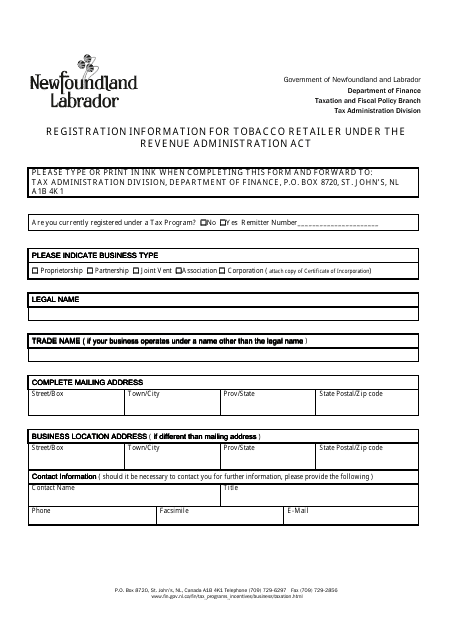

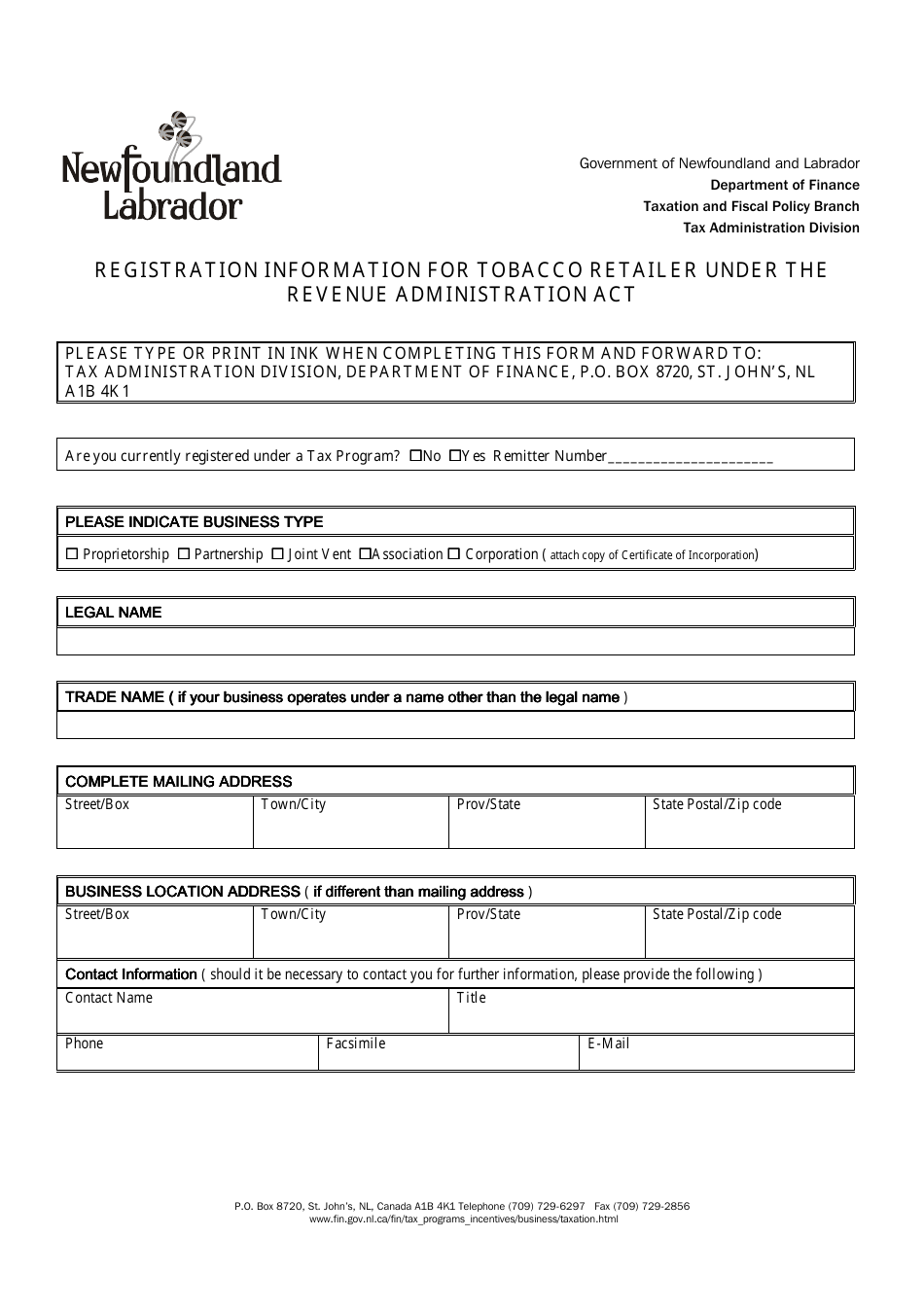

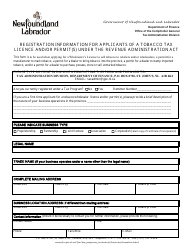

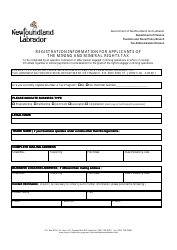

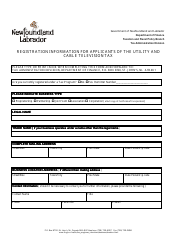

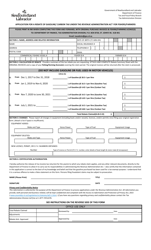

Registration Information for Tobacco Retailer Under the Revenue Administration Act - Newfoundland and Labrador, Canada

This Newfoundland and Labrador-specific " Registration Information For Tobacco Retailer Under The Revenue Administration Act " is a document released by the Newfoundland and Labrador Department of Finance .

Download the fillable PDF by clicking the link below and use it according to the applicable legal guidelines.

FAQ

Q: What is the Revenue Administration Act?

A: The Revenue Administration Act is a provincial legislation in Newfoundland and Labrador, Canada.

Q: What is a tobacco retailer?

A: A tobacco retailer is a business or individual engaged in the sale or distribution of tobacco products.

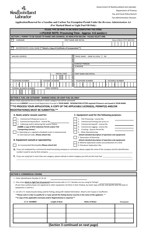

Q: Why do tobacco retailers need to register?

A: Tobacco retailers need to register under the Revenue Administration Act to comply with the regulations and requirements set by the government.

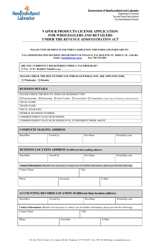

Q: How can I register as a tobacco retailer?

A: To register as a tobacco retailer, you can contact the appropriate government authority responsible for tobacco regulation in Newfoundland and Labrador.

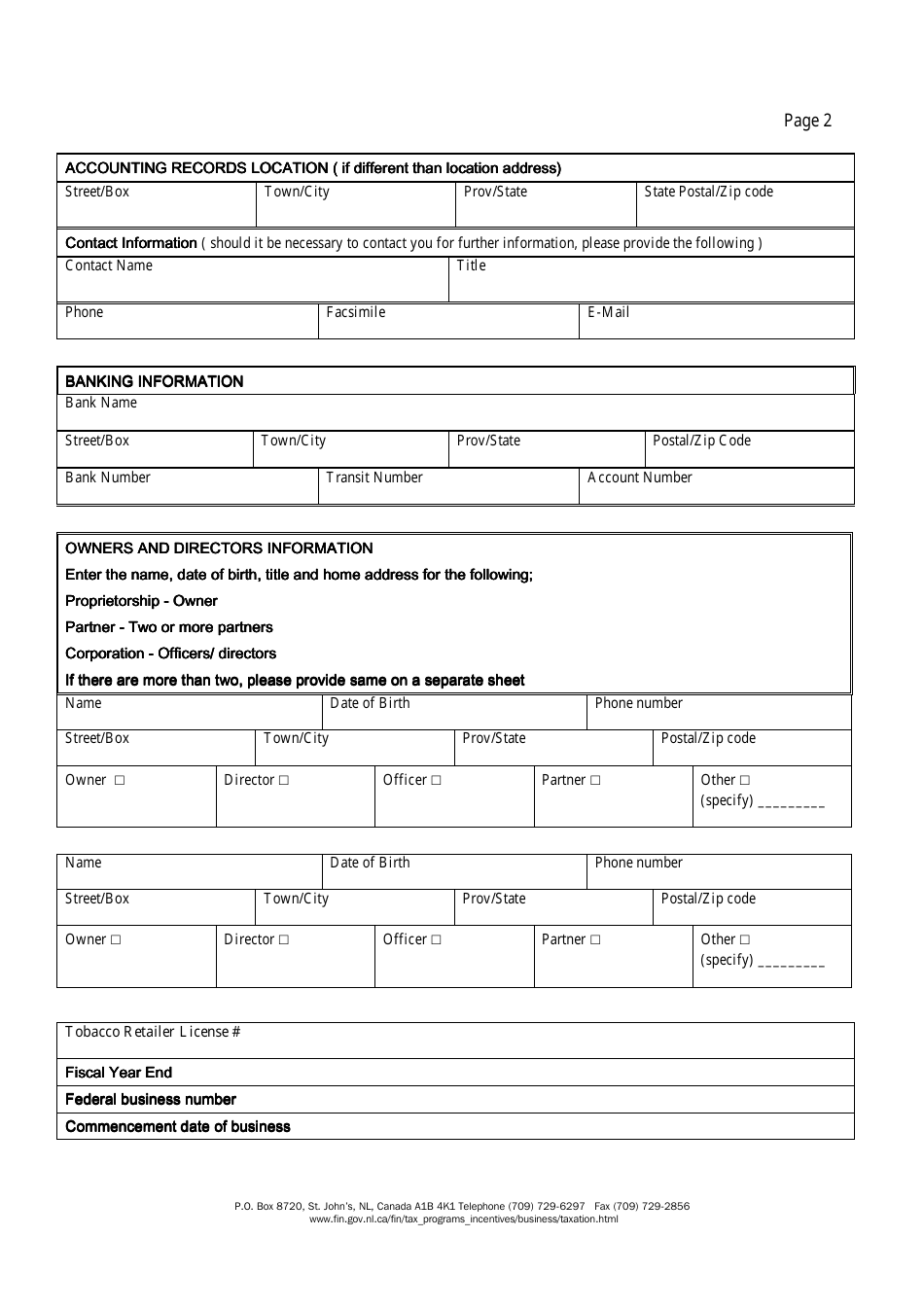

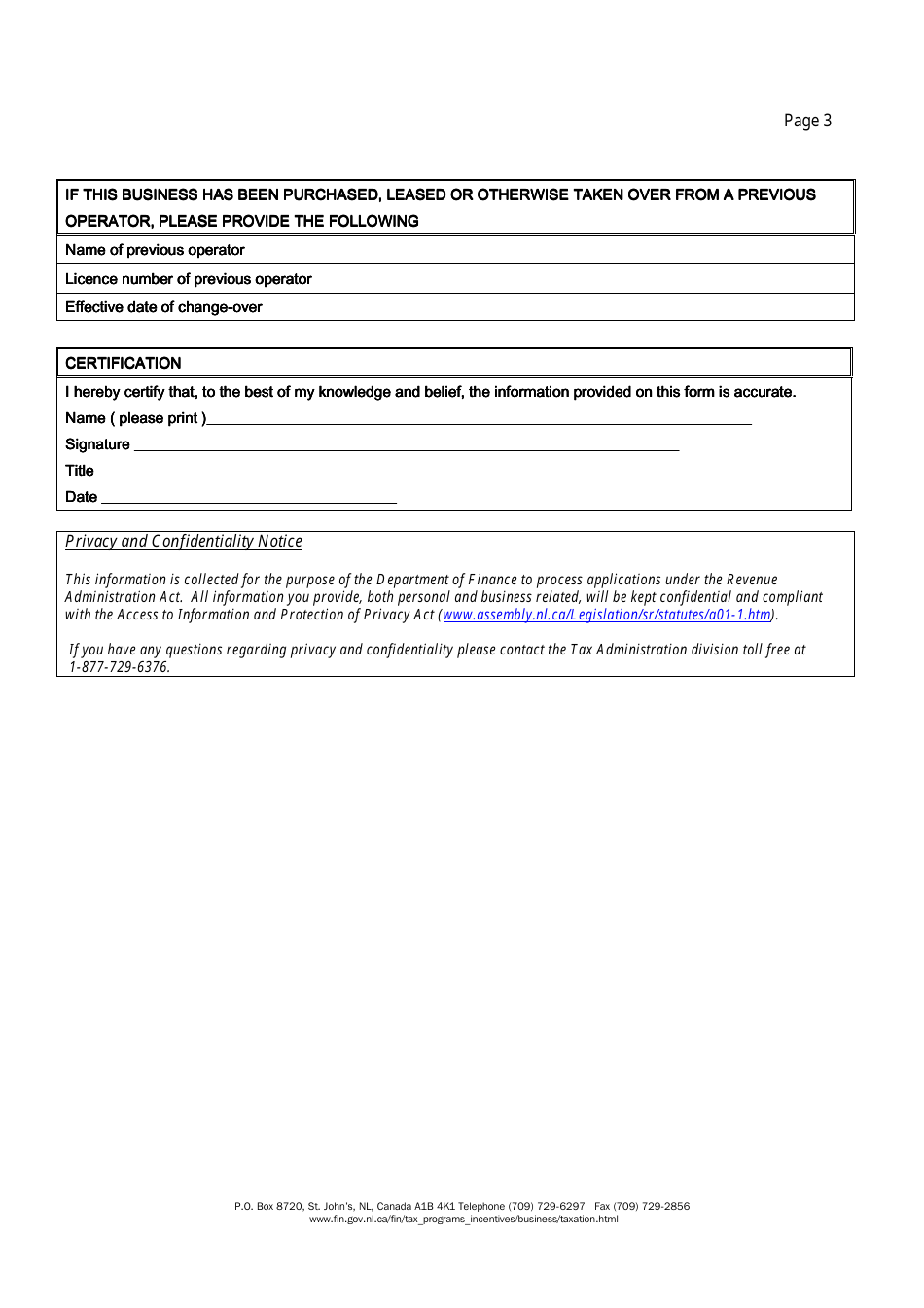

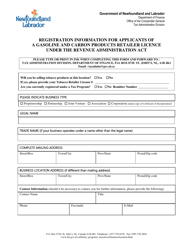

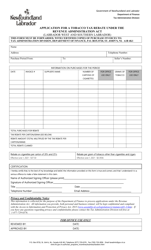

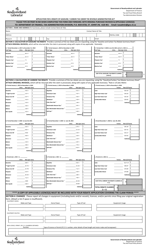

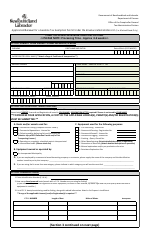

Q: What information do I need to provide for registration?

A: The specific information required for registration will vary, but generally you will need to provide details about your business, such as its name, address, and other relevant information.

Q: Are there any fees associated with the registration?

A: There may be fees associated with the registration as a tobacco retailer. It is advisable to inquire with the government authority for the specific fee structure.

Q: What are the consequences of not registering as a tobacco retailer?

A: Failure to register as a tobacco retailer can result in penalties and legal consequences, including fines and potential closure of the business.

Q: Is registration under the Revenue Administration Act mandatory for all tobacco retailers?

A: Yes, registration under the Revenue Administration Act is mandatory for all tobacco retailers operating in Newfoundland and Labrador, Canada.