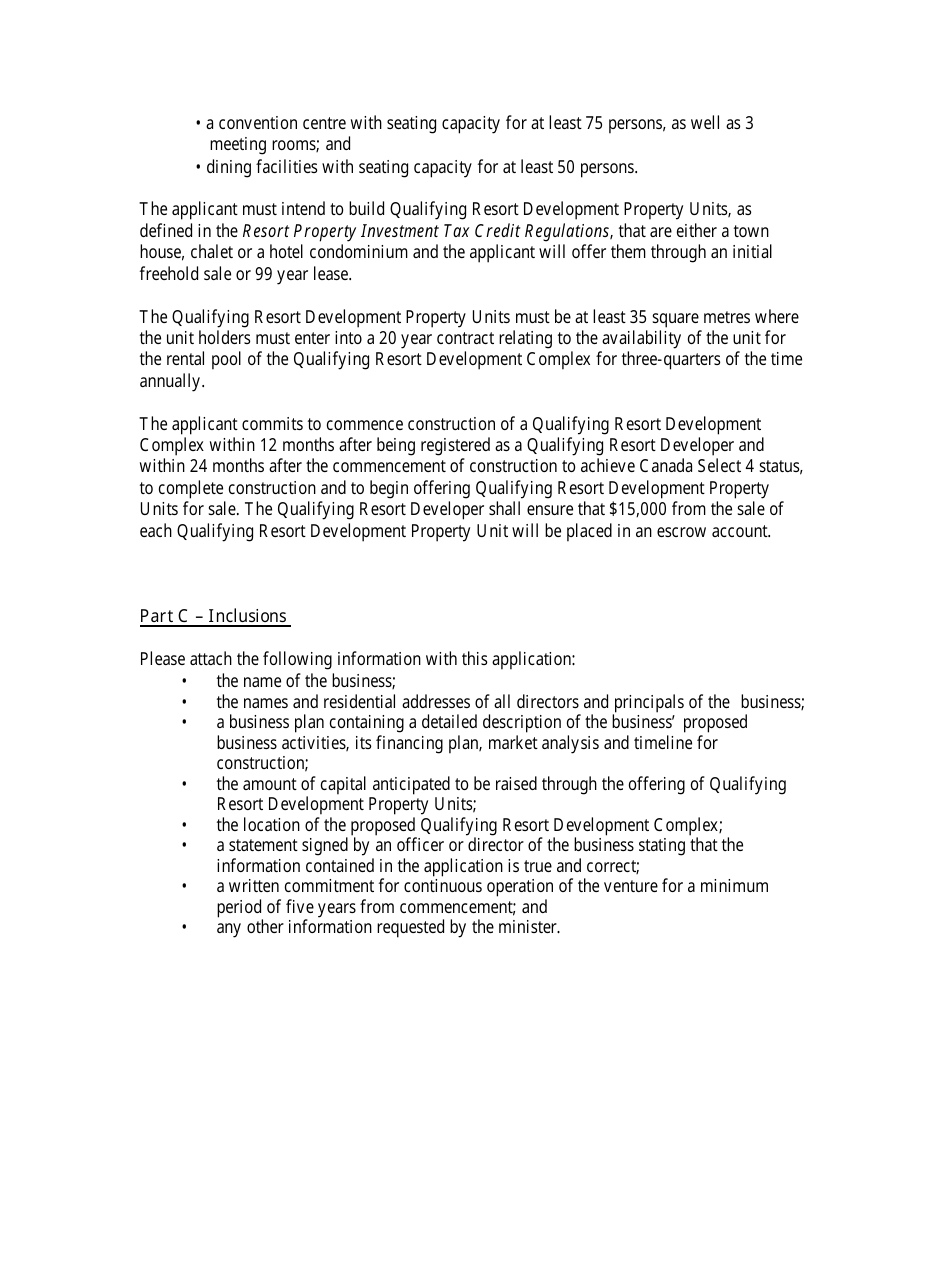

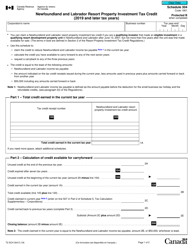

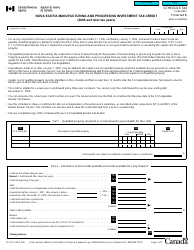

Resort Property Investment Tax Credit Application Form - Newfoundland and Labrador, Canada

This Newfoundland and Labrador-specific " Resort Property Investment Tax Credit Application Form " is a document released by the Newfoundland and Labrador Department of Finance .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

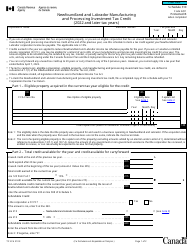

Q: What is the Resort Property Investment Tax Credit?

A: The Resort PropertyInvestment Tax Credit is a tax credit offered in Newfoundland and Labrador, Canada.

Q: Who is eligible to apply for the Resort Property Investment Tax Credit?

A: Individuals who have made eligible investments in resort properties in Newfoundland and Labrador.

Q: What is an eligible investment?

A: An eligible investment includes the purchase of a resort property or shares in a corporation that owns a resort property.

Q: How much is the tax credit?

A: The tax credit is 15% of the eligible investment, up to a maximum of $10,000 per year.

Q: How do I apply for the Resort Property Investment Tax Credit?

A: You can apply by completing and submitting the application form provided by the government of Newfoundland and Labrador.

Q: What is the deadline to apply for the tax credit?

A: The application must be submitted by December 31st of the year following the year in which the eligible investment was made.

Q: How long does it take to receive the tax credit?

A: Once your application is approved, you should receive the tax credit within 8-10 weeks.

Q: Is the tax credit refundable?

A: No, the tax credit is non-refundable, but any unused portions can be carried forward for up to 15 years.

Q: Can I claim the tax credit for multiple years?

A: Yes, you can claim the tax credit for up to 15 years as long as there is an eligible investment in each year.

Q: Are there any restrictions on the use of the tax credit?

A: The tax credit can only be used to reduce your provincial income tax liability in Newfoundland and Labrador.