligible to obtain a Tax Clearance Certificate until the issues are resolved. It is important to address any tax obligations or discrepancies before applying for the certificate.