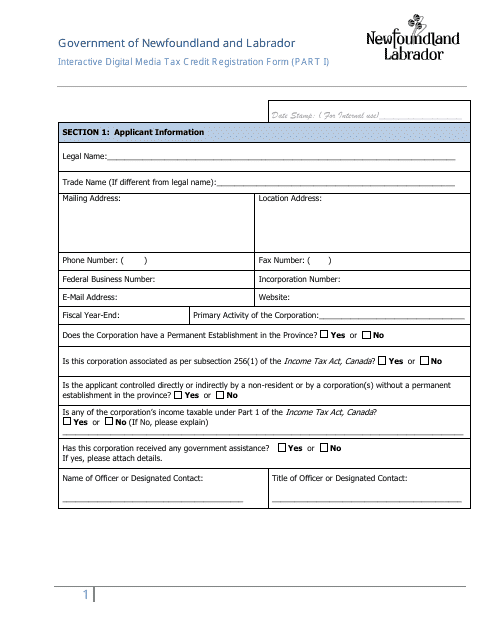

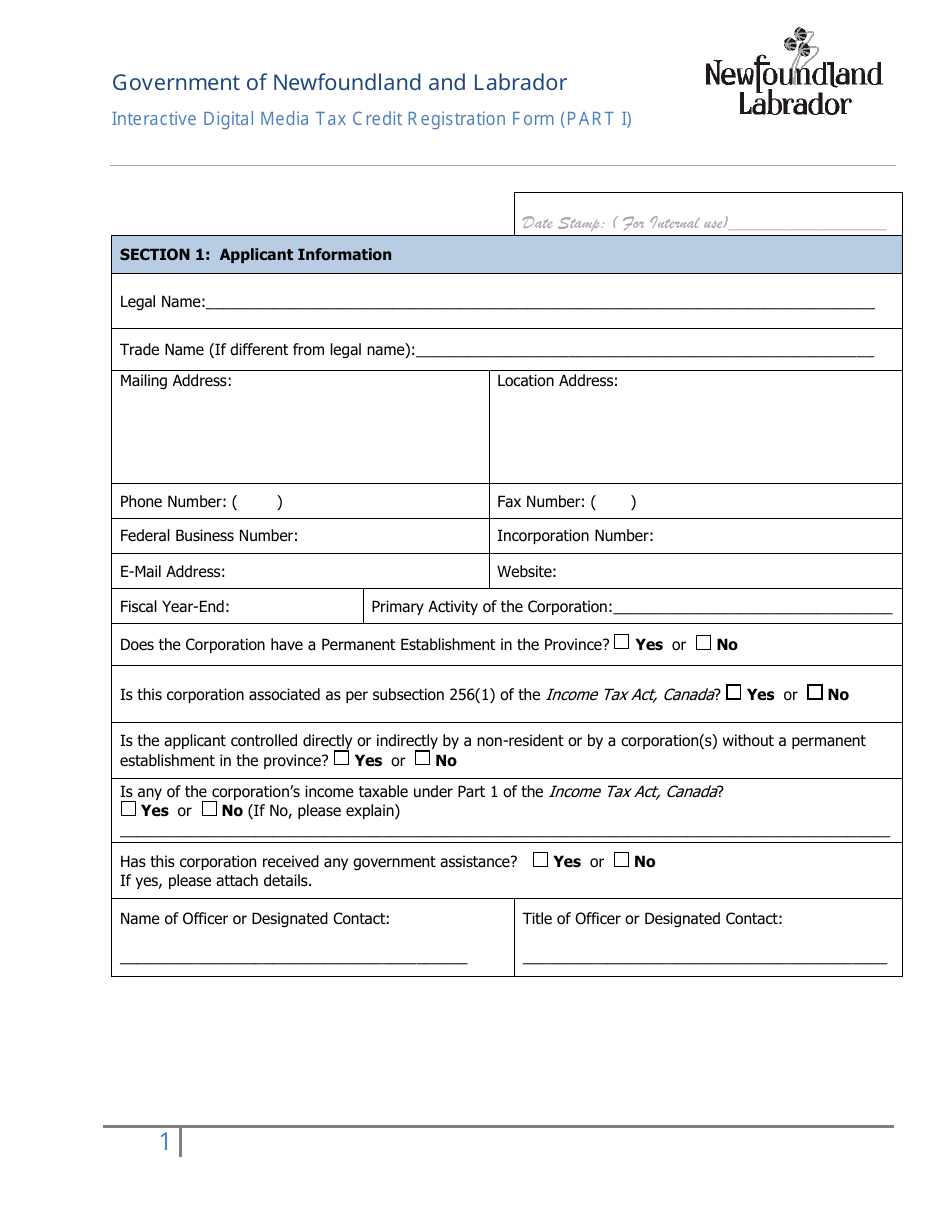

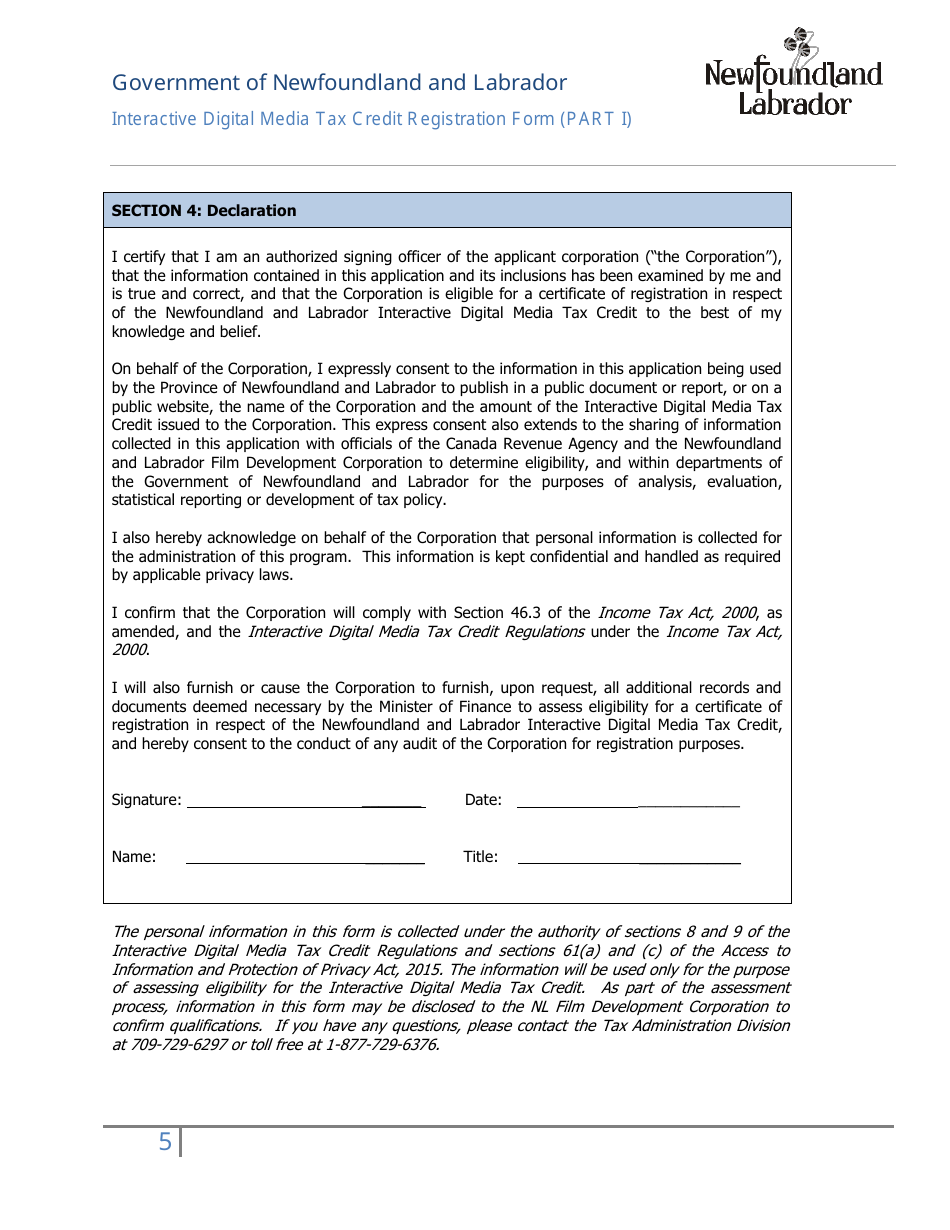

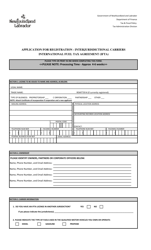

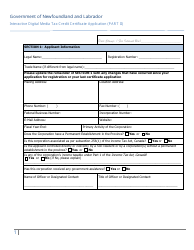

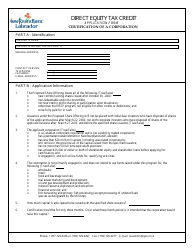

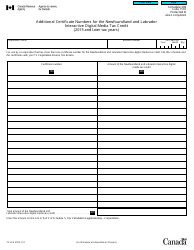

Interactive Digital Media Tax Credit Registration Application (Part I) - Newfoundland and Labrador, Canada

This Newfoundland and Labrador-specific " Interactive Tax Credit Registration Application (part I) " is a document released by the Newfoundland and Labrador Department of Finance .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

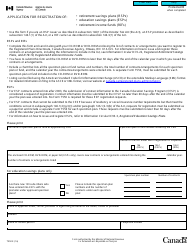

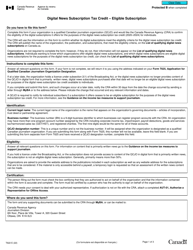

Q: What is the Interactive Digital Media Tax Credit?

A: The Interactive Digital Media Tax Credit is a tax incentive program in Newfoundland and Labrador, Canada.

Q: Who is eligible to apply for the Interactive Digital Media Tax Credit?

A: Eligible businesses in Newfoundland and Labrador, Canada can apply for the Interactive Digital Media Tax Credit.

Q: What is the purpose of the Interactive Digital Media Tax Credit?

A: The purpose of the Interactive Digital Media Tax Credit is to encourage the growth and development of the interactive digital media industry in Newfoundland and Labrador, Canada.

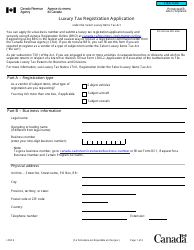

Q: How can businesses apply for the Interactive Digital Media Tax Credit?

A: Businesses can apply for the Interactive Digital Media Tax Credit by completing the registration application.

Q: Is there a deadline for submitting the Interactive Digital Media Tax Credit registration application?

A: Yes, there is a deadline for submitting the Interactive Digital Media Tax Credit registration application. The deadline is specified in the application form.

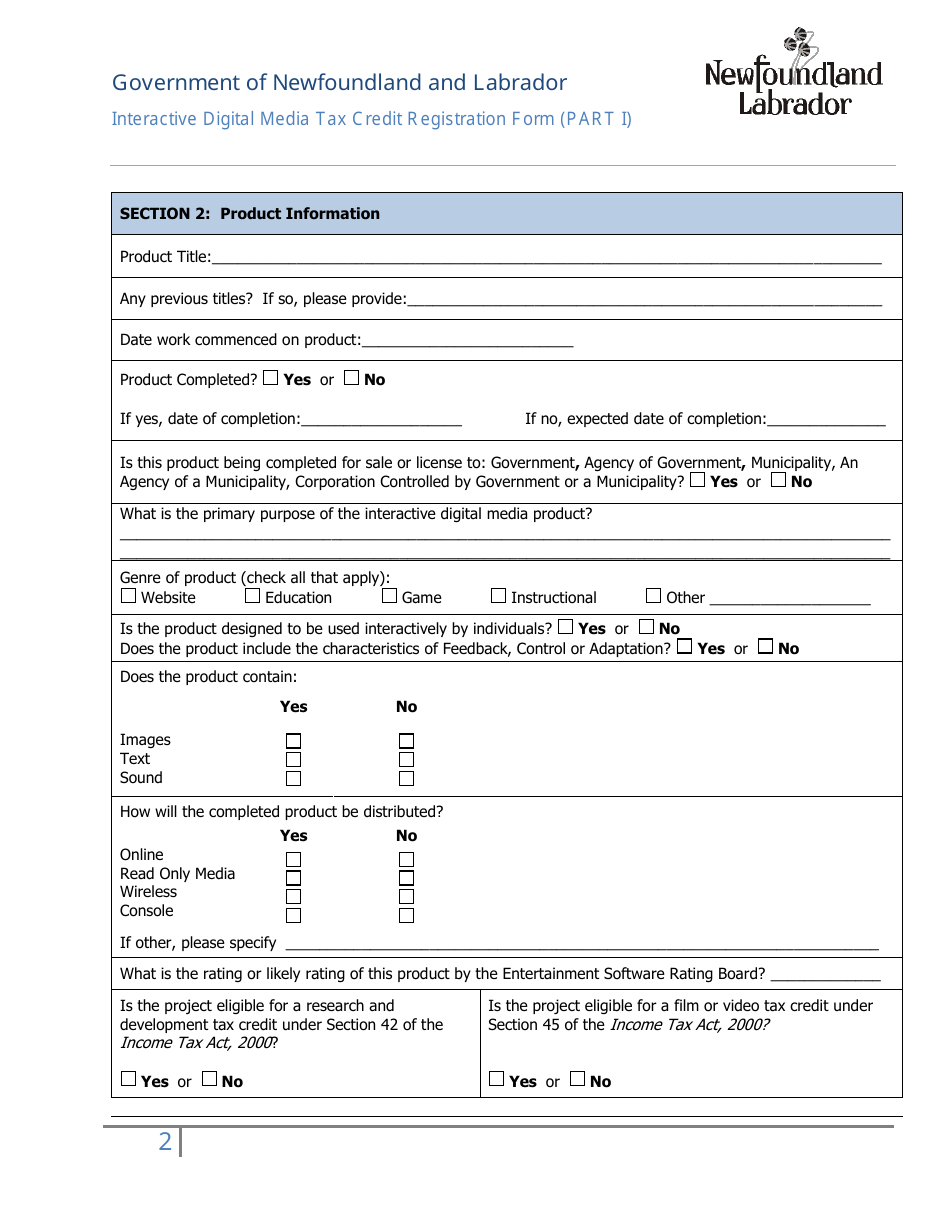

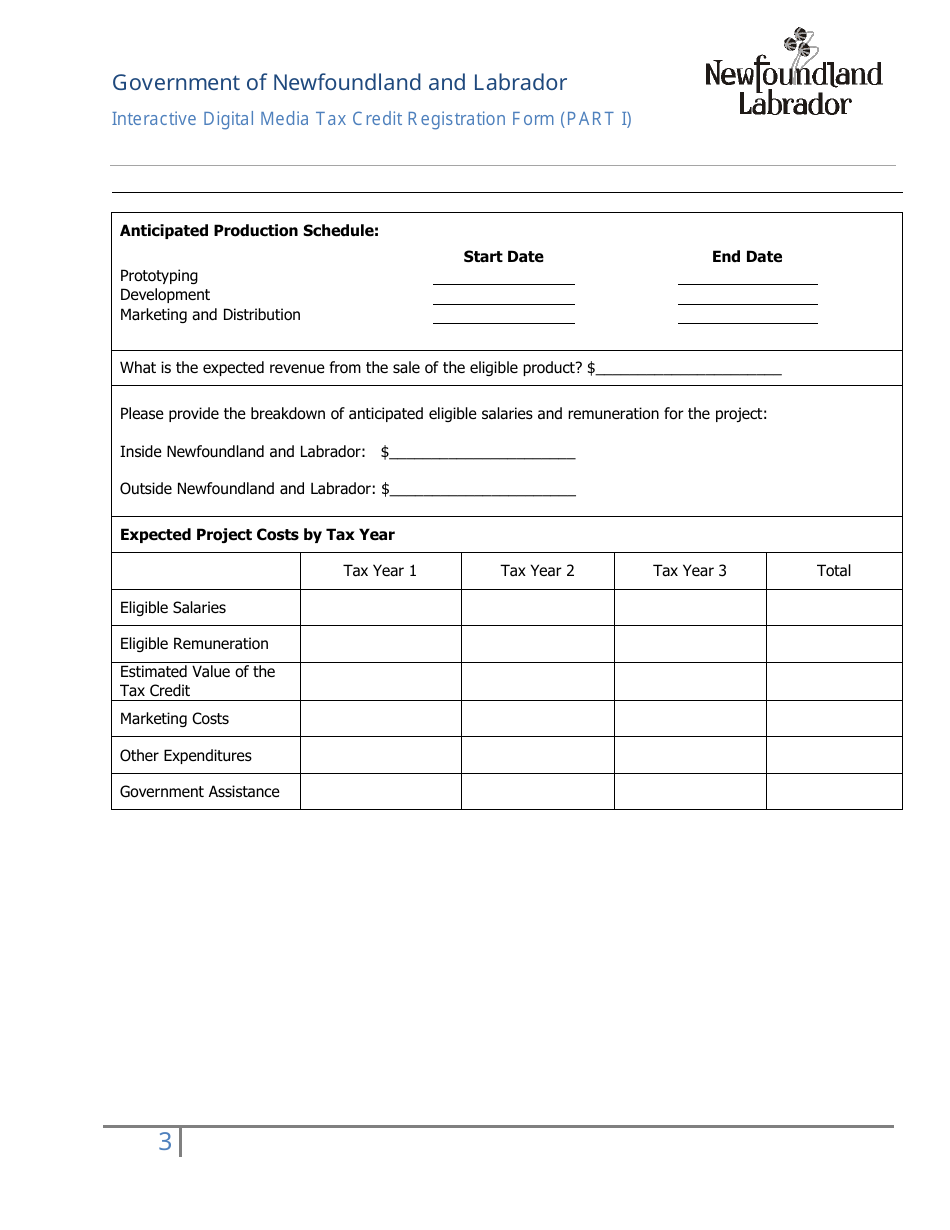

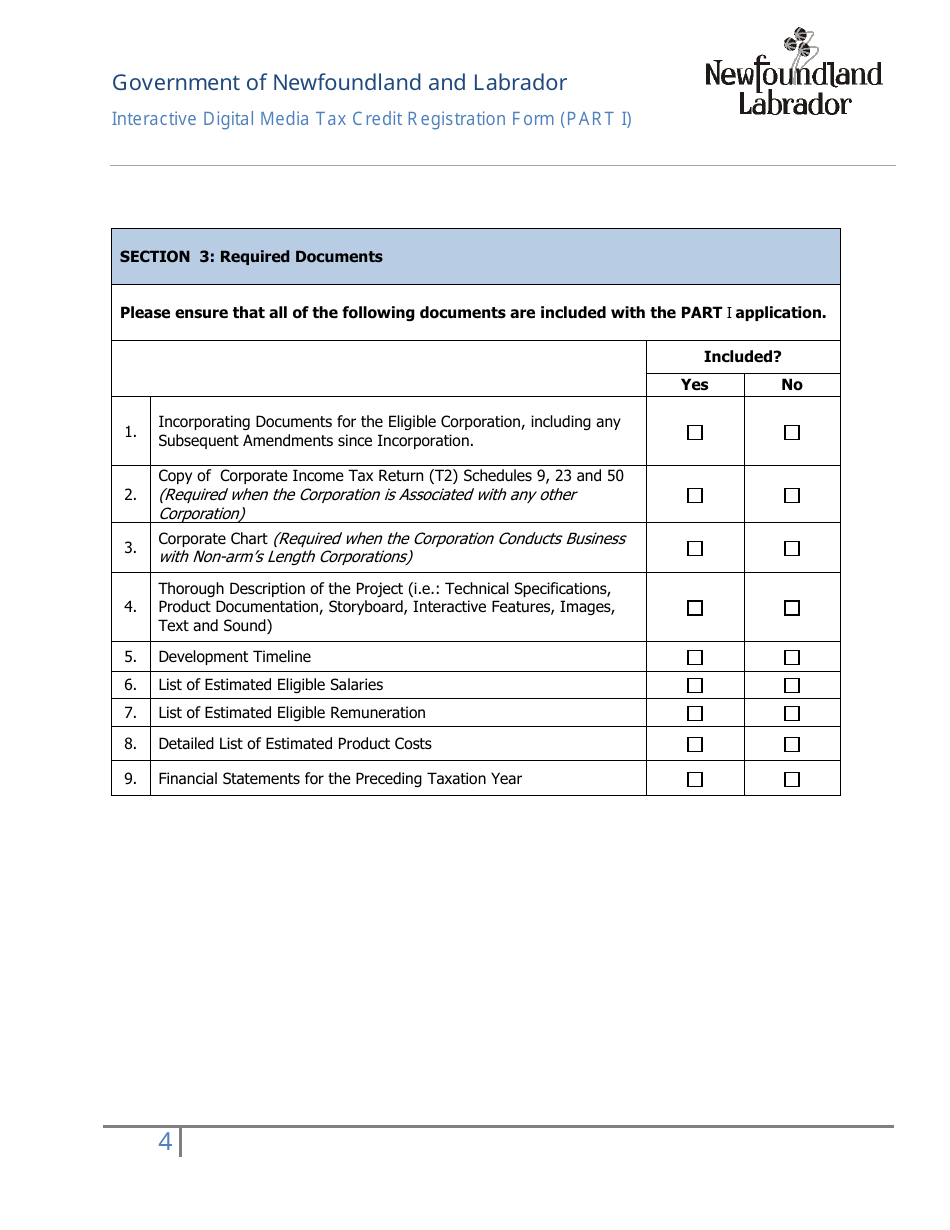

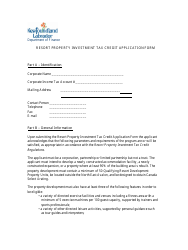

Q: What information is required in the Interactive Digital Media Tax Credit registration application?

A: The Interactive Digital Media Tax Credit registration application requires information about the business and the interactive digital media project.

Q: Are there any fees for submitting the Interactive Digital Media Tax Credit registration application?

A: No, there are no fees for submitting the Interactive Digital Media Tax Credit registration application.

Q: What happens after submitting the Interactive Digital Media Tax Credit registration application?

A: After submitting the Interactive Digital Media Tax Credit registration application, businesses may be contacted for further information or documentation.

Q: What are the benefits of the Interactive Digital Media Tax Credit?

A: The Interactive Digital Media Tax Credit provides eligible businesses with a tax credit based on eligible expenses incurred for developing an interactive digital media product.