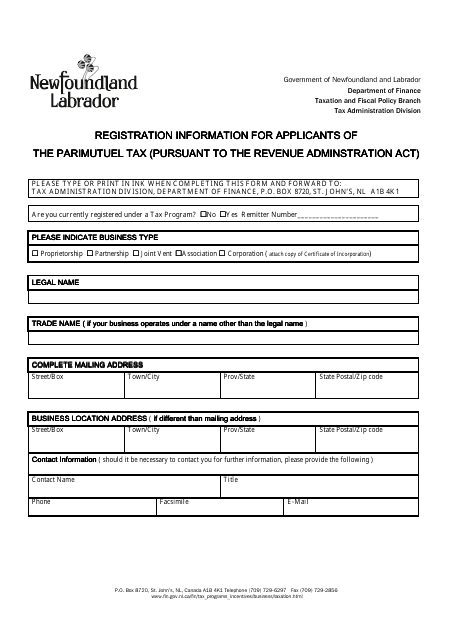

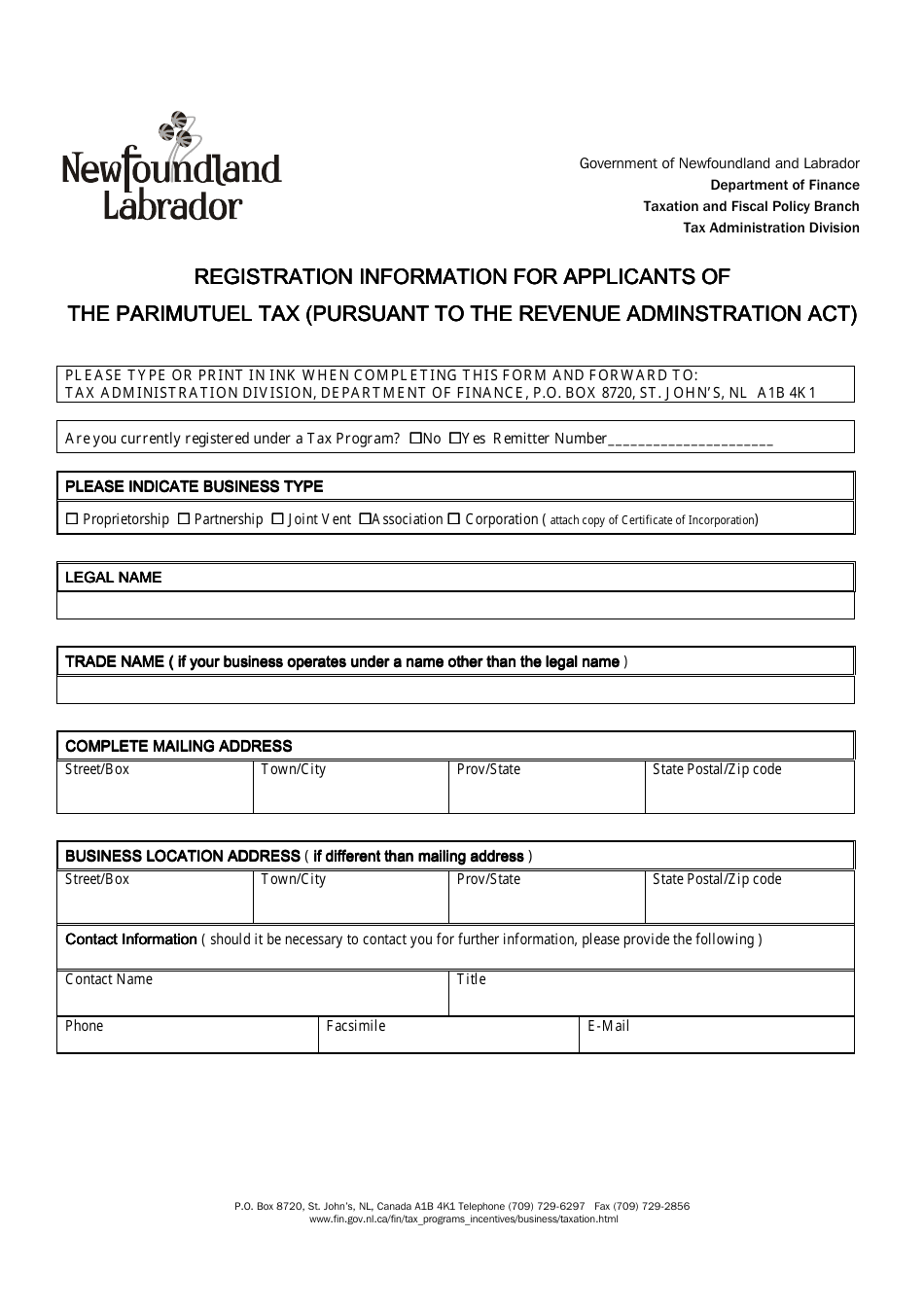

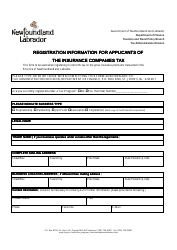

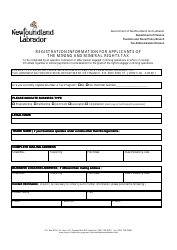

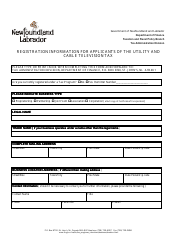

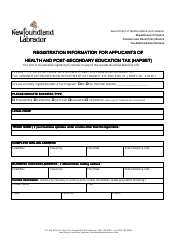

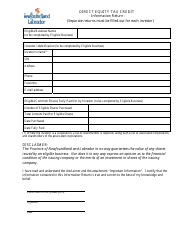

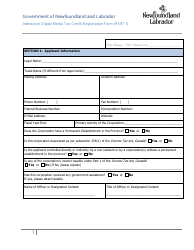

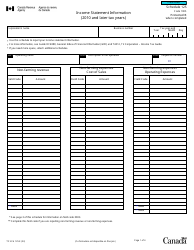

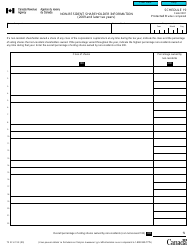

Registration Information for Applicants of the Parimutuel Tax (Pursuant to the Revenue Administration Act) - Newfoundland and Labrador, Canada

This fillable " Registration Information For Applicants Of The Parimutuel Tax (pursuant To The Revenue Administration Act) " is a document issued by the Newfoundland and Labrador Department of Finance specifically for Newfoundland and Labrador residents.

Download the PDF by clicking the link below and complete it directly in your browser or through the Adobe Desktop application.

FAQ

Q: What is the Parimutuel Tax?

A: The Parimutuel Tax is a tax imposed on certain types of gambling, such as horse racing and wagering on sports events.

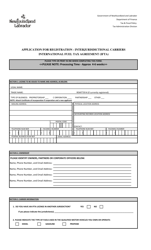

Q: Who needs to register for the Parimutuel Tax?

A: Any individual or organization involved in conducting parimutuel betting activities in Newfoundland and Labrador, Canada, needs to register for the Parimutuel Tax.

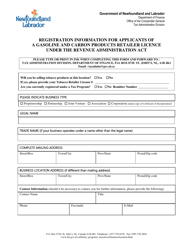

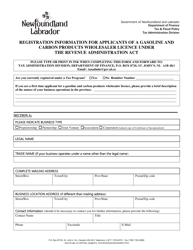

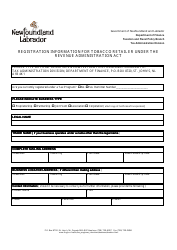

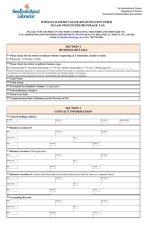

Q: How can I register for the Parimutuel Tax?

A: You can register for the Parimutuel Tax by completing the registration form provided by the Revenue Administration Division of Newfoundland and Labrador.

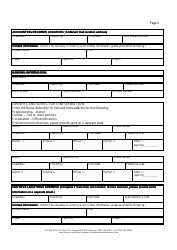

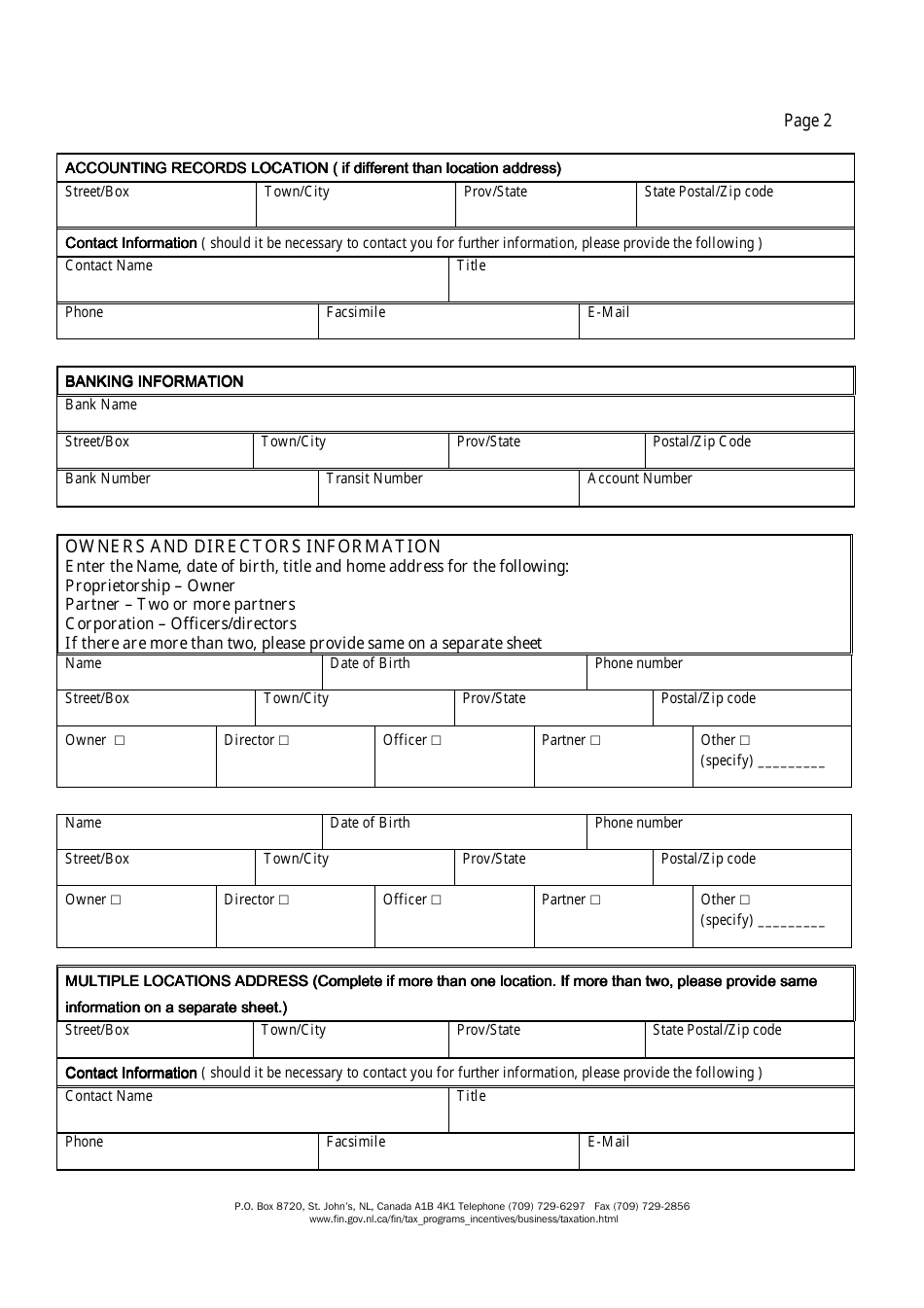

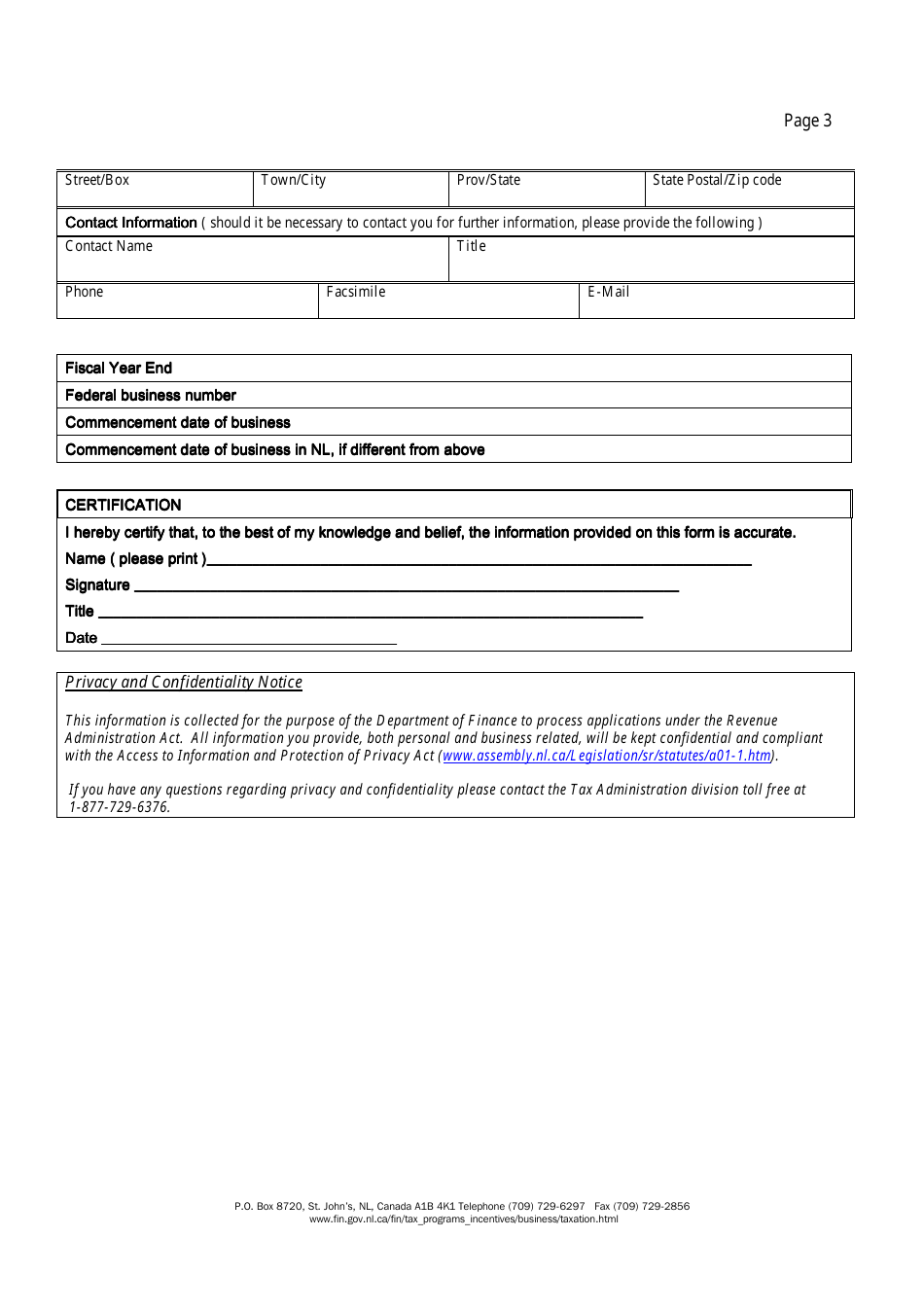

Q: What information do I need to provide during registration?

A: During registration, you will need to provide details such as your name, address, contact information, and information about your parimutuel betting activities.

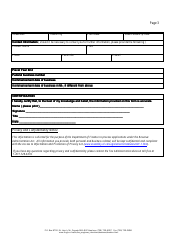

Q: Are there any fees associated with the registration?

A: Yes, there are fees associated with the Parimutuel Tax registration. The exact amount of the fees can be found in the registration form and is subject to change.

Q: Is there a deadline for registering for the Parimutuel Tax?

A: Yes, there is a deadline for registering for the Parimutuel Tax. It is recommended to contact the Revenue Administration Division for the most up-to-date information regarding registration deadlines.

Q: What are the consequences of not registering for the Parimutuel Tax?

A: Failure to register for the Parimutuel Tax can result in penalties, fines, and legal actions by the Newfoundland and Labrador government.

Q: Can I cancel my registration for the Parimutuel Tax?

A: Yes, you can cancel your registration for the Parimutuel Tax. You will need to contact the Revenue Administration Division and follow the necessary procedures for cancellation.

Q: Are there any exemptions to the Parimutuel Tax?

A: There may be certain exemptions or special provisions under the Parimutuel Tax law. It is recommended to consult the Revenue Administration Division or seek professional advice for specific exemption criteria.