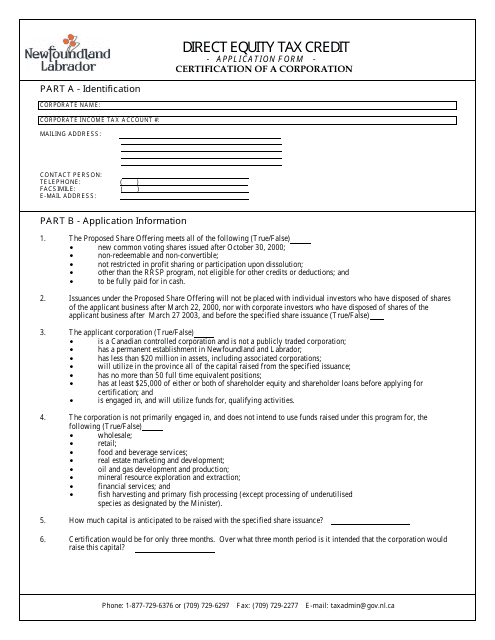

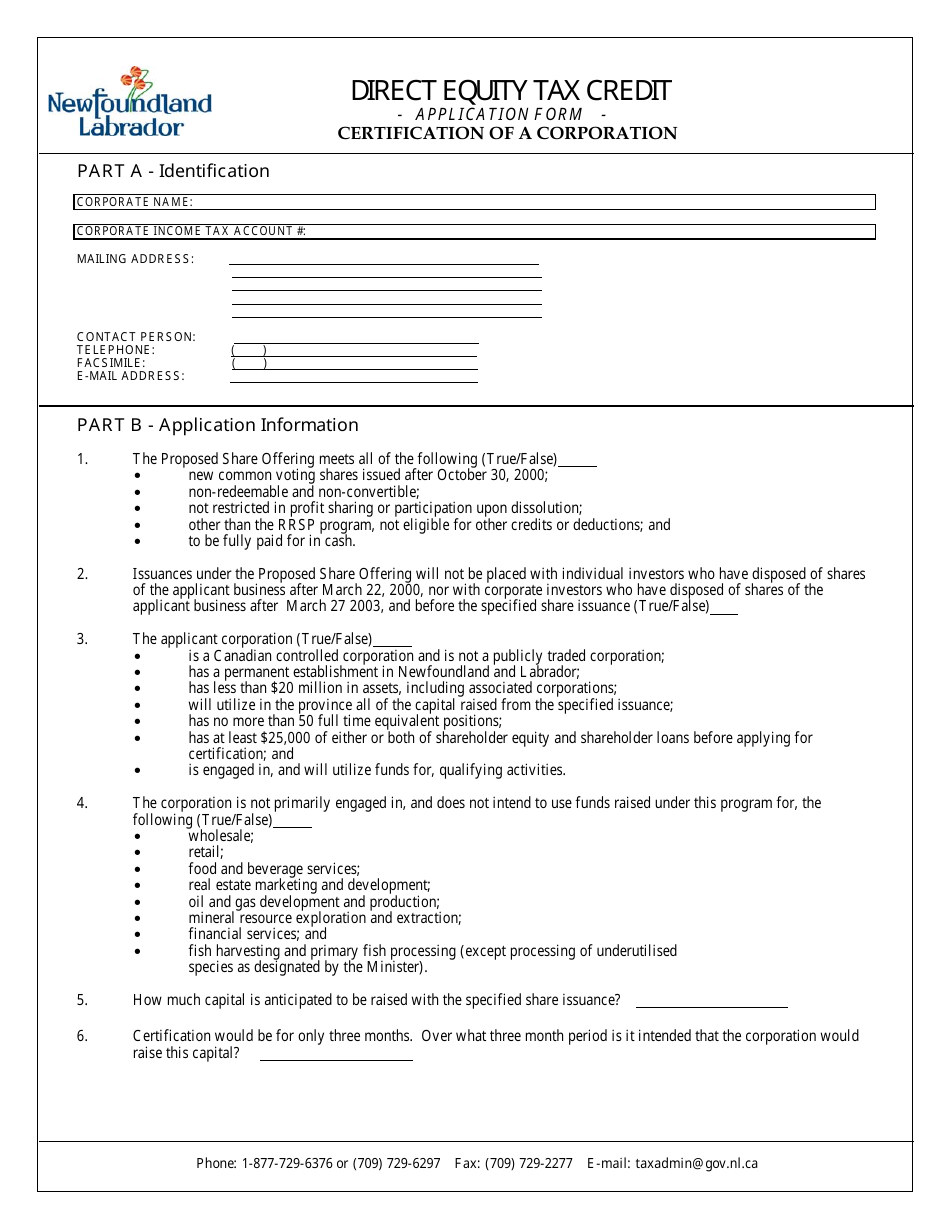

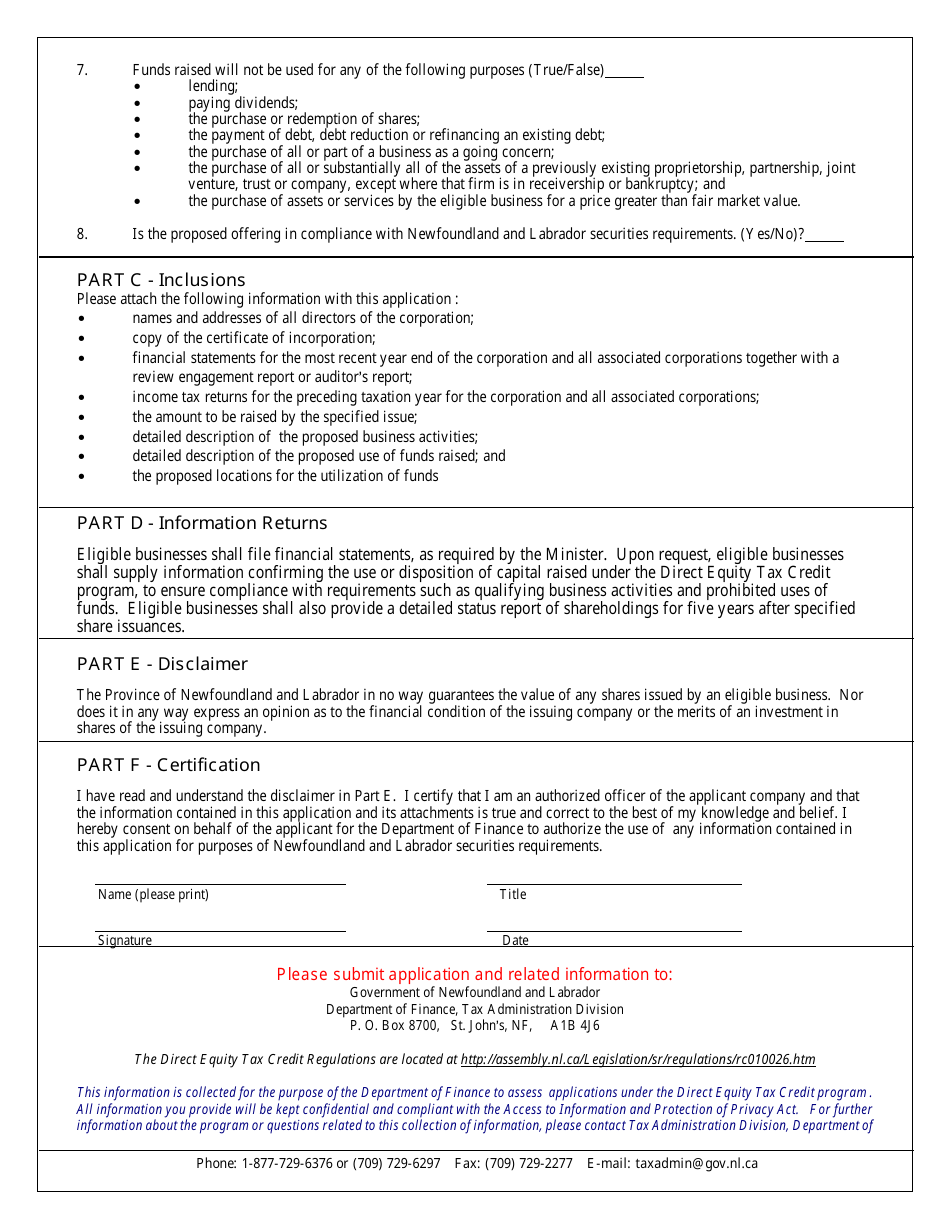

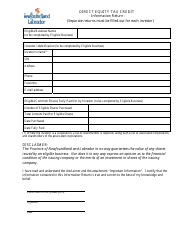

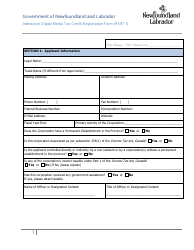

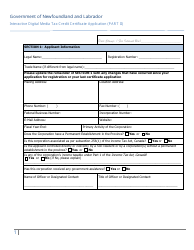

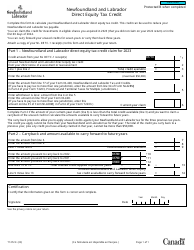

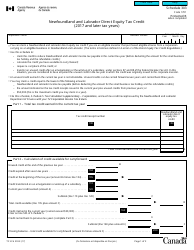

Direct Equity Tax Credit Program Application Form - Newfoundland and Labrador, Canada

This Newfoundland and Labrador-specific " Direct Equity Tax Credit Program Application Form " is a document released by the Newfoundland and Labrador Department of Finance .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is the Direct Equity Tax Credit Program?

A: The Direct Equity Tax Credit Program is a program in Newfoundland and Labrador, Canada that provides tax credits to individuals who invest directly in eligible businesses.

Q: Who is eligible to apply for the Direct Equity Tax Credit Program?

A: Individuals who are residents of Newfoundland and Labrador, Canada and meet certain criteria are eligible to apply for the program.

Q: What are the benefits of the Direct Equity Tax Credit Program?

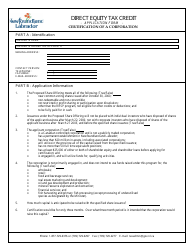

A: The program offers tax credits of up to 35% of the amount invested in eligible businesses, which can help reduce an individual's tax liability.

Q: What types of businesses are eligible for the Direct Equity Tax Credit Program?

A: The program supports a wide range of eligible businesses, including those in sectors such as agriculture, fishing, manufacturing, and technology.

Q: How can I apply for the Direct Equity Tax Credit Program?

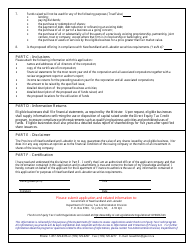

A: To apply, individuals need to complete the application form and submit it to the designated authority along with all required supporting documents.

Q: Are there any deadlines for applying to the Direct Equity Tax Credit Program?

A: Yes, the program has specific application deadlines which are typically announced by the authority administering the program.

Q: Are there any fees associated with the Direct Equity Tax Credit Program?

A: There may be fees associated with the program, such as processing fees, but these details can be obtained from the official program guidelines or by contacting the program authority directly.