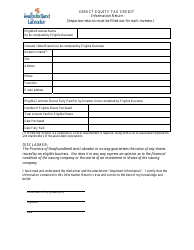

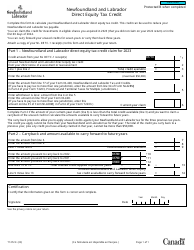

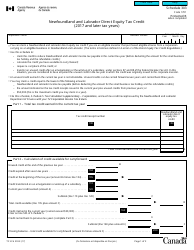

Direct Equity Tax Credit Program Information Return - Newfoundland and Labrador, Canada

This fillable " Direct Equity Tax Credit Program Information Return " is a document issued by the Newfoundland and Labrador Department of Finance specifically for Newfoundland and Labrador residents.

Download the PDF by clicking the link below and complete it directly in your browser or through the Adobe Desktop application.

FAQ

Q: What is the Direct Equity Tax Credit Program?

A: The Direct Equity Tax Credit Program is a program in Newfoundland and Labrador, Canada.

Q: How does the Direct Equity Tax Credit Program work?

A: The program provides a tax credit to investors who invest in eligible businesses in Newfoundland and Labrador.

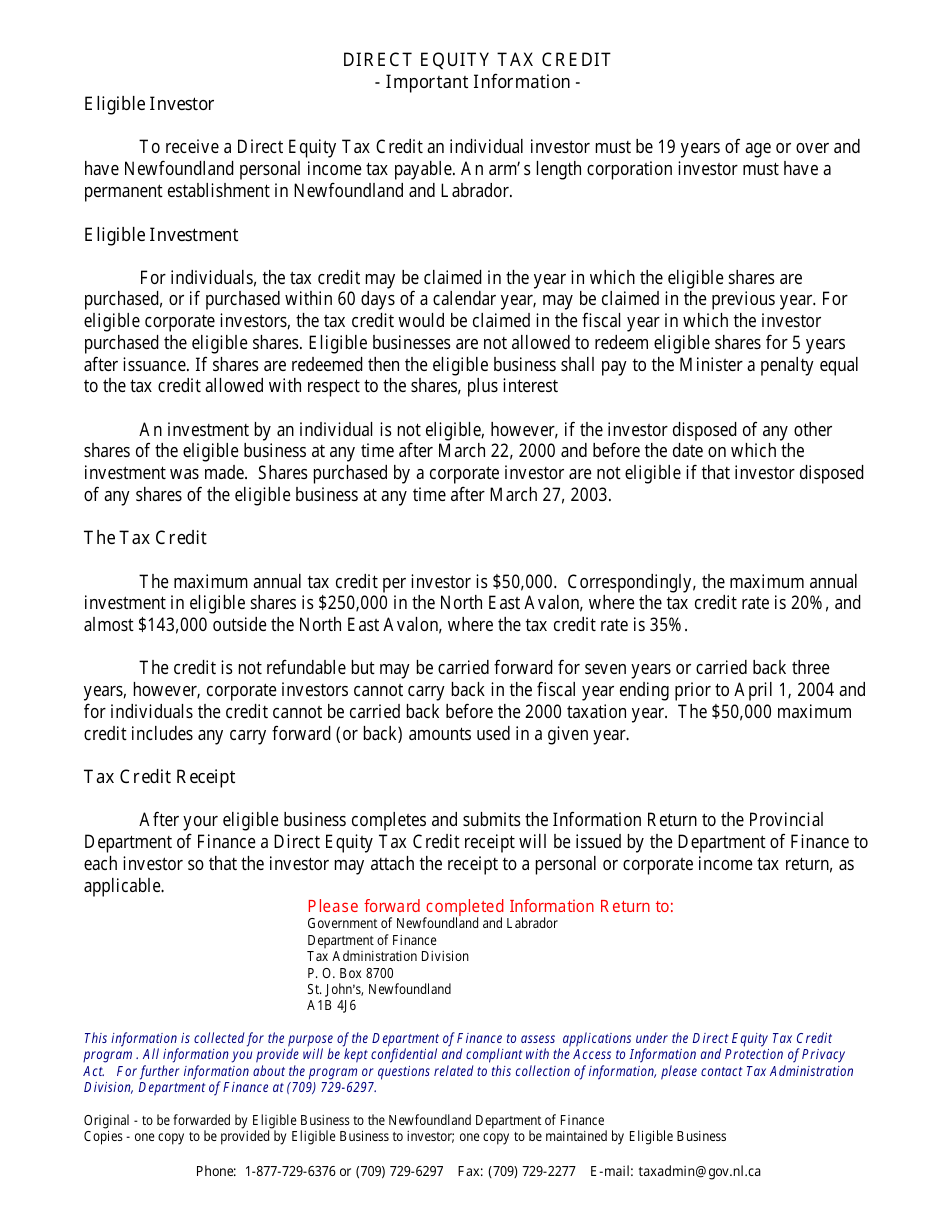

Q: Who is eligible for the Direct Equity Tax Credit Program?

A: Investors who make eligible investments in businesses in Newfoundland and Labrador are eligible.

Q: What is the purpose of the Direct Equity Tax Credit Program?

A: The program aims to encourage investment in businesses in Newfoundland and Labrador and support economic growth.

Q: How much is the tax credit under the Direct Equity Tax Credit Program?

A: The amount of the tax credit depends on the size of the investment and the terms of the program.

Q: Are there any restrictions on the types of businesses that can qualify for the Direct Equity Tax Credit Program?

A: Yes, only certain types of businesses are eligible for the program. The eligibility criteria are determined by the government.